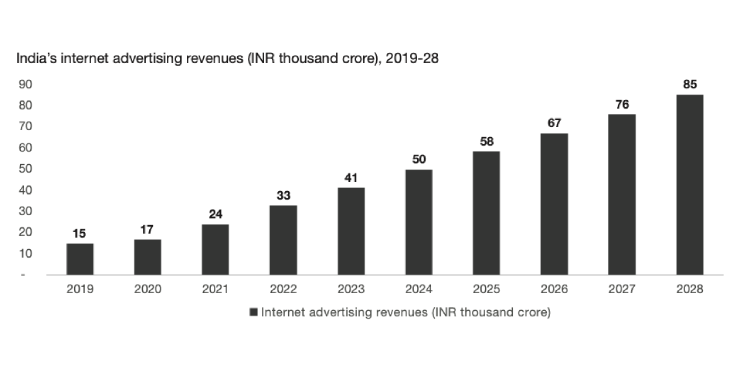

New Delhi: India’s digital advertising industry is set to witness exponential growth, with revenues projected to soar from INR 41,310 crore in 2023 to INR 85,231 crore by 2028, registering a CAGR of 15.6%, according to PwC’s latest report, India’s Digital Advertising – Navigating Growth in the Changing Media Landscape. This growth is complemented by broader expansion across the Indian Entertainment & Media (E&M) sector, as detailed in PwC India’s report, Global Entertainment & Media Outlook 2024–28: India Perspective.

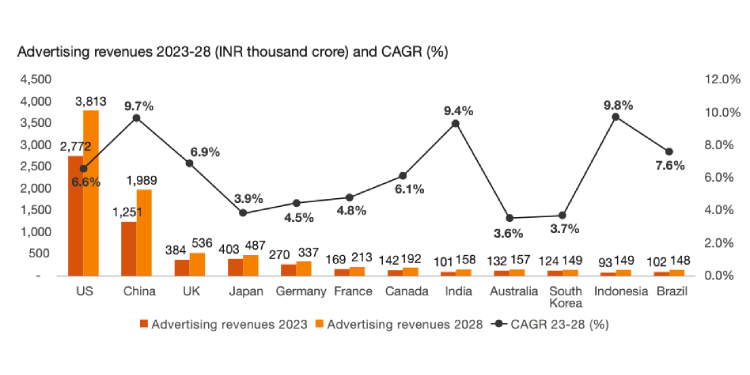

The Indian E&M industry is projected to grow at a CAGR of 8.3% to reach INR 3,65,000 crore (USD 19.2 billion) by 2028, significantly outpacing the global rate of 4.6%. This positions India as a key player in the global media landscape, currently ranked as the 9th largest E&M market.

Social Media and OTT Leading the Charge

Social media platforms and OTT services are major drivers of digital advertising growth. The OTT segment is projected to be the third-fastest-growing category in India’s E&M industry, with a CAGR of 14.9%, putting the country ahead by 2028.

In line with global trends, video remains the most engaging ad format, with OTT revenues increasing from INR 17,496 crore in 2023 to INR 35,062 crore by 2028. The Advertising Video on Demand (AVOD) model will continue to dominate, growing at a remarkable 26% CAGR.

Gaming and Esports: A Key Growth Engine

India’s gaming and esports market is booming, with revenues projected to grow at a CAGR of 19.2%, rising from INR 16,480 crore in 2023 to INR 39,583 crore by 2028. With the inclusion of real money gaming (as outlined in PwC’s India Gaming Report 2024), the combined gaming and esports revenues are expected to reach INR 66,000 crore (USD 8 billion) by 2028, at a CAGR of 14.5%.

Globally, video games and esports revenues will grow at a CAGR of 8.0%, underscoring India’s significant outperformance in this segment.

Regional and Vernacular Content Expansion

The demand for regional and vernacular content is reshaping India’s digital advertising strategies. Over 50% of digital consumption is now in regional languages, driven by the rising number of Tier II and Tier III internet users.

Infrastructure and OOH Growth

India’s out-of-home (OOH) advertising market witnessed massive growth of 12.9% in 2023, supported by infrastructure enhancements. It is expected to maintain steady growth at a CAGR of 7.6% through 2028.

Print and Cinema Resilience in India

India’s print advertising revenues defy global trends, with the market expected to grow at 3% CAGR despite a worldwide decline of -2.6%. By 2028, India will become the third-largest print market globally.

India’s cinema market is also expanding rapidly, with a 14.1% CAGR, highlighting its importance in the country’s overall media and entertainment sector.

Music and B2B Growth

India’s music industry is experiencing robust growth across live, recorded, and digital formats, with revenues rising from INR 2,416 crore in 2019 to INR 6,686 crore in 2023. By 2028, music revenues are projected to exceed INR 10,899 crore (USD 1.3 billion), growing at a CAGR of 10.3%.

India also leads the world in B2B revenue growth, with a CAGR of 5.6%, compared to the global average of 1.9%. This highlights India’s strength in business-driven media and marketing solutions.

Technological Innovations Transforming Advertising

Programmatic advertising continues to gain traction in India, leveraging AI and real-time algorithms to optimize ad placements. Generative AI (GenAI) is reshaping content creation, enabling hyper-personalized ad experiences, while AR and VR technologies are enhancing consumer engagement across sectors like retail and automotive.

Strategic Recommendations for Advertisers

The report advises advertisers to:

- Invest in localized and vernacular content to tap India’s diverse linguistic markets.

- Leverage first-party data to comply with privacy regulations and enhance personalization.

- Experiment with emerging technologies such as AR, VR, and AI to create impactful campaigns.

- Adopt an integrated omnichannel strategy across digital and traditional platforms to maximize reach.

India’s digital advertising landscape is set to transform dramatically, fueled by technological advancements, mobile-first audiences, and a rapidly expanding E&M industry. With sectors like gaming, OTT, and regional content leading the way, the market presents unparalleled opportunities for brands to innovate and grow.