Mumbai: India launched its first 5G network in October 2022, marking one of the most rapid nationwide 5G network deployments in the world. Moreover, India’s 5G network ranks among the top-performing networks globally. But while consumer sentiment towards 5G is positive it is declining. Ookla has analysed India’s 5G performance and evaluate whether the user experience has improved since the launch of 5G.

Key Takeaways:

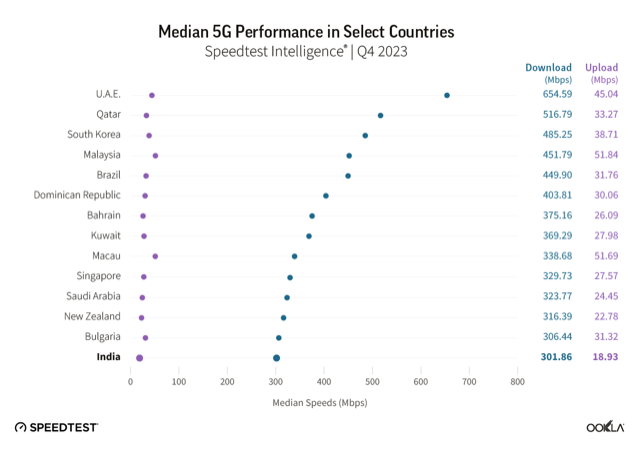

India ranked 14th globally in 5G median download speeds with 301.86 Mbps based on Q4 2023 data. Thanks to Reliance Jio and Bharti Airtel’s large-scale and swift deployment across the nation, India reached the top 15 markets with the fastest reported 5G median download speeds globally.

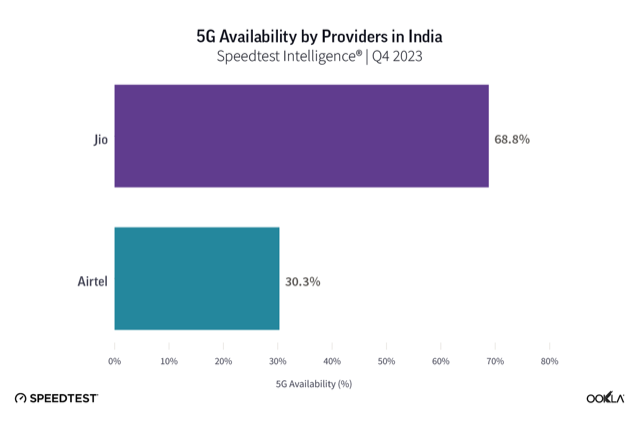

India’s country-wide 5G Availability increased throughout in 2023. 5G Availability improved from 28.1% in Q1 to 52.0% in Q4 2023, representing a 23.9 percentage point increase within a year. Reliance Jio’s 5G availability rate during Q4 2023 was 68.8%, 38.5 percentage points higher than Airtel’s 30.4%.

India’s country-wide 5G Availability increased throughout in 2023. 5G Availability improved from 28.1% in Q1 to 52.0% in Q4 2023, representing a 23.9 percentage point increase within a year. Reliance Jio’s 5G availability rate during Q4 2023 was 68.8%, 38.5 percentage points higher than Airtel’s 30.4%.

India’s 5G network offers a superior experience in video streaming and mobile gaming compared to the existing 4G-LTE. Reliance Jio and Airtel’s 5G networks have improved video start times and reduced buffering compared to 4G LTE, clocking 5G video start times of 1.14 seconds and 1.29 seconds, respectively. In contrast, Reliance Jio’s 4G LTE video start time was 1.99 seconds and 1.73 seconds for Airtel. Mobile gamers also experienced improved median latency, with 77 ms and 92 ms for Reliance Jio and Airtel, respectively. 5G Net Promoter Scores (NPS) in India continue to surpass those of 4G LTE. Operators’ 5G NPS continue to score positively compared to 4G, driven by improved performance. Reliance Jio and Airtel scored positively in their 5G NPS in Q4 2023, with similar NPS of 7.4 and 7.5, respectively. Both operators showed higher NPS on 5G compared to 4G LTE, with Reliance Jio seeing an uplift of 41.2 points on 5G compared to Airtel’s 37.6. Rapid and large-scale deployment boosts India’s 5G performance ranking

The two largest operators in India, Reliance Jio and Bharti Airtel, have been the primary drivers of the 5G rollout in the country, making significant efforts to provide 5G coverage across the nation through rapid deployment. By the end of December 2023, India had more than four hundred thousand 5G base stations (BTSs) deployed nationwide, an increase of 7.7 times from January 2023, making it one of the fastest countries to roll out 5G globally. Ericsson forecasted that the number of 5G subscribers in India reached 130 million at the end of December 2023, compared to just over 10 million recorded at the close of 2022.

The large-scale and rapid deployment of the 5G network in India has been paying off by elevating India’s position in the list of countries providing the fastest 5G median download speed. Speedtest Intelligence® data shows that in Q4 2023, India was in the top 15 countries with the fastest 5G median download speeds globally, sitting in the 14th spot.

The data shows that in Q4 2023, India recorded a 5G median download speed of 301.86 Mbps, slightly below Bulgaria’s speed of 306.44 Mbps. The GCC countries of the United Arab Emirates and Qatar led the fastest 5G markets globally during the period, with speeds of 654.59 Mbps and 516.79 Mbps, respectively. South Korea was the fastest Asia Pacific country, coming in third overall with a speed of 485.25 Mbps.

The data shows that in Q4 2023, India recorded a 5G median download speed of 301.86 Mbps, slightly below Bulgaria’s speed of 306.44 Mbps. The GCC countries of the United Arab Emirates and Qatar led the fastest 5G markets globally during the period, with speeds of 654.59 Mbps and 516.79 Mbps, respectively. South Korea was the fastest Asia Pacific country, coming in third overall with a speed of 485.25 Mbps.

Median 5G download speed is 18 times that of 4G: India is a “mobile-first” market, with its mobile users consuming the highest data amount per smartphone globally. The average data traffic per smartphone in India is expected to increase further from 31 GB per month in 2023 to around 75 GB per month by 2029. Currently, 4G is the dominant mobile technology driving the demand for data. As more consumers adopt 5G, the preferred technology will gradually shift.

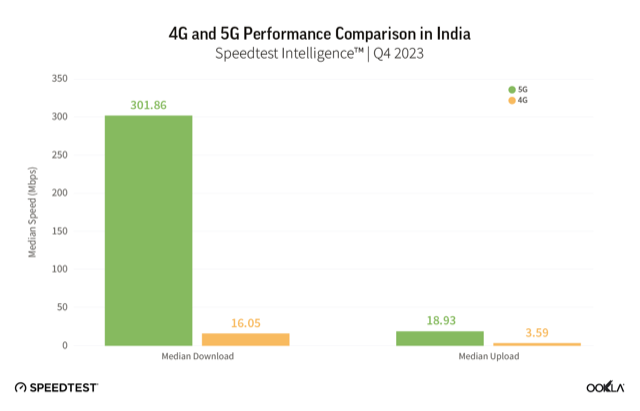

While the current 4G network in India may serve the daily connectivity needs of most mobile users, 5G technology offers a considerable performance uplift that can improve the user experience. When we compare 5G and 4G performance in India for Q4 2023, the 5G median download speed of 301.86 Mbps was 18 times faster than the 4G median download speed of 16.05 Mbps. Similarly, the 5G median upload speed (16.05 Mbps) was 5 times faster than 4G’s upload speed of 3.59 Mbps during the same period.

While median 5G speed is a valuable measure to gauge the midpoint of the user experience on 5G networks, it does not provide a complete picture of the actual improvement over 4G. To further demonstrate the performance gap between 4G and 5G, we compared 4G median download speeds against the lower 10% of 5G speeds.

Between Q4 2022 and Q4 2023, Speedtest Intelligence data revealed that users experiencing “slower” 5G speeds (i.e., speeds that fall in the lower 10% of 5G download speed samples) consistently had better speeds than the median download speed of 4G. 5G download speeds in the 10th percentile were more than twice that of the reported 4G median download speeds. In Q4 2023, the median download speed for 4G users was 16.05 Mbps, while the lower 10% of 5G users experienced speeds that were 2.4 times faster, at 38.21 Mbps or slower. 4G users migrating to 5G will notice the difference in performance, especially as they start to consume more data-intensive mobile applications and content.

Between Q4 2022 and Q4 2023, Speedtest Intelligence data revealed that users experiencing “slower” 5G speeds (i.e., speeds that fall in the lower 10% of 5G download speed samples) consistently had better speeds than the median download speed of 4G. 5G download speeds in the 10th percentile were more than twice that of the reported 4G median download speeds. In Q4 2023, the median download speed for 4G users was 16.05 Mbps, while the lower 10% of 5G users experienced speeds that were 2.4 times faster, at 38.21 Mbps or slower. 4G users migrating to 5G will notice the difference in performance, especially as they start to consume more data-intensive mobile applications and content.

5G Availability is rising, with Reliance Jio leading the way: In its previous report, it discussed the strategies of Reliance Jio and Bharti Airtel in expanding their 5G networks across India. Both operators have invested heavily in the rollout to make their networks available nationwide. Reliance Jio, the largest telecom operator in India, has implemented a 5G Standalone (5G SA) network for its 5G network from the beginning. On the other hand, Bharti Airtel has chosen to use a Non-Standalone (NSA) architecture for its 5G rollout at launch. For now, Airtel plans to employ 5G SA for fixed wireless access (FWA) services as traffic increases and eventually shift to a full 5G SA network in the long term.

Ookla’s 5G Availability data from Speedtest Intelligence represents the percentage of 5G-active devices that spend the majority of their time connected to 5G networks. 5G Availability in India showed improvement throughout 2023, starting at 28.1% in Q1 2023 and rising to 52.0% in Q4 2023, representing a 23.9 percentage point increase within a year.

One of the main reasons for the increase in 5G Availability in India is the significant growth in 5G-capable smartphones. According to Counterpoint Research, India’s 5G smartphone shipment share crossed 52% in 2023, growing 66% year-on-year. The introduction of more affordable 5G-capable devices in the market has helped boost 5G adoption in the country. Canalys reported that in Q4 2023, devices in the US$100 to US$199 segment witnessed a growth of 168% in the country.

Using Speedtest Intelligence, Ookla compared 5G Availability between these two operators during Q4 2023. Reliance Jio had the highest 5G Availability among the two at 68.8% during that period, ahead of Airtel, which reported 5G Availability of 30.3%. By leveraging a combination of low-band (700 MHz) and mid-band (3.5 GHz) spectrum, along with its extensive fiber network, Reliance Jio can provide its subscribers with a balance between coverage and performance.

5G delivers improved video streaming experiences: While the operators are keen to grow their customer bases and prioritize migration toward higher-value post-paid subscribers, translating 5G performance gains into discernible improvements for the end-user experience is vital. Speedtest Intelligence Quality of experience (QoE) measurements provides insights into consumers’ real-life connectivity and quality of experience across various services like web browsing, video streaming, gaming, and video conferencing.

Network operators in India are actively working to enhance the value of consumer mobile subscriptions by focussing on video content delivery, just like other operators worldwide. The emergence of over-the-top (OTT) platforms has significantly changed the way Indian audiences watch videos, movies, and TV shows, thanks to the vast range of local content available. Ormax Media reported that India’s audience for OTT platforms is on a steady rise, reaching 481 million users in 2023, marking a 13.5% YoY increase from the previous year’s 424 million.

The video adaptive start time metric from Video Analytics in Speedtest Intelligence measures the time spent waiting for the video to start playing in the adaptive bitrate stage of the test, providing insight into consumers’ video streaming experience.

Based on Q4 2023 data, the results showed that Reliance Jio and Airtel’s 5G networks offered faster video start times for customers than their 4G LTE networks. Reliance Jio’s 5G network reported a quicker video start time of 1.14 seconds than Airtel’s 5G network, which was 1.99 seconds. Reliance Jio’s customers experienced a more noticeable decrease in video start time from 4G to 5G, with a reduction of 0.85 seconds. Airtel’s consumers showed a slightly smaller improvement, with a difference of 0.44 seconds from 4G to 5G.

Mobile gaming benefits from 5G lower latency: The Indian online gaming industry has grown significantly at a CAGR of 28% over the last three years, reaching Rs. 164 billion (US$1.9 billion) in 2023. India also boasts a substantial gaming community, with an estimated 425 million gamers in 2023, making it second only to China in terms of the world’s largest gaming community. Mobile gaming dominates India’s online gaming market, with 94% of the total gamer base actively engaging in mobile gaming experiences.

With such a large mobile gaming segment in India, 5G is expected to improve the gaming experience on mobile devices, further increasing its popularity. Boasting lower latency and improved throughput than previous mobile technologies, 5G allows for a better user experience, particularly for online gaming and cloud gaming services.

Game Latency is a measure of lag time to popular gaming server locations. Latency affects a gamer’s reaction time and is essential in games that require quick reaction time. Based on Ookla’s Q4 2023 data, Reliance Jio had a lower latency of 77 ms on 5G compared to Airtel’s 92 ms. Both operators experienced better latency on 5G compared to 4G LTE. Reliance Jio’s latency improved by 29% on 5G compared to 4G (109 ms), whereas Airtel’s users experienced around a 15% improvement on 5G than 4G (108 ms).

Consumer sentiment towards 5G is positive but declining: Network performance, availability, and quality are all factors that can impact a customer’s overall satisfaction with their service provider. Ookla measures Net Promoter Score (NPS), a gauge of customer satisfaction and loyalty. After completing a Speedtest, users are asked to rate the likelihood of recommending their service provider to friends or family on a 0-10 scale. These ratings are categorised into Detractors (score 0-6), Passives (score 7-8), and Promoters (score 9-10). NPS represents the percentage of Promoters minus the percent of Detractors displayed from -100 to 100. A score above 0 indicates that a provider’s audience is more loyal than not.

In its recent article, it had found that 5G users, on average, rated their network operator with NPS scores that were universally higher than those for 4G LTE users. The story is similar in India, where 5G NPS scores are on the positive end of the scale as opposed to scores for 4G. However, our data shows that, for all operators combined, 5G NPS in India has been decreasing quarterly. The difference in terms of uplift that 5G brings over 4G NPS score has decreased from 59.7 in Q4 2022 to 37.9 in Q4

While it can be difficult to pinpoint the reasons behind 5G NPS declines, network performance isn’t the only factor that plays a role. Other factors can include customer care, pricing, and quality of other services. It’s also important to remember that as 5G scales in many of these early launch markets, the profile of 5G users is also changing from predominantly urban-based users to more of a mix of urban, suburban, and rural users, which brings additional coverage and performance challenges for network operators.

When comparing the 5G NPS scores of the two 5G operators in India, Ookla’s Speedtest Intelligence data shows that in Q4 2023, NPS for 5G users for both operators were similar, at 7.4 for Reliance Jio and 7.5 for Airtel. Reliance Jio’s 5G service recorded the largest difference in NPS when comparing users on its 4G LTE network to those on 5G during that period, with an uplift of 41.2 basis points. Airtel saw an increase of 37.6 basis points in its NPS score when comparing its 4G LTE network to its 5G network. That said, it’s worth noting that 5G NPS tends to decline as the initial excitement of the latest technology wears off, mirroring other early 5G markets.

India has deployed its 5G network in record time, investing billions of dollars following its launch one and a half years ago. Additionally, the country is making significant progress in the adoption of the technology. While India rejoices in its rapid 5G deployment success, it is imperative that it continues to invest in new innovative services that are accessible to consumers to fulfill the promises and potential of 5G.

Both Reliance Jio and Airtel have introduced 5G Fixed Wireless Access (FWA) services, known as Jio AirFiber and Xstream AirFiber, respectively. These services are aimed at complementing their current 5G offerings as they explore new 5G use cases to monetize their investments. The operators are also looking to broaden their 5G service offerings to serve key enterprise verticals that demand highly reliable and low-latency communication.

Vodafone Idea, the third-largest service provider in India, plans to launch its 5G services by mid-2024. Additionally, India’s Department of Telecommunications (DoT) will hold another spectrum auction in May 2024, offering more 5G bands to the market, thereby augmenting the 5G services available in India. Until then, Ookla said that it will continue to closely monitor the progress of 5G in India and see how performance and user experience evolve in the market.