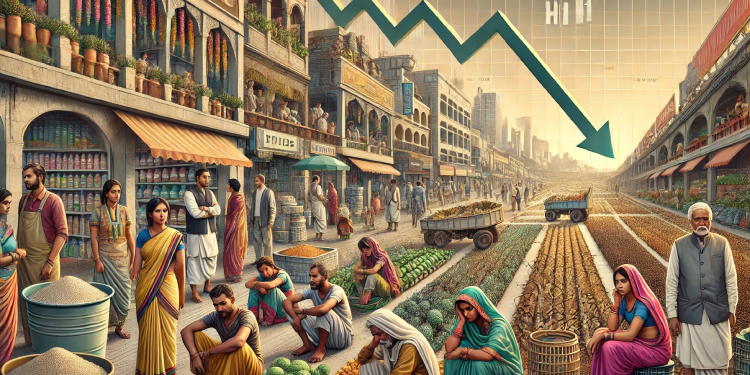

In urban areas, volume growth fell to 4.5% from 6.9% in the corresponding quarter of the previous year. This follows an exceptional period of consecutive quarters of growth, last observed in 2024 over the past five years.

While urban markets are not in decline, they are grappling with rising costs, which have affected purchasing power. Household spending saw a sharp rise, with average quarterly expenditures exceeding ₹6,000 for the first time in 2022 and reaching ₹6,761 in 2024—a 13% increase over two years. The average price per kilogram of FMCG products also increased by ₹4 in the August-October quarter, reflecting escalating inflation.

Meanwhile, Kantar report said it also seemed the rural market showed volume growth of 4%, slightly lower than urban areas. The slowdown is attributed mainly to the wheat flour (atta) category, which has underperformed. However, excluding atta, rural FMCG growth remains steady, with seasonal gains observed. Personal care categories in rural markets witnessed significant growth, rising from 2.8% in August-October 2023 to 5.4% in the same quarter of 2024, signalling improved consumer sentiment.

Inflation remains a critical factor for both regions, with the Consumer Food Price Index (CFPI) nearing 11% in rural areas. The divergence between value and volume growth is evident, with value growth outpacing volume growth due to inflationary pressures. While concerns over rainfall and its impact on the rabi season persist, no severe disruptions are expected.

Industry analysts anticipate that the FMCG sector will sustain similar growth levels into the first half of 2025. However, inflation is likely to remain a key challenge, influencing consumer spending patterns in the coming months.