WPP, the world’s largest advertising group, has reported a record pre-tax profit of £1.45 billion (US$1.1 billion) in the 12 months to December 31, an increase of 12 per cent in what the company says is “another record year”.

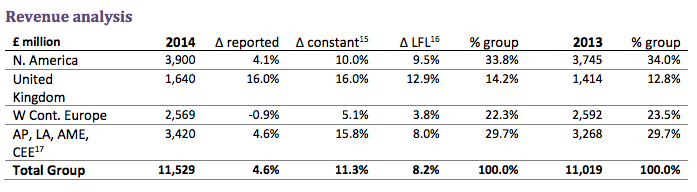

Revenue climbed 4.6 per cent to £11.5b (A$22.7b) with “like for like revenue growth in all regions”.

Asia Pacific, which is grouped in with Latin America and Central and Eastern Europe, Africa and the Middle East, now makes up 30 per cent of WPP’s revenue.

The strong performance came despite what it described as “strong currency headwinds”.

Growth in advertising and media investment management, branding and healthcare and specialist communications all showed “particularly strong growth”, the company said.

The 2015 year has started well, WPP added, with like-for-like revenue growth in January of 6.7 per cent.

Continuing to benefit from consolidation trends in the industry, billings were up 8.8 per cent to £46.2bn with advertising networks, Ogilvy & Mather and Grey standing out for their global performance alongside JWT in the UK and Asia Pacific.

In 2014, JWT Worldwide, Ogilvy & Mather, Y&R, Grey and United generated net new business billings of £898m. In the same year, GroupM, the Group’s media investment management company, which includes Mindshare, MEC, MediaCom, Maxus, GroupM Search and Xaxis, together generated net new business billings of £4.4bn.

As a whole the Group’s new business billings were slightly down on the record year in 2013, totalling £5.8bn.

Despite this Sorrell was cautious of client confidence, noting they may be “unwilling” to take risks due to the “flapping grey swans” that remain and the “black ones” that can always surprise.

“Although clients may be more confident than they were in September 2008 post-Lehman, with stronger balance sheets, sub-trend global GDP growth at around 3.0-3.5 per cent real and 5.0-5.5 per cent nominal, combined with these levels of uncertainty and strengthened corporate governance scrutiny, make them unwilling to take further risks,” Sorrell explained.

The “fragile” Eurozone, “litany of woes” in the Middle East – including ISIS – and “continuing fears” around the slowdown from 2013 in larger markets such as Brazil, Russia and China which “looks likely to continue into 2015” were all cited as ongoing areas of concern for clients.

However, in the UK Sorrell pointed to the “increasingly uncertain result of the General Election” which he said may “crimp” the strong economic recovery.

“If the Conservatives win outright (unlikely?) or lead a coalition or even form a minority government, there will be a Referendum on the EU in 2016 or 2017, which will cause significant uncertainty,” he said. “If Labour wins outright (also unlikely?), or leads a coalition (more likely with the SNP?) or forms a minority government, it will win partly on a “bashing business” manifesto, which may resonate at the ballot box.”

Sorrell continued: “All seems a case of ‘Morton’s Fork’. Either way, the United Kingdom economy may slip into the political cycle again, with austerity in the early part of the five year cycle to deal with the continuing Budget deficit and better times around the next election in five years’ time (or earlier?) – just like the current Chancellor has done so brilliantly for the Coalition, in their first term.”

He added that with no events like the Olympics, or FIFA World Cup or US Presidential Election to boost marketing investments, the outlook for 2015 looks similar to 2014.

“Clients remain focused on a strategy of adding capacity and brand building in both fast growth geographic markets and functional markets, like digital, and containing or reducing capacity, perhaps with brand building to maintain or increase market share, in the mature, slow growth markets,” he said.