Ad volumes of the BFSI sector on Television rose by 2% during Jan-Apr ’21 compared to the same period in the previous year, as per the TAM AdEx report on Banking and Finance Investments (BFSI).

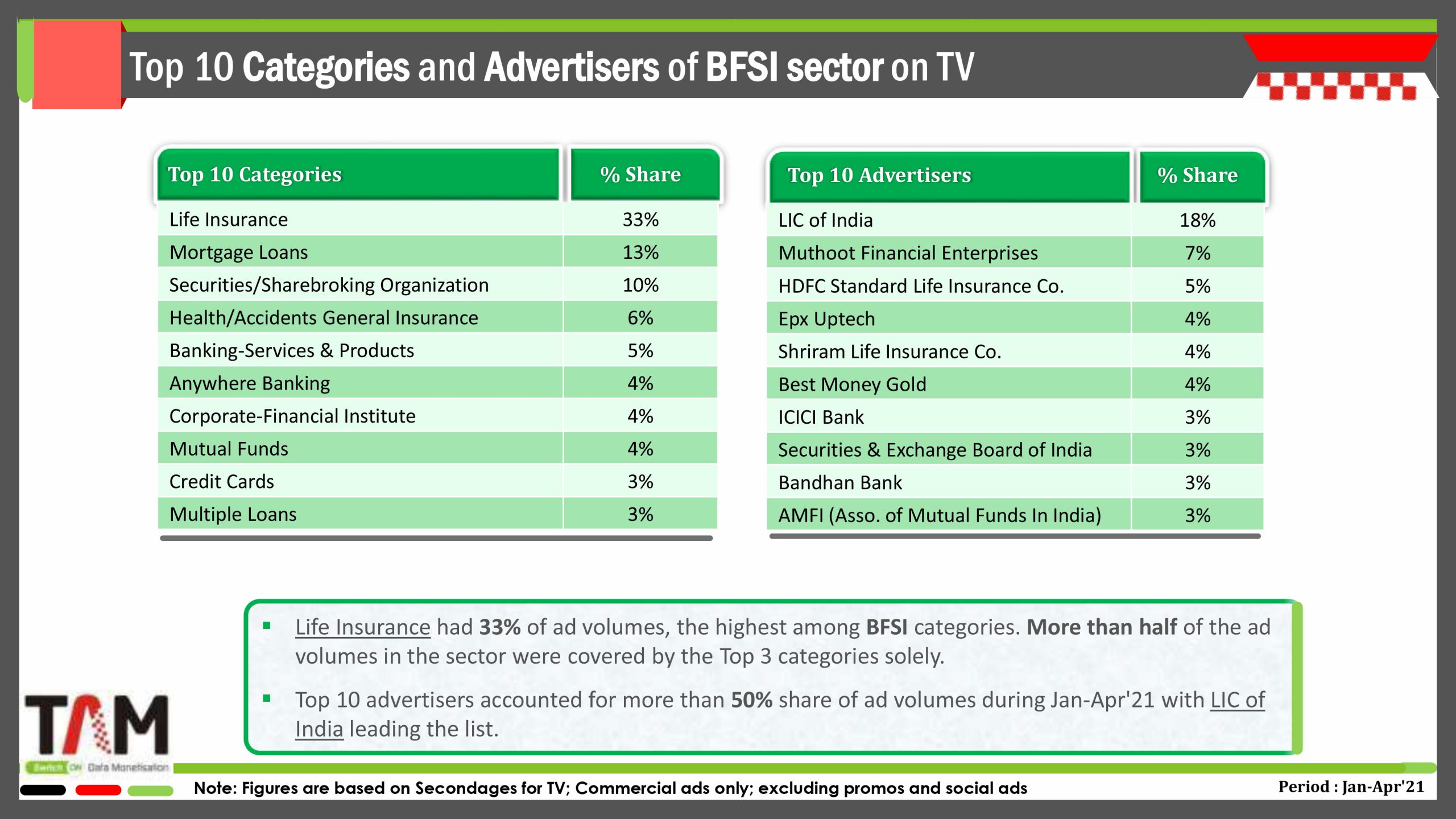

In the Television category, the Top 10 advertisers accounted for more than 50% share of ad volumes during Jan-Apr’21, with LIC of India leading the list. Life Insurance had 33% of ad volumes, the highest among BFSI categories. More than half of the ad volumes in the sector were covered by the Top 3 categories solely in the Television category.

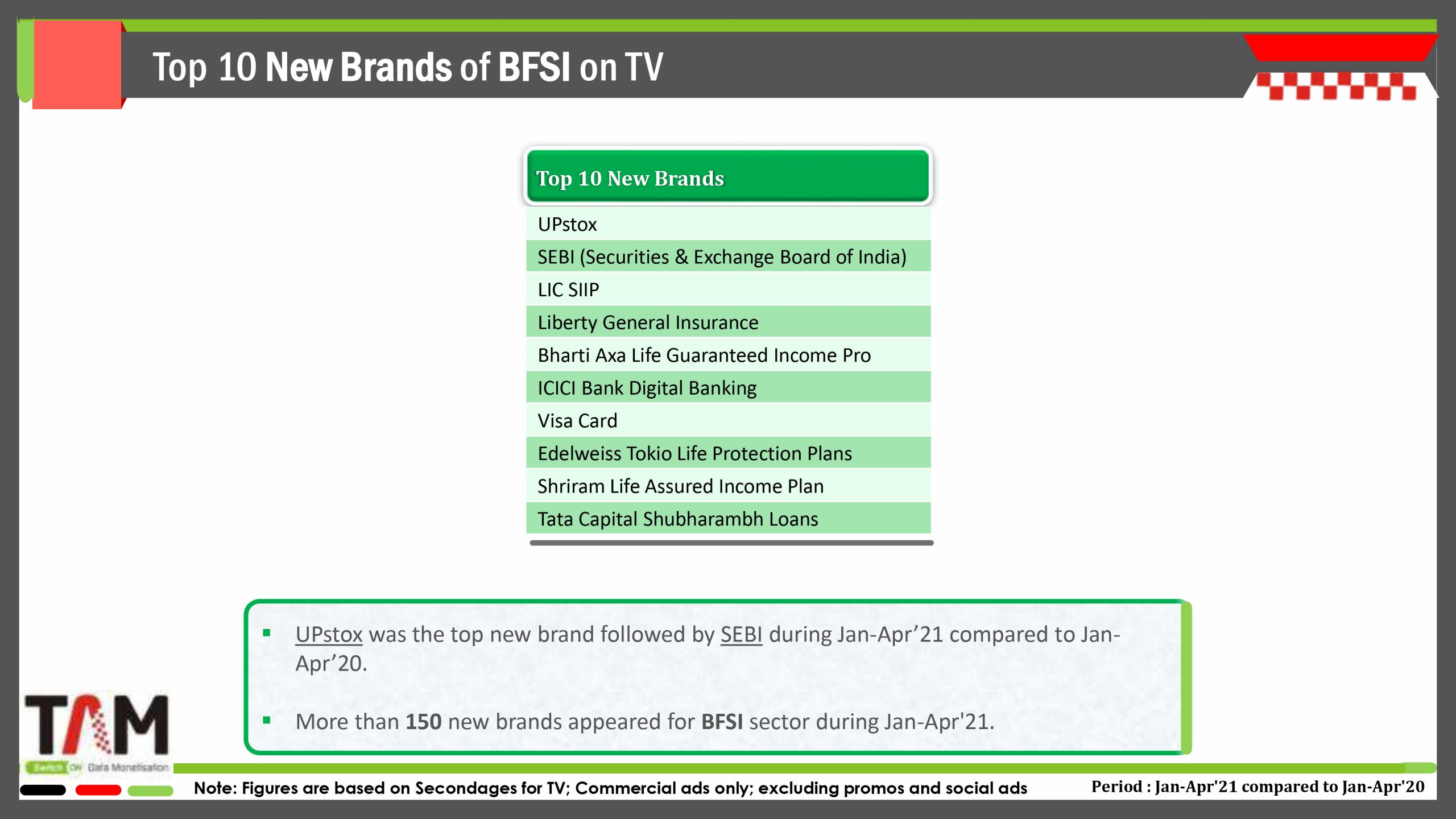

In the Television medium, UPstox was the top new brand followed by SEBI during Jan-Apr’21 compared to Jan- Apr’20. More than 150 unique brands appeared for the BFSI sector during Jan-Apr ’21.

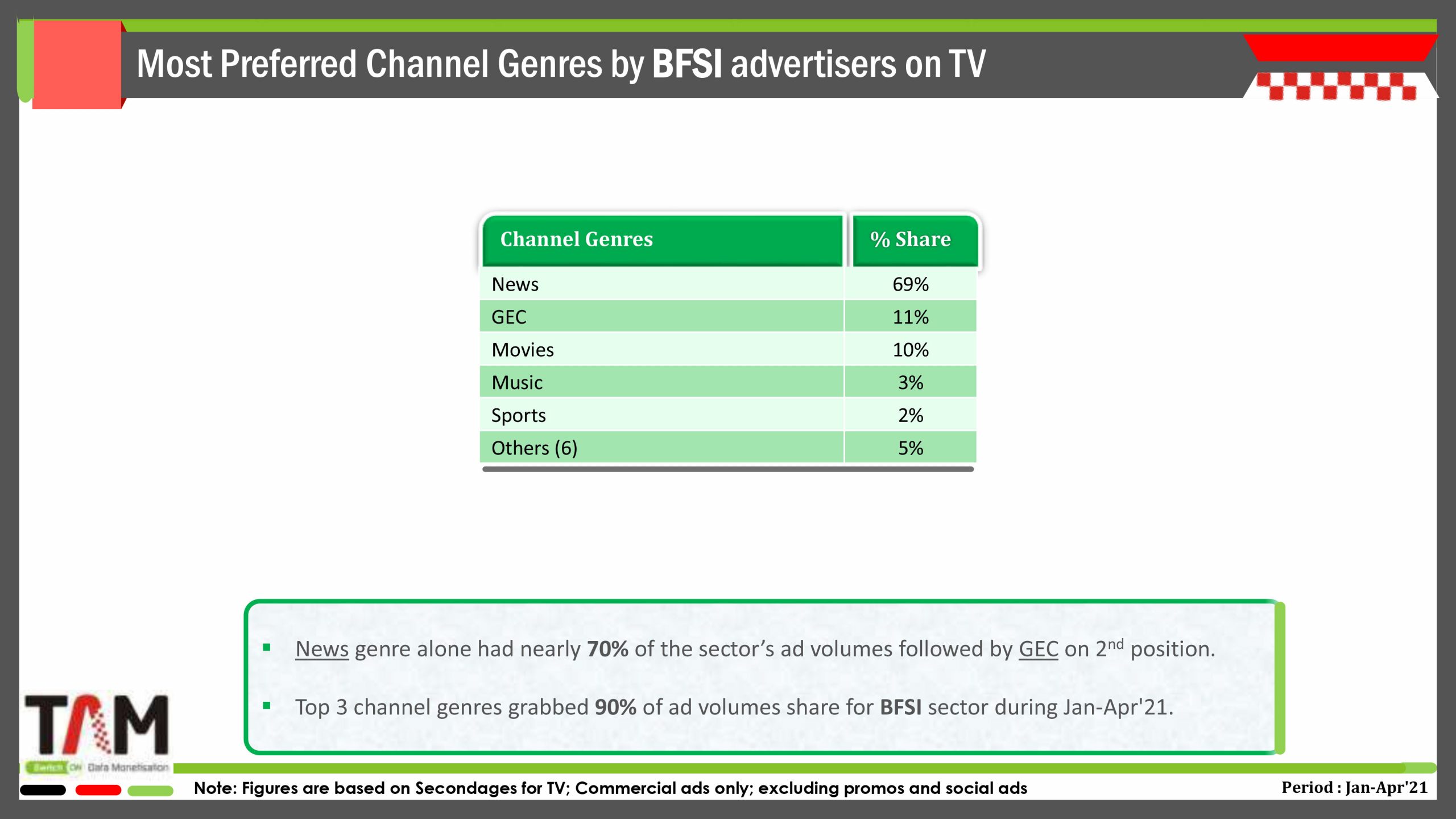

The News genre alone had nearly 70% of the sector’s ad volumes, followed by GEC in 2nd position. Top 3 channel genres grabbed 90% of ad volume share for the BFSI sector during Jan-Apr’21.

Prime Time was the most preferred time band on TV, followed by Afternoon.

Together, the Prime Time, Afternoon, and Morning time bands combined for more than 70% of ad volume.

The Advertisers of the BFSI sector preferred 20 – 40 secs ad size on TV. 20-40 seconds and <20 seconds ads added 89% share of sector ad volumes during Jan- Apr’21.

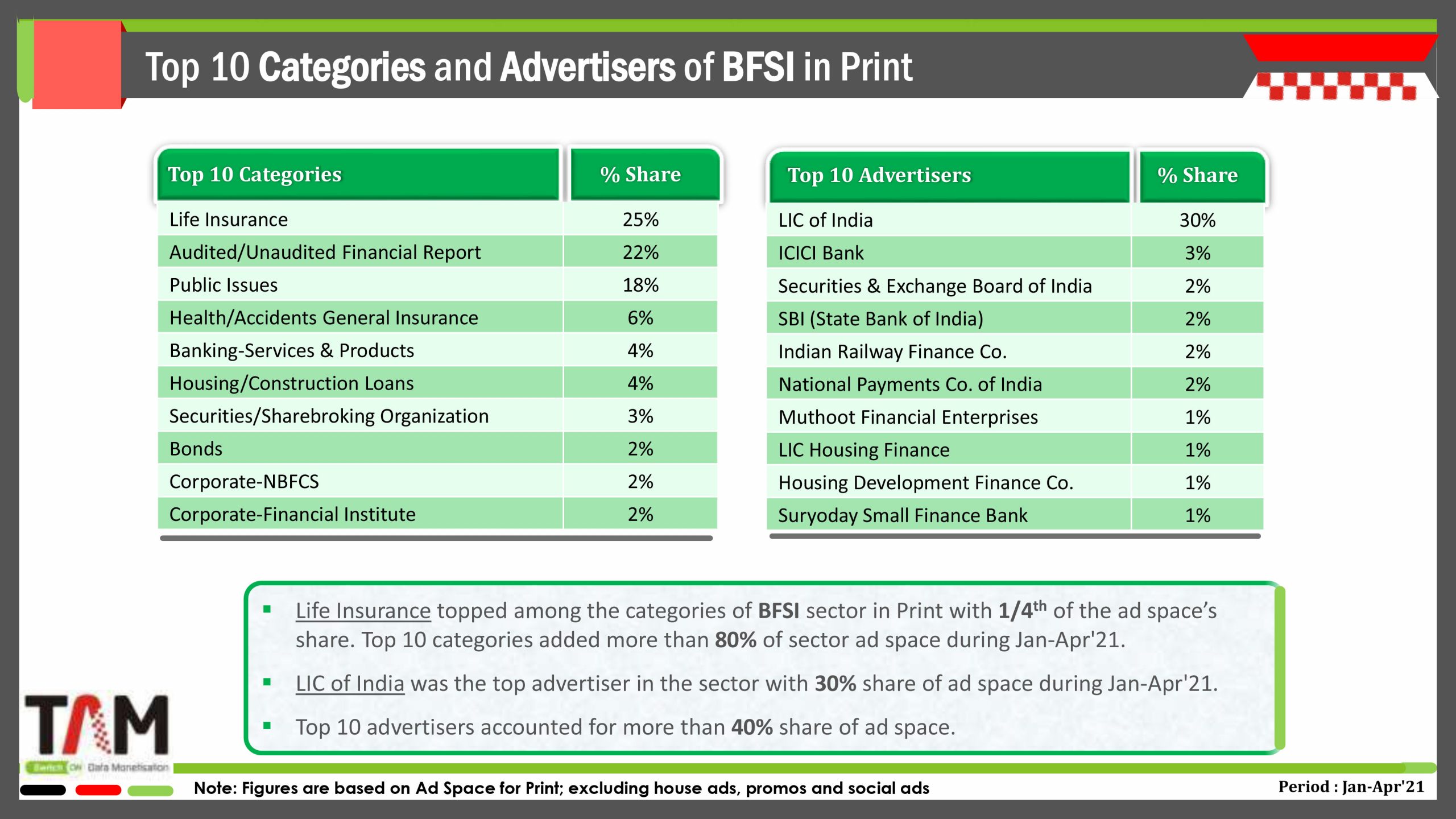

Print medium witnessed Advertising growth of 49% in Jan-Apr’21 over Jan-Apr’20. LIC of India topped with a 30% share of the sector’s ad space.

Life Insurance topped among the categories of the BFSI sector in Print with 1/4th of the ad space’s share. The top 10 categories added more than 80% of sector ad space during Jan-Apr’21. LIC of India was the top advertiser in the sector with a 30% share of ad space during Jan-Apr’21. Top 10 advertisers accounted for more than 40% share of ad space.

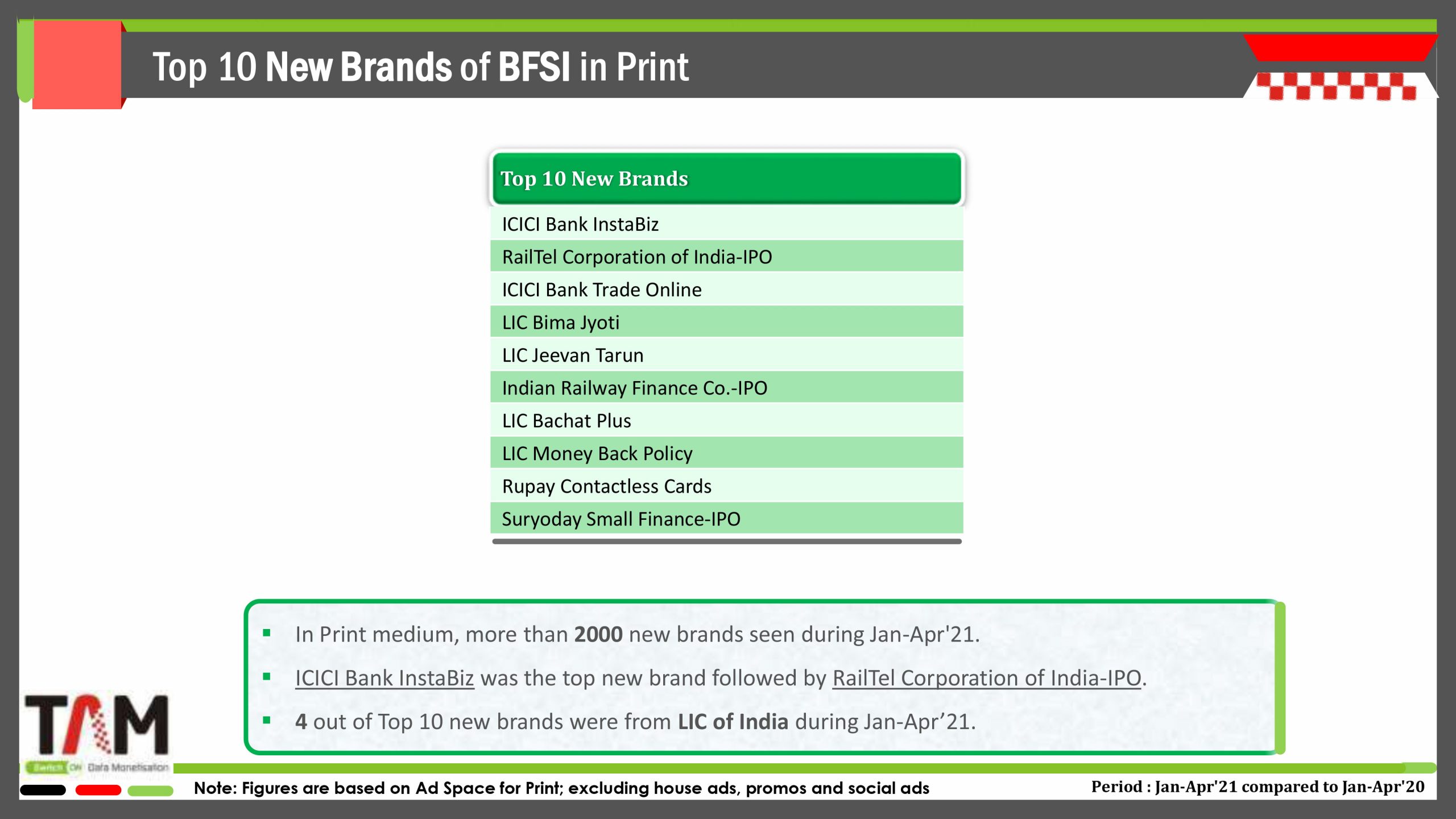

More than 2000 new brands were seen in the Print medium during Jan-Apr ’21. ICICI Bank InstaBiz was the top new brand, followed by RailTel Corporation of India-IPO. 4 out of the Top 10 new brands were from LIC of India during Jan-Apr ’21.

The English language was on top with a 52% share of ad space. The Top 5 Publication languages together added 87% share of the sector’s ad space. General Interest publication genre had 56% share of sector’s ad space in Jan-Apr’ 21.

Among 4 zones, South Zone topped in BFSI advertising with 35% share during Jan-Apr’21. Mumbai & New Delhi were Top 2 cities in overall India for advertising in the sector.

Radio

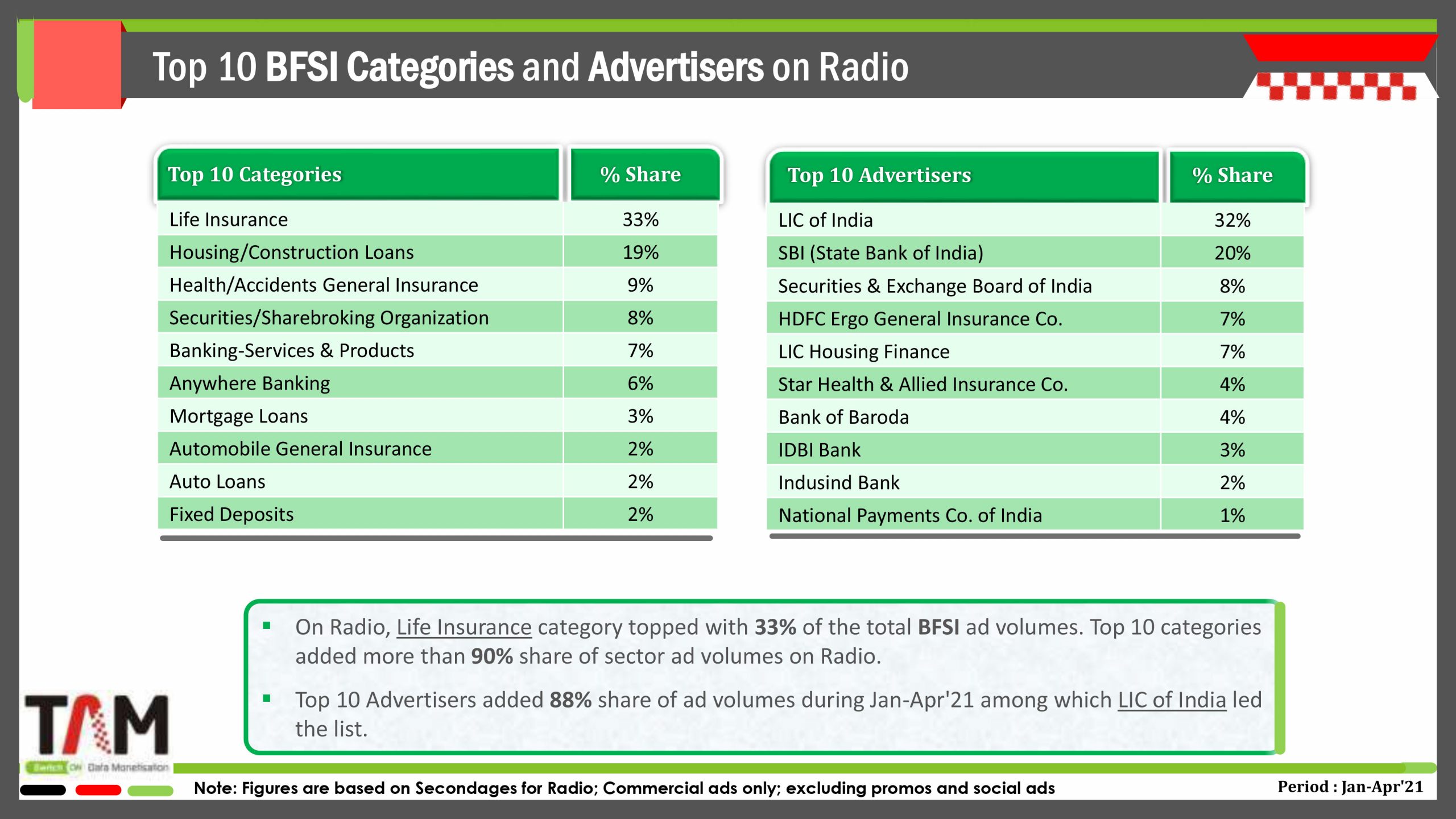

BFSI ad volumes on Radio grew by 27% in Jan- Apr’21 over Jan-Apr’20. The Life Insurance category topped with 33% of the BFSI ad volumes

The top 10 categories added more than 90% share of sector ad volumes on Radio. Top 10 Advertisers added 88% share of ad volumes during Jan-Apr’21, among which LIC of India led the list.

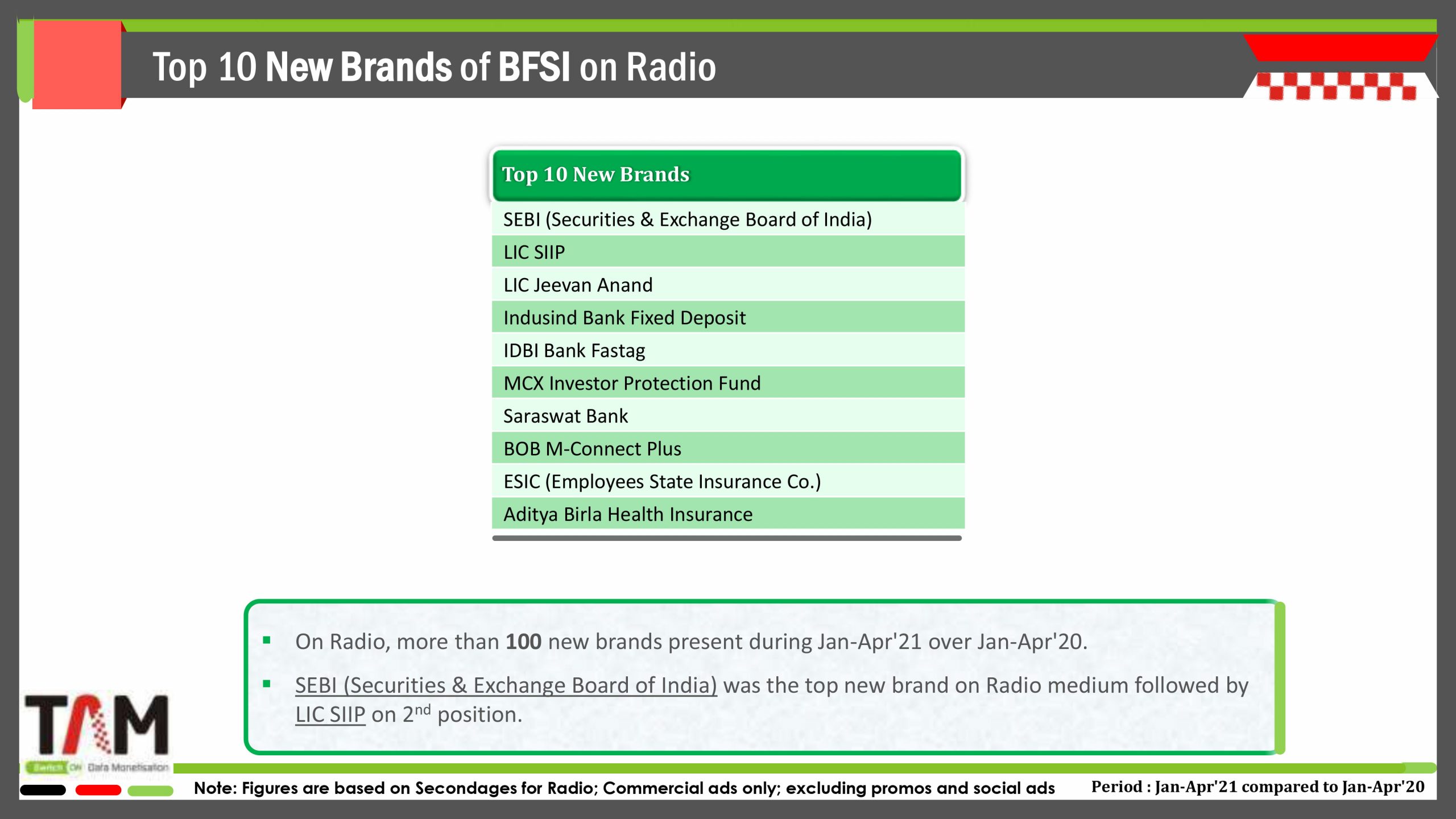

On Radio, more than 100 new brands present during Jan-Apr’21 over Jan-Apr’20.

SEBI (Securities & Exchange Board of India) was the top new brand on Radio medium, followed by LIC SIIP in 2nd position.

Advertising for the BFSI sector was preferred in the Evening and Morning time-band, combining 87% share of sector ad volumes on Radio.

Digital

On the Digital medium, ad insertions increased significantly by 84% during Jan-Apr’21 than in the same period last year.

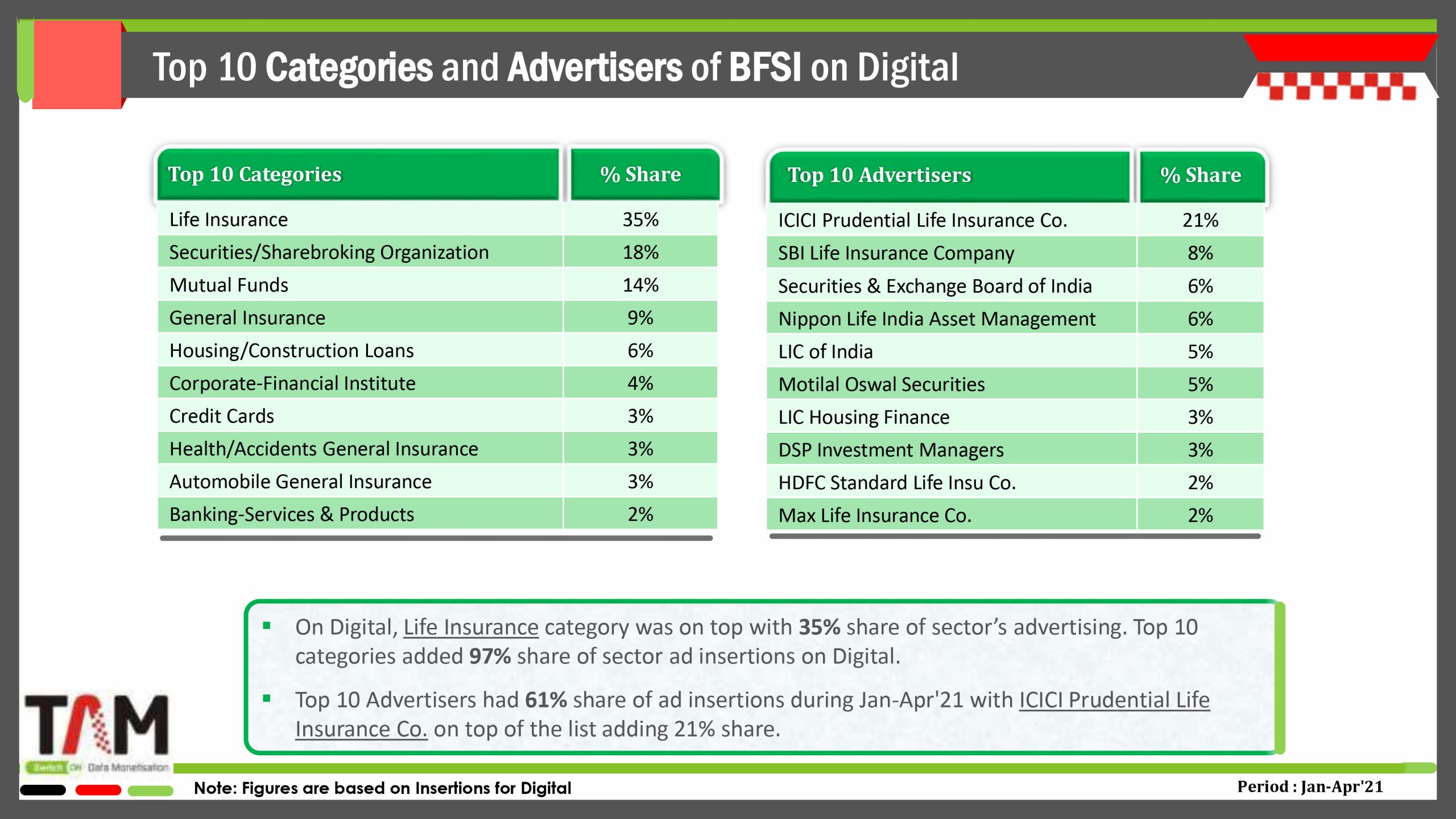

On Digital, the Life Insurance category was on top with a 35% share of the sector’s advertising. The top 10 categories added 97% share of sector ad insertions on Digital. Top 10 Advertisers had 61% share of ad insertions during Jan-Apr’21 with ICICI Prudential Life Insurance Co. on top of the list adding 21% share.

Ad Network transaction method topped with 45% share of BFSI’s ad insertions on Digital during Jan-Apr’21 closely followed by Programmatic/Ad Network with 43% share.