Recently TAM shared the report on a flashback to 2020 where the report talked about Advertising Overview on Television, Trends: Lockdown vs. Unlockdown, Covid Prevention Categories (Health & Hygiene), and many more. A television advertisement is a span of television programming produced and paid for by an organization. It conveys a message, aimed to market a product or service. TAM AdEx monitors more than 600+ TV Channels.

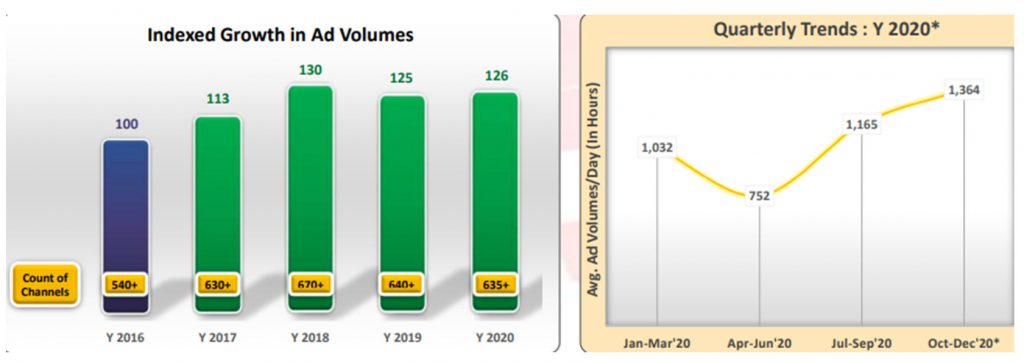

On Television Ad Volumes sustained despite the Covid Crisis, the Year 2018 registered the highest growth of 30% in Ad Volumes followed by Y 2020 with a 26% rise compared to Y 2016. Avg. Ad Volumes/Day rose by 39% in the 4th quarter compared to average Ad Volumes of 1st, 2nd and 3rd quarters. And Due to Covid-19, the lowest Avg. Ad Volumes observed in the 2nd quarter which includes the lockdown period.

In Monthly Trend of Avg. Ad Volumes/Day in 2020, Television Ad Volumes recovered to Pre-Lockdown level just within 3 months of post Lockdown period. Whereas during the festive period, Ad Volumes on Television witnessed double-digit growth.

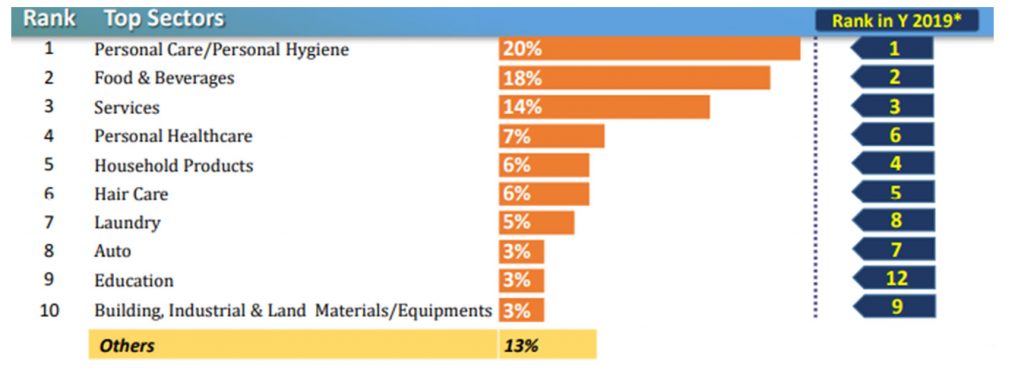

In all the sectors Personal Care/Personal Hygiene sector had a 20% share of Ad Volumes followed by F&B with an 18% share. The top 3 sectors together added a 52% share of Ad Volumes which were also on top during Y 2019. And the Education sector was the new entrant in the Top 10 sectors’ list.

In categories, the Toilet Soaps category maintained its 1stposition during Y 2020 with 7% share of Ad Volumes. Ecom-Media/Entertainment/Social Media moved up by 5 positions to achieve 2ndrank replacing Toilet/Floor Cleaners. Rubs and Balms category was the only new entrant in the Top 10 categories’ list. Whereas 2 Out of the Top 10 categories were from Personal Care/Personal Hygiene and F&B sectors each.

In advertisers, HUL topped the list followed by Reckitt. Top 10 advertisers together added 45% share of Ad Volumes during 2020. Colgate Palmolive India, Cadburys India, and Amazon Online India were in the list of Top 10 advertisers with a positive rank shift compared to 2019. And in Brands Top 2 brands were from Reckitt Benckiser which had almost the same share of Ad Volumes during Y 2020. In 2020, there was a total of 13.5K+ brands present.

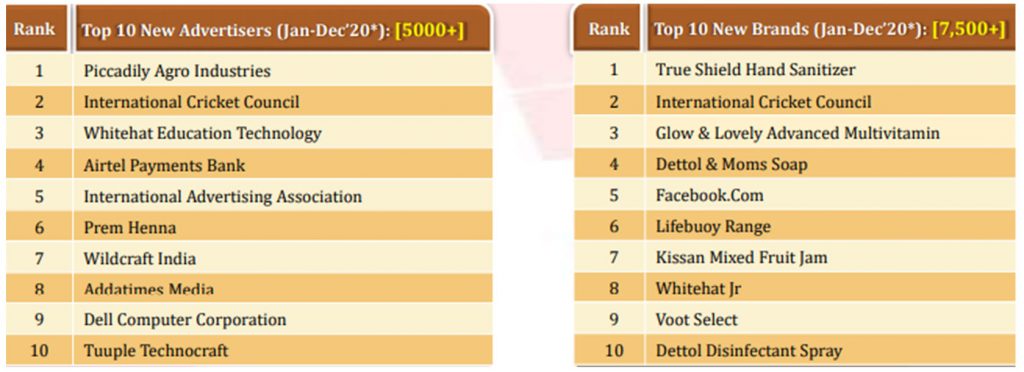

In Leading exclusive Advertiser and Brands, 5K+ exclusive advertisers & 7.5K+ exclusive brands advertised during Y 2020 compared to Y 2019. Piccadilly Agro Industries and True Shield Hand Sanitizer were the top exclusive advertiser and brand respectively during Y 2020 compared to Y 2019. Also, HUL advertiser had its 3 and Reckitt Benckiser had 2 exclusive brands in the Top 10 list of 2020 compared to Y 2019.

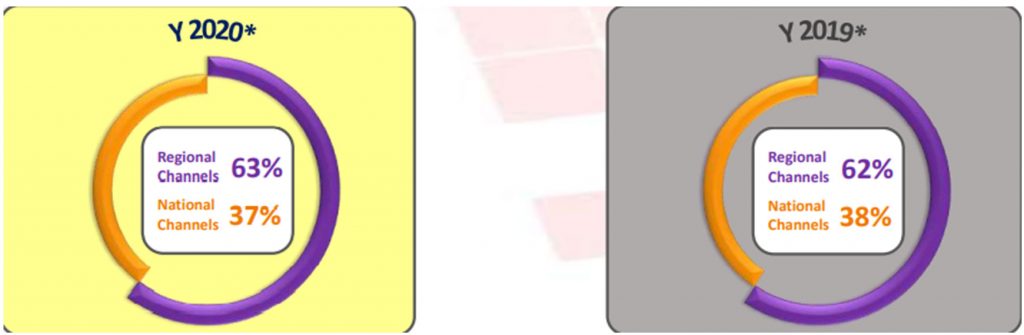

In Top channels, News and GEC covered 58% of Ad Volumes. And, Top 5 channel genres accounted for more than 90% share of Ad Volumes during both the periods. Regional and National channels had 63% and 37% share of Ad Volumes respectively= during 2020. 1% increase in the share of Regional channels’ advertising on TV during 2020* over 2019. Ad Volumes on Regional channels witnessed a rise of 2% during 2020* compared to 2019.

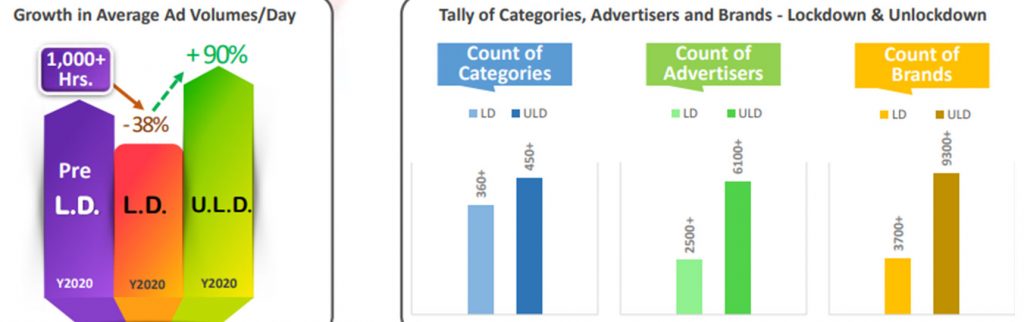

The world has changed due to the pandemic. The advertising industry also witnessed a slow down during the Lockdown Period. Since the Unlock, Businesses are also trying their best to catch up with the changed market scenario. During the Unlockdown period, Advertising on TV also saw significant improvement.90% growth in average Ad Volumes/Day was seen during the Unlockdown period compared to the Lockdown period. Tally of Categories grew by 24% whereas that for Advertisers and Brands rose by more than 2 Times during the Unlockdown period.

In the Unlockdown period, Shampoos among categories and Hindustan Unilever among advertisers saw the highest increase in Ad seconds with the growth of 2.5 Times and 94% respectively compared to the Lockdown period. In terms of growth %, Cars category and Cadburys India advertiser witnessed highest growth % among the Top 10 i.e., 15 Times and 16.5 Times respectively in the Unlockdown period.

In Jul’20, Hand Sanitizer advertising per day grew by more than 100 times compared to Jan’20. Piccadilly Agro Industries was the top advertiser of Hand Sanitizers which added 60% share of Ad Volumes followed by HUL with 16% share during Y 2020. In Dec’20*, Chyawanprash advertising grew by more than 6 times compared to Jan’20. Among the 8 advertisers of Chyawanprash, Dabur India had a 37% share of advertising followed by Emami with a 23% share.