The winter update of IPG Mediabrands’ Magna’s ‘Global Ad Forecast’ notes that India is now consistently the fastest growing market and leads the ad spend growth globally. India is forecast to climb to eighth position by 2028.

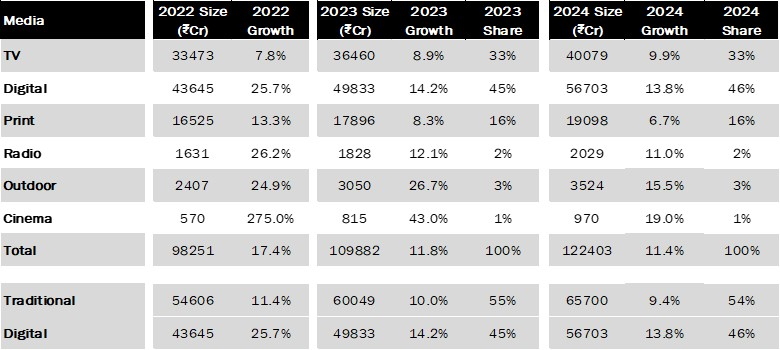

Indian advertising sales grew over 11.8 pc in 2023 to Rs.1099 bn ($14 bn) and is the 11th largest market, according to the report. Total ad sales were estimated at Rs. 982 bn in 2022.

Digital formats’ contribution to growth in India has slowed down – it grew by over 14.2 pc in 2023 vs 25.7 pc in 2022). However digital remains the largest at Rs.500 bn ($6.4 bn) with a share of 46 pc, the report added.

The forecast says linear formats will grow by over 9.9 pc with both TV and print growing equally at over 8 pc. According to Magna. radio (growing at over 12.1 pc) and OOH (over 29.8 pc) are seeing a robust recovery though still short of pre-Covid revenue.

In 2024, the India advertising market is predicted to grow by over 11.4 pc. Digital formats will rise at over 13.9 pc to reach Rs.569 bn ($7.2bn), while linear ad sales will increase by over 9.3 pc to reach Rs.655bn ($8.3bn).

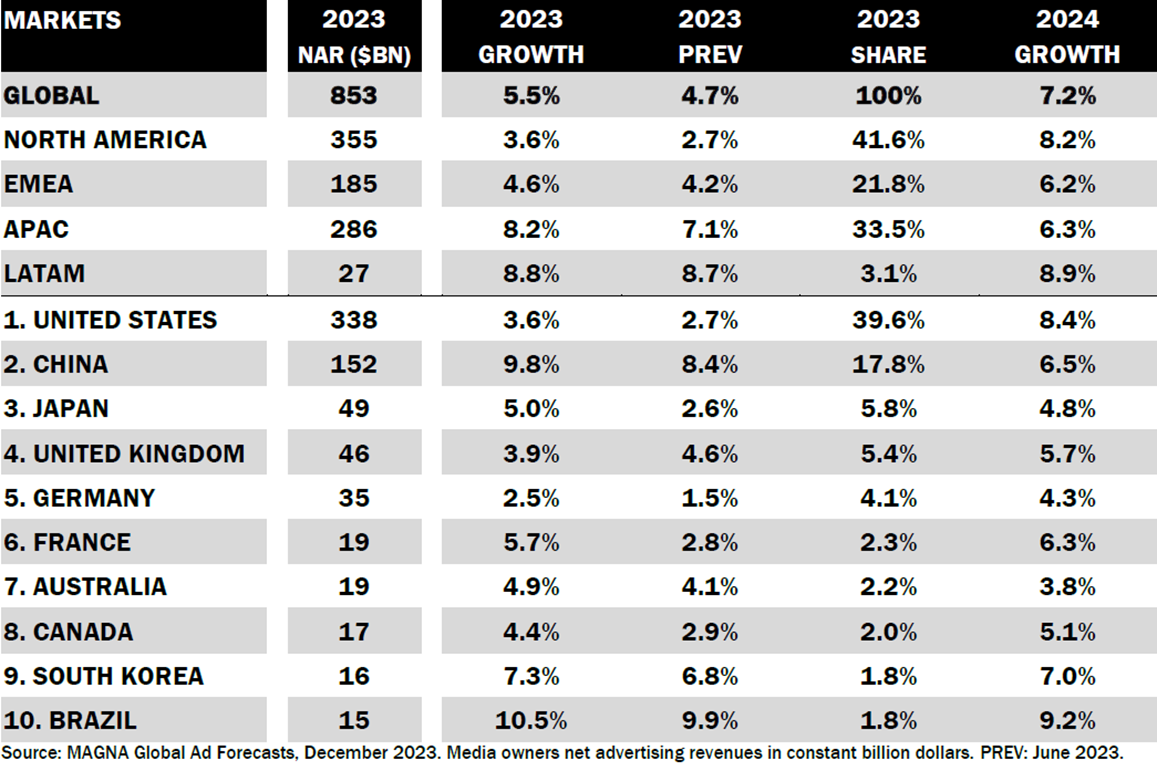

The Asia Pacific advertising economy grew over 8.2 pc to $286 bn this year powered by India, Pakistan and China. In 2024, APAC advertising revenues will increase by over 6 pc, says the forecast.

Venkatesh S, SVP, Director – Intelligence Practice, Magna India, said: “In 2023 H1 advertising spend grew over 9.6 pc, accelerated in the second half of 2023 to over 13.8 pc. The recovery is driven by festive spending and marquee events like ICC WC and elections. Globally, traditional media owners’ (TMO) ad revenue growth is slowing down, while in India both linear (9.9 pc) and digital formats (14.5 pc) are growing. Traditional formats will still be the largest, at least till 2027, though pure play digital is driving the adex. Non-linear formats (AVOD, digital newspaper, podcasting and DOOH) of TMOs are growing steadily in double digits and contribute 5 pc to the total revenue of TMOs.”

India along with China are projected to contribute about half of global GDP growth in 2023 and 2024. After a 7.3 pc expansion in 2022, the IMF in its October 2023 update predicts a slight deceleration in economic activity with real GDP growth of over 6.3 pc in 2023. The GDP has been revised up by 0.4 pc from the April 2023 update as economic growth remains robust.

India is reliant on its own domestic demand, private consumption, and investment spending for its growth. The overall sentiment is positive and upbeat though the market remains complex with local and global pressures. Large consumer base and aspirations of the young Indians works in its favour, a Magna statement explained.

Inflation remains vulnerable to rising food and fuel prices. The task of bringing inflation back to target is a priority for the government, it added, noting that the Union Budget’s focus on boosting manufacturing, higher disposable income with lowering of taxes and increased spending on infrastructure augurs well for adex growth.

Key Takeaways from the Magna Forecast

Category Watch

- Consumers increasing spending, primarily driven by young working adults investing in experiential-led categories like travel, auto, entertainment.

- Categories like CPG continue to see higher spending.

- 2023 H2 which includes festive spending, ICC World Cup and government spending before the upcoming national elections early next year expected to contribute 10 to 12 pc incremental growth.

- CPG, auto and fintech most dominant sectors contributing to adex growth followed by government, communication, travel and real estate.

- Retail including e-commerce, financial services, media & entertainment and apparel to see average growth.

- Startups who have been the mainstay for all tent pole properties have either cut budgets or moved to performance marketing over brand marketing.

- With the new retrospective taxation policy on gaming, brands have exercised caution in spending.

Digital Spends

- With digital growing 14.2 pc, India takes lead in mobile ad growth followed by US and Brazil (report by Adjust).

- India a mobile first-market. Share of mobile within digital will touch 59 pc this year.

- Social media with over 467 mn users has been the bellwether for digital growth, growing at over 19 pc.

- Total video registers over 16 pc growth.

- OTT growth trends driven by increased CTV subscribers, content choices and local language play. OTT subscription market size estimated at 50 mn this year.

Television

- Overall TV growing but Pay TV facing challenges from Free Dish, FTA channels and OTT in terms of subscriber base.

- Following implementation of amended New Tariff Order (NTO) 3.0 which allowed broadcasters to hike channel access price, subscribers have moved out of Pay TV in the price sensitive market.

- Despite this, Television is still the largest video medium with over 900 million viewers and daily viewing at 222 mins.

- With rising consumption of short form content, web series and availability of TV shows on OTT platforms, time spent indicates TV is holding onto audiences.

- Proposed broadcast bill extending purview to include OTT will help eliminate disparities to the advantage of linear television.

- There remains considerable growth opportunity for TV and advertisers are keen to cover the vast population of live audience.

- Television ad revenues in 2023 will grow at over 8.9 pc to reach an estimated Rs.365 bn ($4.6 bn).

- In 2024, TV advertising estimated to grow at over 9.9 pc to reach Rs.401 bn ($5.1 bn).

Newspapers

- Newspapers have risen to be the most credible source of information. With 391mn copies (2021-22) circulated every day and language print taking the lead, geographical spread and the audience size presents massive marketing opportunity.

- Advertising growth is on the back of recovery in volumes; however, yield remains a challenge.

- In 2023, ad sales revenue will grow at over 8.1 pc to Rs.175 bn ($2.2bn).

- In 2024, growth expected to continue at over 9 pc to Rs.187 bn ($2.4bn).

Radio

- Medium has seen gradual recovery. Despite volumes crossing pre-Covid levels, yield has been a struggle though ad rates have flared up slightly.

- Industry battling challenges of measurement limitations and audio streaming apps gaining user base.

- Radio players offering airtime bundled with off-air solutions to augment revenue.

- Government-led allowance of news broadcast and increase in government advertising rates will accelerate ad spends.

- Overall, radio ad revenue growing at over 12.1 pc to Rs.18 bn ($229 mn), which is 80 pc of the pre-Covid market size.

- In 2024, radio estimated to grow at over 11 pc to Rs.20 bn ($254mn)

OOH

- Has grown consistently post the pandemic as audience movement continues to ascend.

- Rising roadside DOOH screens in metros and state capitals, substantial presence in ambient spaces have added to demand, leading to growth in DOOH spends which contributes 5 pc to total (OOH spends).

- In 2023 OOH revenue increased 26.7 pc to Rs.30 bn ($382mn) reaching 90 pc of the pre-Covid market size

- Pace will be sustained for a few more years.

- In 2024, OOH will exceed 2019 revenues adding over 16 pc.

In-Cinema Advertising

- Up sharply as audiences are flocking to cinemas.

- State-of-the-art technologies like IMAX and Dolby Atmos have been another reason for audience draw.

- Will cover 74 pc of 2019 market size by end of 2023 with over 43 pc growth to Rs.8 bn ($102mn).

- In 2024, the growth is estimated to be over 19 pc.

Hema Malik, Chief Investment Officer, IPG Mediabrands India, commented: “India continues to script its unique narrative in the advertising landscape, boasting robust growth across diverse mediums despite evolving consumer preferences and market dynamics. The promising trajectory across television, digital, radio, and out-of-home channels signifies the dynamic nature of our advertising landscape. I am optimistic about the future as India’s advertising story unfolds, driven by innovation, adaptability, and a burgeoning consumer base.”