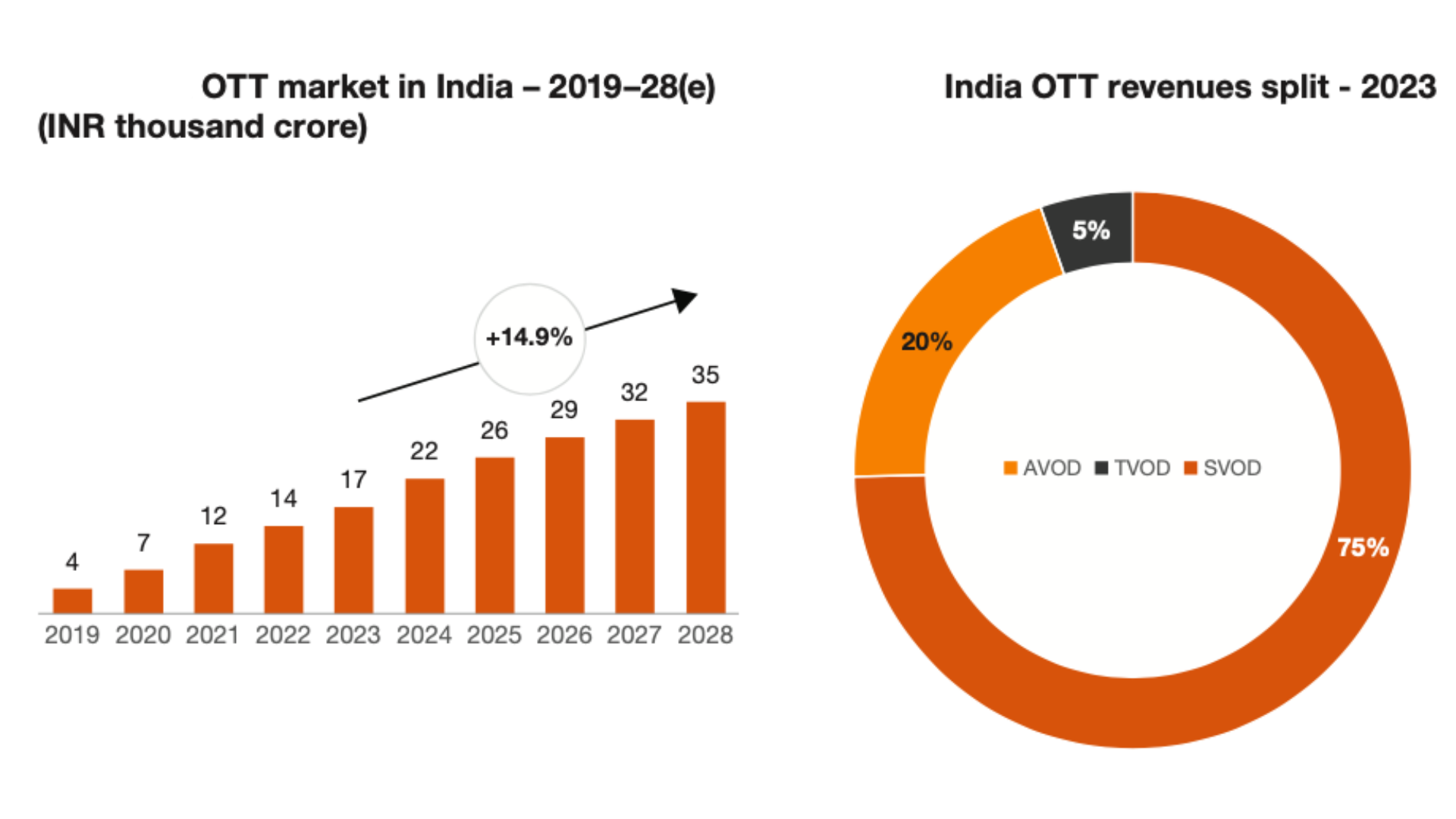

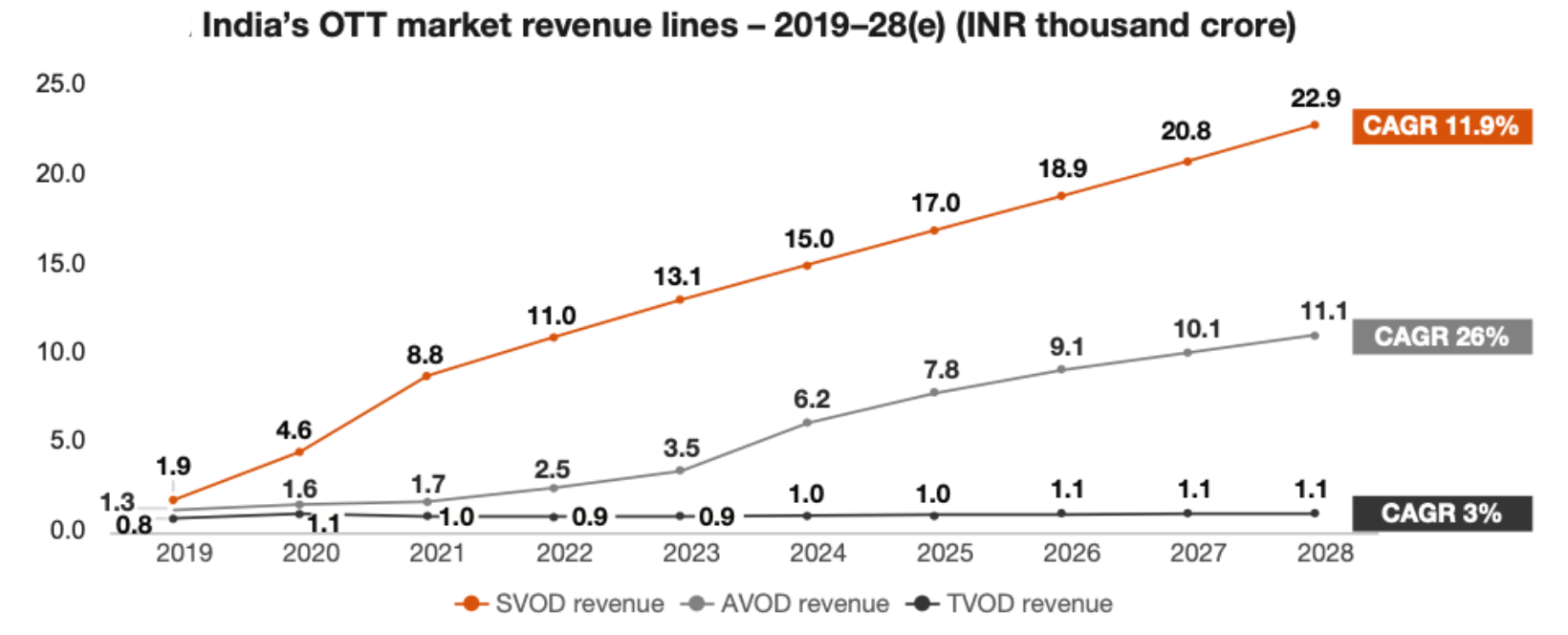

Mumbai: India’s OTT (over-the-top) market has seen a dramatic surge in revenues, quadrupling since 2019, with a market value of INR 17,496 crore in 2023. The market is expected to double by 2028, reaching INR 35,062 crore, driven by a compounded annual growth rate (CAGR) of 14.9%. Subscription video-on-demand (SVOD) services will dominate, accounting for 65% of the market share by 2028, while advertising-based video-on-demand (AVOD) is projected to grow at 26.0% CAGR, reaching INR 11,097 crore by 2028.

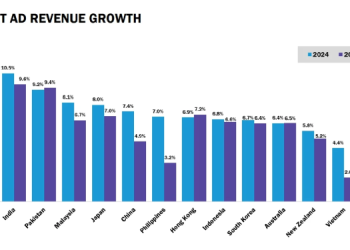

India is set to become the world’s fastest-growing OTT market in the next five years. However, after a pandemic-driven subscriber boom, the focus has shifted to fiscal discipline, consolidation, and partnerships as platforms navigate economic uncertainties. Consumers are increasingly reevaluating OTT subscriptions, and platforms are adapting by introducing lower-cost subscription plans supported by ads and cracking down on password sharing.

In 2023, India had 57 OTT platforms and 10.1 crore video OTT subscriptions, which are growing at 10.8% CAGR and expected to reach 16.9 crore by 2028. Regional content is gaining traction, with over 50% of OTT content in regional languages. Despite this growth, India has one of the lowest annual revenue per subscription figures globally at INR 1,290, making partnerships for content and distribution or diversification of revenue streams crucial for OTT platforms.

The ongoing consolidation in the market is prompting smaller players to merge or exit due to high content costs and monetisation struggles. Larger platforms are leveraging this opportunity to strengthen their positions. PwC’s Global Entertainment and Media Outlook notes that this consolidation is attracting significant investment, promising higher returns and positioning India as a global leader in the OTT sector.

Additionally, content aggregation is on the rise, with larger platforms partnering with smaller or regional OTT services to diversify their offerings. OTT aggregators, offering single sign-on access and unified billing, are also enhancing the user experience.

Key Growth Opportunities for OTT Platforms:

- Advertising-Supported Models: With the prevalence of lite and free streaming plans, advertising-funded models will continue to thrive. International streaming services are already offering low-cost mobile plans and free access to sports, providing a balanced mix of lower costs and accessible content to attract budget-conscious consumers.

- Gaming and Esports: The rapid growth of India’s animation, visual effects, gaming, and comics (AVGC) industry presents a major opportunity. With the rise of mobile gaming and esports, OTT platforms are collaborating with gamers and influencers to broadcast popular tournaments. This sector targets a tech-savvy, young audience and offers monetisation opportunities through ads, sponsorships, and microtransactions.

- Regional Content and Hyperlocal Storytelling: Regional content has become a significant driver of OTT consumption in India. With over 20 major languages and a diverse cultural landscape, platforms are increasingly focusing on localised content to cater to regional audiences. Regional OTT players, particularly in Tamil, Telugu, Marathi, and Bengali, are seeing strong demand, particularly from Non-Resident Indians (NRIs). This trend is leading platforms to produce content that resonates with local audiences, driving higher engagement and loyalty.

By tapping into these content categories, OTT platforms can cater to the needs of underserved regional markets, establish stronger connections with viewers, and differentiate themselves in India’s highly competitive OTT landscape.