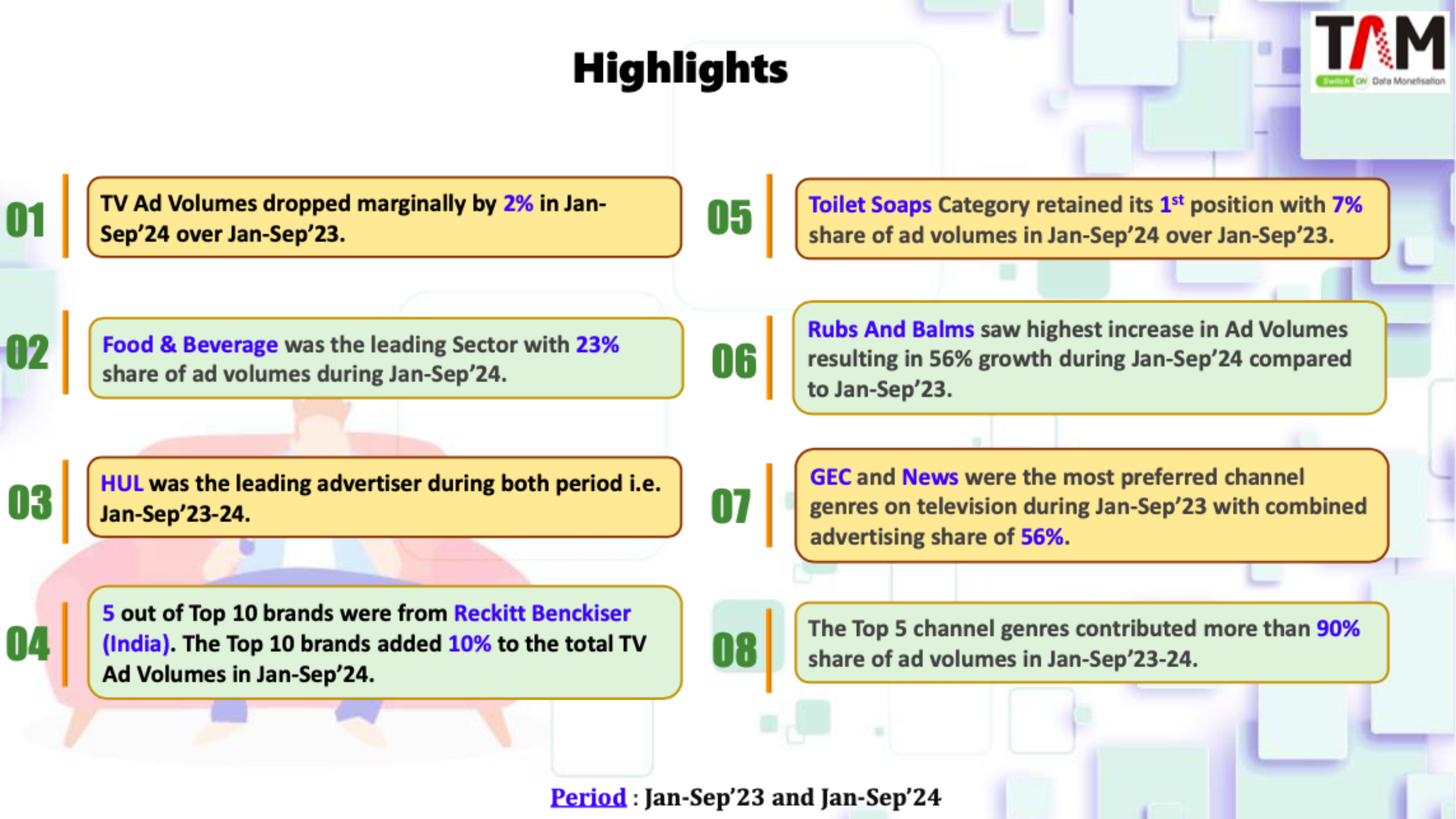

Mumbai: India’s television advertising sector showcased resilience in the first three quarters of 2024, despite a 2% decline in ad volumes compared to the same period in 2023, according to the latest TAM AdEx Report. The report highlights dynamic shifts in top-performing sectors, categories, and brands, reaffirming television’s pivotal role in the country’s advertising landscape.

Food & Beverages Sector Leads Ad Volume Share

The Food & Beverages (F&B) sector dominated TV ad volumes with a 23% share, maintaining its leadership position. Other key contributors included:

- Personal Care/Personal Hygiene (18%)

- Services (14%)

- Household Products (9%)

- Personal Healthcare (8%).

Collectively, the top 10 sectors accounted for 89% of total TV ad volumes, showcasing a stable reliance on television as a marketing platform.

Growth in Emerging Categories

The report highlighted impressive growth across 215+ categories in Jan-Sep 2024. Leading the charge were:

- Rubs and Balms – 56% growth

- Cement – 77% growth

- Ecom-Online Shopping – 42% growth

- Vitamins/Tonics/Health Supplements – 65% growth

- Tea – 16% growth.

Additionally, categories such as Washing Powders/Liquids and Milk Beverages saw double-digit growth, reflecting evolving consumer preferences.

Hindustan Unilever Retains Top Spot

Among advertisers, Hindustan Unilever (HUL) continued to dominate, followed by Reckitt Benckiser, Godrej Consumer Products, Procter & Gamble, and Colgate Palmolive India. The top 10 advertisers contributed 45% of total TV ad volumes in 2024.

Top Brands Drive Impact

The report also identified the top-performing brands, with Harpic Power Plus 10x Advanced, Dettol Toilet Soaps, and JioCinema App leading the charts. Notably, five of the top 10 brands belonged to Reckitt Benckiser, emphasizing the prominence of the Personal Care/Personal Hygiene sector.

Channel Preferences and Trends

Television ad volumes were primarily concentrated on General Entertainment Channels (GECs, 30%) and News channels (26%), which together accounted for 56% of total ad volumes. While these genres saw a minor uptick in share, Movies and Music genres experienced slight declines.

Despite marginal declines, television remains a cornerstone of India’s advertising ecosystem. The TAM AdEx report underlines television’s adaptability and continued relevance, driven by top brands, emerging categories, and diverse channel preferences. As advertisers explore innovative formats and invest in growth sectors, the future of television advertising in India looks promising.