TAM Shared its report on Mirroring 2020 for Digital Advertising. The report highlighted Advertising Overview on Digital, Trends in Unlockdown Period compared to Lockdown, Leading Web Publishers on Digital, Digital Platforms, Transaction Methods and Creative Types in Digital Advertising and many more.

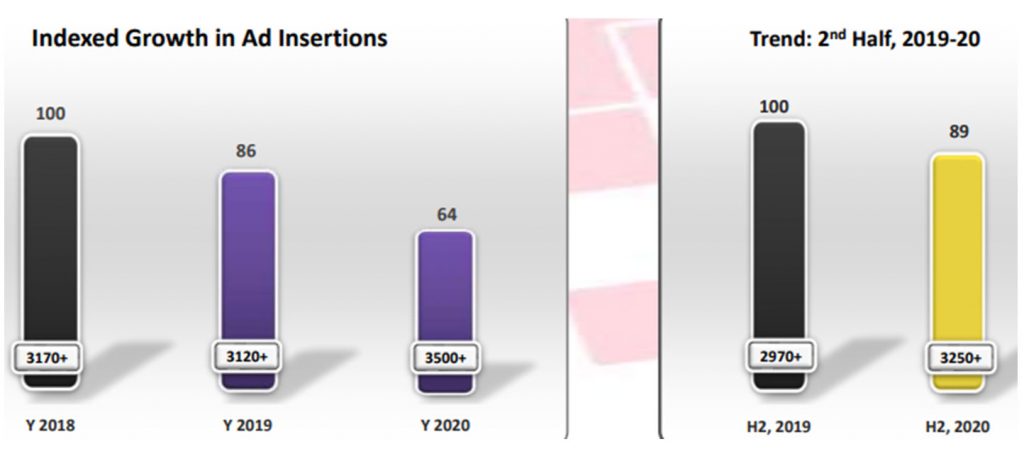

The Trend of Ad Insertions on Digital 2020 saw a 36% decline in Ad Insertions on Digital platforms compared to Y 2018. Compared to 2019, Ad Insertions in Y 2020 dropped by 26%. Ad Insertions declined by only 11% in the 2nd half of Y 2020 over Y 2019, which shows a recovery in Digital during the Unlockdown period (H2, 2020)

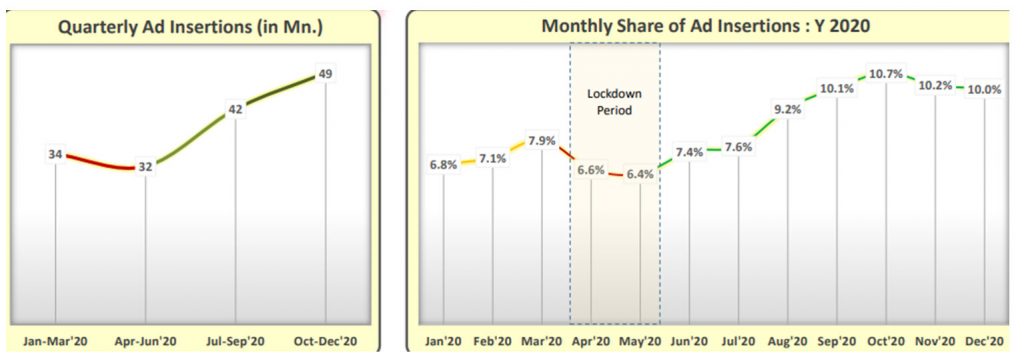

Due to Covid-19, relatively low Ad Insertions registered in 2nd quarter which includes the lockdown period. Ad Insertions increased by 34% in the 4th quarter compared to the combined average of the first 3 quarters of Y 2020. Also, Digital Ad Insertions recovered to Pre-Lockdown level just within 3 months of post Lockdown period.

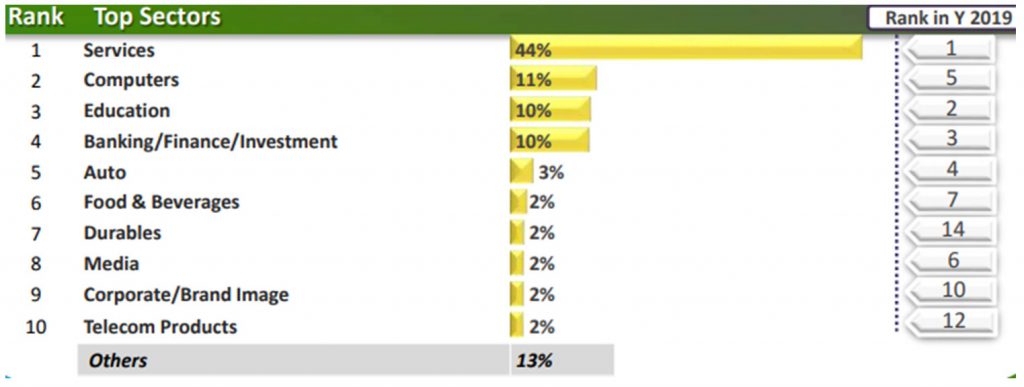

In the Leading Sectors, the Durables sector moved up by 7 positions to enter the Top 10. The services sector solely had a 44% share of Ad Insertions followed by Computers with 11% share during Y 2020. The top 2 sectors together added more than 50% share of Ad Insertions on Digital.

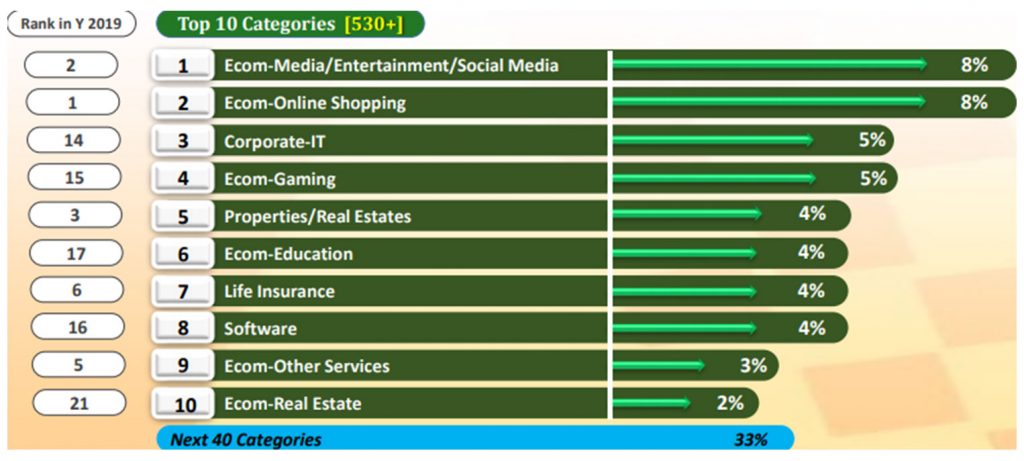

Among Leading Categories, 5 out of the Top 10 Categories were new Entrants in 2020. Ecom-Media/Entertainment/Social Media category moved to 1st position during Y 2020 compared to 2nd in Y 2019. Corporate-IT, Ecom-Gaming, Ecom-Education, Software, and Ecom-Real Estate were new entrants among the Top 10 categories in Y 2020. Whereas, 6 Out of Top 10 categories were from Services sector.

Among Leading Advertisers, 7 out of the Top 10 Advertisers were new Entrants in 2020. Amazon Online India topped the advertisers’ list on Digital followed by ICICI Prudential Life Insurance Co. Amazon and Flipkart retained their positions during Y 2020 and Grammarly Inc. moved to 5th rank in Y 2020 with a considerable rank shift over Y 2019. In Leading Brands, 6 brands of the Top 10 belonged to the Services sector. Amazon.in was the top brand on Digital during Y 2020 followed by ICICI Pru iProtect Smart. Also, during 2020, there was a total of 61.9 K+ brands present on Digital.

In Top Growing Categories, 220+ Categories registered Positive Growth. Among the categories, Corporate-IT saw the highest increase in Ad Insertions with a growth of 2.2 Times followed by Ecom Gaming with 2.1 Times growth during Y 2020 compared to Y 2019. In terms of growth %, Temples/Spiritual category witnessed highest growth % among the Top 10 i.e., 454 Times.

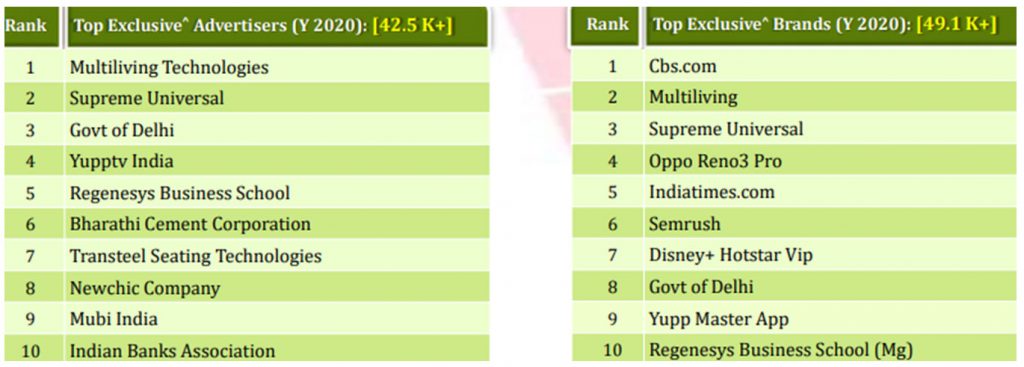

In Leading exclusive Advertiser and Brands in Y 2020, 42.5 K+ advertisers & 49.1 K+ brands exclusively advertised during Y 2020 on Digital compared to Y 2019. Multi living Technologies and Cbs.com were the top exclusive advertiser and brand respectively in Y 2020 compared to Y 2019. Whereas 5 of the Top 10 exclusive brands belonged to the Services sector.

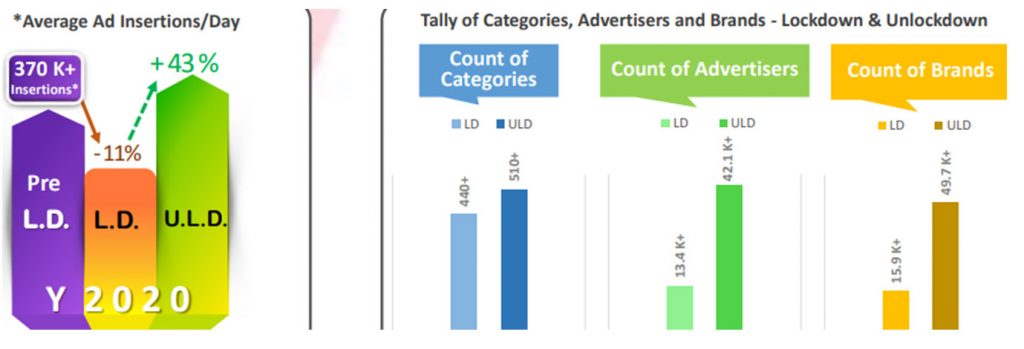

During Unlockdown, more than 40% growth seen on Avg. Ad Insertions/Day compared to Lockdown period. Count of Categories grew by 17% and that for Advertisers & Brands rose by more than 3 Times during Unlockdown compared to Lockdown period.

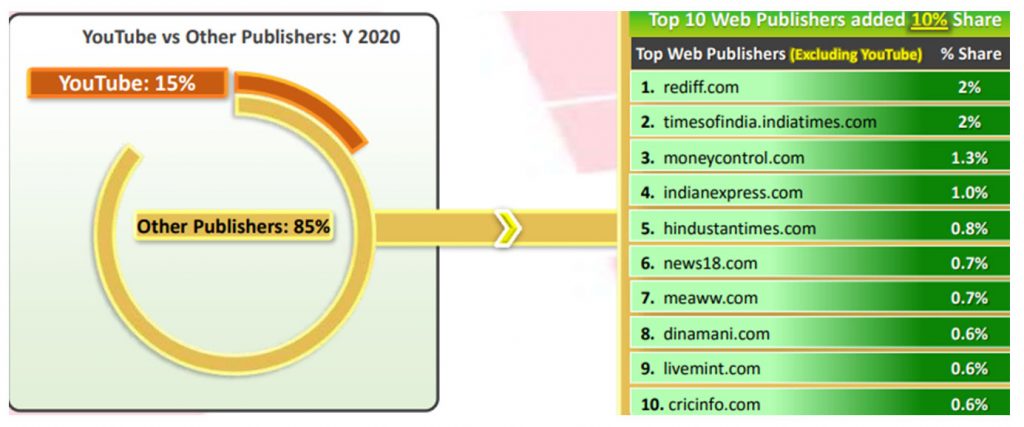

In leading web publisher, YouTube was the top Publisher with a 15% share of Digital advertising in Y 2020. Excluding YouTube, Rediff.com topped among the publishers of Y 2020 compared to 2nd position in Y 2019; Moneycontrol.com also stepped up by 4 positions to achieve 3rd rank in Y 2020 compared to 7th in Y 2019.

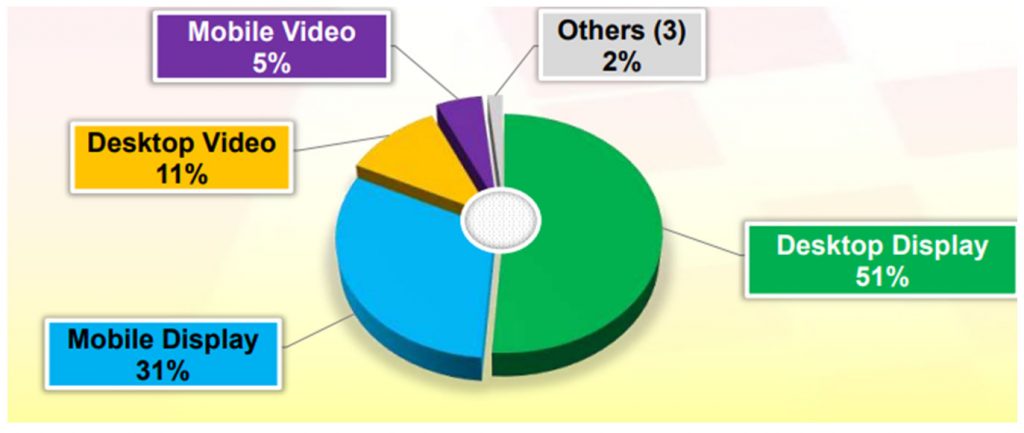

In Leading Digital Platforms 2020, Desktop Display topped with more than half of Digital Ad Insertions during Y 2020 followed by Mobile Display on 2nd position with 31% share. Share of Ad Insertions on Desktop Display increased by 8% in Y 2020 compared to Y 2019.

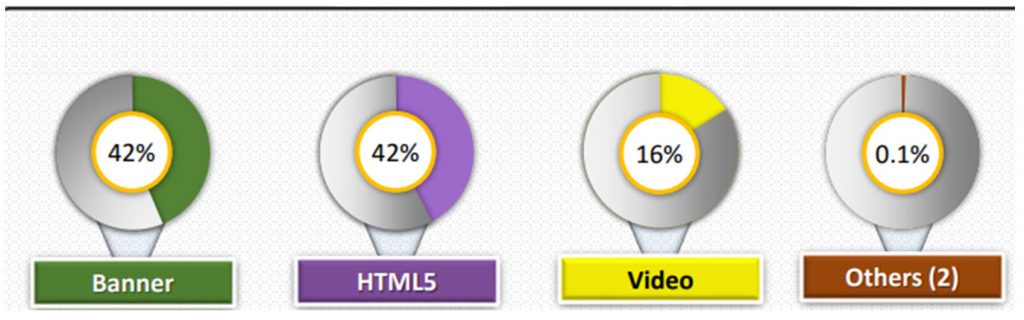

Banner ads bagged highest Insertions on Digital closely followed by HTML5 with almost same share. Video followed on 3rd position with 16% share in Y 2020. 14% rise in share of Banner ads was seen during Y 2020 compared to Y 2019.