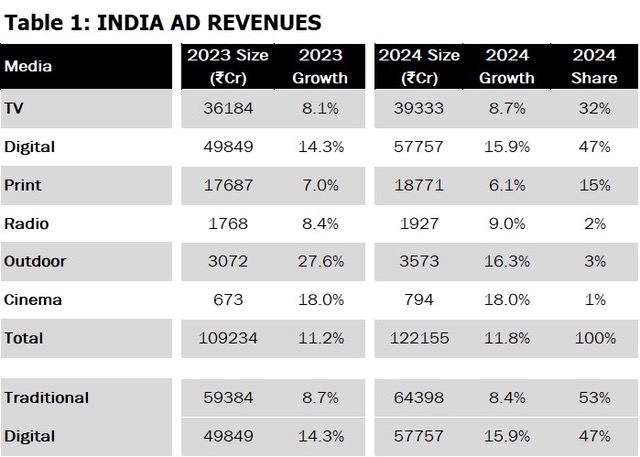

Mumbai: The Indian advertising industry is projected to grow to ₹1.2 Trillion (US$14.6 billion) in 2024, showing a 50% increase from pre-pandemic levels, with forecasts indicating an 11.8% growth in advertising revenue for that year, slightly up from 2023. However, print, radio, and cinema sectors remain below 2019 levels.

Digital media is set to grow by over 15.9%, driven by India’s focus on enhancing digital infrastructure for affordable internet access. It is expected to constitute 50% of total revenues by 2026, surpassing traditional media. Television remains the dominant media, with social media overtaking search. Traditional media is also growing steadily, with linear formats projected to increase by 8.4% in 2024. India’s GDP growth is robust at 6.8% in 2024 and expected to maintain this trend at 6.5% in 2025. Magna forecasts a 10% growth in 2025, aiming for ₹1.7 trillion (US$21.1 billion) by 2028, positioning India among the top 10 global markets by 2025.

Venkatesh S, SVP, Director – Intelligence Practice, MAGNA India, said: “The Indian advertising market is set to expand by 11.8% in 2024, reaching ₹1.2 trillion, driven by a robust 15.9% growth in digital media. Traditional media formats are also growing, enduring the relevance of Print, OOH and Radio in addition to Television. The government’s emphasis on digital public infrastructure is propelling digital ad spend to nearly half of total revenues by 2026. Our forecast highlights social media’s significant rise, overtaking search as the second largest media format after television.”

Growth in India is projected to remain strong at 6.8 percent in 2024 and 6.5 percent in 2025, with the robustness reflecting, continuing strength in domestic demand and a rising working-age population according to IMF. With the per capita income increasing multifold, consumer spending outlook remains positive. India has been evolving as one of the world’s most dynamic consumption environments and is expected to maintain steady economic growth. The fastest growing economy is projected to surpass China’s growth rate by over 2% points. India, by 2028 is expected to become the 3rd largest economy leaving behind Germany and Japan.

Inflation projected to decline from +5.4% in 2023 to +4.2% in 2024 and long-term inflation estimates remaining anchored, monetary policy stance of central bank is expected to support growth.

In 2024, total advertising revenue from ₹1.1 Trillion (US$13.1 billion) will touch ₹1.2 Trillion (US$14.6 billion). Digital formats or new media contribute over 60% to the incremental revenue. Digital is estimated to grow +15.9% and linear growth will be at +8.4%. In a normal year, H1 contribution is generally less than H2, however general elections scheduled from March to May followed by ICC T20 Cricket World Cup in June-July will boost H1 growth (+11.8%) equal to second half of the year (+11.9%). Both general elections and live sports will lead to a significant growth in adex across both Digital and Linear media.

In 2023, listed companies’ average income and profits have grown in double digits. This is encouraging as private investment in capacity building and marketing activities will increase. Auto sector demonstrated significant growth across all segments in 2023, this is expected to boost marketing and advertising budgets in 2024. CPG continues to rise as more people start to move up the economic ladder and the benefits of economic progress become accessible to the public. The urban segment is the largest contributor, however, in the last few years, the growth has come at a faster pace in rural India. With normal monsoons expected, rural demand will pick up and this bodes well for the sector. Retail sector is experiencing exponential growth across pop strata. Sizeable middle class, changing demographic profile, increasing disposable income, and urbanization are some of the factors driving organized retail. E-commerce has transformed the way business is done and has enabled newer segments like D2C. Rapid expansion into Tier-2 and Tier-3 cities will aide sectoral growth.

CPG, Auto, Retail, Government & Political advertising, and Finance are expected to be the most dominant sectors contributing to India’s adex growth in 2024, followed by Pharma, Education, Real Estate, Media & Entertainment and Building Materials making up the top ten sectors.

Consumption trends continue to favour digital media. The liberal and reformist policies of the Government have been instrumental in developing digital public goods. All digital formats are growing at a healthy pace specifically social, video & audio streaming and online gaming. With the democratisation of content consumption, Ad-supported video on demand platforms have transformed viewership by providing easy and affordable access to live sporting events. As of 2023, wireless base stood at 1.15 billion subscribers and 95% of the data consumed have come from 4G connections. Rise in mobile penetration and decline in data costs is expected to add to the internet base. In 2024, digital ad spends will grow +15.9% to top ₹580 billion (US$6.9 billion). Social & Search with 34% and 33% shares drive the digital pie followed by Display & Video at 19% and 14%. In terms of growth, Social (+21.9%) and Video (+19.1%) are the fastest growing formats.

Television reaches 778 million viewers (759 million 2022) and overall time spent has increased to 230 mins (218 mins 2022). Close to a third of homes do not have television and linear TV has potential to grow. Probable launch of Direct-to-mobile will increase the reach of Television, trials for this home-grown technology would soon be planned across cities. Overall Television ad revenues in 2024 will grow +8.7% to reach an estimated ₹393 billion (US$4.7 billion). Elections will drive advertising growth for TV, specifically for news and T20 World Cup will further boost revenues.

Print media has reinforced itself as the most trustworthy source of information. The circulation in 2022-23 has gone from 391mn to 402mn copies and the largest local media is still relevant providing the geographical spread and audience size. Advertisers’ belief in this consumption story led to a handsome growth of +7.0% last year. In 2024, ad sales revenue will grow +6.1% to ₹188 billion (US$2.2 billion) but it is still 11% below pre-covid levels. Digital print revenue is estimated to be ₹13 billion (US$159 million). Drop in social media referral traffic as Meta dissociated itself with news is hurting publishers. Print advertising growth will come on the back of national elections and local elections in 8 states.

Radio is still ailing from the slowdown caused during covid, recovering only 86% of the 2019 levels. While there is enormous increase in volumes, ad rates have remained soft. The long-standing challenge of audience measurement capabilities is hurting the medium. Increase in Government ad rates will help growth considering this is an election year. Government recommendations on News broadcast, reduction in license fee and mandatory FM tuner on mobiles will bring windfall to the industry. The revenue for 2024 is estimated to be ₹19 billion (US$231 million) reflecting a growth of +9.0% over previous year.

OOH media is on a growth trajectory and is expected to cross 2019 levels this year. All 3 forms, Traditional, transit and DOOH is showing incremental revenues. Government push on infrastructure and urbanization will boost OOH inventory especially premium formats. In 2024 OOH revenue will increase +16% to reach ₹34 billion (US$402 million). DOOH share to total OOH is at 6%, growing at a CAGR of +33%, by 2028 share of DOOH will touch 11%. Roadstar, a unified audience measurement tool for the OOH industry developed by the national body for Outdoor Media, is likely to see light, this should help demonstrate effectiveness of the medium and facilitating growth. In-cinema advertising was the biggest casualty of covid which has recovered to the extent of 72%. Successive come back from all languages with box office hits in 2023 and good inflow of content in 2024 will drive both demand from advertisers as well as surge in audience foot falls. In 2024, the growth is estimated to be +19% to reach ₹8 billion (US$95 million).

Hema Malik, Chief Investment Officer, IPG Mediabrands India, commented: “India’s advertising industry is gearing up for an impressive 2024, with significant growth driven by pivotal events like the general elections and ICC T20 World Cup. We expect substantial ad spend increases across sectors such as auto, retail, and CPG. The anticipated 11.8% growth in ad revenues highlights the market’s resilience and potential. With rural demand expected to rise due to favorable monsoons and digital ad spend projected to reach ₹580 billion, the convergence of traditional and digital media presents unique opportunities for advertisers.”