In an era dominated by digital and television advertising, radio continues to hold its ground as a powerful medium for advertisers. The latest TAM AdEx Report on Radio Advertising in 2024 reveals remarkable growth trends, showcasing radio’s resilience and relevance in India’s media landscape. With an 80% increase in ad volumes per station since 2020, radio advertising has not only bounced back post-pandemic but has also positioned itself as a lucrative platform for brands across various sectors.

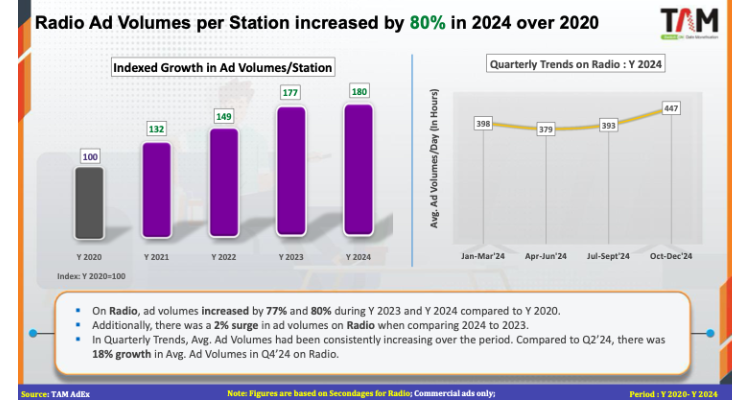

Ad Volume Growth: A Positive Trajectory

Radio advertising has witnessed a consistent rise in ad volumes over the years. The TAM AdEx data highlights an 80% growth in ad volumes per station from 2020 to 2024, a 2% increase in total radio ad volumes in 2024 compared to 2023, and an 18% jump in Q4 2024 over Q2 2024, indicating seasonal variations. These figures reinforce that radio remains an influential and preferred medium for advertisers looking to connect with diverse audiences.

Dominant Sectors in Radio Advertising

In 2024, Services dominated radio advertising, securing a 30% share of total ad volumes. The Auto sector, benefiting from a resurgence in vehicle sales, followed with an 11% share. The Services sector remains the undisputed leader, reflecting the broad range of services promoted via radio. The Auto sector saw significant investment in radio advertising, as car manufacturers aimed to boost sales. Retail brands continue to leverage radio for promotions, especially in Tier 2 and Tier 3 cities.

Top Advertising Categories

Properties/Real Estate emerged as the top advertising category, capturing 15% of total radio ad volumes. Cars and Jewellery retail outlets followed closely, benefiting from increasing consumer spending and aspirational buying trends.

Leading Advertisers and Brands

Among advertisers, Maruti Suzuki India emerged as the top radio advertiser of 2024, climbing from 3rd place in 2023. Meanwhile, LIC Housing Finance led among individual brands, reflecting the growing demand for home financing solutions.

Fastest Growing Categories

Over 185+ categories registered positive growth, with the Cars category leading the charge at 57% growth. Other high-growth categories included Retail Outlets (Jewellers) with 42% growth, Life Insurance with 45% growth, Mortgage Loans with 2.7x growth, and Toothpaste with 2.9x growth. These trends demonstrate that industries continue to recognize the effectiveness of radio advertising.

Geographic Trends in Radio Advertising

Geographically, Gujarat was the top advertising state (18% share), followed by Maharashtra (16%). Jaipur ranked as the leading city for radio ads, surpassing New Delhi, Nagpur, and Surat. The Top 10 cities contributed 62% of total radio ad volumes, highlighting the strong presence of radio in regional markets.

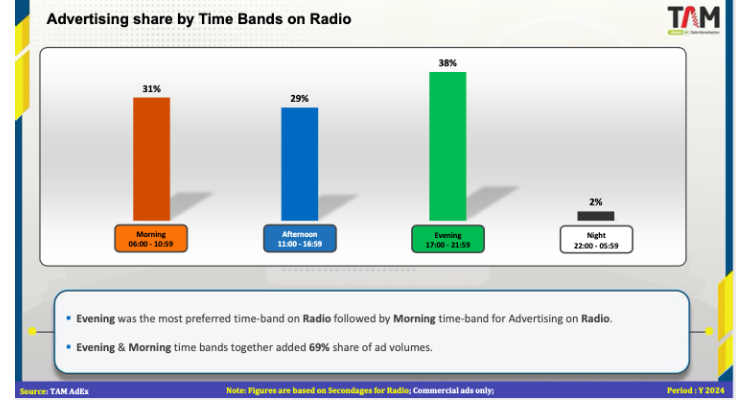

Preferred Time Slots for Advertisements

The Evening slot (17:00 – 21:59) remained the most preferred time, accounting for 38% of all ad volumes. The Morning slot (06:00 – 10:59) followed closely at 31%, emphasizing prime listening hours.

Ad Duration Trends

The 20-40 second ad format dominated radio advertising, accounting for 68% of all ad durations, while shorter ads under 20 seconds gained slight traction, increasing from 26% to 27%.

The TAM AdEx 2024 report reaffirms that radio advertising is thriving, proving its effectiveness for diverse industries. With growing ad volumes, dominant sectors like Services and Auto, and the rise of regional advertising, radio remains an indispensable part of India’s advertising ecosystem. As brands continue to navigate the evolving media landscape, radio’s unmatched reach, affordability, and engagement make it a strategic choice for advertisers looking to connect with audiences beyond digital screens.