TAM shared its report on, Advertising by the sector: Auto. The report was highlighted by Ad Volumes for the Auto sector on TV and Radio, Ad Space for the Auto sector in Print, and Ad Insertions for the Auto sector on Digital. It covers insights on Top 10 Categories, Advertisers, and Brands of the Auto sector across traditional and digital mediums.

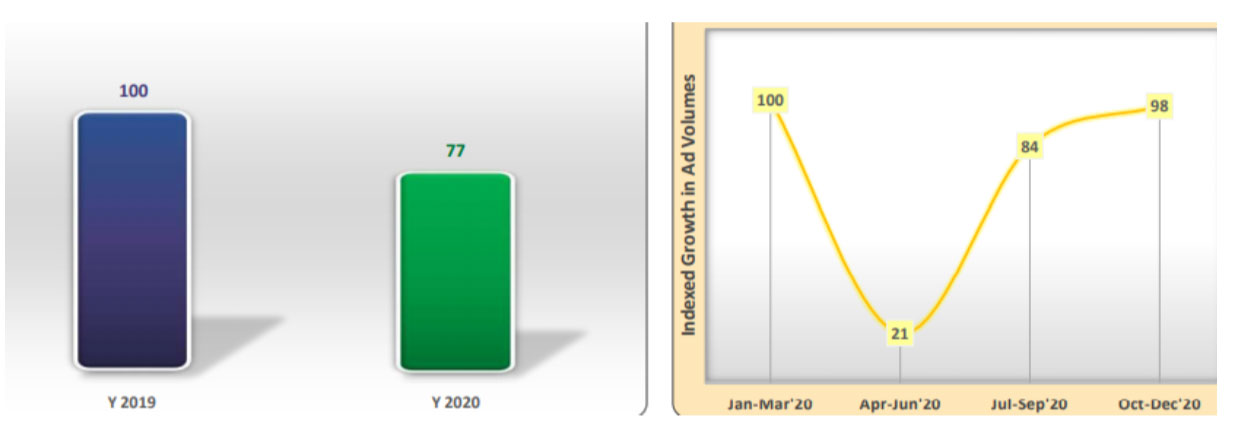

Compare to the 3rdQuarter of Y 2020, Q4 witnessed 16% Ad Volume growth. Covid-19 hit the Ad Volumes of Auto sector on Television in Y 2020 over Y 2019 i.e., dropped by 23%. Due to Covid-19, the lowest Ad Volumes observed in 2ndquarter which includes the lockdown period. Also, From August months onwards, ad volumes for the Auto sector increased to double-figure and reached a maximum during festival season (Oct’20).

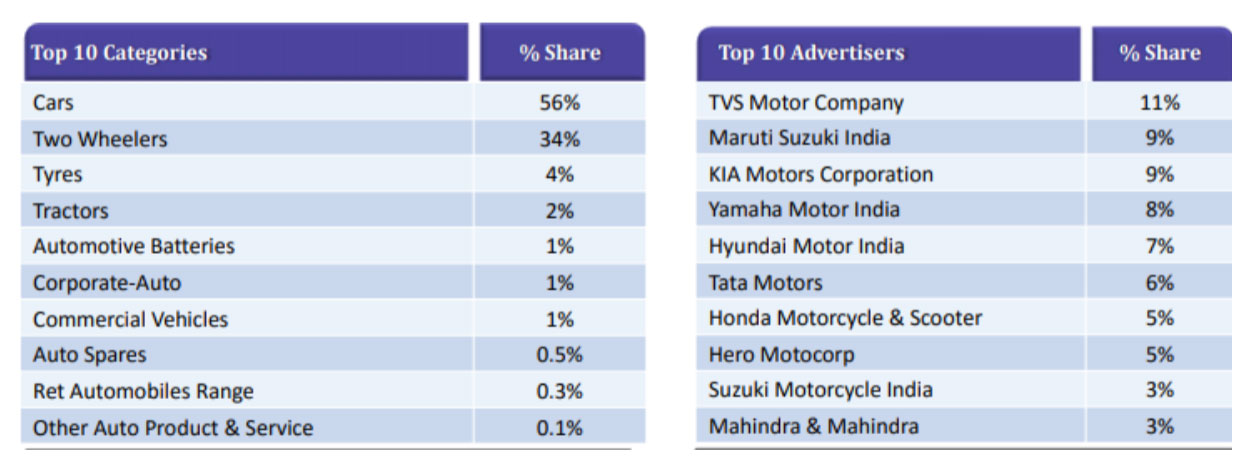

In the Top 10 Categories and Advertisers of Auto for TV, the ‘Cars’ category alone contributed 56% to the ad volume share followed by Two-wheelers with 34% share. Top 10 Advertisers accounted for more than 60% share of ad volumes in Y 2020 with TVS Motor Company topping the list.

Among the Top 10 Auto brands, KIA Sonnet was on Top followed by TVS Jupiter. Top 10 Brands accounted 28% share of ad volumes in Y 2020.

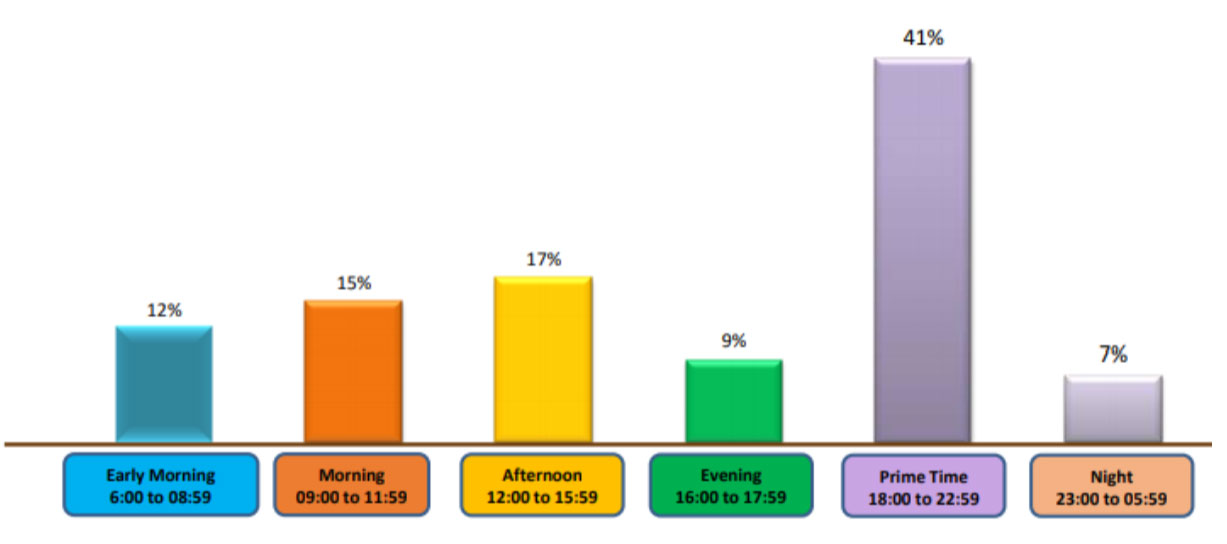

Prime Time was the most preferred time-band on TV followed by Afternoon and Morning time-bands. Primetime & Evening time bands together accounted for 49% share of Ad Volumes.

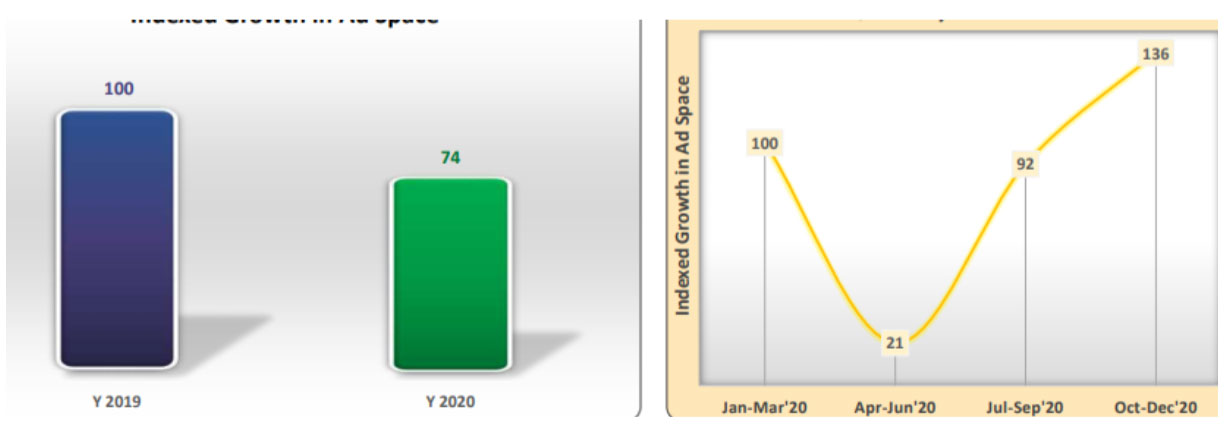

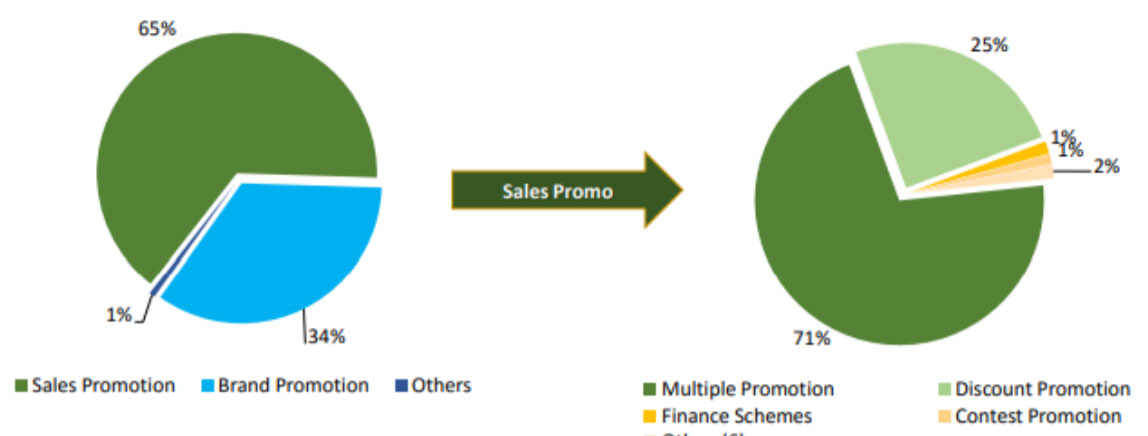

Compare to 1stQuarter of Y 2020, Q4 witnessed 1.4 Times Ad Space growth. Ad Space of Auto sector in Print decline by 26% in Y 2020 over Y 2019. Whereas, Due to Covid-19, the lowest Ad Volumes observed in 2ndquarter which includes the lockdown period.

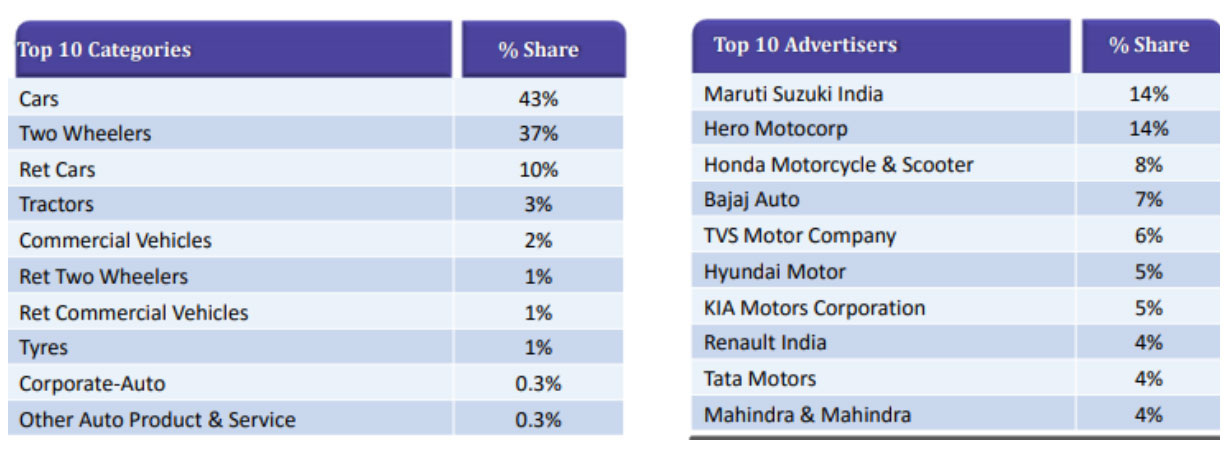

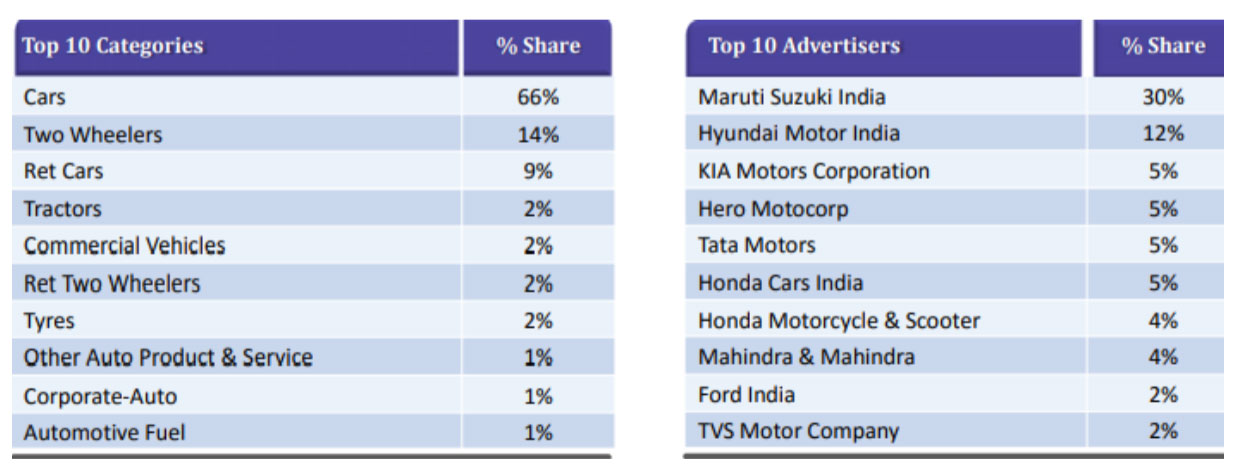

In Top 10 Categories and Advertisers of Auto Sector for Print, Cars & Two Wheelers together accounted more than 80% Ad Space among Top 10 Categories of the Auto sector and the Top 5 Advertisers accounted 50% share of Ad Space in Y 2020 with Maruti Suzuki India & Hero Motocorp leading the list with 14% share each.

In Newspaper: Publication Language and Genre for Auto sector in Print, Top 5 Publication Languages accounted 81% share of Auto sector’s Ad space. General Interest publication genre added 98% share of Auto sector’s Ad Volume.

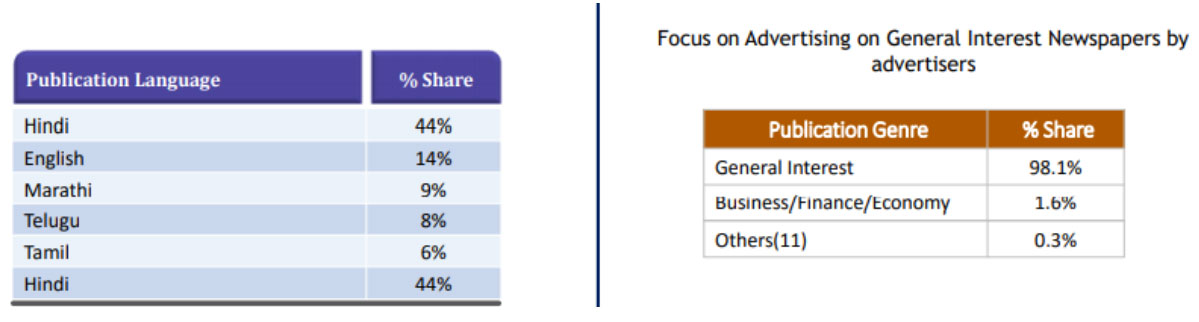

Sales Promotion for the ‘Auto’ sector accounted for 65% of Ad Space in the Print medium. Among Sales Promotions, Multiple Promotions occupied 71% share of the pie followed by Discount Promotion with 25% share in Y 2020.

Compared to 1stQuarter of Y 2020, Q4 witnessed 2.3 times Ad Volume growth. Ad Volumes for the Auto sector on Radio declined by 24% in Y 2020 over Y 2019. whereas, Due to Covid-19, the lowest Ad Volumes observed in 2ndquarter which includes the lockdown period.

In the Top 10 Categories and Advertisers of Auto for Radio, ads for Cars & Two Wheelers ruled with 80% of the total ad volume share of the Auto sector. Top 5 Advertisers accounted for more than 55% share of ad volume in Y 2020 with Maruti Suzuki India leading the list.

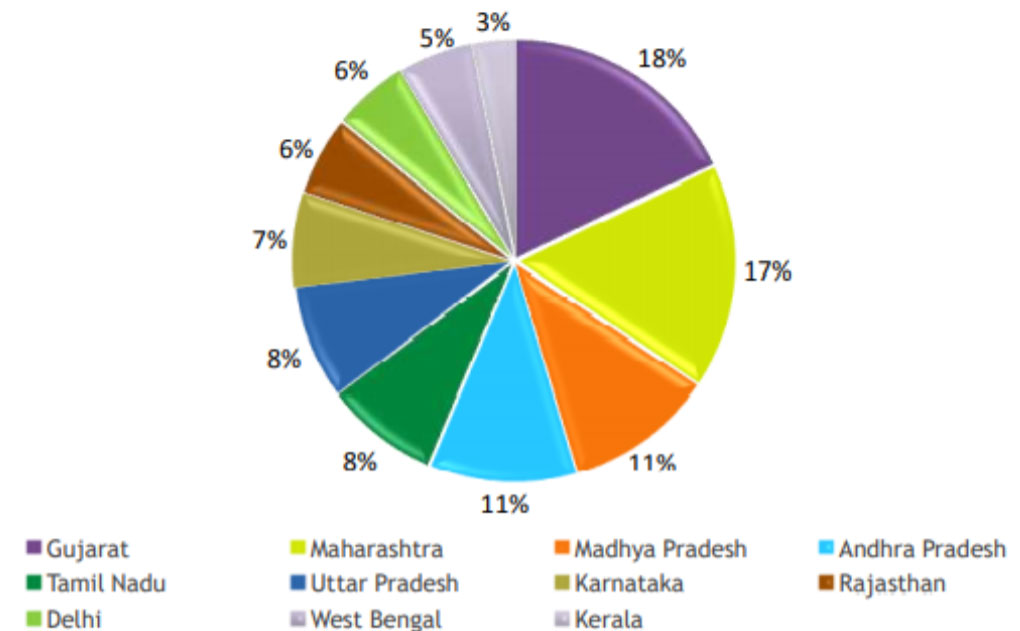

The Top 5 states occupied around 65% share of Ad Volumes for the Auto sector. Gujarat state was on top with 18% share of Ad Volumes closely followed by Maharashtra with 17% share.

Compared to 1stQuarter of Y 2020, Q4 witnessed substantial rise Ad Insertion growth on Digital. Ad Insertions of Auto sector on Digital declined by 59% in Y 2020 over Y 2019. Whereas, Due to Covid-19, lowest Ad insertions observed in 2ndquarter which includes the lockdown period.

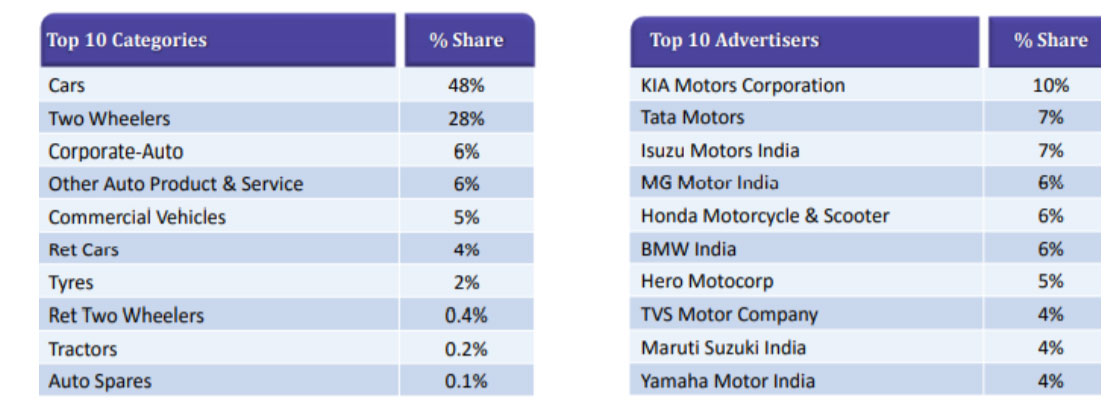

In Top 10 Categories and Advertisers of Auto Sector for Digital, ‘Cars’was the top category with 48% share followed by Two Wheelers with 28%. Also, the Top 10 Advertisers accounted for more than 59% share of Ad Insertions in Y 2020 with KIA Motors Corporation leading the list.

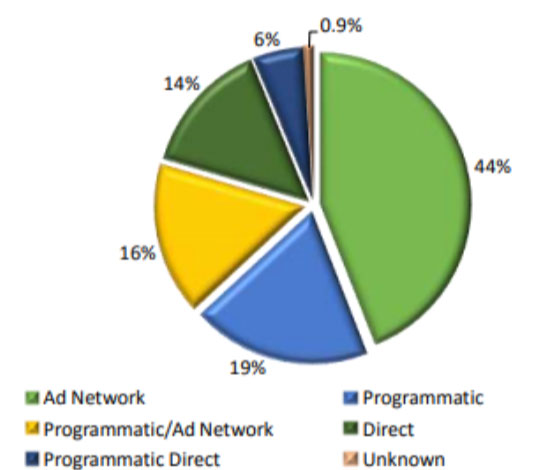

Ad Network topped with more than 40% share of transaction method for Digital advertising of Auto sector in Y 2020. Programmatic and Programmatic/Ad Network transaction methods wereon 2ndand 3rdposition in Auto Ad Insertions on Digital.