Mumbai: The Union Budget has boosted the sentiment in the ad market. In 2025 the Adex set to grow by 11%. The Madison Ad Report is back with its prognosis for the year that went by and predictions for 2025.

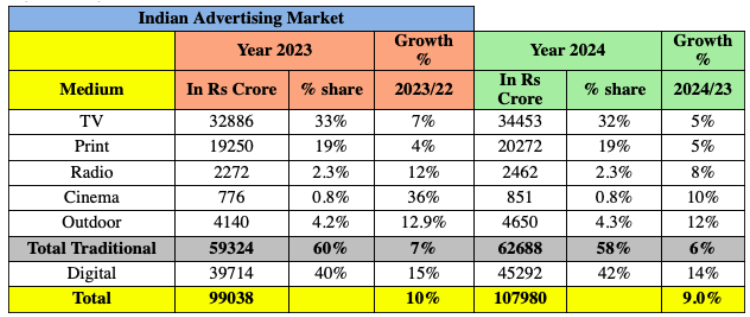

- Adex growth slowed down in 2024. But this is the new norm. Total Adex grew by 9% to reach Rs. 1.08 lakh crore. Traditional grew by 6%. Lowest growth Adex was registered last year since 2017, except the Covid year.

- Digital registered the highest growth of 14%, followed by OOH at 12%, Cinema at 10%. TV and Print registered a 5% growth.

- Digital firmly established as the No. 1 medium for the 3rdconsecutive year with 42% share.

- On the back of a good budget, in 2025, India Adex is expected to grow by 11%, vs 8% for Global Adex

Key findings of the Report:

Figures at a glance:

Overall:

1) In 2024 total Adex grew by 9%, even lower than our tepid projection of 12%. Traditional Adex grew by 6% and Digital Adex by 14%.

2) For the first time, the Indian Adex grew lower than Global Adex growth of 11%. US, inspite of its humungous size (market share of 31.2%) is the fastest growing market, with a growth rate of 11%. China on the other hand slowed down, registering a growth of just 3%. Brazil which was one of the fastest growing markets till 2023, registered negative growth.

3) Traditional Adex dominates Indian Adex with a 58% share, whereas in Global Adex, the figure is just 25%.

4) The Audio Visual medium contributes to 37% of total Adex. Linear TV at Rs. 34,453 crore, Connected TV at Rs. 1,453 crore and OTT at Rs. 4,397 crore, totalling to Rs. 40,303 crores.

5) H1 2024 grew by 16% on account of ICC T20 World Cup, spends by Government institutions and political parties during general elections. But H2 grew by just 1%, resulting in the overall poor performance of 9% in the year.

6) TV has lost almost 2,500 advertisers to Digital, Influencer Advertising and Ecommerce advertising.

7) FMCG, E-commerce and Auto continue to be the Top 3 categories, contributing 50% to Adex, although in terms of share FMCG has lost 1%.

8) There is no change in the Top three Advertisers of Adex – HUL, Reckitt and RIL. Top 10 Advertisers spend 41% of their spends on Digital. 5 out of the top 10 Advertisers are FMCG. The Top 50 Advertisers contribute 34% to total Adex, up from 30% last year, while the Top 10 account for 16%, compared to 14% previously.

Digital

1) Digital grew at 14% in 2024, similar to 15% growth in 2023 indicating that we need to now curtail our expectations of high growth, since the Digital base has substantially increased.

2) Digital continues to be the largest contributor to Adex with a 42% Share and has gained 2% points in terms of Share.

3) With a share of 42% of Adex, Digital in India still trails behind Global Adex, where its share is 75%.

4) Video Advertising and Social account for 50% of Digital spends. Social, Ecommerce and Search Advertising have contributed to the growth, growing at 21%, 17% and 15% respectively.

5) Connected TV has emerged as a preferred channel to target premium audiences. CTV advertising in India has grown significantly by almost 35%, reaching an estimated market size of close to Rs. 1,500 crore.

6) Digital will continue to be the key driver of Adex in 2025, with the highest growth estimate of 17% and will further increase its share to 44%.

Television

1) TV registered a modest growth of 5%, to reach Rs. 34,453 crore in 2024, dropping its share further from 33% to 32%.

2) The growth rate of 5%, is the slowest in 8 years, baring the Covid year of 2020.

3) There was a marginal decline in TV FCT volume by 1% in 2024, with the total volume reducing from 2,162 million seconds in 2023 to 2,134 million seconds in 2024.

4) FMCG remains the dominant category, contributing 46% of total TV spending in 2024, down marginally from 47% in 2023.

5) Regional language channels are showing lot of potential and account for a significant share of 30% of TV Adex and have demonstrated higher growth rates of 9% to 12%.

6) The report expect TV Adex to grow by 6% in 2025 to reach a total of Rs. 36,520 crore, but further dropping its share to 30%.

1) Print Adex has crossed its pre Covid levels and grew by 5% to reach Rs. 20,272 crore.

2) Print has maintained its share of total Adex at 19%. It is still far higher than the Global average of 3%.

3) Print experienced no volume growth in 2024, but still showed 5% growth in Adex indicating higher ad rates and premium pricing, especially in English and Marathi.

4) Auto, FMCG, Education, Retail and Real Estate continue to contribute to 50% to Print Adex. This year Auto continues to be the leader of the pack with 14% share and contributed most to the growth of Print Adex.

5) Hindi and English Publications contribute over 64% to the total Print Advertising space consumed in India.

6) We expect Print to grow by 7% in 2025 to reach Rs. 21,691 crore and a share of 18%.

Other Media

1) OOH Media grew by 12% to Rs. 4,650 crore and maintained its share of 4%. Traditional, Transit and DOOH are the three major forms of Outdoor that are now used.

2) The Radio Adex has grown by 8% to reach Rs. 2,462 crore and maintained its share of 2%.

3) Cinema achieved a growth of 10%, as against a projected growth of 35% on the back of very few major new releases.

Sharing the highlights of the report, Sam Balsara, chairman Madison World said, “The Union Budget signals good news for advertising, we should expect buoyancy in markets.”