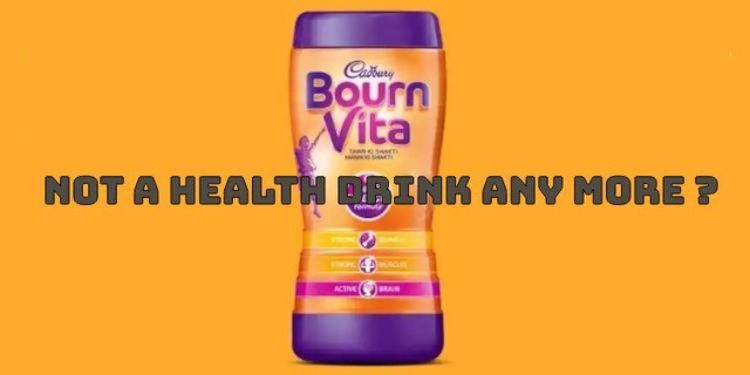

The government has advised all the e-commerce companies to remove drinks and beverages, including Bournvita, from the health drinks category from their portals.

“National Commission for Protection of Child Rights (NCPCR), a statutory body constituted under section (3) of the Commission of Protection of Child Rights (CPCR) Act 2005 after its inquiry under Section 14 of CRPC Act 2005 concluded that there is no health drink’ defined under FSS Act 2006, rules and regulations submitted by FSSAI and Mondelez India Food Pvt Ltd,” the Commerce and Industry Ministry said in an advisory to all e-commerce companies.

The order which is dated April 10, 2024. said that all e-commerce companies/portals are advised to remove drinks and beverages, including Bournvita, from the category of health drinks from their platforms/sites.

On April 2, food safety standards regulator FSSAI directed all e-commerce food business operators (FBOs) to ensure appropriate categorisation of food products being sold on their websites.

The Food Safety and Standards Authority of India (FSSAI) has noted that instances of food products licensed under ‘Proprietary Food’ with the nearest category Dairy-Based Beverage Mix or Cereal-Based Beverage Mix or Malt-Based Beverage being sold on e-commerce websites under the category Health Drink, Energy Drink, etc, it added.

Impact of the advisory

The government advisory mandating the removal of drinks and beverages, including popular brands like Bournvita, from the health drinks category on e-commerce platforms is set to have a different impact across various sectors.

The directive will have a significant influence on the perceptions and behavior of consumers; those products which were categorized as health drinks previously, may experience a shift in consumer trust and preference. With the removal of these items from the health drinks category, consumers may reevaluate their understanding of what constitutes a healthy beverage, leading to changes in purchase patterns and consumption habits. Additionally, the transparency brought about by the reclassification may prompt consumers to become more discerning and vigilant about the nutritional content and health claims of products they purchase online.

Moreover, the directive will undoubtedly affect the revenue streams of e-commerce platforms and manufacturers alike. E-commerce companies reliant on the sale of beverages in the health drinks category may experience a dip in sales as these products are reclassified. To mitigate potential losses, platforms will need to adapt their marketing strategies and product offerings to cater to evolving consumer preferences. Similarly, manufacturers of affected products may face challenges in repositioning their brands and communicating the nutritional benefits of their beverages outside the health drinks category.

Furthermore, the impact extends to regulatory compliance and industry dynamics. E-commerce platforms must swiftly realign their product categorization systems to adhere to the government directive, ensuring compliance with regulatory standards. This shift in classification may also prompt manufacturers to innovate and diversify their product portfolios to meet changing consumer demands and regulatory requirements. Consequently, the competitive landscape within the beverages industry may undergo transformation as companies adapt to the new regulatory environment.