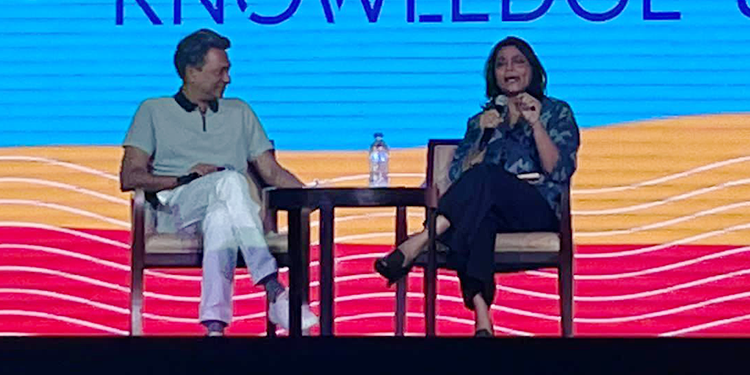

“We are back to normal. 2021 was not normal. The cycle has corrected,” noted Rajan Anandan, MD of Sequoia Capital and Surge, in conversation with journalist Anuradha Sengupta on day two of Goafest 2023.

Responding to Sengupta’s question on high valuations and the subsequent drying up of funding in the startup space, Anandan reasoned that the excess liquidity made available during Covid went into several sectors, including real estate and PE.

“When you have that much (interest free) capital available, you do see a level of exuberance,” noted the speaker.

Late stage funding has slowed down and a company needs to have good unit economics to attract funding in that stage, explained Anandan. He said, “In India, Series B funding and beyond (over Rs.100 cr) has slowed down. (For) Less than that, there are a very healthy number of companies starting up.”

“All late stage companies today have one priority – and that is to get profitable. That means you are only going to invest in advertising if you see a very clear RoI. Over the next 18 months every late stage company is either going to get profitable or go out of business. We believe most late stage companies will get profitable,” he explained, pointing to cases like Paytm.

As a consequence of this focus on profitability, there would be continued squeeze on advertising, he pointed out.

“Advertising will remain muted for 12 to 18 months. This is a near term cut on expenditure. Once they turn the corner, we will see very profitable companies. By 2026, you will have a set of clients with very good fundamentals,” he added.

On the investor mood for India, Anandan observed, “Today we have more ‘dry power’ earmarked for India than it has ever been. It is being invested more carefully.”

The digital advertising market would grow to Rs.2 lakh crore by 2030, of which a lot will be from small businesses, underlined Anandan, pointing to an opportunity ad agencies and media houses would do well to tap into.

E-commerce advertising was growing manifold and was another opportunity area, according to the speaker. It is roughly 3 to 4 pc of ecom GMP, he computed.

“The other opportunity is in e-commerce advertising, which is expected to touch Rs. 70,000 cr in seven and a half years,” he surmised