TAM AdEx released the Cross Media Report for Rewinding year 2022 for Advertising in the Retail Sector on TV, Print, Radio and Digital.

TV

In the year 2022, Retail ad volumes on Television rose by 62pc over 2020 and 16pc compared to 2021. Compared to the first quarter of year 2022, Q4 witnessed 48pc increase in ad volumes. Q2’22 witnessed the highest ad volumes which was 73pc higher as compared to Q1’22.

The lowest Ad Volumes were reported in Feb’22 and Nov’22 with Oct’22 registering the highest share of ad volumes for Retail at 15pc.

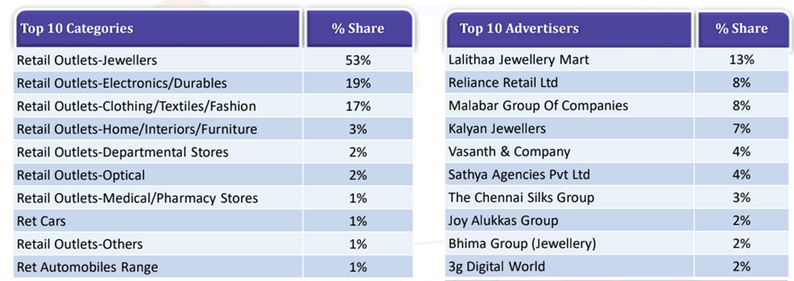

In the Top 10 Categories and Advertisers of Retail for TV in 2022, Retail Outlets-Jewellers category alone contributed to 53pc share. Top 10 Advertisers accounted to 54pc share of ad volumes with Lalithaa Jewellery Mart leading the list.

Among the Top 10 Brands from Retail sector for the year 2022, initial three belonged to Jewellery brands with Bhima Jewellers & Joy Alukkas Jewellery being new entrants in the list. Top 10 Brands accounted to 46pc share of ad volumes with Lalithaa Jewellery topping the list.

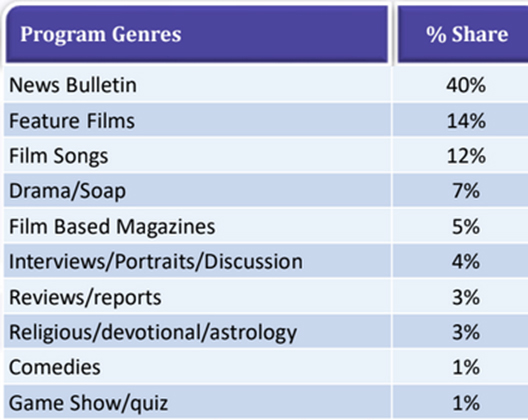

News and GEC were the two channel genres on TV which together accounted for 76pc of ad volumes share for Retail sector during 2022. News channel genre topped the preference list of Retail players during 2022.

News Bulletin was most preferred for promoting Retail brands on Television. Top two program genres, News Bulletin and Feature Films together added 55pc to the total ad volume share.

Prime Time was the most preferred time-band on TV followed by Afternoon and Morning time-bands which together accounted for 74pc share of Ad Volumes in 2022.

Advertisers of Retail sector preferred 20-40 seconds ad size on TV. 20-40 seconds and <20 seconds ads together covered 94pc share in Y 2022.

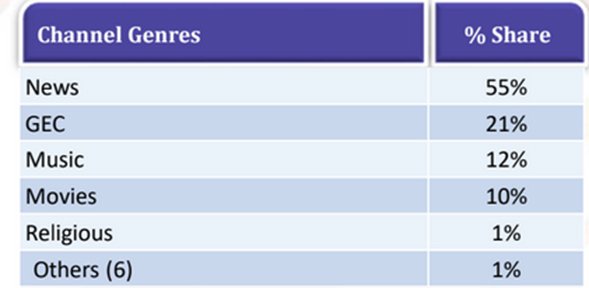

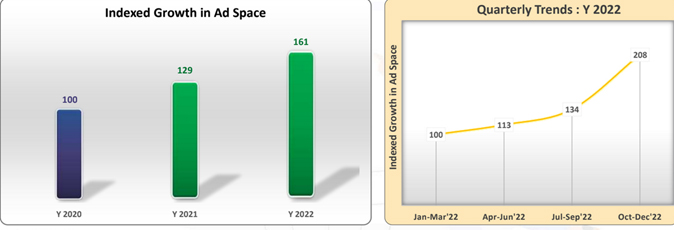

Ad Space of Retail sector in Print increased by 29pc and 61pc in 2021 and 2022 respectively compared to Y 2020. The growth was 24pc in 2022 when compared to 2021. In 2022, Q4’22 witnessed highest ad space with growth of 2x compared to 1st Quarter of year 2022.

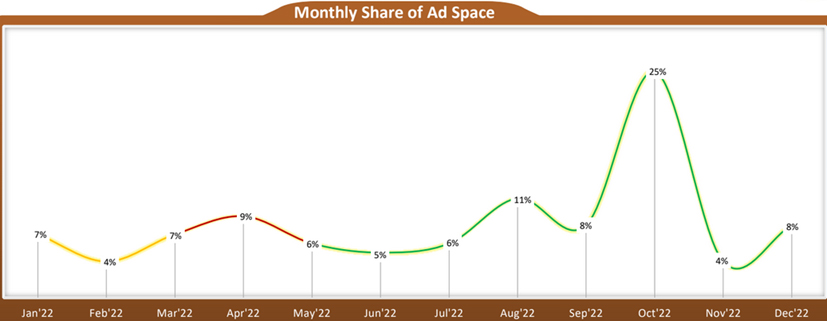

Oct’22 witnessed the highest share of ad space of 25pc, followed by Aug’22 with 11pc share.

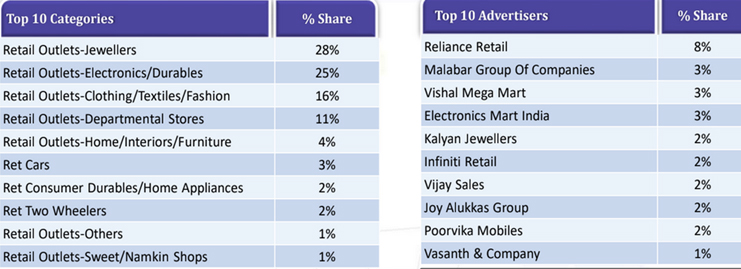

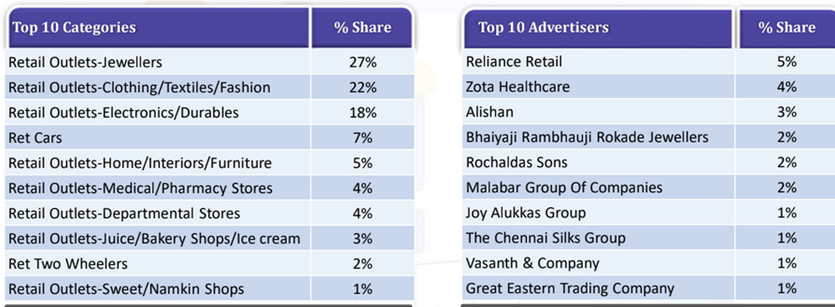

Retail Outlets-Jewellers was leading the list of Top 10 Categories of Retail Sector in Y 2022. Top 10 Advertisers accounted for 27pc share of Ad Space in Y 2022 with Reliance Retail retaining its first position in the list.

Top 10 Brands accounted to 20pc share of ad space in Y 2022 with Vishal Mega-Mart leading the list.

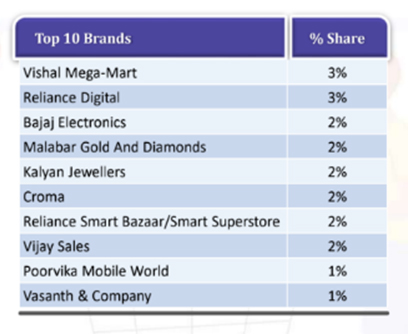

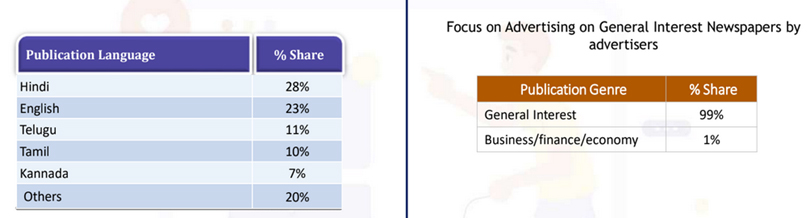

Top 5 Publication Languages accounted for 80pc share of sector’s Ad space. General Interest publication genre dominated with 99pc share of sector’s ad space.

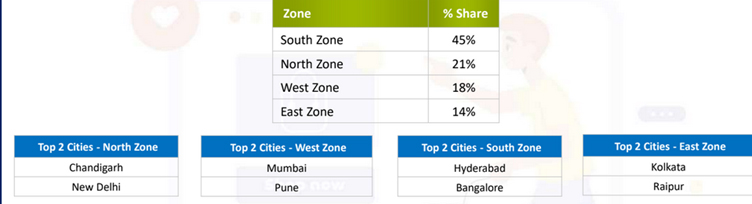

Among 4 zones, South was on first position for Retail advertising with 45pc share during 2022. Hyderabad and Chandigarh were top 2 cities in overall India.

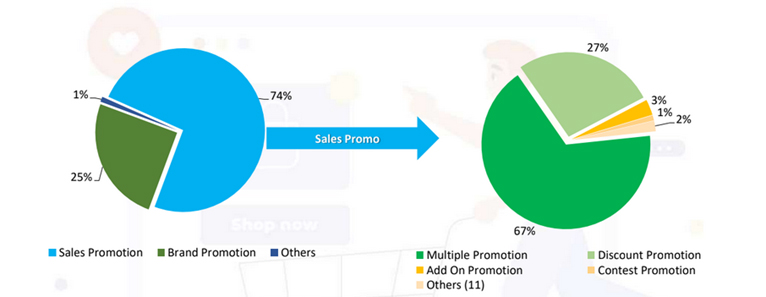

Sales Promotion for ‘Retail’ sector accounted for 74pc of Ad Space in Print medium. Among Sales Promotions, Multiple Promotion occupied 67pc share of the ad pie followed by Discount Promotion with 27pc share in 2022.

RADIO

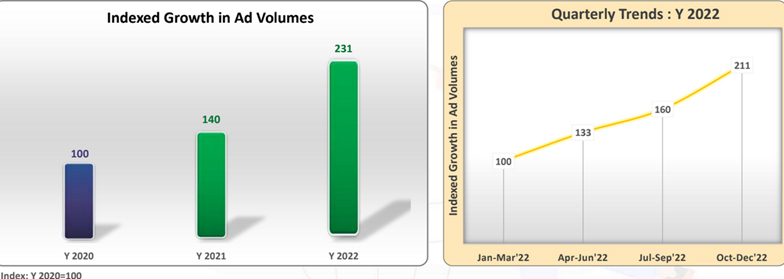

Ad Volume for Retail sector on Radio in 2021 and 2022 increased by 40pc and 2.3 times respectively over Y 2020. More than 60pc rise was seen in sector ad volumes during Y 2022 when compared to Y 2021. The Retail sector experienced a rising trend in quarterly advertising volumes, with Q4 of 2022 having the highest share of advertising volume at 2.1 times that of Q1.

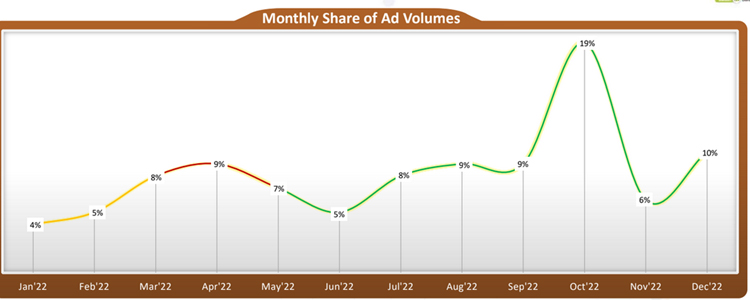

Oct’22 registered the highest share of ad volumes of 19pc, followed by 10pc in Dec’22. The lowest share of ad volume was observed in Jan’22 with 4pc.

On Radio, Retail ads for Jewellers, Clothing & Electronics category ruled with 67pc of the total ad volume share of the sector. Top 10 Advertisers accounted for 23pc share of ad volumes in 2022 with Reliance Retail leading the list.

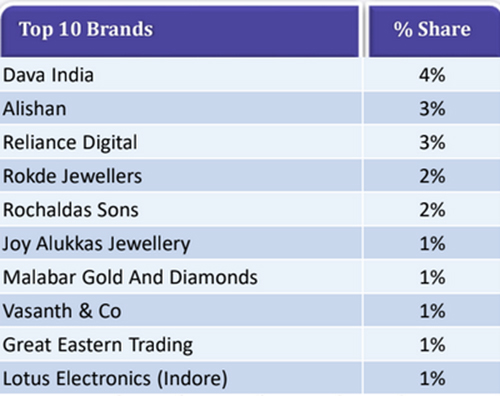

Top 10 brands from Retail sector on Radio accounted to 20pc share of ad volumes in 2022 with Dava India, a division of Zota Healthcare, leading the list.

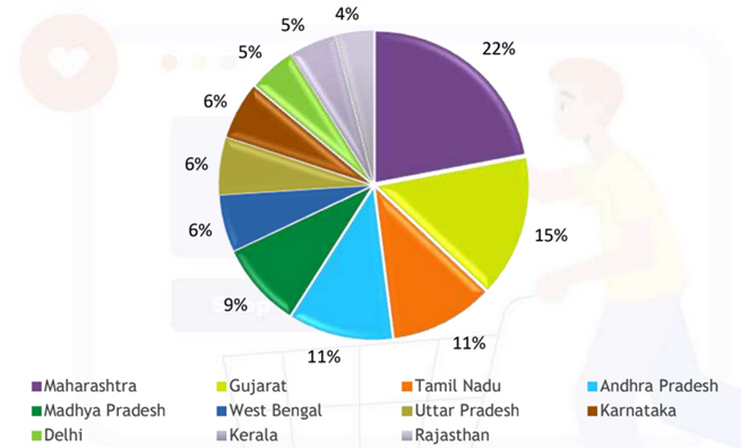

The top three states occupied 48pc share of Ad Volumes for the Retail sector. Maharashtra state was on top with 22pc share of ad volumes followed by Gujarat with 15pc share.

Advertising for Retail sector was preferred in Evening and Afternoon time-band on Radio. Afternoon and Evening time bands together added 69pc share of ad volumes in 2022.

DIGITAL

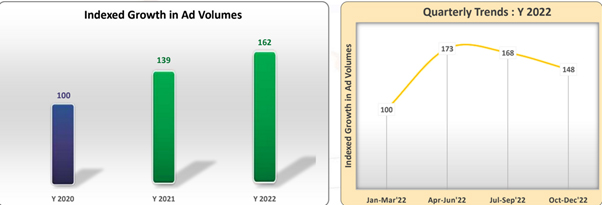

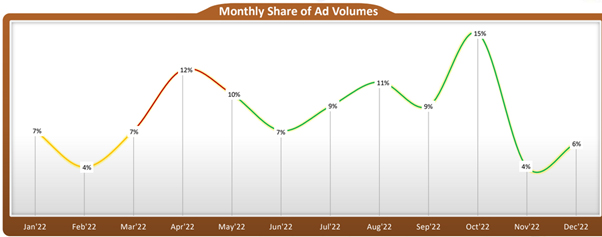

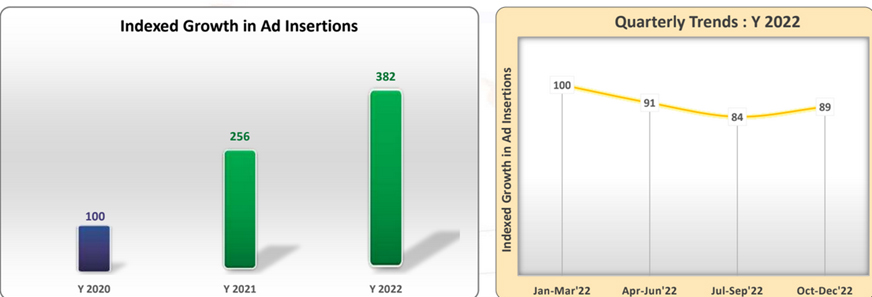

Ad Insertions of Retail sector on Digital increased by 3.8 times in Y 2022 over Y 2020. When compared to Y 2021, Y 2022 witnessed growth of almost 50pc. The lowest ad insertion in 2022 was observed in Q3’22.

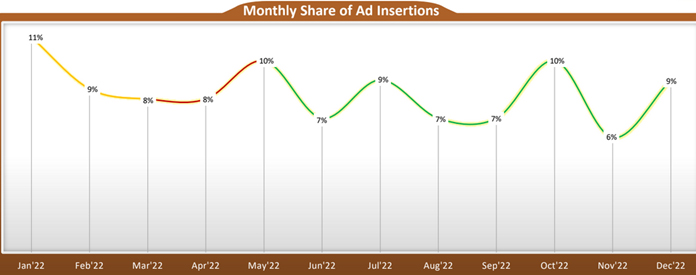

Highest share of ad insertions was observed in Jan’22 with 11pc share and Nov’22 had lowest of 6pc share.

On Digital Medium, Electronics/Durables & Home/Interiors/Furniture were top Retail categories with 23pc share of ad insertions each. Top 10 Advertisers accounted for 44pc share of Ad Insertions in Y 2022 with Infiniti Retail leading the list.

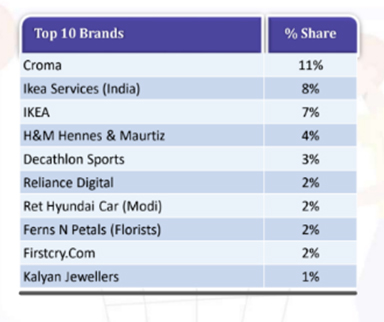

In the year 2022, Croma topped the list of the top 10 brands that collectively made up 43pc of the sector’s Ad Insertions.

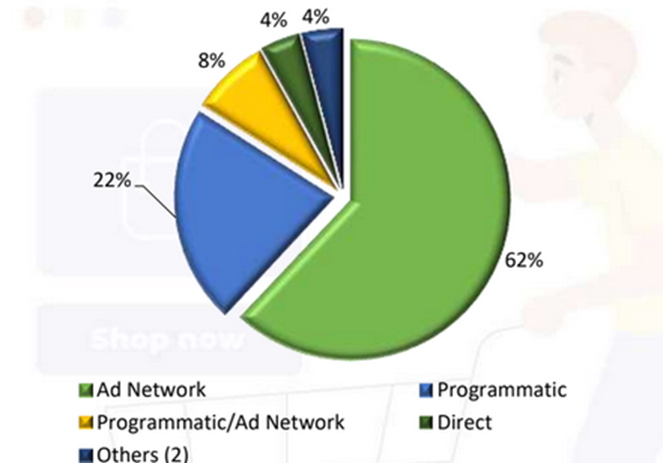

Ad Network method of transaction secured first position with 62pc share of Digital advertising of Retail sector in Y 2022. Programmatic and Programmatic/Ad Network transaction methods had 22pc and 8pc share of Retail Ad Insertions on Digital respectively.