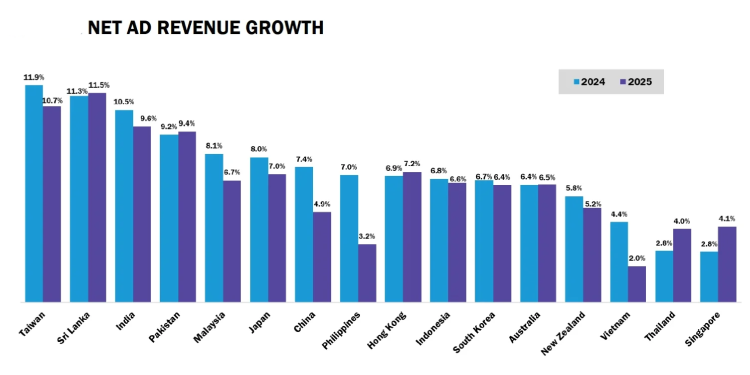

The Asia-Pacific (APAC) advertising market is on track to hit $289 billion in 2024, representing a 7.5% year-over-year growth, according to the latest report from MAGNA’s winter update of Global Advertising Forecast. This growth is largely driven by the expansion of digital advertising, with search and social media platforms leading the charge. As digital pure players continue to capture a larger share of the market, the future of advertising in the APAC region looks promising, with digital expected to account for 82% of total ad budgets by 2029.

The global advertising market is on track to reach $933 billion in 2024, marking a 10% year-over-year increase, in line with earlier expectations. Digital advertising continues to dominate, with search, social media, and short-form video driving much of the growth. Google, Meta, and Amazon — the industry’s “big three” — have collectively increased their market share, with their combined revenues now accounting for 51% of global ad sales.

Despite a strong performance in digital, traditional media owners (TMOs) saw moderate growth, primarily driven by cyclical events and the increasing shift towards non-linear advertising formats, such as ad-supported streaming. However, the pace of growth for TMOs is increasingly being overshadowed by the rapid expansion of Digital Pure Players (DPPs), whose revenues grew by 13% in 2024 to a total of $659 billion, largely due to the success of retail media networks, AI-driven targeting, and mobile-first formats.

APAC’s Strong Performance: Digital Transformation Accelerates

The Asia-Pacific (APAC) region remains one of the most dynamic markets for advertising growth. In 2024, APAC’s ad market is projected to reach $289 billion, reflecting a 7.5% growth from the previous year. The region’s advertising landscape continues to be reshaped by the rise of digital media, with search, social media, and short-form video leading the charge. While traditional media in the region has grown at a slower pace, digital pure players are outpacing market growth, capturing an increasingly larger share of total ad spend.

Key drivers of growth include the continued ecommerce boom, the expanding popularity of ad-supported streaming and short-form video formats (such as TikTok), and the rapid adoption of AI-powered advertising across platforms like Google and Meta. This digital transformation in APAC mirrors global trends, but with unique regional nuances, particularly in countries like India, China, and Australia.

India: A Powerhouse for Digital Ad Spend Growth

Among the APAC markets, India stands out as a significant growth engine. The Indian ad market is expected to grow by 11% in 2024, driven by a surge in digital advertising spend. India’s advertising landscape is being transformed by rapid mobile-first adoption, the explosive growth of social media platforms like Facebook, Instagram, and TikTok, and the expanding reach of ecommerce.

India’s digital-first approach to advertising is propelled by the increasing use of smartphones, with advertisers shifting budgets to platforms that leverage mobile technology and short-form video formats. The country’s population, with its growing middle class and increased digital connectivity, makes it a prime market for ecommerce brands and digital-first advertisers. Additionally, India has become a key battleground for global giants like Meta, Google, and Amazon, which are seeing increased ad revenue from both global and local brands targeting India’s vast and tech-savvy consumer base.

In addition to social media, video-based formats have also taken off in India. TikTok (now Reels on Instagram) and YouTube have benefited from India’s growing video consumption habits, with video ad sales seeing significant growth. This trend has been further accelerated by the increasing popularity of short-form video platforms and the shift to ad-supported streaming services.

India’s growth story is also tied to its emergence as a global hub for retail media networks. As ecommerce platforms like Amazon India and Flipkart continue to grow, they offer brands the ability to integrate retail media directly into the shopping experience, creating more touchpoints for digital advertising and driving more revenue into the commerce media sector.

APAC’s Digital Future: The Rise of Digital Pure Players:

Across APAC, the growth of Digital Pure Players (DPPs) remains a defining trend in 2024. DPPs, including TikTok, YouTube, Amazon, and Alibaba, are expected to generate $659 billion in global ad revenues, with a significant portion of that coming from the APAC region. This growth is fueled by the ongoing rise of ecommerce, AI-powered targeting, and an expanding mobile-first user base.

As retail media networks continue to proliferate, brands are redirecting advertising dollars from traditional trade marketing to digital platforms. In India, this shift is particularly evident, with ecommerce giants and local brands increasing their reliance on digital advertising to capture the growing share of online consumers. The region is also seeing a boom in social media ad spend, with platforms like Facebook, Instagram, and Snapchat benefitting from rising user engagement and advanced targeting capabilities.

While China and Japan have also experienced significant digital growth, India’s emerging middle class and its mobile-first consumer base position it as one of the key growth markets for digital advertising in the coming years.

Traditional Media Owners Adapt to Digital Shifts:

While Traditional Media Owners (TMOs) in APAC, such as Comcast, Disney, and Warner Bros. Discovery, have seen growth, their pace is slower compared to the Digital Pure Players. In markets like Japan and South Korea, traditional TV and linear advertising formats are still important, but these markets are increasingly pivoting to ad-supported streaming and non-linear TV formats to capture growing audiences on digital platforms.

In contrast, Australia and India have seen faster adoption of ad-supported streaming services, contributing to strong growth in non-linear TV. This shift has been aided by the growing demand for on-demand content, with Amazon Prime Video, Netflix, and Disney+ Hotstar seeing more advertising opportunities on their platforms.

Looking Ahead: The Digital Shift in APAC and Beyond

The future of the APAC advertising market is digital. As we move towards 2029, digital pure players are expected to command 82% of the total ad spend in the region. Formats such as search, social media, short-form video, and ecommerce media are poised for continued growth, while traditional media will gradually lose share.

In India, the trend toward digital-first advertising will only intensify, driven by the rise of mobile-first consumption and the increasing sophistication of AI-driven marketing strategies. Brands will increasingly rely on retail media, short-form video, and social media to engage consumers across the country’s rapidly expanding digital ecosystem.

Leigh Terry, CEO IPG Mediabrands APAC, said, “The APAC advertising market is thriving, growing by 7.5% in 2024 to reach $289 billion. This growth is fueled by digital advertising, with search and social media leading the charge. While traditional media is seeing modest growth, digital pure players are driving the majority of the market share. The future is bright for digital advertising in APAC, with its share of total budgets projected to reach 82% by 2029. Despite some economic uncertainties, the overall market remains stable and poised for continued growth.”