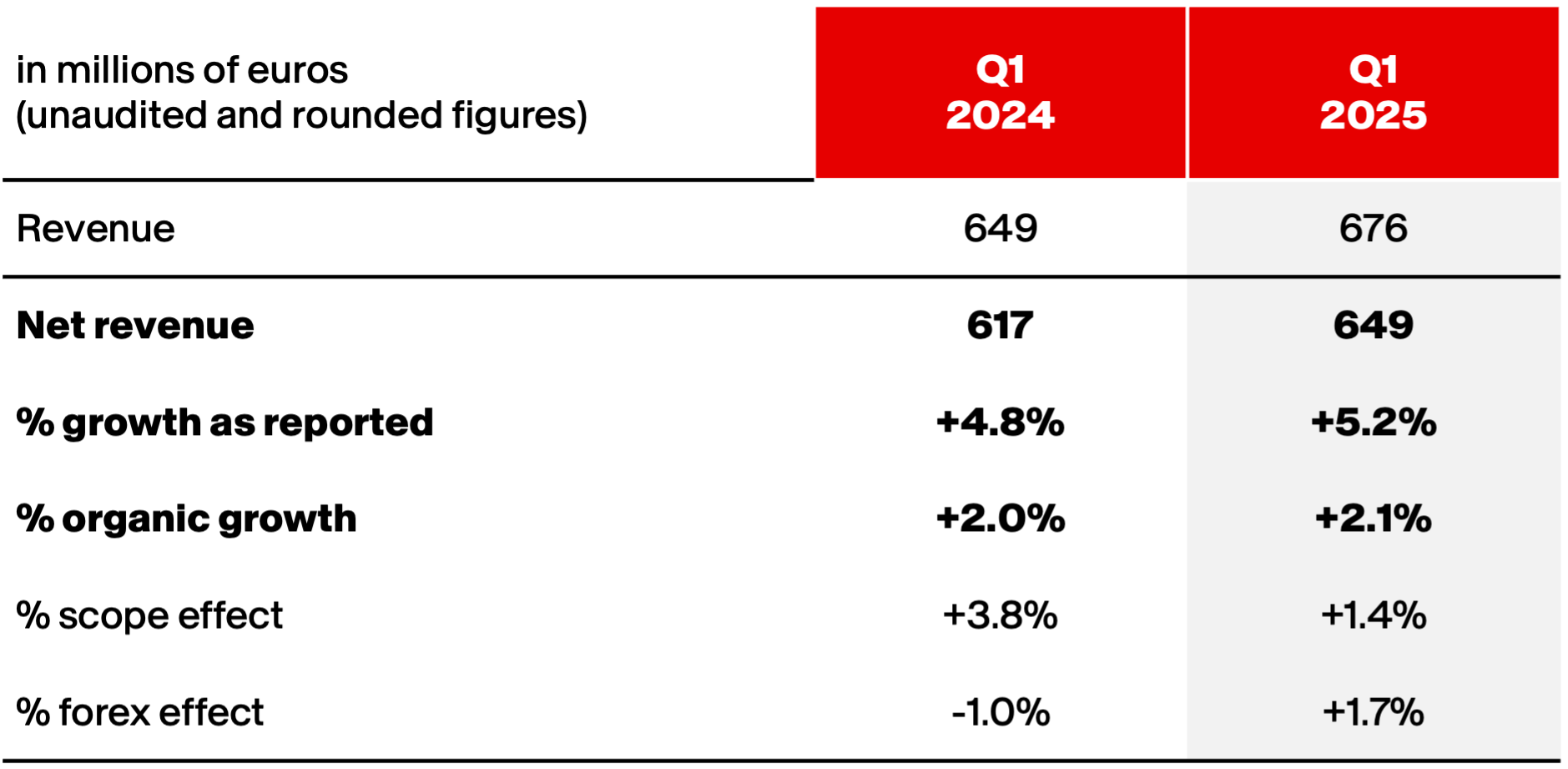

Mumbai: Havas has announced a solid start to 2025, reporting organic growth of 2.1% in net revenue for the first quarter. The group’s reported growth stands at 5.2%, reflecting the positive impact of recent strategic acquisitions and favorable currency movements. Havas has reaffirmed its full-year objectives, underscoring its continued momentum across key global markets.

“Havas has made a good start to 2025, maintaining its momentum and generating organic growth in net revenue of 2.1% and growth of 5.2% as reported,” said Yannick Bolloré, Chairman and CEO of Havas. “This performance, in line with our targets, reflects our business momentum, particularly in North America and Latin America, as well as progress on our bolt-on acquisition strategy.”

He further emphasized, “We continue to focus on the Group’s development, through the global roll-out of our ‘Converged’ strategy and operating system – which is powered by the best data, tech and AI – the expansion of our capacity in high-growth sectors, and an unwavering commitment to creative excellence. We are therefore confirming our objectives for 2025, while keeping a close eye on the global geopolitical and economic situation, in order to respond quickly and effectively, supporting our clients and teams in this context. I’d like to thank our clients for their trust, and highlight the dedication of our talented teams worldwide, who are key to our success.”

Key Q1 2025 Figures:

- Net revenue: €649 million, up 5.2% as reported

- Organic growth: 2.1%

- Revenue: €676 million, up 4.0% as reported

Growth was primarily driven by strong performance in North and Latin America, successful acquisitions, and favorable foreign exchange rates. The scope of consolidation changes contributed a 1.4% increase, while currency effects added a further 1.7%.

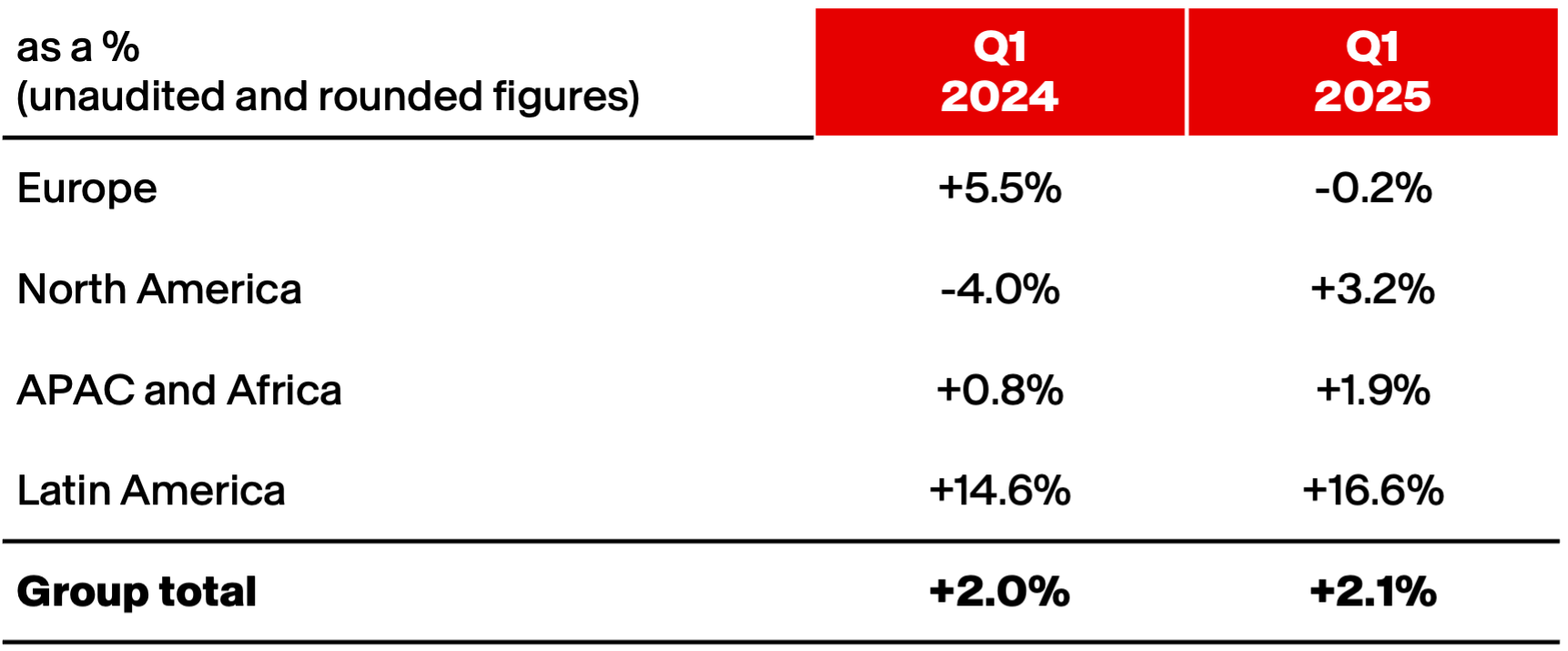

Regional Performance:

- North America saw a solid 3.2% organic growth, fueled by Havas Health’s double-digit performance.

- Latin America recorded exceptional 16.6% organic growth, led by Havas Creative and Havas Media.

- APAC & Africa posted a 1.9% organic increase, mainly from Havas Media.

- Europe saw a slight 0.2% dip in organic growth, with stable performance in France and slight declines in the UK.

Strategic Acquisitions:

During Q1 2025, Havas expanded its footprint through three significant acquisitions:

- CA Sports (Spain) – a specialist in sports sponsorship, now part of Havas Play.

- Channel Bakers (USA) – a leader in retail media innovation and Amazon Ads advanced partner, joining Havas Market.

- Don (Argentina) – a multi-award-winning creative agency enhancing Havas’ creative strength in Latin America.

Notable Client Wins:

- Havas Media Network: Campos Coffee, Carl Buddig, Collegium Pharmaceutical, Elizabeth Arden, MagicBricks, and others.

- Havas Creative Network: EA Games, EDF, Asahi, Red Lobster, and Free Telecom, among others.

- Havas Health Network: New mandates from Danone Nutrition, GSK, Merck, Novartis, and Sanofi.

Havas’ creative excellence continues to be recognized globally. Uncommon New York was named “Agency of the Year” by Campaign, while Havas Play retained its top spot among French agencies in the WARC Media 100 ranking.

Outlook for 2025:

Despite rising global economic uncertainties, Havas has not yet seen direct impacts from recent US protectionist measures and remains vigilant. The company has reaffirmed its 2025 financial guidance:

- Organic net revenue growth: Above 2%

- Adjusted EBIT margin: Between 12.5% and 13.5%

- Dividend payout ratio: Around 40%

Looking ahead to 2028, the group is targeting:

- Adjusted EBIT margin: Between 14.0% and 15.0%

- Dividend payout ratio: Around 40%

Upcoming Events:

- 2024 Annual Report: April 15, 2025

- 2025 Half-Year Financial Results: July 29, 2025

- Annual Shareholders’ Meeting: May 28, 2025, Amsterdam

The company will hold an analyst call on April 10, 2025, featuring François Laroze, CFO and COO of Havas.