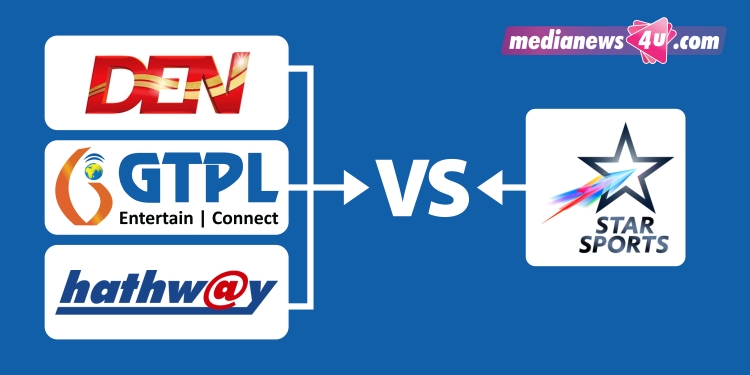

Disney Star India’s primary sports channel Star Sports has lost its placement on 22.8 million cable homes as Multi System Operators (MSOs) GTPL, DEN and Hathway have moved the channel out of their base packs following disagreement over the channels’ pricing under NTO 3.0.

MSOs defend their move stating that they have always been at the forefront to provide affordable services to consumers and continuously trying to offer more value-for-money services. The decision to rationalise sports offerings is another step in this direction, they argue. The price hike by the broadcaster after the implementation of NTO 3.0 makes their packs expensive, hence to balance customer choice and affordable pricing unbundling becomes essential, is their contention.

They also justify the stand citing that entertainment channels are required for all viewers through the year, whereas sports content is not watched by everyone and demand arises only during important tournaments.

DTH players have successfully used the sports genre to keep higher ARPUs compared to cable. Now, cable platforms are also looking at a similar strategy to pass on cost only to viewers willing to pay extra and not to all subscribers by bundling it with entertainment.

Impact on reach and viewership

Star Sports, which owns the TV broadcasting rights of IPL, will now be available on a-la-carte basis which subscribers can avail at Rs 19 extra to the respective MSOs.

Removal of the channel from the base pack of an MSO will impact the reach and viewership of a channel, especially in the immediate term. However, if the content is compelling enough, it may make users pay, say experts.

Responding to a query from MediaNews4U, Pankaj Krishna, Founder & CEO, Chrome Data Analytics and Media, said, “The decision by GTPL, DEN, and Hathway to move Star Sports out of their base package may have an impact on the reach of the channel, especially among viewers who rely on the base package to access content. It’s also possible that the move by these MSOs could lead to consumers subscribing to the channel on an a-la-carte basis, which could result in higher revenues for the channel in the long run.”

“Ultimately, the impact on the reach of Star Sports will depend on a number of factors, including the availability of alternative Star channels carrying the same content, the willingness of viewers to pay for a-la-carte subscriptions, and the marketing efforts of the channel to attract new viewers.” Krishna added.

Sapna Sharma, Co-Founder and COO, Efficacy Worldwide, said, “GTPL, DEN and Hathway form a large chunk of cost-conscious consumers, who, unlike their not-so-cost-conscious consumers, evaluate every price point as a part of monthly budgeting. When the NTO 3.0 row is already on, and the consumers are aware of some form of extra levy on them by the broadcaster, they are bound to drop Star Sports and switch to Jio for watching IPL. This in my mind does have an immediate effect on the deliveries of Star Sports on IPL but more important is the fact that in the long run their return to linear TV becomes a question mark. We have seen in the past also that once a consumer starts to drift towards OTT consumption their time spent on linear TV decreases significantly.”

Abhishek Mukherjee, Chief Business Officer, The Media Ant, said, “Yes- unless there is a strong appeal to TRAI. Audiences will switch to Free Channels to watch good quality content like IPL on 4k video + Great studio teams and analysis.”

A senior advisor from the distribution industry said, “Yes it will impact. The base pack in the past was almost 65 to 70pc and I think the number will be the same. And at the same time the base pack prices are being increased, so the pack which is above the base pack will significantly go up. So obviously the reach will fall.”

“Some weeks back when there was a fight on the NTO 3.0. If you see the ratings of that week, there was a significant drop in GEC ratings. That’s an indication that if all MSOs cut them off, there is reach loss even for the main channels. The similar logic will apply to Star Sports when it moves from a base pack to a higher pack but the loss won’t be that significant for a sports channel.”

Will the move benefit Jio Cinema?

Of the 67 million cable homes in India, the recent data from the ground sources reveals that GTPL owns 9 million, Hathway has 6.5 million and DEN holds 7.3 million that totals to 22.8 million subscribers. This translated to one third of the total number of cable subscribers in the country. Will this benefit Jio Cinema by translating into incremental digital viewership?

Krishna said, “It’s possible that the move to remove Star Sports from their base packages could benefit Jio Cinema by translating into incremental digital viewership, especially among consumers who are looking for alternative ways to access sports content.”

“Jio Cinema offers a range of content, including sports, and is available to Jio subscribers on their mobile devices. By making sports content available on Jio Cinema, Jio may be able to attract viewers who are looking for convenient, on-the-go access to their favorite sports events,” he added.

Sapna said, “Not only in the short term of IPL viewership, but also in the long term by pushing a sizeable chunk of audience which is already in the waiting for an option like Jio to fulfil their content consumption needs.”

Mukherjee said, “Yes they will benefit- as they’re Live Streaming IPL for Free on OTT and CTV. OTT will have an audience of 500Mn and CTV : there are 32Mn HHs with High Speed broadband + Smart TV connections who will watch for Free as well with great quality experience. I believe audience will stand to win as they get great content at multiple digital touch points like laptop, mobile and large screen smart TV.”

The senior advisor quoted above added, “No, not directly. Sports is watched more on TV than on mobile screens as a full match. There is a likelihood that people will pay more money for two months and watch IPL, so there is always that benefit.”

But there will be some incremental gains for Jio, he cedes.

Is it an unfair or anti-competition trade practice?

The steps taken by the MSOs also triggered conversation on whether the act of removing Star Sports from base pack amounts to unfair or anti competition trade practice as per NTO 3.0, which also assured affordable a-la-carte options.

Krishna said, “According to the New Tariff Order 3.0, all channels must be made available on a-la-carte basis. This means that consumers should be able to choose and pay only for the channels they want to watch, rather than being forced to subscribe to a package of channels that includes unwanted channels.”

He added, “ONLY if MSOs have removed Star Sports from their base pack and have not provided an affordable a-la-carte option for consumers to subscribe to the channel, it could be considered an anti-trade practice and a violation of the NTO 3.0 regulations.”

Sapna said, “It’s a very complex debate. The MSOs, in my opinion, have a right to demand their share of the pie of the revised price regime as offered by broadcasters. The price hike from Rs.12 to 19, then adding those channels to the base pack and reducing the gross earnings of the MSOs, can be looked at from both stand points. In one way the broadcaster is free to increase/decrease pricing of their channels but in the same light the MSOs are also free to design packs and maximise revenues for the service they are offering – by having a wide network and maintenance of infra for carrying linear TV feeds to their subscribers. Thus, I doubt it can be called an anti trade practice prima facie. Having said that these are individual opinions and TRAI is the legitimate body to decide on the same.”

Mukherjee said, “I am not a Legal expert- I am sure the parties involved will check the precedent of Trade Practice here- there is an industry body who will intervene if consumer is feeling short-changed- end of the day Digital Consumer will be the King this IPL season.”

“Any part of NTO 1.0, 2.0 or 3.0 is about giving the choice to the customer. Even if Star Sports is priced at Rs.19 and is removed from the base pack, it will take an ad in next three to four days before IPL saying that it’s a-la-carte available at Rs 19 a month, dump the base pack plus Star Sports and take Star Sports as just one channel. That’s what NTO gives – it’s not the affordability, it’s the choice. There is nothing anti trade in this. You can pick and choose,” added the advisor.

Feedback: [email protected]