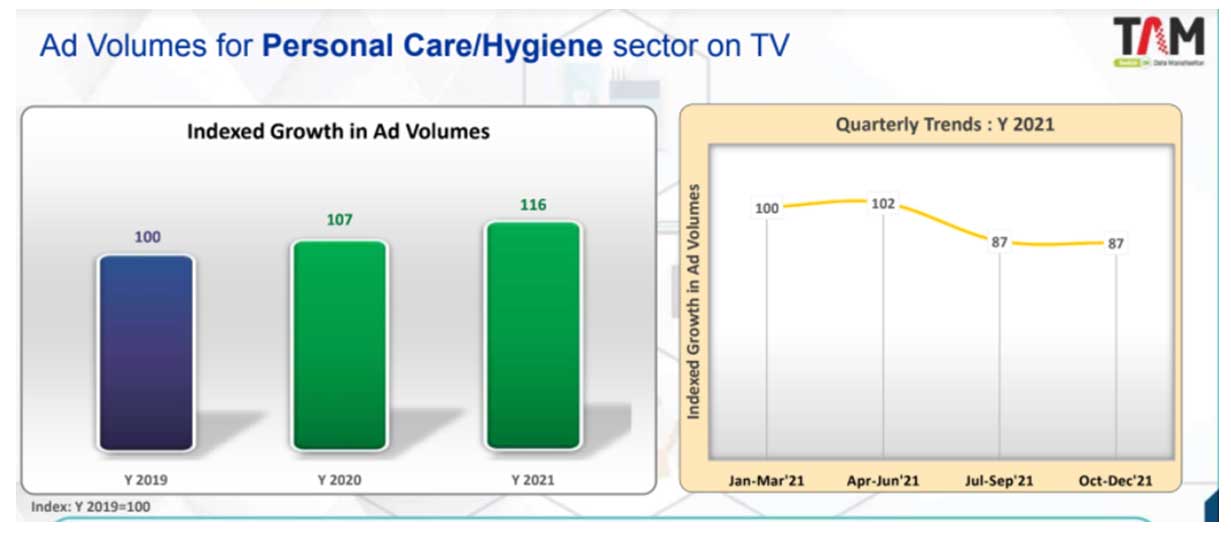

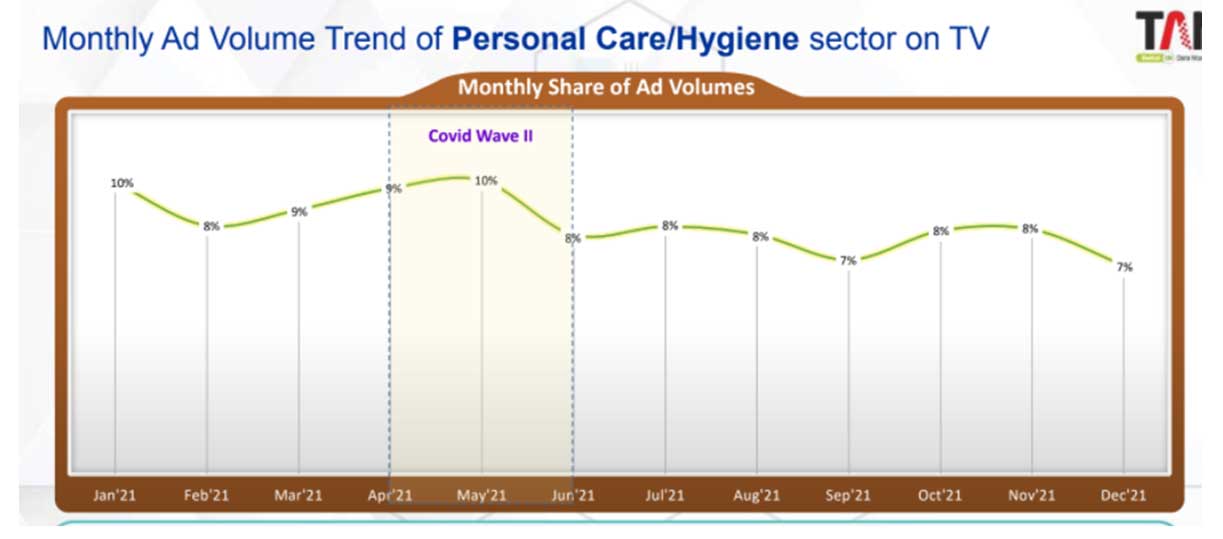

Ad Volumes of the Personal Care/Hygiene sector on Television increased by 7% and 16% in 2020 and 2021 over 2019 respectively, states TAM Report. Compared to the 1st quarter of Y 2021, Q2 witnessed a slight rise of 2% in ad volumes of the Personal Care/Hygiene sector. A drop was recorded in Personal Care/Hygiene sector advertising after May’21 with a steady ad volume share till Dec’21.

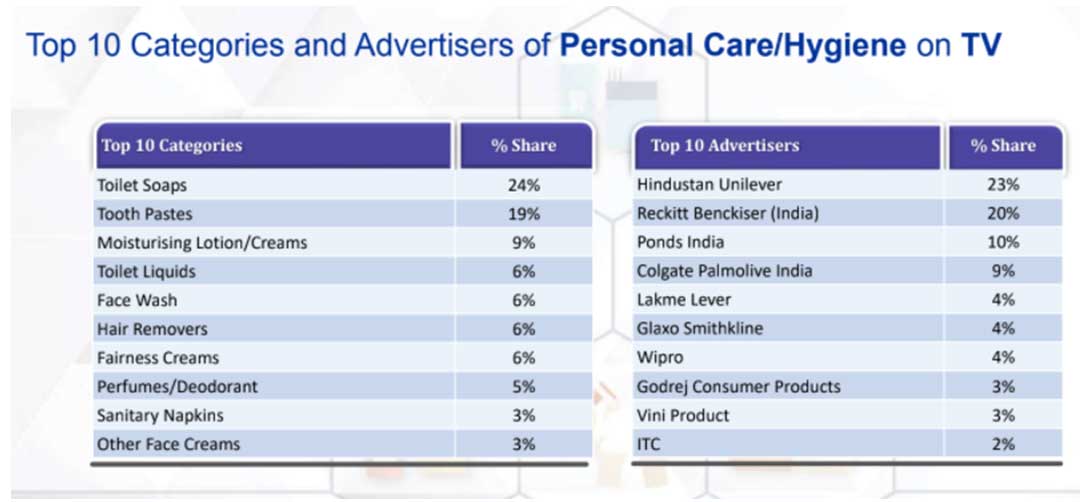

Highest ad volume share registered in Jan’21 followed by May’21 for the Personal Care/Hygiene sector on Television. The Top 3 categories contributed more than 50% to the ad volume of the Personal Care/Hygiene sector on Television. Top 10 Advertisers accounted for more than 80% share of ad volumes in Y 2021 with Hindustan Unilever topping the list with nearly 1/4th share. Among the Top 10 brands, 3 belonged to the Toilet Soaps category.

The top 10 brands accounted for more than 25% share of ad volumes in 2021 with Dettol Toilet Soaps topping the list. The top 2 channel genres on TV together accounted for more than 60% of ad volumes share of the Personal Care/Hygiene sector during 2021. Feature Films was the most preferred program genre for promoting Personal Care/Hygiene brands on Television.

The Top 2 program genres- Feature Films and Film Songs together added more than 40% to the total ad volume of the Personal Care/Hygiene sector. Prime Time was the most preferred time band on TV followed by Afternoon and Morning time bands. Primetime, Afternoon & Morning time bands together accounted for more than 65% share of ad volumes for the sector. Advertisers of the Personal Care/Hygiene sector preferred 20-40 secs ad size on TV. 20-40 seconds and <20 seconds ads together covered more than 95% shares in 2021.

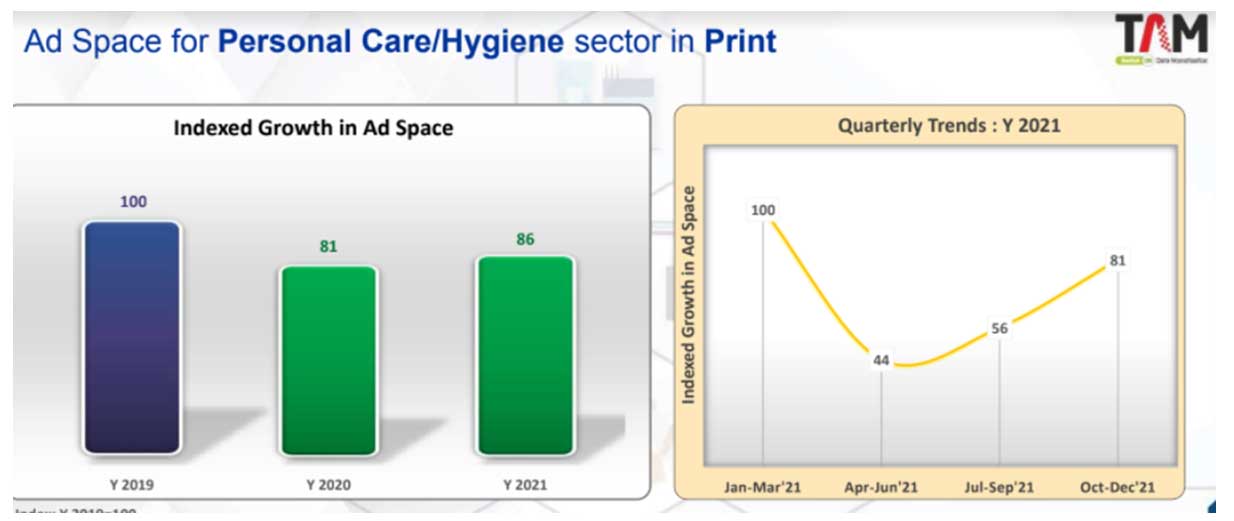

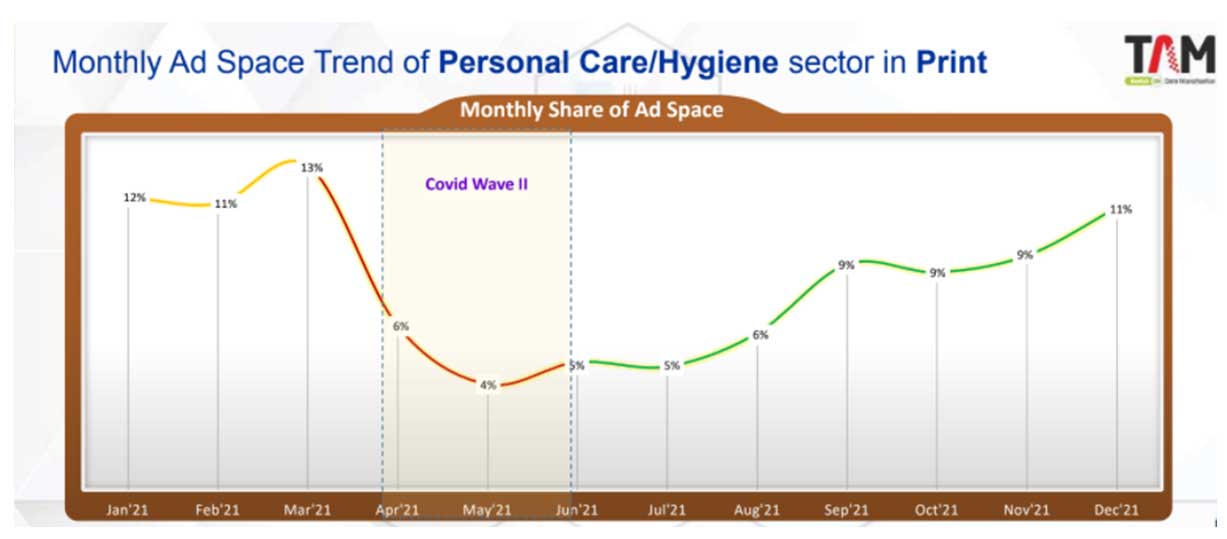

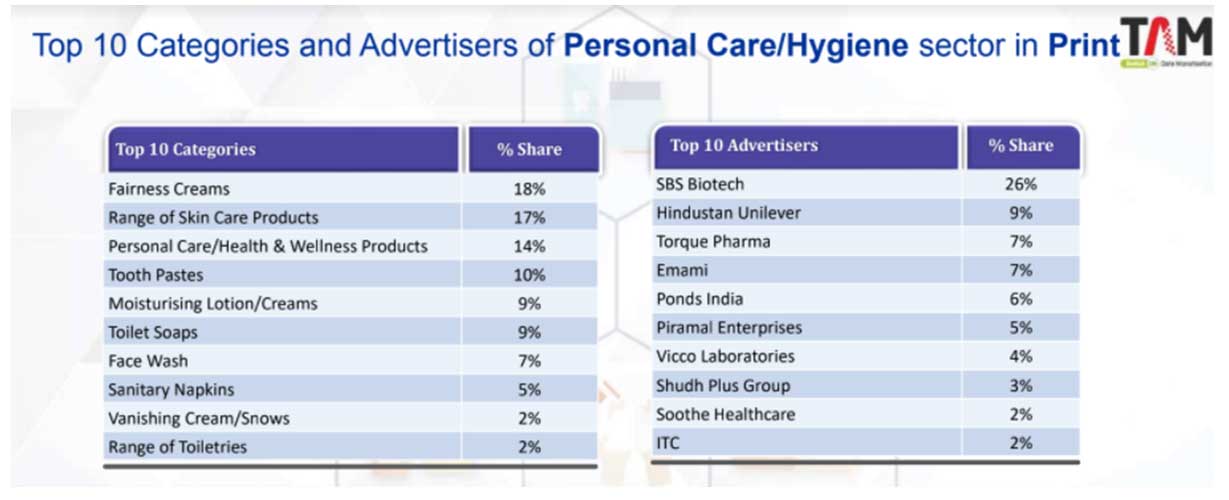

The Ad Space of Personal Care/Hygiene sector in Print saw a decreasing trend in 2020-21 compared to 2019. After a dip in Q2, a rising trend was noticed in Q3 and Q4, with 27% and nearly double ad space growth respectively. Top 10 Brands accounted for 49% share of ad space in 2021 with Roop Mantra Ayur Face Cream leading the list. Among the Top 10 brands, 3 brands were from SBS Biotech with a 22% share of ad space together. Top 5 Publication Languages accounted for 88% share of the Sector’s ad space.

The General Interest publication genre added almost 100% share of the Personal Care/Hygiene sector’s ad Space. Among the 4 zones, publications from the North zone had the highest share of advertising for the sector i.e. 40%. Mumbai & Kolkata were top cities in the West and East Zone respectively as well as in overall India.

Sales Promotion for the Personal Care/Hygiene sector accounted for 16% of Ad Space in the Print medium. Among Sales Promotions, Discount Promotion occupied 45% share of the pie followed by Add on Promotion with 27% share in 2021.

Radio

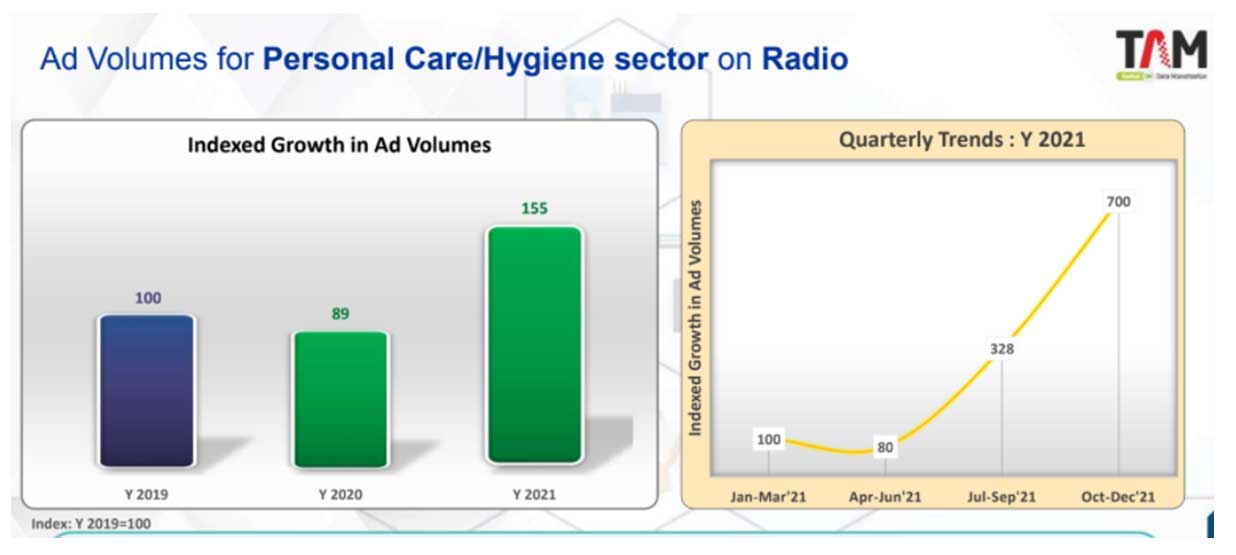

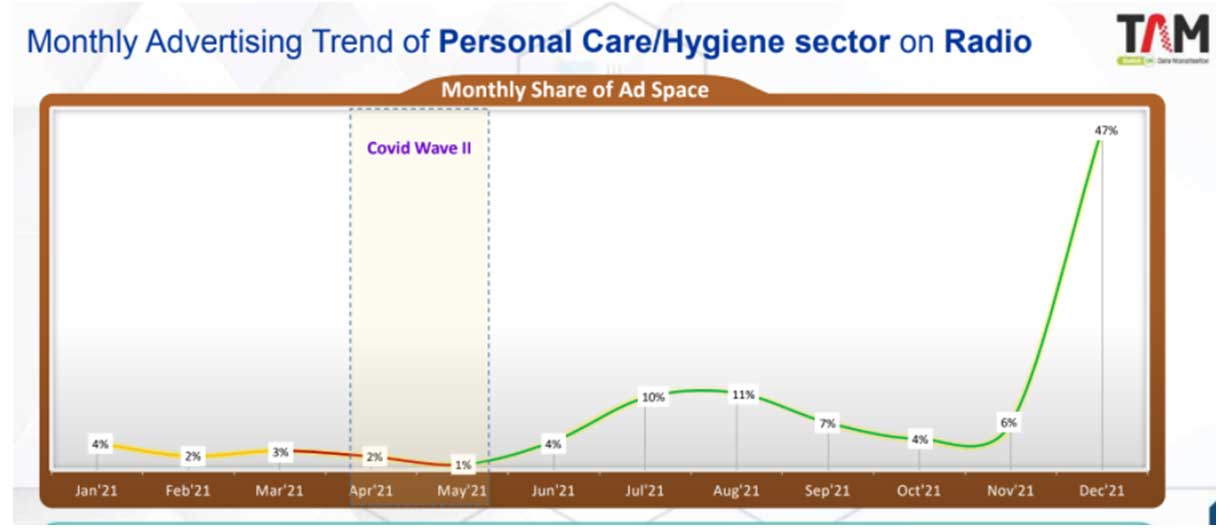

Ad Volume for the Personal Care/Hygiene sector on Radio grew by 55% in 2021 over 2019. Due to huge growth in the Tooth Pastes category of Personal Care/Hygiene sector on Radio, the 4th quarter witnessed an exponential growth of around 8 times compared to the 1st quarter.

The lowest ad volumes for the Personal Care/Hygiene sector on Radio was observed during Apr-May’21 which was during the 2ndwave of Covid. In the months of Jan’21, Nov’21 and Dec’21, Vicco Laboratories had the highest share of Ad Volumes for the Tooth Pastes category.

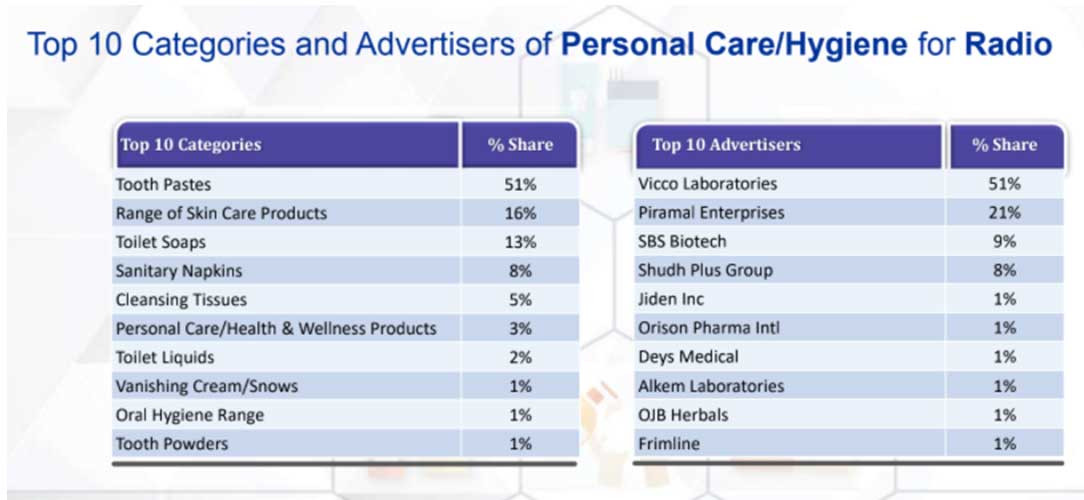

On Radio, ads for Tooth Pastes and Toilet Soaps ruled with more than 65% share of the total ad volumes. Top 10 Advertisers accounted for a 95% share of ad volume in 2021 with Vicco Laboratories leading the list. Top 10 Brands accounted for 92% share of Ad Volumes in 2020 with ViccoVajradanti Paste having nearly half of the share.

The Top 3 states occupied 44% share of Ad Volumes for the Personal Care/Hygiene sector. Gujarat state was on top with 19% share of Ad Volumes followed by Maharashtra and UP with 14 and 11% share respectively. 72% share of the Personal Care/Hygiene ad volumes were during Afternoon and Evening time-bands in 2021.

Digital

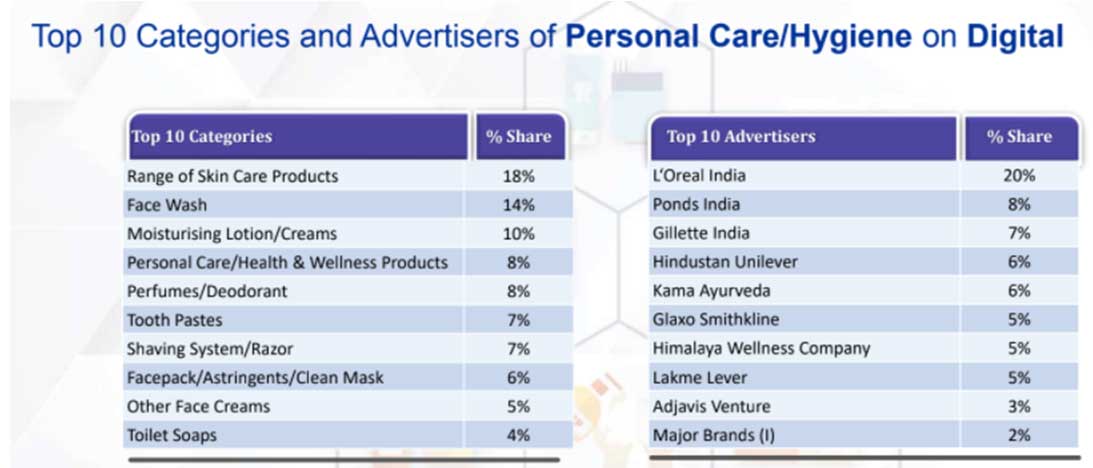

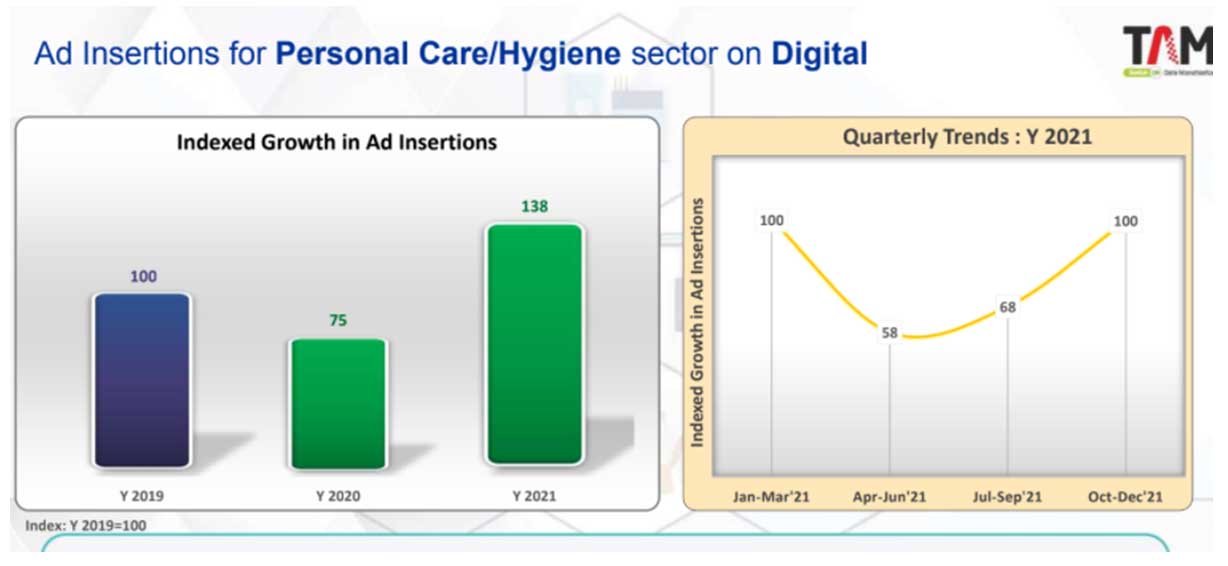

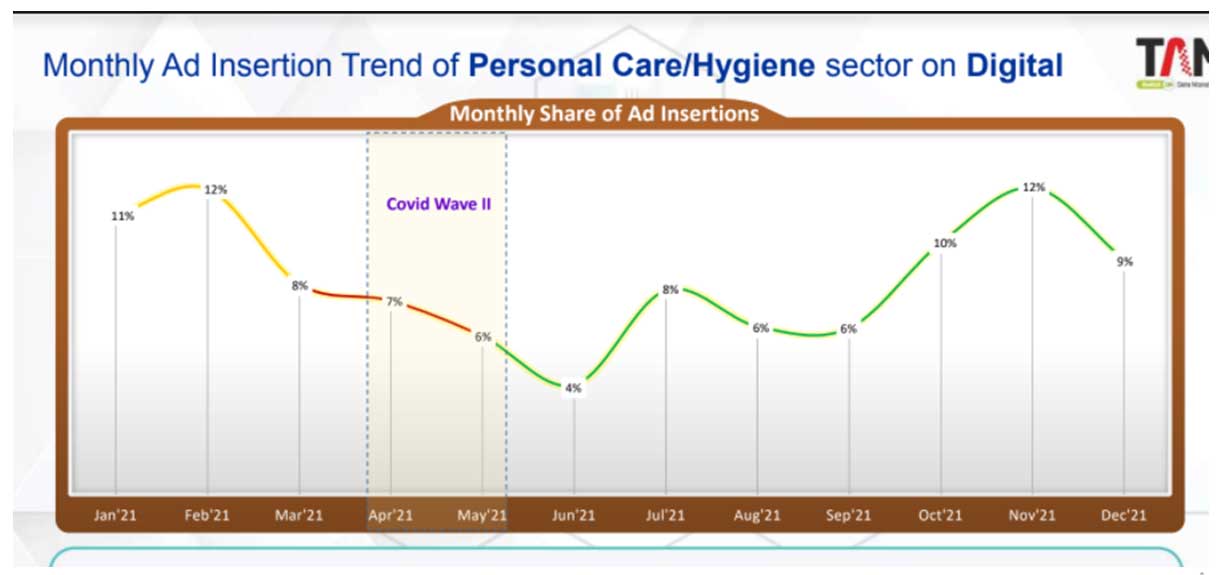

Ad insertions of the Personal Care/Hygiene sector on Digital increased by 38% in 2021 over 2019. Compared to the 2nd quarter of Y 2021, Q3 and Q4 witnessed 17% and 72% growth in ad insertions respectively. Following a downward trend in advertising from April to May of Y 2021, digital advertising for the sector recovered in the second half of the year, with Nov’21 having a similar share as Feb’21. On Digital medium, Range of Skin Care Products and Face Wash were top Personal Care/Hygiene categories with 18% & 14% share respectively.

The top 10 Advertisers accounted for more than 65% share of ad insertions in Y 2021 with L‘Oreal India leading the list. Top 10 Brands accounted for 37% share of ad insertion in 2021. Kama Ayurveda Range Of Products topped the list with a 6% share of the total ad insertions for the Personal Care/Hygiene sector.

Programmatic topped with 72% share of transaction method for Digital advertising of Personal Care/Hygiene sector in 2021. The Ad Network and Programmatic/Ad Network transaction methods had 22% and 4% share of Personal Care/Hygiene ad insertions on Digital.