Despite financial uncertainty, consumers are not willing to reduce the amount they spend on health and well-being, according to the latest in a series of consumer surveys that Accenture (NYSE: ACN) has been conducting to test the pulse of consumer outlook and sentiment since the start of the pandemic.

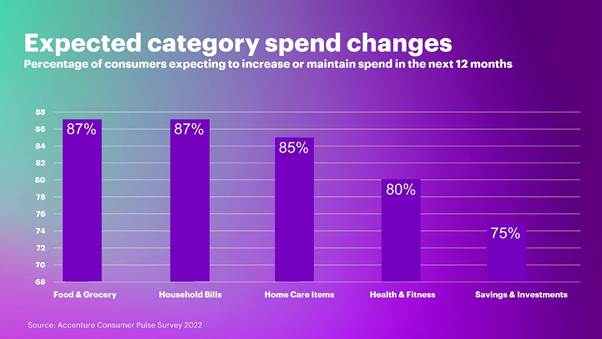

The survey — of more than 11,000 consumers in 16 countries including India — found that even in the face of widespread uncertainty and personal financial strains, consumers are considering health and fitness to be an “essential,” alongside groceries and household cleaning products. Even though two-thirds (66%) of survey respondents said they feel squeezed financially, 80% also said they intend to maintain or increase their spend on areas related to health and fitness — such as exercise classes or vitamins and supplements — in the next year.

“While the mindshare for health and wellness as a category in India is growing at a rapid pace, the market size is relatively lower. We believe there is a huge opportunity for consumer goods companies in India to really listen to evolving consumer needs and accordingly reimagine their product strategy and portfolio, explore adjacencies in their business models and focus on building more trust and credibility with consumers,” said Anurag Gupta, managing director and lead – strategy & consulting, Accenture in India.

The survey also found that respondents seem to be taking a more holistic view of wellness, reframing it as much more of a consumer staple. In addition to more than four in 10 respondents (42%) saying they are increasing the amount of physical activity, one-third (33%) of respondents said that they’re more focused on self-care — such as indulging in a bath or beauty treatment — than they were a year ago.

Manish Gupta, managing director and lead – products, Accenture in India said, “With growing consumer focus on preventive healthcare and holistic well-being, it will be crucial for companies to use data and analytics to better understand consumption patterns, innovate to come up with new products, services and collaborations. We are already witnessing cross-industry partnerships across consumer electronics, wearable devices, healthcare, insurance, consumer goods, auto among others. To succeed in the post-pandemic economy, consumer-facing companies need to further assess their existing offerings, push the boundaries in terms of ecosystem partnerships and make bold moves to grow their business.”

Even with rising travel costs, the survey found that half (51%) of consumers also plan to maintain or increase their spend on leisure travel in the next year — perhaps not surprising considering the widely recognized well-being benefits associated with a vacation. Furthermore, two in five (39%) high-income respondents have booked a luxury trip or wellness retreat for some time in the next 12 months. Among millennials, one in five (21%) booked to go away to a wellness retreat this year. In addition, one-third (33%) of all survey respondents said they are willing to sacrifice spending on non-essential household products or electronics so that they can afford to travel.

While the survey identified where and how consumers are prioritizing spend, it is important that businesses understand the context in which those purchasing decisions are made. According to a recent Accenture report, “The Human Paradox: From Customer Centricity to Life Centricity,” it is becoming increasingly difficult for consumers to balance purpose and practicality in their purchases, with nearly two-thirds (64%) wishing that companies would respond faster with new offerings to meet their changing needs. Only by understanding the context will businesses have the right strategy to offer the most relevant brands, products or services.

You can explore our new thought leadership app, which provides a personalized feed of all our latest reports, case studies, blogs, interactive data charts, podcasts and more.