Singapore: Adjust, a mobile analytics platform, has released its Gaming App Insights 2025 report, spotlighting the Asia-Pacific (APAC) region as a critical driver of global growth in mobile gaming. While overall global figures presented a mixed outlook, APAC defied the trend with 4% year-on-year growth in game installs in 2024, reinforcing its position as a mobile gaming powerhouse.

“Despite market shifts, mobile gaming in APAC remains on a strong growth trajectory,” said April Tayson, Regional Vice President for INSEAU at Adjust. “As mobile-first adoption accelerates, it’s developers and marketers focusing on long-term player engagement — rather than short-term gains — who will be best positioned to thrive. Leveraging the power of AI-driven personalization and hybrid monetization, to name a few, will be key in building sustainable success in this dynamic industry.”

Global Performance Snapshot: LATAM and MENA Lead, North America Lags

The report revealed robust growth in Latin America (+8% installs, +7% sessions) and MENA (+10% installs, +5% sessions), while North America (-11% installs, -14% sessions) and Europe (-1% installs, -6% sessions) saw declines, underlining the need for adaptation in saturated markets.

Indonesia and the Philippines emerged as top performers in the region. Indonesia saw a 21% increase in installs and 6% in sessions, while the Philippines recorded 4% and 9% growth respectively. In contrast, India saw a modest 2% install increase but a 1% decline in sessions, and Vietnam experienced minimal install growth and a sharp 18% drop in sessions.

Session lengths in APAC continue to surpass global averages, with Indonesia (44.31 mins), Philippines (43.4 mins), and Singapore (39.14 mins) leading the region. The average session duration in APAC rose slightly to 34.84 minutes, compared to the global average of 30.75 minutes.

Hyper casual games led in installs (27%) but suffered from high churn, making up just 11% of sessions. Action games proved more engaging, contributing 21% of sessions despite only 10% of installs. Strategy games showed the highest YoY install growth at +83%, while casino (+32%) and arcade (+23%) genres led session growth.

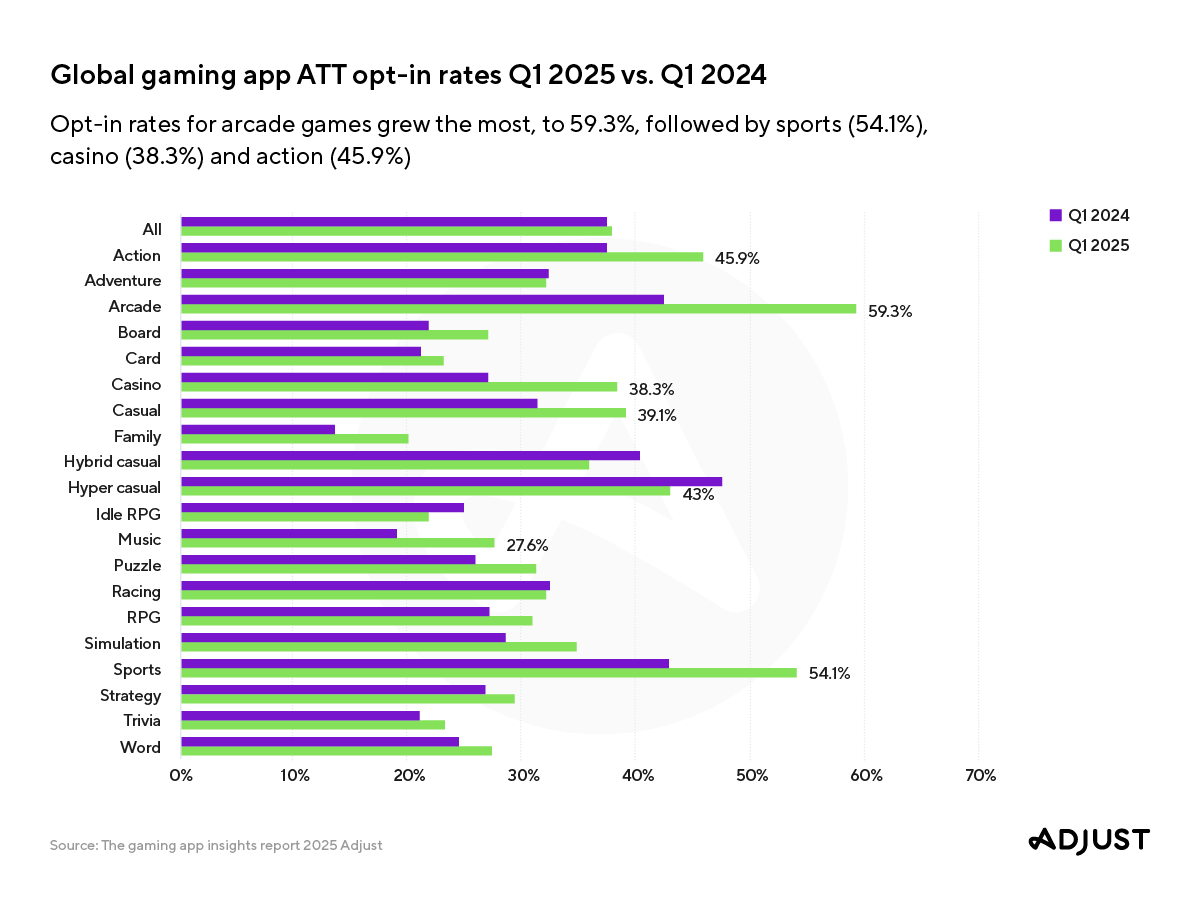

ATT (App Tracking Transparency) opt-in rates globally rose to 40% in Q1 2025, with notable increases in APAC markets. Indonesia (58.6%), Malaysia (51.9%), and the Philippines (47.4%) saw the strongest gains, indicating improved user acceptance of tracking frameworks.

Arcade games showed the highest opt-in spike globally, rising from 42.4% to 59.3%, followed by sports (54.1%), casino (38.3%), and action games (45.9%).

Key Global Shifts in Gaming Strategy

- Adjust identified five major trends reshaping the mobile gaming industry in 2025:

- AI-driven personalization for enhancing in-game experience and retention

- Hybrid monetization models combining ads, subscriptions, IAPs, and battle passes

- Cross-platform play increasing LTV by enabling seamless play across mobile, console, and PC

- Emerging UA channels, including CTV, influencer marketing, and alternative app stores

- Data-led retention strategies leveraging predictive analytics and real-time personalization

“With APAC’s sustained momentum, marketers need to stay agile in adapting to evolving player behaviors,” April added. “Success will depend on embracing diverse monetization models, optimizing user acquisition across new channels, and continuously refining engagement strategies to keep players invested in the long run.”

The report signals a call to action for marketers and developers to blend creativity with data and adapt swiftly to consumer behaviors — especially in mobile-first economies like those in APAC, where the next wave of gaming growth is already underway.