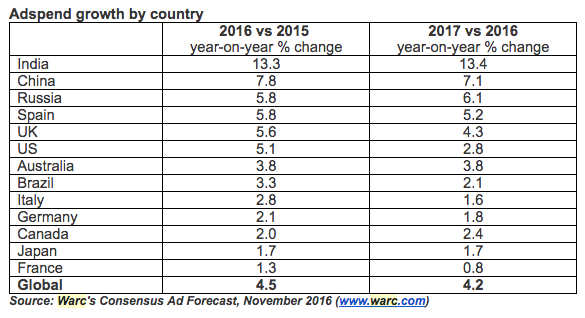

Advertising spend growth is to slow globally next year, including in China, but India is to see an even brisker rate of growth in 2017, according to data from Warc.

The report forecasts that the global advertising spend in 2017 will grow at 4.2 per cent, which is lesser than the growth rate 4.5 per cent in 2016.

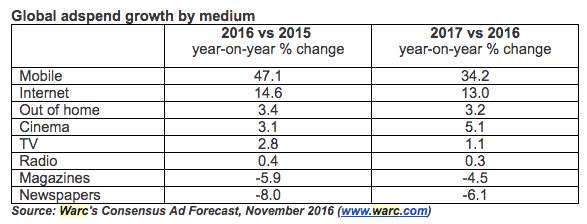

All major media channels except newspapers and magazines are expected to record ad-spend growth this year and next year. However, the two largest, TV (+1.1 per cent) and internet (+13.0 per cent) are forecast to see their growth rate ease during 2017. The pace of growth of mobile, the fastest growing medium, is to slow from 47.1% this year to 34.2% next year.

Warc’s Consensus Ad Forecast is based on a weighted average of ad spend predictions at current prices from ad agencies, media monitoring companies, analysts, Warc’s own team and other industry bodies. The current sources include Carat, eMarketer, GroupM, Magna Global, Nikkei Advertising Research Institute (NARI), Pitch-Madison, Pivotal Research Group and ZenithOptimedia.

All 13 markets covered in the report are forecast to see the amount invested in advertising rise both this year and next, though for eight of these the growth rate will be softer in 2017.

India is expected to see the strongest annual rise in ad spend this year, up 13.3 per cent, with a similar rate of growth anticipated next year. The world’s largest ad market, the US, is expected to post ad spend growth of 5.1 per cent this year – buoyed by the presidential election campaigns and the Rio Olympics. US ad spend growth is then forecast to cool next year – rising by 2.8 per cent – as the impact of these events is lost.

All four BRIC markets, India (+13.4 per cent), China (+7.1 per cent), Russia (+6.1 per cent) and Brazil (+2.1 per cent), are expected to post rises in ad expenditure this year and next.

France has the softest growth rate (+0.8 per cent) of the 13 markets studied forecast, while UK ‘s ad market is forecast to record adspend growth of 5.6 per cent this year and 4.3 per cent next.

All media, barring newspapers and magazines, are predicted to record year-on-year growth in 2017, with mobile expected to see the greatest ad spend rise, up 34.2 per cent.