John Doerr, once said “The Internet is the greatest legal creation of wealth in history.” There can’t be a more legitimate statement made in business history. Now if you talk of Internet, you can’t keep Google out of the picture.

Google has had a fascinating journey and its impact on businesses and consumers equally is stellar to say the least.

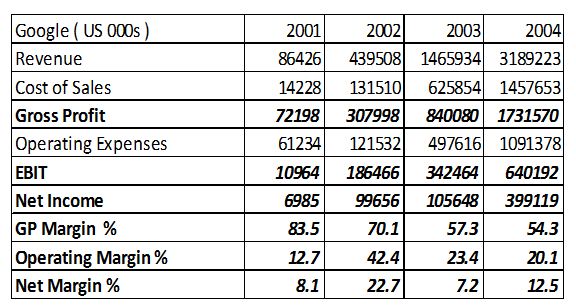

When Google listed itself in 2004, its financials were quite impressive for a new age company even before listing, probably few lessons for the unicorns to learn.

Source: Annual Report 2004

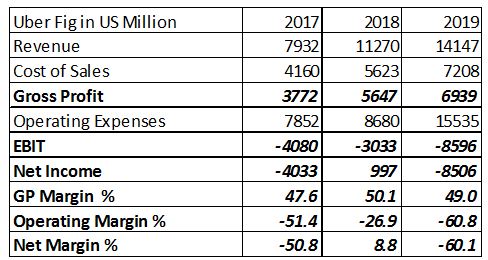

Google unlike many of the unicorns was profitable and its margins were healthy considering it was a start-up. The whole moot point is financials do matter only revenue growth is good for nothing. Just juxtapose this to Uber which was supposed to list with much fanfare at a valuation of 100 Billion, it was considered to be one of the big flops of Wall Street in the listing ecosystem. The financials do tell us a story, revenue growth has closed to doubled but if you just look at the margins it’s a quicksand. Growth at any cost is Uber.

Fast-forward to the current year from 2004, the journey has been a Lollapalooza for Google.

Source: 10K -2019

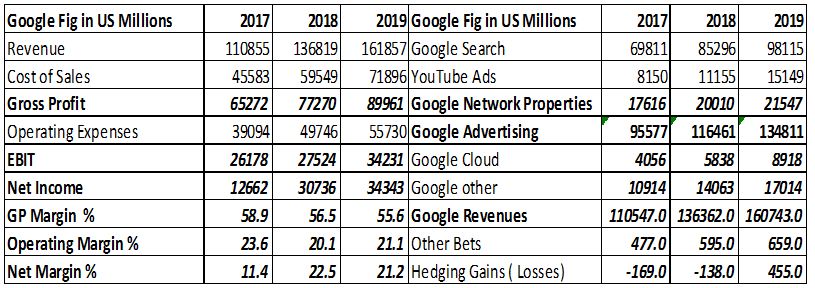

One of Warren Buffet’s most famous quotes is that “In business, I look for economic castles protected by unbreachable ‘moats.” An “economic castle” is a great business, and the “unbreachable moat” is the strategy or market dynamic that heightens the barriers-to-entry and makes it difficult or ideally impossible to compete with, or gain access to, the economic castle.

For Google, the economic castle is clearly the search business, augmented by its amazing AdWords monetization framework. Google derives close to 83-85% of its business from Advertising and out of which 98 Billion comes from search alone.

Competitive economics in tech business, do shift with change in scale, growth rates, maturity of the products and shifts in consumer behaviour. Google has mastered the art of strategic competition leading its way through significant acquisition’s.

Acquisition strategy is a double-edged sword, you get it right and the multiplier effect accumulates and giving the firm significant advantages and if you get it wrong, you pay a heavy price for a liability on your Balance sheet.

Google hasn’t got it right always, but it has got it right more often and when you’re a leader, you can afford to make mistakes and still recover because that’s what the castle allows you to do “Experiment for Innovation “.

The strategic ones for Google have been YouTube for $1.65 Billion, Double Click $3.8 Billion, Android for$ 50 Million. These acquisitions have made the economic castle not only powerful, but also a fortress with unbreachable shock wiring. Take Chrome, YouTube, Android, and Search, they brilliantly layer themselves between the consumer and engages with him or her presenting a wonderful opportunity for businesses to reach out to their audience. These interlinked bridges of software make the circle of competitive advantage not only wider but also deeply entrenched from which escape is impossible.

When software came into existence, it seemed like a miracle from heaven, WHY? because the variable costs were zero, what you had is duplication cost, which in pure economical terms, means you would make near 100% profit on each incremental unit that you sold.

Operating Leverage shoots through the roof, Contribution Margins expand like never seen before and if you have no debt as is the case of Google, your combined leverage is robust with no risk and cash keeps on compounding.

$132 Billion as cash on its books as on 31st Dec 2019 is a testimony to the above.

Cash is king in business and the virtuous cycle begins with compounding itself into a fortress which is what has made Google a consumer brand.

Google derives its strength from Audience agglomeration, resulting in monetising its platforms effectively and efficiently. Warren Buffett elucidated this brilliantly in his 1991 letter.

An economic franchise arises from a product or service that is needed or desired, it has no close substitute and is not subject to price regulation. Google perfectly fits into the Bucket of franchise earnings and hence the strength of Balance Sheet.

We would like to quote his partner and vice chairman of Berkshire, Charlie Munger to have a closure of Google.

“Google has a huge new moat. In fact, I’ve probably never seen such a wide moat in my life”

By Tanvi Mehta, Ramaswamy Ranganathan and Sudarshan Rajan, who are value investors and also teach the craft of valuation in leading Business Schools.