Apple is a Brand? well the answer is quite obvious. What makes it so valuable for consumers? Now think deeply, was Jet Airways a Brand, Kingfisher Airlines? well the answer is somewhere midway, most people who have travelled on both the airlines have generally spoken well about the services, the comfort was unquestionable, but we all know what happened to these brands. What did they lack as an Enterprise?

The most pertinent question then to ask is to not ask Whether the firm has Brand power? but Whether the brand power is leading to PRICING POWER? The best way a Brandconfers advantage to a firm is through its “Rock of Gibraltar” like financial parameters. Any firm having brand/s should have pricing power and this is the most important element in determining whether you have a brand, which is worth investing and eventually milking it.

Apple is a classic example of such power in operation, in fact it won’t be hyperbole to call this as a “MIRACLE OF THE CENTURY”. We all know the way Apple has changed the ball game in the competitive smartphone business, the innovation engine has slowed down tremendously but the Brand Power still remains intact.

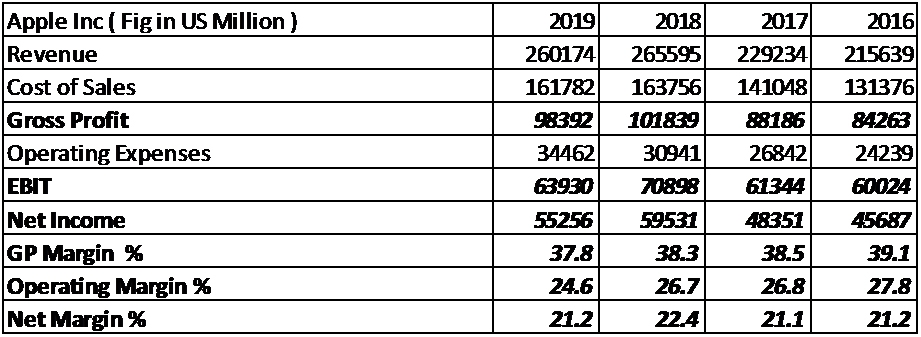

Let us view Apple from a financial perspective to validate the overall power of a Brand.

Source: Apple Annual Reports

Apple still generates about 38% of Gross Margins which is quite unprecedented for its scale enabling to sustain the durable competitive advantage viz spending on R&D, investing heavily into data privacy and retaining and recruiting the best talent.

The best part for Apple is its robust ecosystem that existing consumers do not want to give up on account of high “switching costs”. The network effects take over, acting like law of gravity on the existing consumers deepening the engagement and creating high stickiness. What else can explain these stupendous high margins on such a high revenue base.

The strength of network keeps compounding and the Brand gets highly protected through consumer loyalty. Consumer loyalty in survey after survey is at its peak even after more than a decade of iPhone launch. Apple remains the most popular brand for “switchers” and 20% of the android phone users will prefer to shift to IPhone on their next smartphone purchase (as per Merrill Lynch).

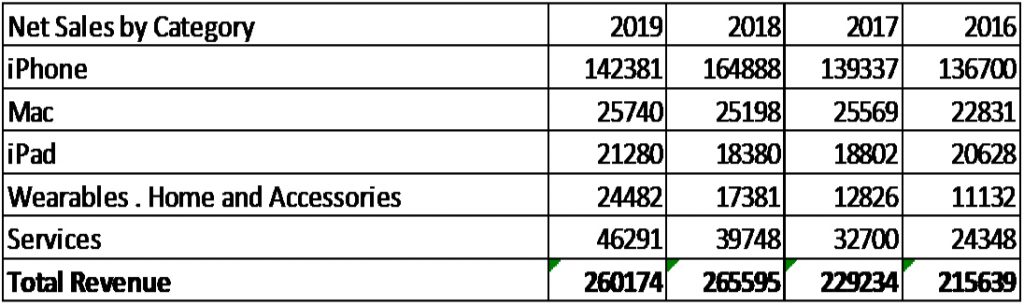

The huge advantage which the brand confers is the advantage of Mother Brand. This is clearly visible in case of Apple, given below is the break up of revenue for Apple and the most astonishing fact is to have a deeper look at the Wearables and Services Revenues of Apple. The picture is mind boggling, in 2016 the revenue was $35480 Million, in just 4 years the Business has grown to $70773 Million growing at CAGR of 18.8%.

Figures in US$ Million

Source: Apple Annual Reports

What does it convey? Hold your breath – The revenues of Facebook for 2019 is $70697 Million, which Apple makes it only on its wearables and services. The network effects which is clearly visible in play and robustly growing.

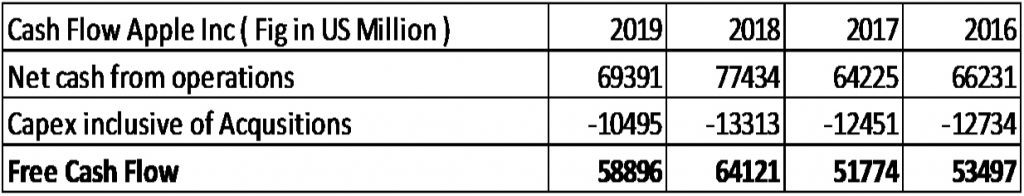

Apple has gone on to become a cash machine in the history of corporate world, this kind of cash it has on its balance sheet and the free cash flows it churns out year after year is simply phenomenal and a testimony to the strength of its Brand.

Source: Apple Annual Reports

The company has gone on to generate more than $228 Billion of free cash cumulatively in the past 4 years. Free Cash flow is a true measure of business success, as cash coming is a more robust sign of business doing well then net income. At the end Profit is still an opinion and Cash Flows the reality of a business.

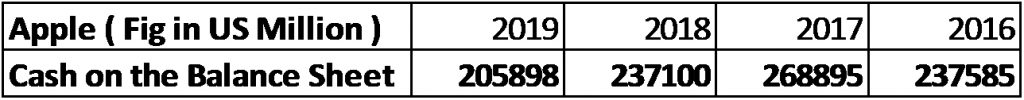

The Brand Power of Apple has gone on to create a financial fortress on its Balance sheet.

Source: Apple Annual Reports

Any Business which has this kind of cash is unheard of, no doubt the Brand Power compounds its cash machine. Apple is not hoarding cash; in fact, it has been most generous in returning cash to its shareholders.

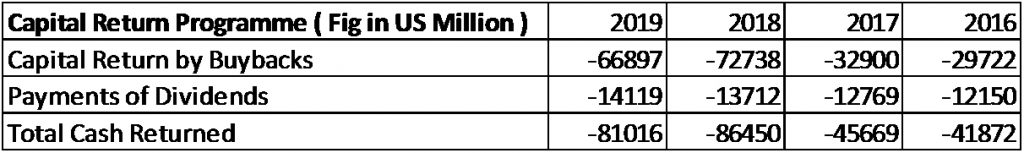

Source: Apple Annual Reports

Cumulatively Apple has given away $ 255 Billion dollars over the last 4 years and yet remains cash rich to the tune of $206 Billion.

The Margins, Cash on books, and Free cash flow tell us a narrative, the narrative is that Apple is a cash machine, with robust MOAT in place. The Mother Brand effects are coming into play and the services revenues will only grow and compound and in the next 5 years that could be a huge money spinner for Apple.

To conclude, the network effect of Apple has coagulated and deeply entrenched itself into the life of the consumer. The cash on books will give it options to acquire whenever it sees an opportunity, in fact management needs to be congratulated for not doing any big acquisitions and throwing good money, chasing growth for optical purpose.

The overall brand power of Apple remains intact, Pricing Power remains intact, the Mother Brand effects to drive the next wave of growth for Apple.

Authored by Tanvi Mehta, Ramaswamy Ranganathan and Sudarshan Rajan, who are value investors and also teach the craft of valuation in leading Business Schools.