According to TAM Sports Report, indexed ad volume growth in eliminator of IPL 15 was 17 pc more compared to eliminator of IPL 14. In first and second play-off of IPL 15, indexed ad volume grew by 11 pc and 8 pc respectively over IPL 14.

Ad Volumes per channel in the finals of IPL 15 elevated by 9 pc from the finals of IPL 14.

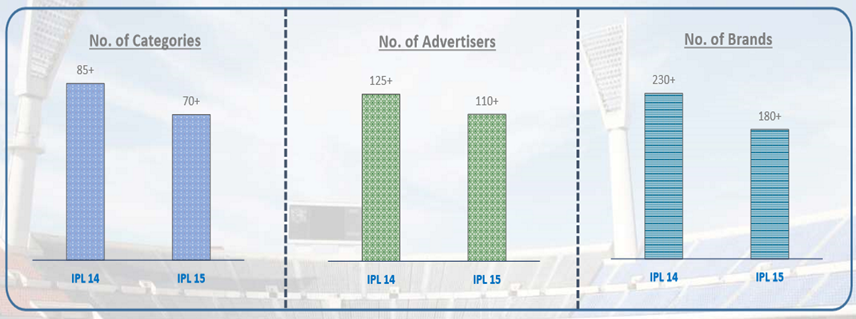

Tally of Categories, advertisers and brands dropped by 21 pc, 13 pc and 21 pc respectively in IPL 15 compared to IPL 14.

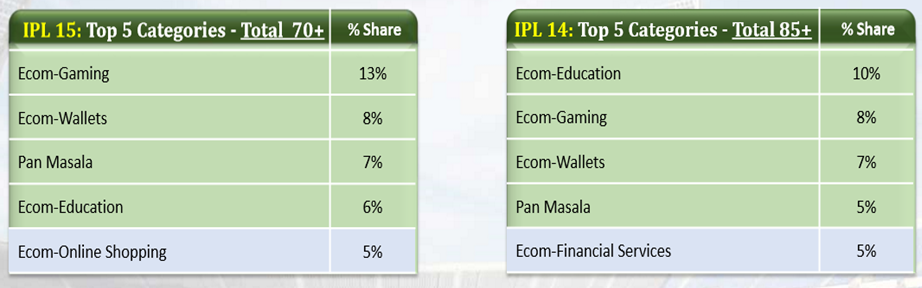

Among the top categories, Ecom-Gaming topped in IPL 15 while it ranked 2nd in IPL 14. Ecom-Education that topped in IPL 14 stood at 4th position in IPL 15. During IPL 15, the top five categories accounted for 39 pc of total ad volume compared to 36 pc in IPL 14.

Four categories were common among Top 5 in IPL 15 and IPL 14.

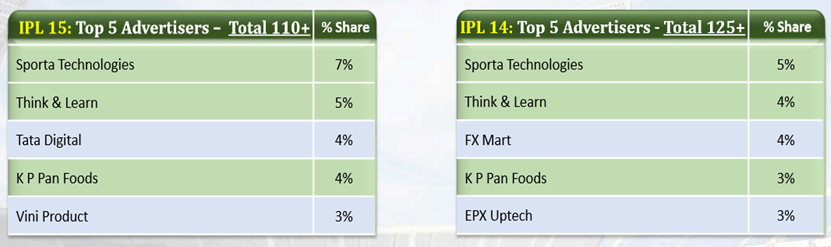

Among the top five advertisers, Sporta Technologies, Think & Learn and K P Pan Foods were common between IPL 15 and IPL 14. The top five sponsors contributed to 24 pc share of ad volumes during IPL 15 compared to 20 pc share during IPL 14.

Sporta Technologies topped in terms of advertising with 7% share during IPL 15.

Among the top five brands, Dream11.com and Cred were common between IPL 15 and IPL 14. Top five brands contributed to 21 pc share of ad volumes in IPL 15 compared to 18 pc share in IPL 14.

Dream11.com was the top advertised brand during both IPL 15 and IPL 14.

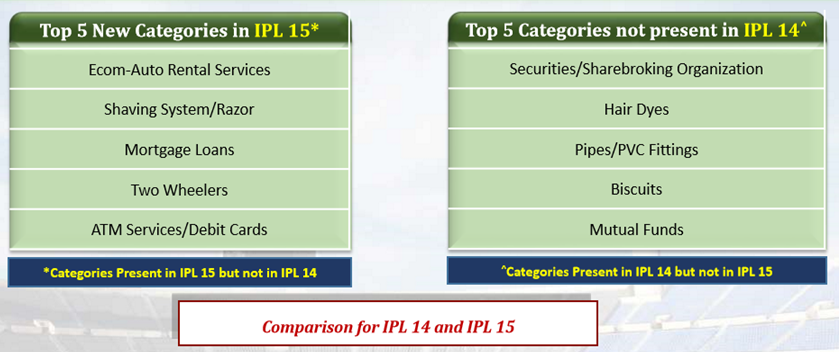

In IPL 15, there were 20+ new categories compared to IPL 14. 40 categories did not feature in IPL 15 compared to IPL 14.

Among the new categories, Ecom-Auto Rental Services topped the list followed by Shaving System/Razor.

During commercial breaks, 10-20 second ads were the most preferred ones followed by 21-40 second ads.