Owning a house is a very big milestone for a lot of people. It is also an expensive affair. High property prices make it difficult for many to purchase their dream house. Home loans make this process easy by funding up to 80% of the cost of the house. Home loans are secured loans that are extended to an individual to buy a property. This house/property is mortgaged with the lender till the home loan is repaid along with the interest.

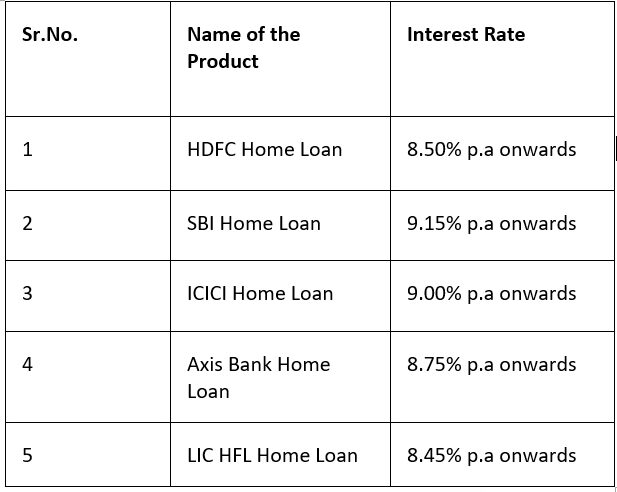

With so many options of home loans available in the market today, it can be difficult to choose the right one. We have listed some of the best home loans available to help you choose the right home loan that best suits your needs and requirements:

Note: All the rates mentioned here are as of 4th April, 2023. Kindly contact the bank/financial institution for more details.

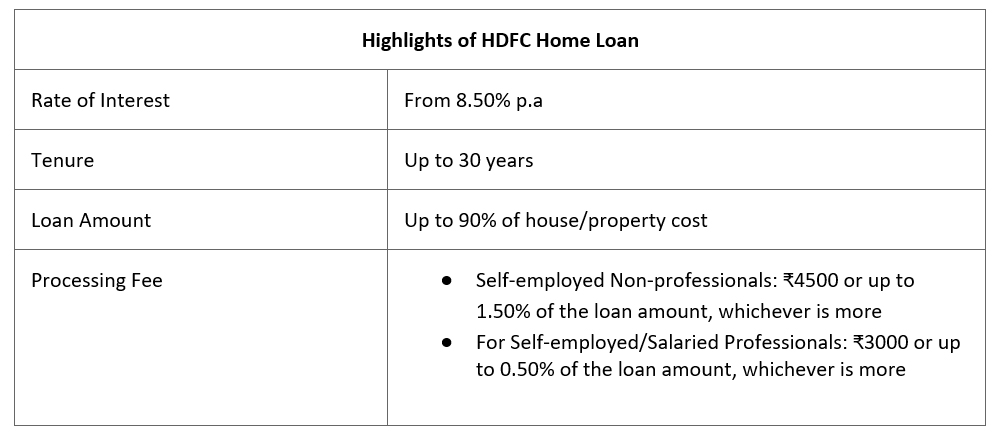

HDFC Home Loan

HDFC Bank offers affordable home loans for people who qualify from 8.50% p.a onwards for tenures up to 30 years. The bank also offers the facility of balance transfer to existing housing loan borrowers. They also have ‘Reach Loans’ for salaried individuals and micro entrepreneurs who may have enough documents to get a home loan. Their ‘Rural Housing Loan’ is aimed at horticulturists, agriculturists, dairy farmers, etc, who are residing in urban or rural areas and salaried/self employed individuals who want to construct or purchase homes in their villages or home towns.

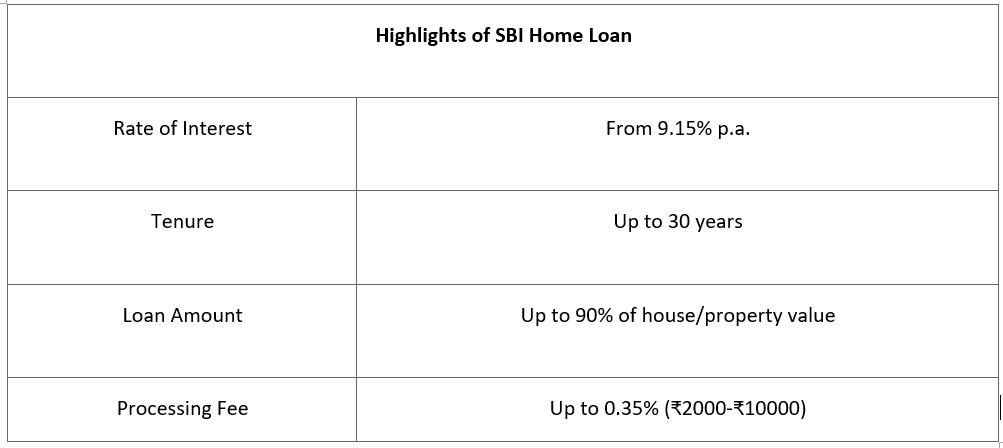

SBI Home Loan

SBI Bank is one of the largest mortgage lenders in India. The interest rate for housing loans offered by them starts from 9.15% p.a for loan amount up to 90% of the house’s cost. They offer several special housing loan products for government employees, non-salaried individuals, defense personnel and for people living in tribal/ hilly areas. Some other home loan benefits that State Bank of India offers include an additional 0.50% interest rate for women, step-up loan, balance transfer facility, housing loan overdraft facility, etc.

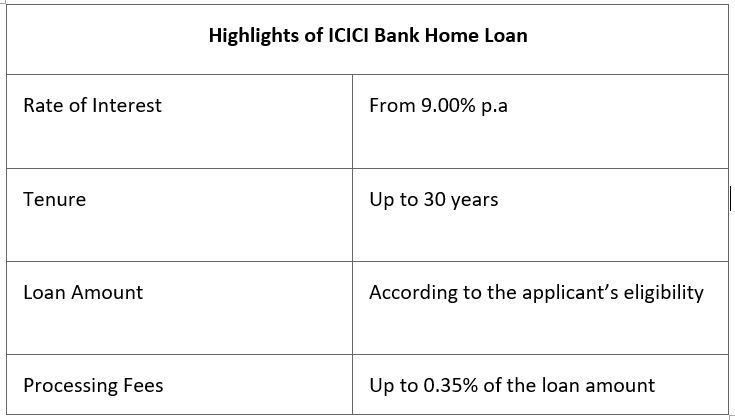

ICICI Home Loan

ICICI Bank is a multinational bank and financial services company that is headquartered in Mumbai. They offer home loans from 9.00% onwards for tenures up to 30 years. ICICI Bank provides the facility of balance transfer to existing housing loan borrowers of other banks and pre-approved housing loans to its salary account holders. Their ‘Pratham Housing Loan Scheme’ is an affordable home loan scheme that is offered to salaried individuals who have a minimum salary of ₹10000 per month and self-employed individuals who have had the business for at least 5 years. They also offer ‘ICICI Extra Home Loan’ which is a special housing loan scheme that is backed by Mortgage Guarantee.

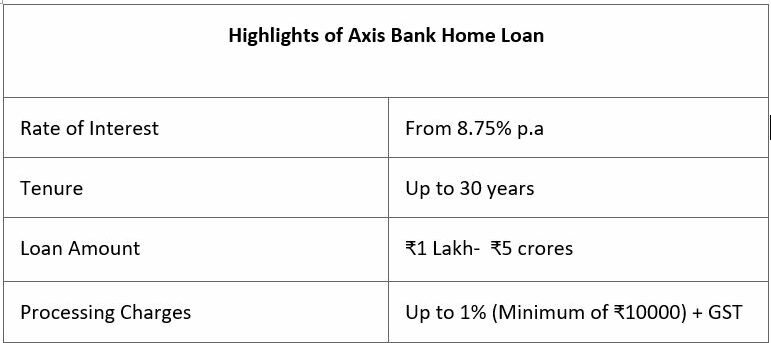

Axis Bank Home Loan

Axis Bank is one of the largest private sector banks in India. They offer a spectrum of financial services including personal loans, home loans, etc. They offer home loans from 8.75% p.a onwards for loan terms up to 30 years and for loan amounts of up to ₹5 Crores. They provide special housing loan schemes and offer facilities such as housing loan overdraft facility, EMI waivers, etc.

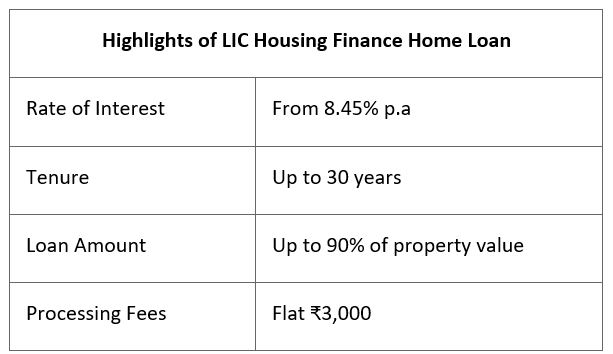

LIC Housing Finance Ltd Home Loan

LIC Housing Finance Ltd is one of the largest mortgage loan companies in India. It has its corporate headquarters in Mumbai. It is a subsidiary company of LIC. They offer LIC HFL home loan from 8.45% p.a onwards for tenures up to 30 years. They also provide the facility of housing loan balance transfer/takeover to existing housing loan borrowers of other banks and financial institutions. This housing finance company also provides ‘Griha Suvidha Home Loan’ to salaried individuals who get their salary in cash and to self-employed people who require extended loan tenures.

There are other banking and financial institutions that also provide home loans other than the ones mentioned above such as Shubham home loan, PNB home loan, Aditya Birla home Loan, etc. Before applying for a home loan, make sure that you do proper research and find a home loan that fits your budget and meets your requirements. Different lenders offer different features and advantages. Some offer advantages such as lower EMIs, mixed interest rates, overdraft facility, balance transfer facility, etc. While comparing housing loans, it is important to check certain key factors. The major points of comparison when it comes to housing loans are interest rates, turnaround time, processing fees and loan to value ratio (LTV). It is important that you view the loan as an entire package and not just look at individual elements. For example: In case a housing loan has a very low interest rate, there are chances that the fee structure is high.