In India, where the data is recovered at an astoundingly low price, the growing shift of viewing preference from linear TV to OTT has been remarkably significant. Broadly classified under the age group of 30 or younger, they are quickly becoming the most sought-after demographics for both advertisers and entertainers. While broadcast TV still remains highly relevant across Entertainment & Media platforms, multiple stakeholders are now expressing the need to shape strategies that accommodate the cross device unique audiences and duplication in streaming.

As these streaming platforms evolve, it is essential to understand the incremental reach that can allow publishers/advertisers to seize and capture an appeal with a huge, engaging audience. Incremental reach is not limited to differentiating between TV and online viewership, but instead establishes a distinctive audience that engages with OTT platforms in addition to the audience exposed to linear TV campaigns. The Chrome DM panel, representing 1174.54 million internet/C&S individuals in India, uses a hybrid process of assembling online surveys and tracking content by means of digital fingerprinting technology to collect data.

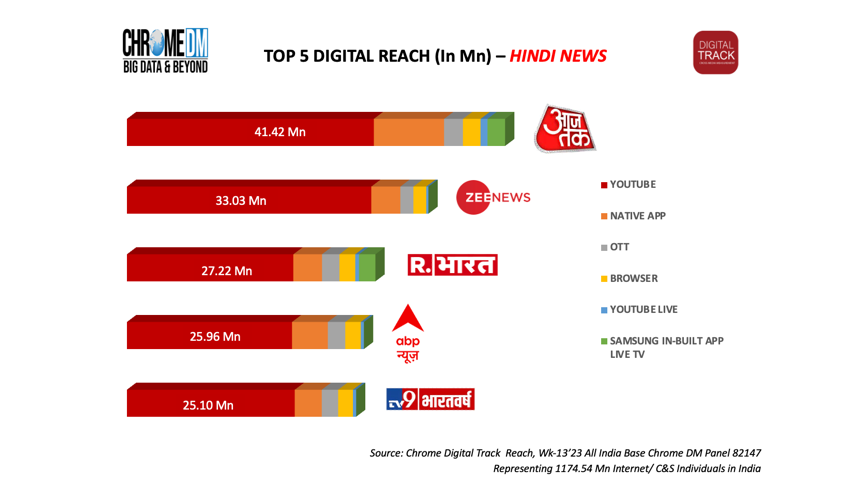

These reports are generated using an in-house SDKs installed in mobile phones and connected TVs across a panel of 81,782 respondents. As per the report generated by Digital Track during week-13, AAJ TAK dominated overall reach with 41.42 million individuals across all digital endpoints i.e. YouTube, Native Apps, OTT, Browser, YouTube Live & Samsung In-built Apps. YouTube dominated the digital medium by reaching more than half of the viewer base. Zee News follows in second position by reaching 33.03 million unique viewers.

These reports are generated using an in-house SDKs installed in mobile phones and connected TVs across a panel of 81,782 respondents. As per the report generated by Digital Track during week-13, AAJ TAK dominated overall reach with 41.42 million individuals across all digital endpoints i.e. YouTube, Native Apps, OTT, Browser, YouTube Live & Samsung In-built Apps. YouTube dominated the digital medium by reaching more than half of the viewer base. Zee News follows in second position by reaching 33.03 million unique viewers.

Moving forward, the cord-cutting behaviour paired with the subsequent migration of the young user base to online streaming platforms ensures a turn of transition from C&S broadcast to digital platforms. The world is fast moving to digital and rightly so – no wires, no cables, no geographical boundaries and to a great extent no intermediaries. The transition from C&S to digital must be equitable. Revenues will sway towards digital, and online platforms will retain a competitive edge as they continue to emerge as the preferred choice amongst the viewers and consumers in the coming years. Digitisation in a true sense is democratization of content, and so should the transition.