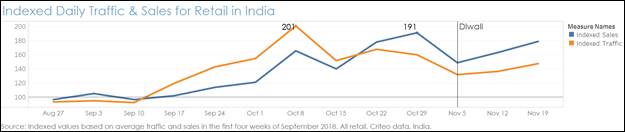

New Delhi: Criteo, the advertising platform for the open Internet, today released seasonal data in anticipation of Diwali, to help e-commerce companies and online retailers better understand the buying behaviour of their customers during the festive season in India. The seasonal data, based on consumers’ online browsing and buying behaviour during the peak season, revealed that the highest sales peak and website traffic were witnessed a month before Diwali. +91% Uplift in online retail sales in the weeks leading up to Diwali.

As the major ecommerce players in India ride on the growing popularity of online shopping, festive season has become a period of great significance. Almost every ecommerce player in the ecosystem launches mega-sales during the festive season as consumers look to explore thousands of brands online and spend their disposable income. There is a brand war with high budget spending on advertisements as well as sales offers on consumer products and services.

According to Criteo’s findings, which are based on an aggregated analysis of 412 million retail shopping transactions made in India last year, it revealed that traffic and sales start to pick up in September and reach highs during October. Traffic reaches a peak increase of +101% four weeks prior, and sales peak the week before Diwali.

Expressing his views on the Diwali season trends, Kenneth Pao, Executive Managing Director, APAC, Criteo said: “The shopping spree amongst Indians starts in the month of August with the Rakshabandhan festival and this buying trend continues and strengthens until Diwali in October/November and Indian buying trend changes tremendously. At Criteo, we identified many trends through the analysis of 412 million retail shopping transactions, on an aggregated basis. The festive season in the last few years has seen a trend of large number of shoppers shifting from traditional modes of shopping to online shopping. With a rapid increase in the number of smartphones and mobile data consumption, phones have become the first point of brand interaction with their users. With the rising adoption of m-commerce and huge discounts offered by ecommerce players, Diwali automatically becomes the season of shopping. We are witnessing huge uplift in sales, revenue and online traffic on ecommerce portals, many factors contribute to this trend, such as the ease of digital payment and the readiness of consumers to try the various payment methods. Huge budgets that are specially allocated by brands for advertisements during the Diwali sale period is yet another major factor. ”

According to data gathered by Criteo, retailers should bid more aggressively and consistently, and should start doing so at least 5-6 weeks before Diwali. High average order values could also be seen throughout this period. There is an increase of +42% in conversions and +95% in average order values, which led to a +177% increase in revenue. 40% of shoppers in October were either new or had not been seen in two months.

Strong uplift in retail sales is seen on mobile web and app, three weeks before Diwali. The uplift in sales from app is the highest a month prior to Diwali. App and mobile consistently see the highest surges in the 3 weeks before Diwali. This may be due to consumers having less time to spend on their PCs/laptops during the festival period, which in turn causes them to use their smartphones to complete last-minute purchases. Up to +66% uplift in retail sales from apps and +29% increasein retail sales from mobile web in the weeks leading up to Diwali. This clearly shows that m-commerce is experiencing a huge rise in India. Consumers can easily explore thousands of products and brands at their own convenience, which saves time, money and energy.

Bookings to India start surging in September and remain high into the second week of October, reaching a peak increase of+48%. Travel to India also see peaks in the month following Diwali. Criteo also analysed the trends from identifying 23 million flight bookings across desktop, smartphones and tablets from 32 travel advertisers in India.