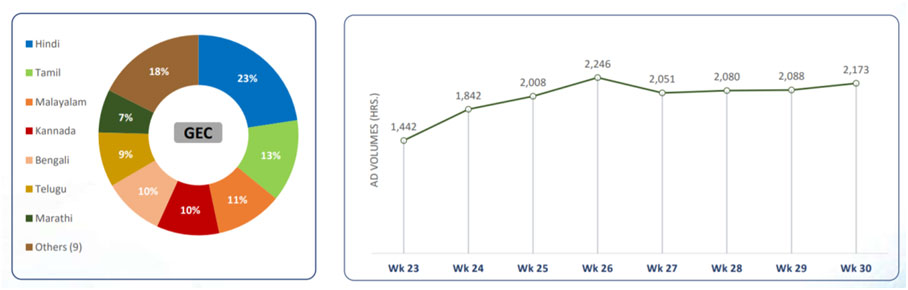

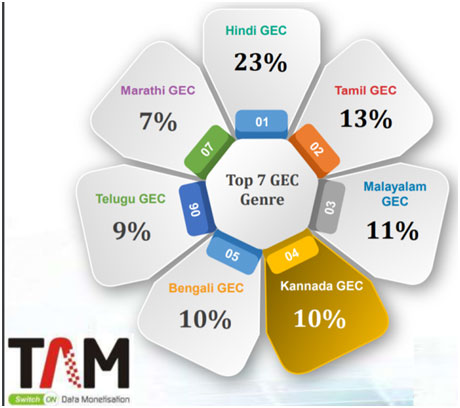

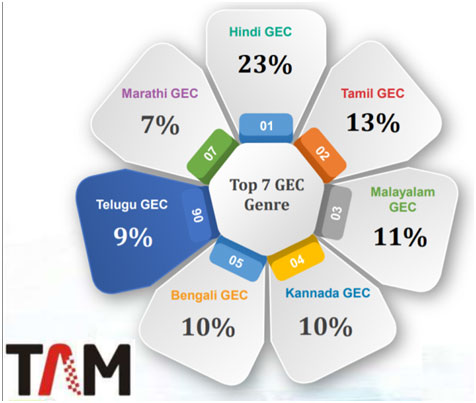

The TAM AdEx-Television Advertising Report VIII for period Apr-Jul’20*, it comprises of 2 sections that is Overall Television Advertising during Jun-Jul’20* and Deep diving into the details of GEC Channel Genre focusing on Hindi GEC, Tamil GEC, Malayalam GEC, Kannada GEC, Bengali GEC, Telugu GEC and Marathi GEC. We focus on the 2nd section of the report:

Channel Genre: GEC

Among GEC genres, Hindi GEC topped with 23% share of Ad Volumes followed by Tamil GEC, meager but steady ad volume growth observed in last 4 weeks i.e. Wk 27-30. Comparing week 30 to week 23, GEC genre registered 51% rise in Ad Volumes.

Hindi GEC

Avg. Ad Volumes/Day on Hindi GEC saw a 5% rise in Jul’20* compared to Jun’20

Ad Volumes of Hindi GEC Genre: Jun-Jul’20*

Avg. Ad Volumes/Day on Hindi GEC saw a marginal rise of 5% in Jul’20* compared to Jun’20. A continuous rise in ad volumes from week 24 onwards with a peak in week 26, comparing week 30 to week 23, Ad Volumes grew by 50% on Hindi GEC channels

No. of Categories, Advertisers and Brands: Jun-Jul’20*

Tally of Categories, Advertisers and Brands saw rise in Jul’20* compared to Jun’20

Top Categories and Advertisers during Jun-Jul’20*: Hindi GEC

9 out of top 10 categories were from FMCG contributing 40% to the Ad Volumes of Hindi GECs, HUL had a huge 40% share of ad volumes followed by Reckitt Benckiser and Top 50 advertisers had 90% share of Ad Volumes on Hindi GEC channels

Categories and Advertisers present in Jun-Jul’20^ and not in Apr-May’20

35+ Categories and 80+ Advertisers advertised only during Jun-Jul’20^ on Hindi GEC channels. Half of the Top 10 Exclusive Categories were from Personal Care/Personal Hygiene Sector.

Tamil GEC

Ad Volumes on Tamil GEC genre stabilized in last 4 weeks after a peak in week 26

Ad Volumes of Tamil GEC Genre: Jun-Jul’20*

Avg. Ad Volumes/Day on Tamil GEC saw a marginal drop in Jul’20* compared to Jun’20, Ad Volumes on Tamil GEC genre stabilized in last 4 weeks after a peak in week 26. Comparing week 30 to week 23, Ad Volumes grew by 54% on Tamil GEC channels.

No. of Categories, Advertisers and Brands: Jun-Jul’20*

Tally of Advertisers and Brands grew by 5% and 3% respectively in Jul’20* compared to Jun’20.

Top Categories and Advertisers during Jun-Jul’20*: Tamil GEC

9 out of top 10 categories were from FMCG contributing 44% to the Ad Volumes on Tamil GECs. Top 10 advertisers on Tamil GEC channels had more than 65% share of Ad Volumes while HUL topped with 40% share of Ad Volumes

Categories and Advertisers present in Jun-Jul’20^ and not in Apr-May’20

35+ Categories and 120+ Advertisers present only during Jun-Jul’20^ on Tamil GEC channels

Malayalam GEC

Avg. Ad Volumes/Day on Malayalam GEC grew by 14% in Jul’20 compared to Jun’20

Ad Volumes of Malayalam GEC Genre: Jun-Jul’20*

Avg. Ad Volumes/Day on Malayalam GEC grew by 14% in Jul’20* compared to Jun’20, a continuous rise in Ad Volumes from week 24 onwards with a small drop in week 27. Week 30 registered highest Ad Volumes which was 50% more compared to week 23

No. of Categories, Advertisers and Brands: Jun-Jul’20*

Tally of Categories, Advertisers and Brands saw rise in Jul’20* compared to Jun’20, number of Advertisers and Brands grew by 11% and 8% respectively

Top Categories and Advertisers during Jun-Jul’20*: Malayalam GEC

Categories for FMCG sector dominated the advertising on Malayalam GECs, HUL with 32% share of Ad Volumes topped the list followed by ITC. The top 10 advertisers on Malayalam GEC channels had 66% share of Ad Volumes

Categories and Advertisers present in Jun-Jul’20^ and not in Apr-May’20

On Malayalam GEC channels, 40+ Categories and 120+ Advertisers advertised exclusively during Jun-Jul’20^

Kannada GEC

Ad volumes grew by 54% on Kannada GEC channels in week 30 compared to week 23Ad volumes grew by 54% on Kannada GEC channels in week 30 compared to week 23

Ad Volumes of Kannada GEC Genre: Jun-Jul’20*

Avg. Ad Volumes/Day grew by 12% in Jul’20* compared to Jun’20 on Kannada GEC, Avg. Ad volume during Wk 27 – 30 grew by 18% compared to Wk 23 – 26. Comparing week 30 to week 23, Ad Volumes grew by 54% on Kannada GEC channels.

No. of Categories, Advertisers and Brands: Jun-Jul’20*

Tally of Advertisers and Brands grew by 19% and 12% respectively in Jul’20* over Jun’20, counts of categories were almost same in Jun and Jul’20*

Top Categories and Advertisers: Jun-Jul’20*

9 of the top 10 categories belong to FMCG accounting 42% to the Ad Volumes on Kannada GECs. HUL was on top position with 37% share on Kannada GEC channels followed by P&G and Top 50 advertisers accounted for more than 90% share of ad volumes on Kannada GEC channels

Categories and Advertisers present in Jun-Jul’20^ and not in Apr-May’20

30+ Categories and 75+ Advertisers advertised only during Jun-Jul’20^ on Kannada GEC channels

Telugu GEC

Ad volumes in last 3 weeks on Telugu GEC channels saw a slender but steady growth.

Ad Volumes of Telugu GEC Genre: Jun-Jul’20*

Ad volumes in last 3 weeks on Telugu GEC channels saw a slender but steady growth, Avg. Ad Volumes/Day dropped by 9% in Jul’20* compared to Jun’20 on Telugu GEC. Comparing week 30 to week 23, Ad Volumes grew by 39% on Telugu GEC channels.

No. of Categories, Advertisers and Brands: Jun-Jul’20*

Although tally of categories are on lower side during Jul’20*, the count of Advertisers and Brands grew by 17% and 7% respectively in Jul’20* over Jun’20.

Top Categories and Advertisers: Jun-Jul’20*

Top 10 categories had 9 FMCG categories accounting 45% to the Ad Volumes of Telugu GECs, more than 40% of the Ad Volume share of Telugu GEC channels was covered by HUL solely. Top 50 advertisers accounted 90% share of Ad Volumes on Telugu GEC channels

Categories and Advertisers present in Jun-Jul’20^ and not in Apr-May’20

40+ Categories and 90+ Advertisers advertised only during Jun-Jul’20^ on Telugu GEC channels