Mumbai: TV ad volumes witnessed growth of 36% for the FMCG sector in 2023 over 2019. Compared to the first quarter of 2023, ad volumes of the fourth quarter increased by 2% for the FMCG sector.

Tam Media Research has put out a report called ‘Tam AdEx : 2023 Cross Media Advertising Recap – FMCG Sector’. Four out of Top 10 categories constitutes Food And Beverages brands. On TV, Rubs and Balms was a new category that entered the top 10 list and secured 10th position in 2023 over 2022. Ad space on the print medium increased by 3% in 2022 for the FMCG sector compared to Y 2019. The fourth quarter of 2023 witnessed growth in ad space by 30% over the first quarter.

Ad space on the Print medium increased by 3% in 2022 for the FMCG sector compared to 2019. The fourth quarter of 2023 witnessed growth in ad space by 30% over the first quarter. 52% of the FMCG ads were in Hindi Publication Language during 2023. North Zone was the leading territory for FMCG advertising with New Delhi being its leading city in 2023.

Indexed ad volumes of radio, increased by 62% in 2023 compared to 2019 for the FMCG sector. Among quarterly trends of 2023, the fourth quarter witnessed growth of 27% compared to the first quarter for FMCG advertising. Ad impressions on digital medium increased by almost seven Times during 2023 over 2019 for the FMCG sector. The second quarter of 2023 observed growth of 29% in ad impressions over first quarter of 2023.

Gujarat was the leading state for FMCG advertising with 25% share of ad volumes, followed by Uttar Pradesh with 18% share. Among advertisers, Vishnu Packaging upheaved to first position in 2023 over 2022. Hear.Com was the leading brand from the FMCG sector with 4% share of ad impressions on Digital. Programmatic (85%) was the top transaction method for digital advertising of the FMCG sector in 2023.

Television: GEC was the most preferred channel genre by the FMCG players in 2023 with 37% share of ad volumes. The top two channel genres together contributed 62% share of ad volumes. Films is the most commonly used genre for promoting FMCG brands on Television. The top two programme genres i.e. Films and drama soap together added more than 40% share of ad volumes on TV. Prime Time garnered highest advertising on TV followed by Afternoon and Morning time-bands. Prime Time, Afternoon and Morning time bands together accounted for 72% share of ad volumes. Advertisers of FMCG sector majorly preferred 20 – 40 seconds ad size on TV. 20-40 seconds and <20 seconds ads together covered more than 90% of share in 2023.

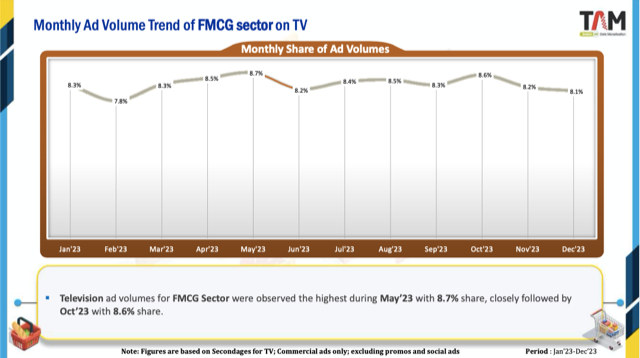

Ad Volumes for the FMCG sector witnessed growth of 36% in 2023 compared to Y 2019. Whereas, when the company compared 2023 with 2022, there was growth of only 3%. Also, ad volumes of 2020, 2021 and 2022 increased by 9%, 33% and 32% respectively over 2019. Among quarterly trends of 2023, fourth quarter observed growth of 2% over 1st Quarter. Additionally, ad volumes of both second and third quarters increased by 4% and 3% respectively over the first quarter. Television ad volumes for FMCG sector were observed the highest during May 2023 with 8.7% share, closely followed by Oct’23 with 8.6% share.

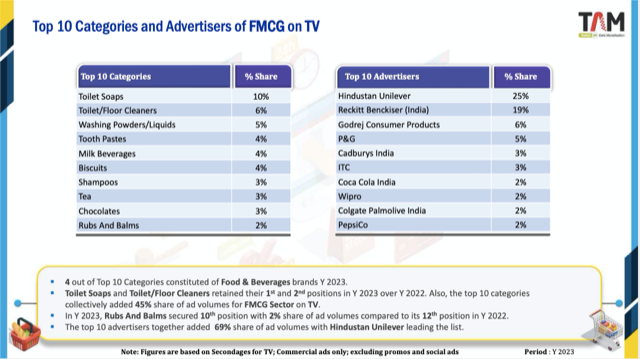

4 out of Top 10 Categories constituted of Food And Beverages brands Y 2023. Toilet Soaps and Toilet/Floor Cleaners retained their first and second positions in 2023 over 2022. Also, the top 10 categories collectively added 45% share of ad volumes for FMCG Sector on TV. In 2023, Rubs And Balms secured 10th position with 2% share of ad volumes compared to its 12th position in 2022. The top 10 advertisers together added 69% share of ad volumes with Hindustan Unilever leading the list.

Dettol Antiseptic Liquid was the leading brand from FMCG Sector in 2023 with 2% share of ad volumes. Out of the top 10 brands, 5 of them belonged to Reckitt Benckiser and 4 belonged to Hindustan Unilever. Together, the top 10 brands accounted for 14% share of ad volumes. During Y 2023, Santoor Sandal And Turmeric, Close Up Ever Fresh and Lifebuoy Toilet Soap entered the top 10 list compared to 2022.

Print: In Print, ad space witnessed growth only in Y 2021 of 3% compared to Y 2023 for the FMCG sector. Whereas, 2020, 2022 and 2023 observed de-growth of 14%, 2% and 13% respectively over 2019. Compared to 2022, ad space for FMCG was decreased by 10% in 2023. Indexed Growth in ad space was observed the highest i.e. 30% in Oct-Dec 2023 compared to Jan-Mar 2023. Additionally, there was an increase in ad space of Apr-Jun’23 and Jul-Sept 2023 of 6% and 12% respectively compared to Jan-Mar 2023.

The FMCG sector had the highest share of ad space of 10% in Oct 23 in Print, whereas, Feb 23 had the lowest share of ad space i.e. 6%. In categories, Range of OTC Products ascended to first position with 7% share of ad space in 2023 over 2022. During 2023, Spices and Tooth Pastes categories entered the top 10 list and secured fifth and ninth positions respectively compared to 2022. The top 10 categories had a collective share of 44% for FMCG Sector. Among the top advertisers, SBS Biotech secured first position with 13% share of ad space.

In 2023, Munimjee & Sons and K P Pan Foods were the only new entrants present in the top 10 list over 2022. Also, the top 10 advertisers added 35% share of ad space for the FMCG sector.

In 2023, Dr Ortho Oil ascended to first position with 3% share of ad space compared to 2022. Also, Patanjali Range of Products descended to sixth position compared to its first position in Y 2022. The top 10 brands from FMCG Sector together accounted for 15% share of ad space during Y 2023. During 2023, there were five new entrants in the brand list for FMCG Sector compared to Y 2022. Also, out of the top 10 brands present in Y 2023, five of them belonged to SBS Biotech.

Hindi was the top Publication Language with 52% share of ad space in Y 2023. Together, the top 5 Publication Languages added 86% share of ad space. General Interest publication genre made a clean sweep with 98% of sector’s ad volume. North Zone topped with 38% share of FMCG advertising in Print in Y 2023. Mumbai and New Delhi were top 2 cities in Pan India for FMCG advertising in print. Sales Promotion for ‘FMCG’ sector accounted for 21% of ad space share in Print medium. Among Sales Promotions, Volume Promotion occupied 37% share of the pie followed by Discount Promotion with 22% share in 2023.

Radio: Advertising for FMCG was preferred in evening followed by morning time-band on radio. 68% share of the FMCG ad volumes were in evening and morning time-bands in 2023.

Indexed ad volumes observed a significant surge of 62% for FMCG Sector during 2023 compared to 2019 on Radio. Also, there was growth in ad volumes of 18% in Y 2023, when compared to 2022. 2021 and 2022 witnessed growth in ad volumes for the FMCG sector of 29% and 37% respectively compared to Y 2019. Whereas, ad volumes for the FMCG sector on radio had de-growth of 9% in Y 2020 over Y 2019.

Compared to Jan-Mar 2023, Oct-Dec 2023 had the highest growth of 27% in the Quarterly Trends of Y 2023. Additionally, Q2 and Q3 of 2023 observed growth of 12% and 20% respectively over Q’1 of 2023. Ad volumes on radio were observed the highest in November 2023 with 10% share for FMCG Sector. Whereas, January 2023 had the lowest share of ad volumes of 6.5%.

The top 10 categories from FMCG Sector collectively added 59% share of ad volumes with Pan Masala leading the list. During 2023, there were four categories that entered the top 10 list compared to 2022. Among Advertisers from FMCG Sector, Vishnu Packaging ascended to first position with 10% share of ad space in Y2023 over 2022. Also, the top 10 advertisers together covered 40% share of ad volumes. Out of the top 10 advertisers present in Y 2023, 4 of them were new entrants compared to Y 2022.

On radio, Vimal Pan Masala upheaved to first position with 10% share of ad volumes compared to its 3rd position in 2023 over 2022. The top 10 brands present in Y 2023 together accounted for 28% share of ad volumes. During 2023, there were 3 exclusive brands present among the Top 10. For FMCG Sector, Gujarat maintained its first position with 25% share on radio. The top five\ states contributed 72% share of ad volumes for the FMCG sector.

Digital: The digital medium observed a surge in ad impressions for the FMCG sector in 2022 of almost nine times compared to 2019. Also, compared to 2022, there was de-growth in ad impressions of 23% in 2023. Compared to 2019, there was significant growth during Y 2021 and Y 2023 i.e. 4 Times and 7 Times respectively for the FMCG sector.

While analysing the quarterly trends, a growth was seen in ad impressions in Q2 and Q4 of Y 2023 by 29% and 10% respectively over Q1 of 2023. Whereas, ad impressions in Jul-Sept 2023 were decreased by 6% compared to Jan-Mar 2023. FMCG sector ad impressions were highest during November 2023 with 11% share on the digital medium and the lowest was observed in February 2023 with 6.5% share.

In categories, Corporate-Pharma/Healthcare entered the top 10 list and secured first position during Y 2023 over Y 2022, whereas Chocolates descended to second position in Y 2023 compared to its first position in 2022. The top 10 categories on Digital medium had a combined share of 41% in 2023. L Oreal India retained its first position in FMCG advertising with the highest share of 7% in 2023 over 2022. Among the top 10 advertisers on digital medium, there were three new entrants for the FMCG sector during 2023 compared to Y 2022. Also, there was a collective share of 43% for the top 10 advertisers on Digital medium.

The top 10 brands accounted 18% share of ad impressions in Y 2023 for FMCG advertising. Apart from Hear.com and Maaza, all the brands present in the top 10 list were new entrants during 2023 over 2022. Programmatic (85%) was the top transaction method for Digital advertising of FMCG sector in 2023. Programmatic and Ad Network transaction methods together captured 93% share of FMCG ad impressions on digital.