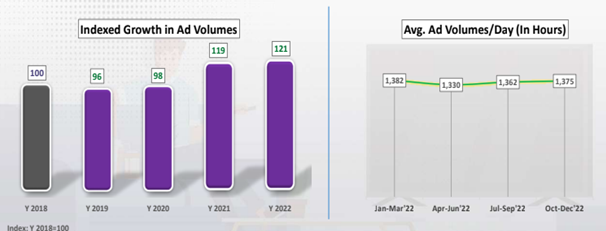

According to TAM AdEx Report on Rewinding year 2022 for Television Advertising, ad volumes increased by 21pc and 26pc in the year 2022 both compared to year 2018 and year 2019 respectively. It soared by 2pc in 2022 over 2021. Lowest average ad volumes observed in second quarter but it was still 10pc more compared to same quarter of year 2021. Average ad volumes/day rose by 3pc in fourth quarter compared to second quarter.

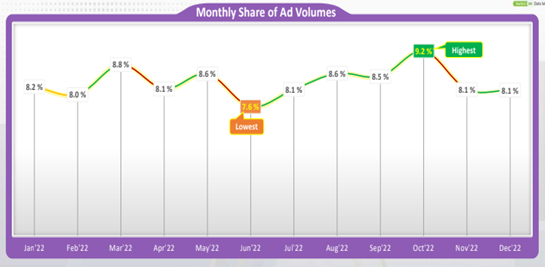

Television Ad Volumes clocked 9.2pc ad volume share in Oct’22 owing to the festive period. June remained the month with lowest percentage ad volume share in both Y 2022 and Y 2021.

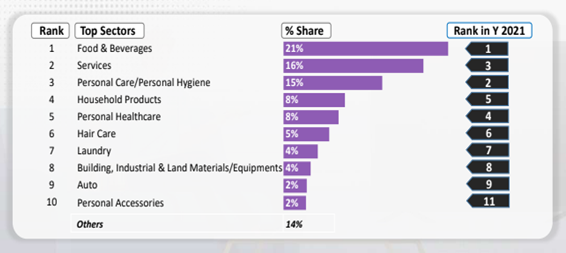

Food & Beverages was the top leading sector with 21pc share of ad volumes in 2022. It led the category in 2021 as well. Services Sector jumped up one spot to 2nd position with 16pc share. In comparison to Y 2021, five of the top 10 sectors retained their ranking in Y 2022.

Among the Top 10 categories, Toilet Soaps and Toilet/Floor Cleaners maintained their top 2 positions during Y 2022 and Y 2021 with more than

4pc share of ad volumes. Aerated Soft Drink moved up by 7 positions to achieve 8th rank in Y 2022 displacing Washing Powders/Liquids. Ranking of four out of Top 10 categories improved in Y 2022 against their ranking in Y 2021.

In the Leading Advertisers, Reckitt topped the list followed by HUL. Top 10 advertisers together added 38pc share of ad volumes during Y 2022. Reckitt Benckiser, Godrej Consumer Products, Coca Cola India and Procter & Gamble were in the list of Top 10 advertisers with positive rank shift compared to Y 2021. Coca Cola India was the new entrant in Top 10 advertisers’ list. FMCG players ruled among the Top 10.

Among the Leading Brands, Dettol Antiseptic Liquid topped the list. Total 14.2 K+ brands were present on TV during Y 2022. Six out of Top 10 brands were from Reckitt Benckiser and three were from HUL. Top 10 Brands contributed 9pc share of Television Ad Volumes.

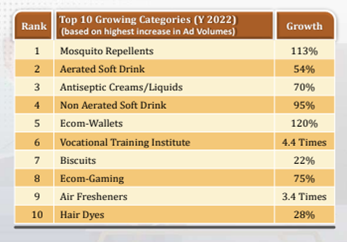

In the top growing categories, 230+ categories registered positive growth. Mosquito Repellents among the categories saw highest increase in ad secondages with growth of 113pc followed by Aerated Soft Drink with 54pc growth during Y 2022 compared to Y 2021. In terms of growth percentage, Vocational Training Institute category witnessed highest growth pc of 4.4 Times among the Top 10 in the Y 2022.

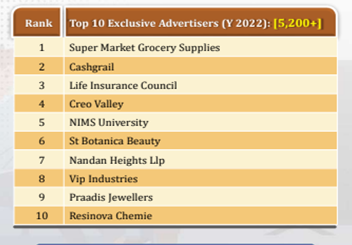

5.2K+ Exclusive advertisers advertised during Y 2022 compared to Y 2021. Super Market Grocery Supplies was the top exclusive advertiser. Services sector had their three brands in the Top 10 exclusive list during Y 2022, while Education and Personal Accessories sectors had two brands each.

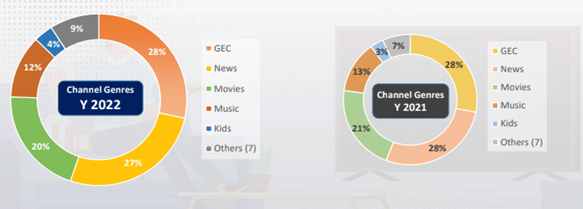

Since Y 2021, GEC overtook News as the most popular channel genre in terms of advertising and continuing in Y 2022. Top five channels genres accounted for more than 90pc share of ad volumes during both Y 2022 and Y 2021.

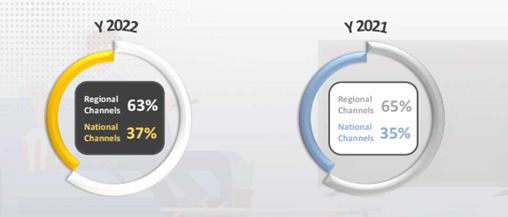

In Y 2022, National channels saw a 8pc ad volume rise compared to Y 2021, while Regional channels slipped by marginal 2pc in Y 2022 over Y 2021. Regional channels dominating the ad volumes share during both Y 2021-22.

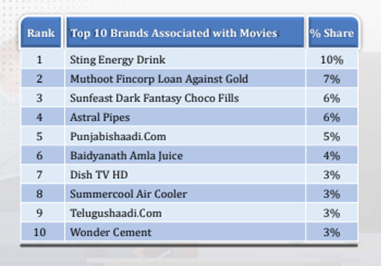

Sting Energy Drink topped among the brands associated with movies with 10pc share of Co-Branding Ad Volumes. The top brand Sting Energy Drink partnered with ‘Raksha Bandhan’ movie. Top 10 brands accounted nearly 50pc share of Co-Branding Ad Volumes during Y 2022. Brands associated with movies saw a huge 2.8 times ad volume growth in Y 2022 over Y 2021.

‘Shabaash Mithu’ and ‘Vikram Vedha’ movie had 8 Co-Brandings each in Y 2022. Number of movies opting co-branding ads for promotion during Y 2022 grew 3 times, 20+ to 60+. Total 60+ movies partnered with Brands.