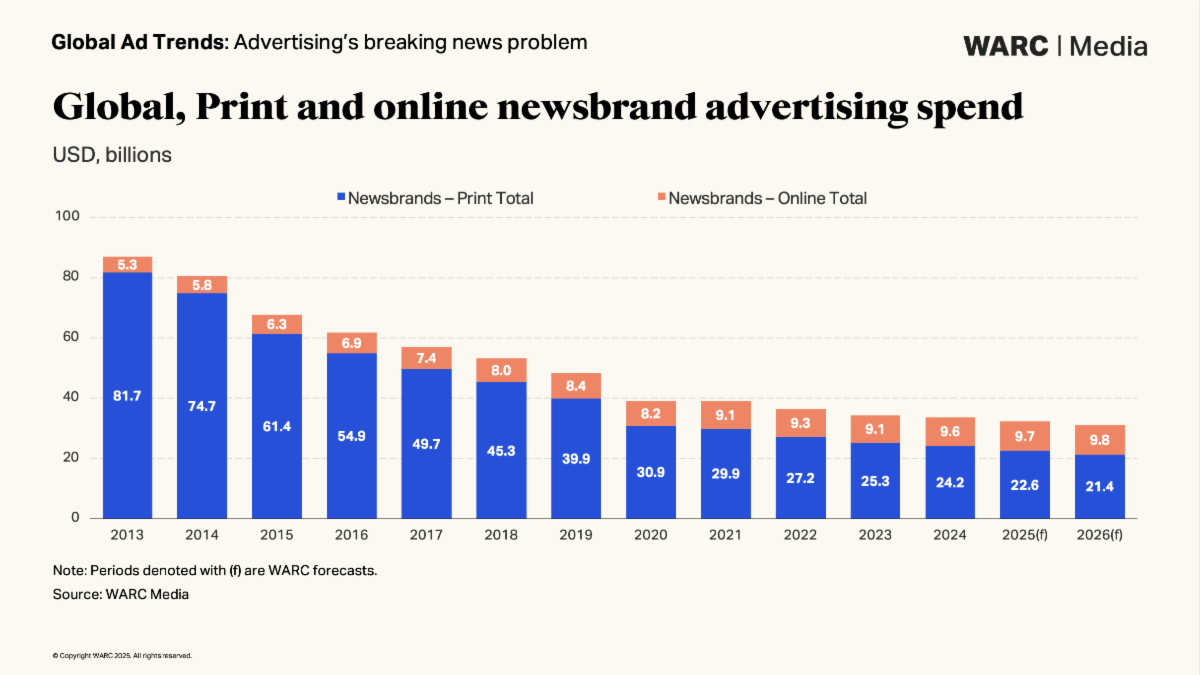

Mumbai: The global advertising landscape is experiencing a fundamental shift. According to WARC Media’s latest Global Ad Trends report, newsbrand ad spend is forecast to fall to $32.3bn in 2025, a steep 33.1% drop from 2019, with spending expected to remain flat through 2026. While audience interest in hard news continues to grow, advertiser investment is shifting away from professional journalism in favour of user-generated content (UGC) and creator-driven platforms.

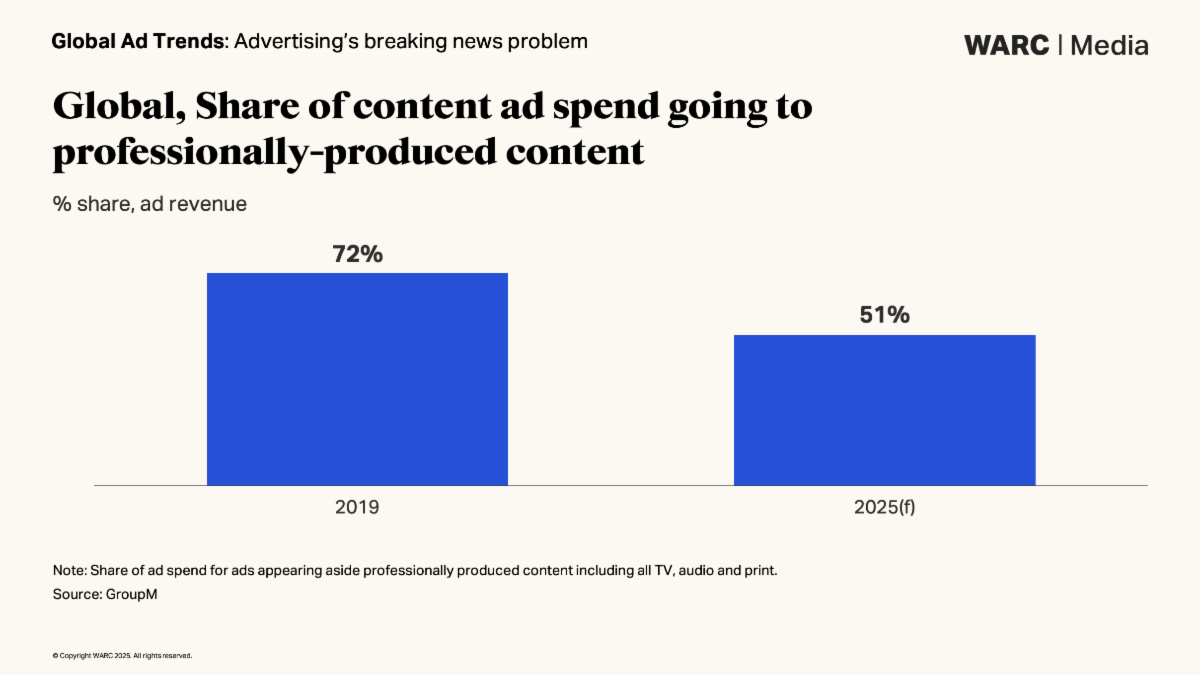

Titled “Advertising’s Breaking News Problem,” the report reveals that only 51% of global ad spend now goes to professionally-produced content, down sharply from 72% in 2019. This trend is most evident in developed markets like the UK and US, where news programming commands just 3.7% of total UK TV ad spend, while in the US, pharmaceutical brands account for 12% of national TV news advertising.

Alex Brownsell, Head of Content at WARC Media, stated, “Brands have become increasingly squeamish about hard news content. Keyword blocking hinders the ability of publishers to monetise newsworthy moments, while ad investment is increasingly shifting from professional journalism to ‘creator-journalists’.”

“In this Global Ad Trends report we look at where the news media ad dollars are being allocated and what newsbrands are doing to combat these losses and win back advertisers.”

The shift towards UGC is driven by its low production costs, algorithm-friendly structure, and perceived audience relatability. By 2026, UGC is projected to overtake professionally-produced content in total content-driven ad spend. The rise of platforms like TikTok and the emergence of AI-generated content are also accelerating this change.

Kate Scott-Dawkins, Global President, Business Intelligence at GroupM, noted, “As spend from the long tail of advertisers continues to outpace growth from the top 200, UGC is likely to dominate even more.”

Despite this global trend, India stands out as a rare exception. The country’s news sector has seen a 6% year-on-year growth in newsbrand ad spend, buoyed by the ongoing dominance of print media in a digitally transforming landscape. India remains the largest print market globally, with traditional formats retaining strong engagement even as urban audiences embrace online consumption.

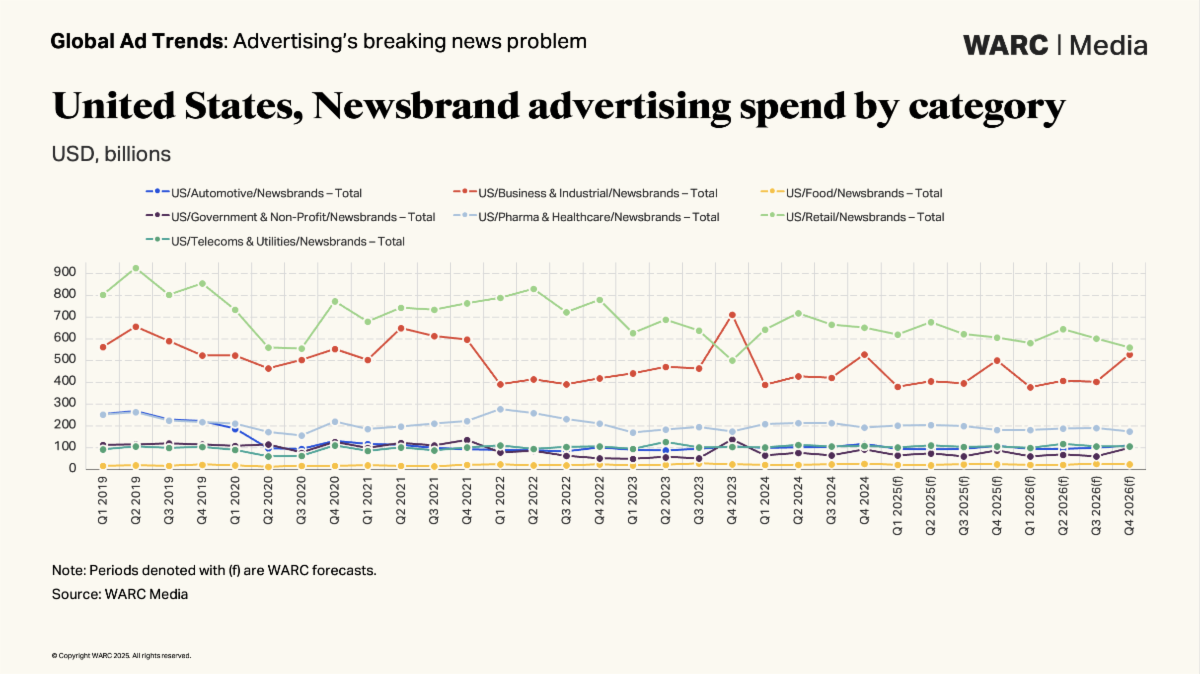

In the US, legacy advertisers like automotive and retail have migrated toward performance-based digital marketing. To adapt, news publishers are now targeting tech, healthcare, and direct-to-consumer (DTC) brands—sectors that continue to value trusted environments and niche reach.

In response to the evolving ad landscape, newsbrands are investing in AI, content classification tools, and multiplatform strategies to better demonstrate brand safety and campaign effectiveness. CNN, for example, is leveraging a neuro-linguistic AI tool to evaluate brand suitability across multimedia formats, while UK publishers like Reach and News UK are building in-house ad tech to manage keyword blocking issues.

Media agencies are also reassessing how they measure value. The introduction of metrics like quality CPM (qCPM) aims to more accurately reflect the effectiveness of ads placed in professional news environments. A Future of News survey by Stagwell found that 85% of EMEA marketing executives believe advertising in news media is a good investment.

Further validating the importance of trusted journalism, Newsworks and Peter Field’s 2023 study revealed that ad campaigns placed in trusted news environments delivered an 88% uplift in profit growth between 2018 and 2022.