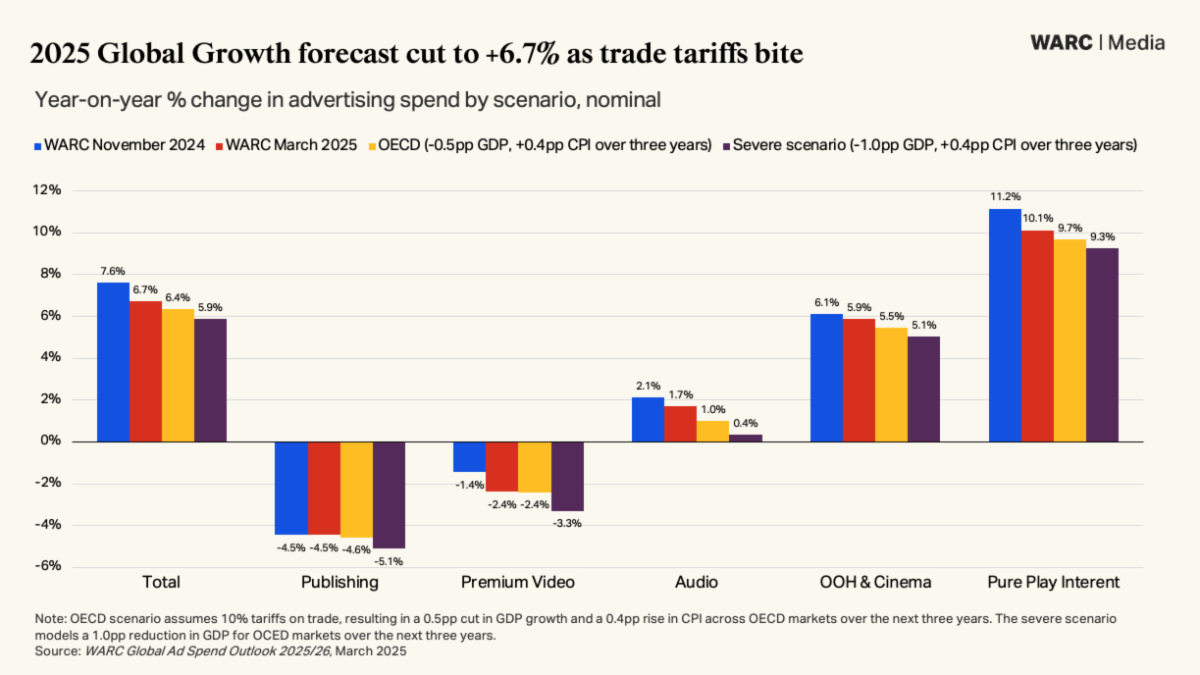

Mumbai: Global advertising forecasts have taken a hit as a new study from WARC indicates that market prospects have been downgraded by nearly $20bn over the next two years due to widespread disruptions from trade tariffs. The revised outlook now projects global ad spend to grow by 6.7% this year to $1.15trn, down almost one percentage point from earlier estimates, with 2026 growth trimmed further to 6.3%.

The downward revision is attributed to a confluence of economic headwinds, notably the growing risk of stagflation and recession across key economies, exacerbated by new trade tariffs set to take effect in the second half of 2025. Additionally, tightening regulatory measures in the EU against tech giants such as Google and Apple, alongside unresolved US antitrust issues with companies like Google and TikTok, have further intensified market volatility.

James McDonald, Director of Data, Intelligence & Forecasting, WARC, and author of the report, says, “The global ad market faces mounting uncertainty as trade tariffs, economic stagnation, and tightening regulation disrupt key sectors – leading us to cut growth prospects by $20bn over the next two years. Automakers, retailers, and tech brands in particular are now reigning in ad spend amid rising manufacturing costs and mounting supply chain pressures.

“Despite the growing volatility, digital advertising remains strong, led by three companies – Alphabet, Amazon and Meta – on course to control over half of the market in 2029. Regulatory scrutiny and uncertainty around TikTok’s future in the US further compound risks to growth, however, advertisers must be nimble in order to seize initiative in this shifting landscape.”

WARC’s latest projections, which are based on data aggregated from over 100 markets and incorporate a proprietary neural network analyzing more than two million data points, outline three potential scenarios. These scenarios range from a baseline forecast based on current indicators to more severe outcomes under heightened tariff and regulatory pressures. The study underscores that the impacts of trade fragmentation are expected to become more pronounced from H2 2025, influencing ad spending patterns globally.

Despite the challenges, digital advertising remains a bright spot in the landscape, with industry giants like Alphabet, Amazon, and Meta projected to command over half of the market by 2029. However, advertisers will need to remain nimble, as rising costs and geopolitical uncertainties continue to reshape global media strategies.