Mumbai: The Indian tablet market (inclusive of detachable and slates) shipped 1.84 million units in 2Q 2024, up 128.8% year-over-year (YoY) according to new data from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker. Along with the fulfillment of the Uttar Pradesh education manifesto deal in 2Q24, abnormally low shipments in the commercial segment in 2Q23 also pertained to a high YoY growth rate of the India tablet market in 2Q24. While the slate tablet market grew by 178.1% YoY, the detachable tablet grew by 23.6% YoY.

In 2Q 2024, the consumer segment grew by 27.5% YoY due to high vendor sell-in and strong demand during e-tail summer sales in May. The commercial segment grew by 279.7% YoY on the back of 455.1% YoY growth in the education segment while the enterprise segment grew by 52.5% YoY.

“The consumer segment had a third consecutive quarter of YoY growth. There has been increased demand for tablets priced at US$200-US$300 as vendors are introducing products with good specifications in this relatively affordable price range. Discounts and cashbacks make the purchases more lucrative, leading to robust demand for consumer tablets, and this trend is expected to continue in the near future,” said Priyansh Tiwari, research analyst, Devices Research, IDC India and South Asia.

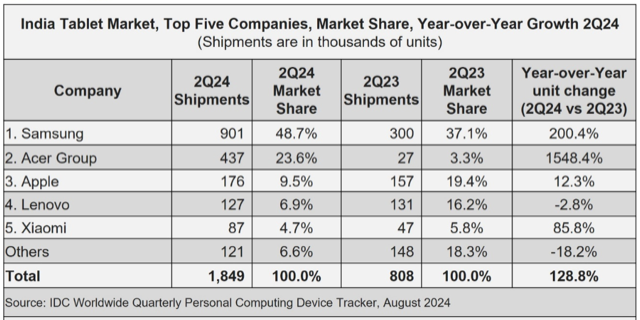

The Top Five Company Highlights: 2Q24

Samsung led the market with a share of 48.7% in 2Q24 as it topped the charts in both the commercial and consumer segments with shares of 54.1% and 38%, respectively. While an increased presence in public sector education projects helped Samsung reach strong numbers in the commercial segment, its heavy inventory push targeting online sales helped it in the consumer segment.

Acer Group was a distant second to Samsung, with a share of 23.6% in 2Q24. The vendor focused mainly on the commercial segment reaching 35.5% share on the back of a few key education projects.

Apple stood third with a share of 9.5%. It did well in both the commercial and consumer segments, growing by 9.8%YoY and 13.2% YoY, respectively. Its growth in the consumer segment was driven by new product launches and subsequent price cuts across the older lineup.

Lenovo stood fourth with a share of 6.9% and a decline of 2.8% YoY in 2Q24. However, its consumer segment showed a robust growth of 46.4% YoY. Lenovo currently has tablets targetted at media consumption and light productivity with features such as high-quality speakers and high-resolution displays.

Xiaomi held fifth position with a 4.7% share and a YoY growth of 85.8%. It stood third in the consumer segment ahead of Lenovo, with a share of 14.1%. The vendor focused on both offline and online channel stocking and targetted the entry-level market.

Commenting on the outlook, Bharath Shenoy, Research Manager, Devices Research, IDC India and South Asia, said, “In the first half of the year, while the commercial segment was robust driven by key education deals and good momentum in the SMB segment, heavy inventory push led to a strong consumer segment. With more education deals in the pipeline and high consumer demand anticipated during online sales in 2H24, IDC anticipates the Tablets market in India to grow by high double digits in 2024”