Accenture has launched the Media Thrive Index to evaluate how reinvention strategies impact media and entertainment firms’ financial and strategic success in a tough industry.

The Media Thrive Index responds to Accenture’s global entertainment study, surveying 6,000 consumers in 10 countries, including India, on media consumption. Findings reveal challenges for traditional media companies that require robust strategies for economic and strategic recovery.

Neeraj Sharma, MD and Lead for Accenture’s Media industry in Growth Markets said, “While the media industry is growing, the industry players are not. This essentially means that the value is shifting elsewhere. It is amply clear that incremental actions taken with a survivalist mentality will not help media companies thrive in the future. For media companies, the need of the hour is to place big bets, go where consumers want to be while exploring new avenues of growth, redefining new roles in the entertainment value chain, and tapping new sources of revenue.”

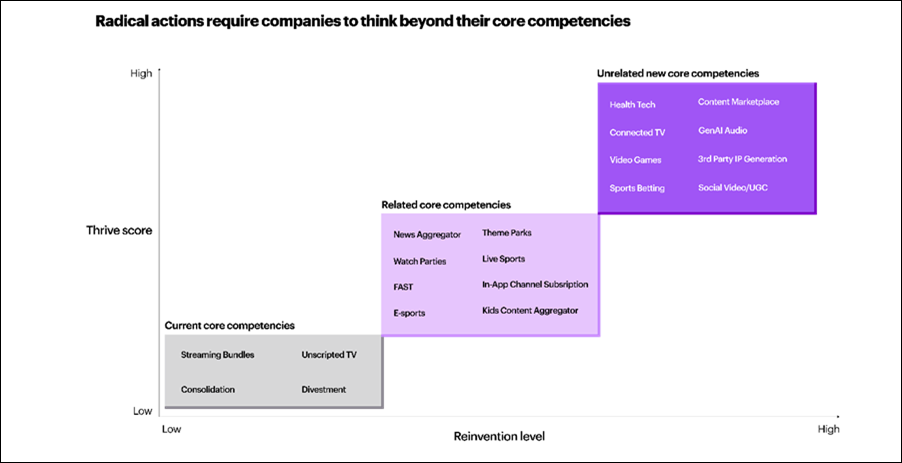

The Media Thrive Index examined 50 strategic choices for reinvention sourced from company initiatives and Accenture’s analysis. Most options are minor tweaks, preserving the status quo. Only radical changes can help legacy media firms achieve financial stability and lasting success.

Caption: Accenture’s Media Thrive Index measures the extent to which a reinvention strategy positions a company to succeed by assessing its likely financial, growth, and strategic impact.

Key findings from the study highlight some of the challenges facing media organizations:

- Tired of Browsing – More than 35% of consumers in India say they struggle to navigate between different entertainment services, apps and devices while 72% say recommended content does not match their interests.

- Serial Churners – Nearly 65% of consumers in India are cancelling and resubscribing to services based on the availability of desirable content. In 2023, 63% of consumers in India cancelled more subscriptions than the previous year.

- Shifting Preferences – Two-thirds of consumers in India consider user-generated content to be as entertaining as traditional forms of media. In all scenarios presented to consumers, such as “when I want something funny” or “when I want to relax,” social media and social video platforms were consistently picked over streaming video services as the media of choice.

Opportunities exist for media organizations to expand offerings by venturing into aggregation platforms and lifestyle bundles. In India, 89% of consumers would prefer using a single app for all digital services, including media and non-media. Accenture forecasts lifestyle bundles to hit $3.5 trillion by 2030, with tech brands leading over traditional media.

For additional insights and findings on the Media Thrive Index, click here for the “Reinvent for Growth” report.

Research Methodology

Accenture conducted global research on consumers’ online entertainment experiences, surveying 6,000 people aged 18+ in 10 countries. The study, done with Oxford Economics, analyzed shifting media habits and advised brands on adapting strategies for success.