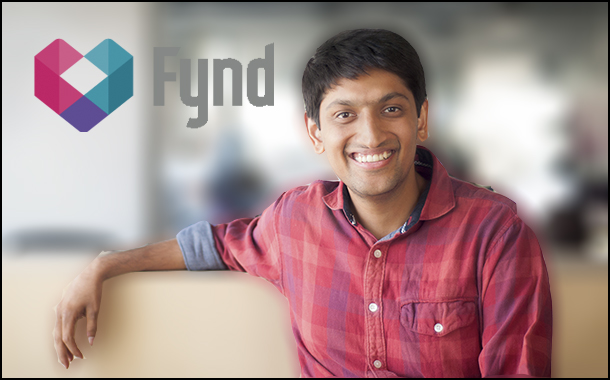

Authored by – Harsh Shah, Co-Founder, Fynd

From the watch on our wrists to the strappy heels on our feet, casual wear, office wear and party wear, almost everything we use to look appealing from head to toe has a brand value associated with it. Buyers have a strong affinity towards brands due to its premium quality and desirability quotient that it creates in the minds of consumers. These brands have established their brand value and positioning over a period of time and most of them are a decade or more old. In the initial days of discovery, e-commerce players were eager to sign up popular brands on their portal in order to attract more customers and up their ante amongst other players. What most of these e-commerce players made the brands believe were that they are helping them extend their reach digitally!

The e-commerce players wanted brands to believe that technology adoption and use of devices such as smartphones and tablets along with improved internet connectivity have made customers shift their shopping preferences online. They advertised the top fashion brands both online and offline and started adopting an unrealistic pricing strategy repeatedly to attract a large consumer base to its online portal.

However, what was required of an e-commerce player was to establish important growth-specific business habits and strategies in order to help a brand grow in a competitive atmosphere. In the fear of losing out in the market, brands embraced e-commerce to drive sales and to make customers avail of their products online as well as offline. Price promotions often tend to hurt the brand, as consumers become conditioned to buy products only during the offer period. Consumers tend to focus more on price over quality and are likely to switch between brands in case of higher discounts. A brand is forced to continuously sell its product at a lower price and offer steeper discounts to gain back consumers from the competition. The continued discounting has a tendency to eat into the margins and eventually bring down the shareholder value. While there are companies that set a minimum benchmark value to their product below to which the product cannot be sold, not all the fashion brands are able to abide by the same set of rules. In a survey conducted by Lab42, it was seen that 7 out of 10 respondents shop online to avail promotional offers while 2 out of 3 respondents shopped online because of low prices on goods. While customers have an eye for quality, they turn price-conscious during the offer period. For brands, price promotions are essential to drive short-term sales, to overlook the long-term negative impact to the brand’s value and to bring back the financial returns to the firm.

While e-commerce sites are constantly catering to the whims and fancies of the customers, they felt the need to bridge certain gaps existing in the market, but in a direct competition with the brands it sells. E-commerce firms generate a massive amount of data regarding the hottest selling products, the latest trends, consumers’ buying behaviour, etc. They are able to easily use the data to identify the existing gaps, find out consumer trends, such as best selling fashion and categories beyond what brands are able to see themselves. E-retailers make use of the available data to develop their own private label brands and to compete with brands they partnered with in the first place. Once launched, these platforms work in favour of their own brands by enhancing their visibility through product placements on top as well as ranking their brands much ahead of other brands on internal search result pages. A point of friction is possible to emerge when e-retailers sell their products at a price point lower than the market operating price of a particular product.

Clearly, it is the private labels that are grabbing the market share currently, especially when it comes to apparel and footwear categories. The price differential with respect to in-house brands falls in the range of 20 to 25 percent. The e-retailers are able to make a good proposition for an already captive audience and boost sales with the help of private labels. Taken together, these trends may seem intimidating to manufacturers of brands. What is required of brands is to build on a dedicated management to thrive in the long run? Brands need to take a stand in maintaining their price regulations and build their offline market simultaneously. To sustain in the long run, the brands should also look for solutions that integrate well with their offline and online space instead of treating the two as separate entities. By offering competitive pricing, subsidised rates, aggressive promotions on superior quality products, e-commerce companies may be driving the traffic to get hold of customers, but it shouldn’t be at the cost of the brand’s identity.

Author Harsh Shah is the Co-Founder of Fynd, a unique fashion e-commerce portal which brings the latest in-store fashion online. The 29-year old young professional is now riding high on a success wave with his 2-year old fashion e-commerce portal. At Fynd, Harsh brings his valuable experience in technology and entrepreneurship to the table and oversees the supply side of operations, including managing partnering brands and stores. His keen interest in consumer-facing technology in the retail sector and management consulting have been instrumental in establishing Fynd as India’s largest O2O fashion ecosystem.