Top Picks from the session:

Sanjay Sindhwani: Digital subscriptions offer deeper audience insights, paving the way for a win-win ecosystem benefiting both publishers and advertisers.

Mayura Shreyams Kumar: Technology evolution demands agility; talent acquisition remains a challenge. We explore diverse verticals for growth, like audio content.

LV Navneeth: Digital pricing challenges stem from traditional media hangovers. Conviction in content’s worthiness is crucial for success in both spheres.

Sitaraman Shankar: Content strength warrants better pricing strategies. Diversification into ONDC and video monetization channels ensures revenue resilience.

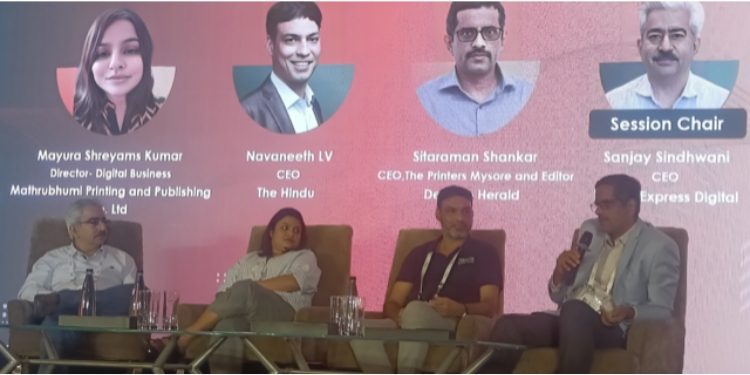

The inaugural edition of The Internet and Mobile Association of India (IAMAI)-Digital Deccan Conclave on June 11th in Chennai witnessed a panel discussion on “Digital Publishing in India – Challenges and Opportunities.” The panel was moderated by Sanjay Sindhwani, CEO of Indian Express Online Media Services. The panellists included Mayura Shreyams Kumar, Director – Digital Business at Mathrubhumi Group, LV Navneeth, CEO of The Hindu Group, and Sitaraman Shankar, Editor of Deccan Herald & CEO of The Printers Mysore.

The discussion began with panellists addressing the challenges they face in their respective digital businesses. Shankar noted, “One of the key challenges we face is the plateauing of website traffic. Over the last 4-5 years, we have multiplied page views and visitors, but it is very difficult to move the needle further for various reasons. The second issue we face is in terms of subscription.”

According to Navneeth, digital subscriptions as a revenue stream present a significant opportunity for digital publishers.

He added, “We are just scratching the surface in terms of digital subscriptions. There is a lot more to be done, but the journey is very exciting. The organization structure is a challenge, and I don’t think we fully understand it. Another challenge is culture, as we are trying to run two different organizations under the same brand, each requiring different speed, agility, and mindset. As we struggle with structure and culture, the big challenge is ‘talent’ – are we able to attract the best journalistic talent for the digital journey? We are better compared to a few years ago, but we are still working on it.“

Mayura stated, “Technology is ever-evolving, and we need to be agile in that space as well. Talent is a challenge, especially because we are in Kerala. The revenue pie we receive from digital is a very minuscule percentage compared to other big digital players. Digital subscription is also another option.”

Responding to Sindhwani’s question on whether revenue issues stem from pricing, Mayura said, “Definitely, pricing has a role, but growth depends on the quality of the audience we engage with. More than pricing and other factors, it is crucial to attract an audience that can engage with us. Even in the newspaper industry, several organizations and bodies discuss pricing, even with competitors. In terms of digital, that’s not happening.”

Navneeth shared a different perspective, stating, “I don’t think the issues are different in newspaper and digital business. The issue of pricing in digital is a hangover from the approach to physical presence. Print is thriving. India is one of the lowest-priced markets in Print compared to Sri Lanka, Pakistan, and Indonesia. It worked well and built businesses around advertising, but it is not working as it used to. In the Print business, we give away too much for too little for too long. Part of our resistance to pricing in digital media comes from traditional media.”

He further added, “It takes courage and conviction in the content. If you don’t believe in the worthiness of your content, the audience will not. It is our problem to solve.”

Shankar commented, “We believe our content is strong and should be priced better. We sell the newspaper at Rs 7 during weekdays and Rs 8 during weekends, which is more than one of our biggest rivals. We don’t want to make the same mistake the industry has made for a long time.”

The panel discussed whether digital will be priced at a premium in the next 5-10 years for both subscription and advertising compared to Print charges today.

Navneeth stated that this will certainly be the scenario. He explained, “In the physical publishing business, every large player in this country has seen the percentage of reader value, or cover price value, increase. Previously, it was around 20-27% of the current price. This is due to the growth of ad revenue and the cover price. We should have the conviction to price the products at double digits.”

Speaking about other revenue streams, Navneeth said, “Advertising and subscription are not the only revenue streams. There are affiliate marketing, syndication, and content commerce. We have focused on some of them and have progressed reasonably well in some areas. There is a lot of value in our archived content. For instance, what differentiates someone who has been around for a long time and someone who does well in news content is the role of content in making sense of what is happening today. We should invest, and without that investment, resources, and proper vision, the revenue stream will remain in excel sheets.“

Shankar spoke further about revenue from ONDC, video monetization, etc.

Mayura added, “With Mathrubhumi Group, we haven’t explored that space yet, but we are looking into it. For us, the book business, especially with audio content, is a category that is growing at the moment. We explore and experiment with all verticals where growth can be concentrated.”

Sindhwani emphasized the importance of having multiple revenue streams.

“When we enter the subscription business, we start learning more about our audiences. The challenge is that we need to pay platforms that use our data to target our audiences on our platform and then take a share of the revenue we get from advertisers. As we build our subscription businesses, we develop technology stacks that allow us to target, understand, and map users. We create logins and identify user content requirements. The ability of digital publishers to deliver value to advertisers will multiply manifold, creating a win-win ecosystem,” Sindhwani said.

He further highlighted, “I believe that in a few years, each one of us will have millions of paid subscribers – I strongly believe in that.”

The discussion also touched on the latest Supreme Court directive, effective from June 18, mandating advertisers to submit a self-declaration certificate (SDC).

Mayura expressed concern, saying, “It is going to affect the Group. First, we wait for the ROs, and now we have to wait for the certificate as well. The process is tedious. Another concern is that the categories mentioned are confusing for verticals like content marketing. The business we could have gained will be delayed due to this process.”

Navneeth concluded, “What started as an advisory to protect consumers has morphed into another issue. The scope has widened extraordinarily. While protecting consumers is important, I don’t think it is practical in the digital media verticals. There are far-reaching implications not just on business but also in terms of exhibition. Industry bodies should come together to represent and protect the interests of the industry and consumers.”