Bengaluru: According to the latest report released by homegrown firm RedSeer Consulting ‘Mid-Festive Check In’, the first week (2nd-5th Oct) of festive sale of 2021, eCommerce platforms including social commerce and grocery, altogether the platforms garnered ~USD $2.7 billion in sales and is on track to achieve USD $4.8Bn gross merchandise value (GMV) which was forecasted by RedSeer Consulting last month.

Further, the report added that the first four days of the Festive week in CY’20 accounted for 63% of the overall festive week sales – as compared to this year where it accounts for ~57% of the projected sales. Smartphones contributed ~50% of GMV during the first four days of sales.

Commenting on the festive sale, Ujjwal Chaudhry, associate partner at RedSeer, said, “With the festive sales lasting longer than last year (9 days compared to 7 days) – we are observing the customer demand being more spread out across the period than being concentrated in the first half of the Festive week. To that tune, we have observed sales of ~USD $2.7Bn across eCommerce platforms and we expect another further ~USD $2.1Bn over the next 5 days.”

RedSeer had earlier said that the platforms will clock over $9 billion gross merchandise value (GMV) during the festive season which is a growth of 23 percent.

According to the report, below are some of the emerging micro trends that are expected to take center stage during the festive season are-

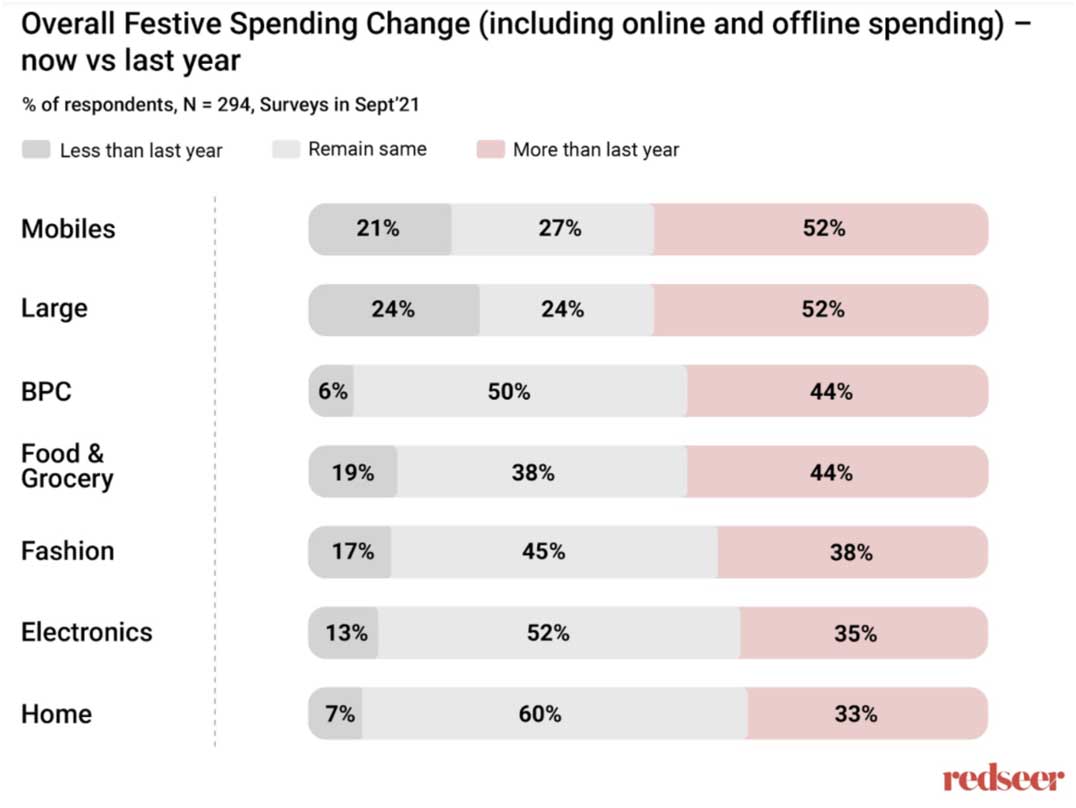

The report estimates that over 75% of customers are planning to buy equivalent to or more than last year across categories like mobiles, large appliances, beauty, and fashion.

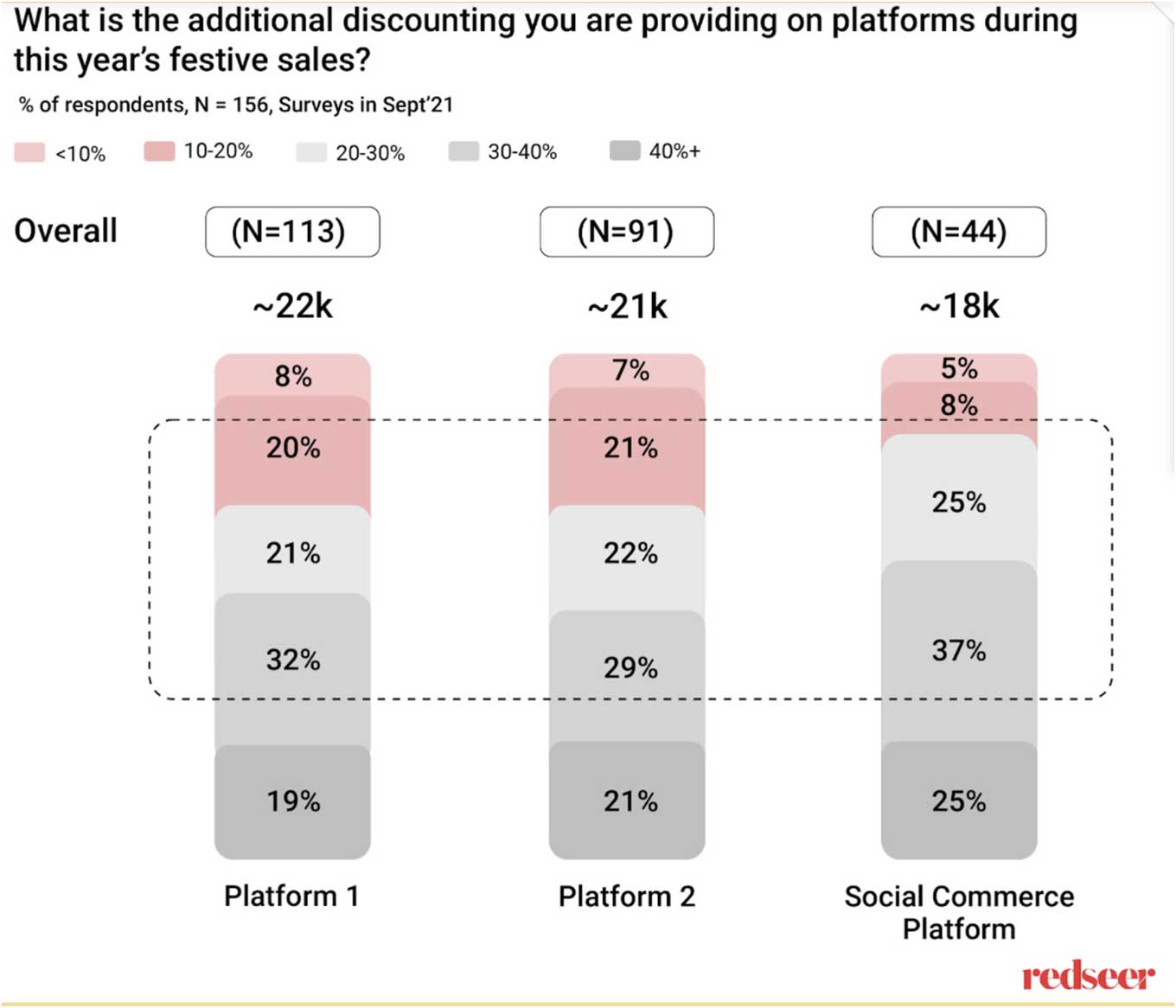

Further the report says that seller sentiments are equally optimistic this year. Many sellers are planning to offer ~10-30% discounts on platforms, with the goal of releasing higher volume sales. Sellers on both eCommerce and social commerce platforms have a favorable perspective of forecasted volume sales and growth during the upcoming festive season.

With horizontal platforms rapidly scaling up their warehousing capabilities towards ensuring prompt delivery, the delivery time is expected to reduce by ~5 hours YoY.

Further with easy credit and instant affordability, BNPL schemes are likely to account for ~10-15% of sales this festive season, says the report. Buy Now Pay Later schemes are expected to continue to play a key role in contributing to enhanced sales. BNPL accounted for ~4-7% of sales last year but is well-poised to command a higher share i.e. ~10-15% of sales this year.