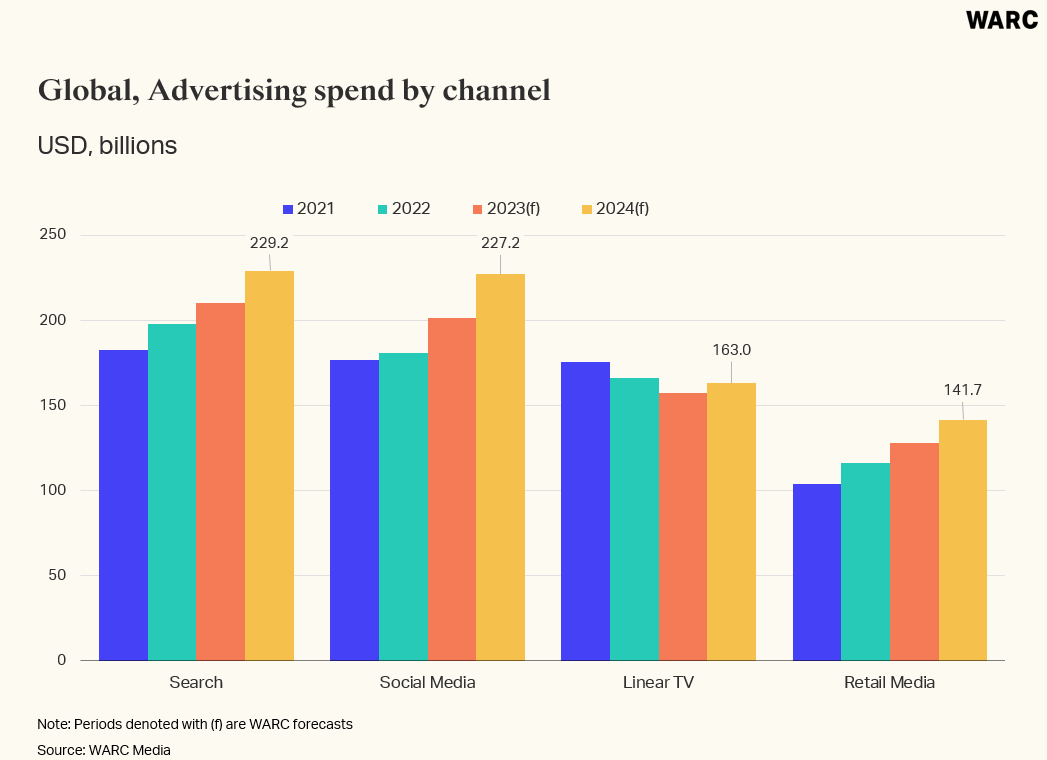

The rise of Retail Media in the advertising landscape has been speedy. Its Global advertising spend is poised to reach $128.2bn this year, per WARC Media, with Amazon the biggest winner. Up 10.2% year-on-year, ad investment is forecast to rise to $141.7bn in 2024 and is on track to overtake linear TV as the third-largest channel by spend within a few years.

WARC Media’s latest Global Ad Trends report examines the surging levels of retail media ad investment, the potential challenges for brands, and includes industry expert commentary about the future of retail data as an enabler of effectiveness across the media landscape.

Alex Brownsell, Head of Content, WARC Media, says: “Retail Media has been the advertising story of the decade so far. The unfashionable and often informal world of trade and shopper marketing has transformed into a $128.2bn digital advertising behemoth.

“What comes next will be less spectacular but more significant to brands, as deterministic retail media data begins to inform campaigns across the media landscape.”

Key findings outlined in WARC Media’s latest Global Ad Trends report, ‘Retail Media’s path to consolidation’ are:

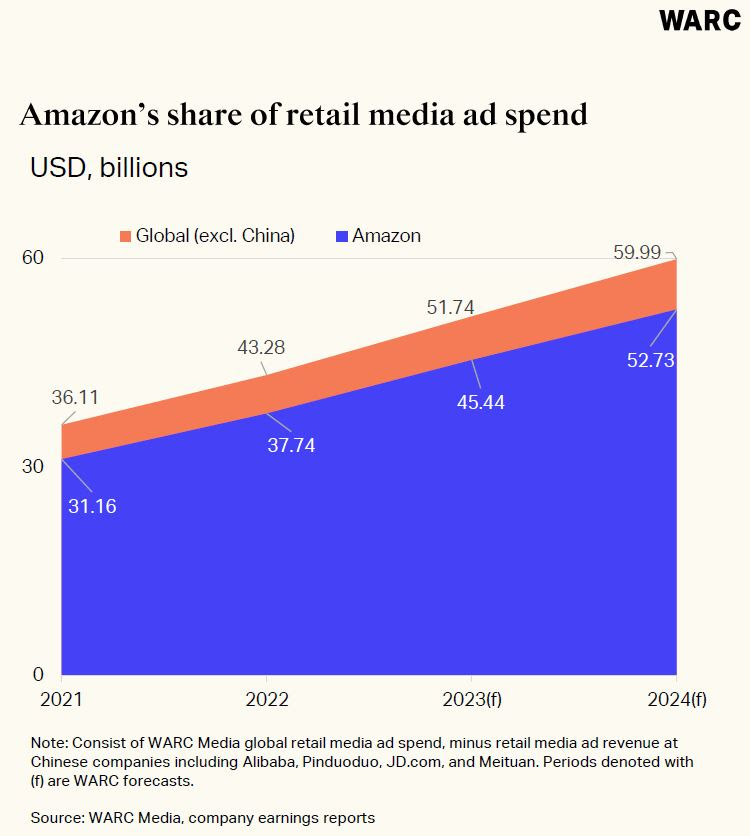

- Amazon is set to supplant Alibaba as the world’s largest retail media owner by ad revenue this year

The growth in retail media is dominated by Alibaba and Amazon. Between them, they earned an estimated $80bn in advertising revenue in 2022, equivalent to more than two thirds (68.3%) of global retail media investment.

Amazon occupies more than four fifths (87.8%) of the market outside of China, according to WARC estimates, and is forecast to earn $45.4bn in ad revenue this year per WARC Media. Its 20.4% year-on-year ad revenue should see Amazon supplant Alibaba as the world’s largest retail media owner this year.

Amazon is forecast to further accelerate in 2024, as its ad revenue reaches $52.7bn (+16%), compared to $42.1bn (+1.4%) for Alibaba.

- Retail Media, primarily used to drive sales, is moving beyond paid search formats

For most marketers, retail media remains a lower funnel channel to drive sales conversion: less than a third (30%) of respondents surveyed by WARC and the Digital Shelf Institute use retail media to build brand awareness.

However, retail media networks are increasingly moving beyond search formats into video, audio and out-of-home through cross-channel partnerships, such as Walmart’s tie up with Roku and Kroger’s deal with Pandora.

This enables the unlocking of upper-funnel ad dollars with brand-building formats to improve campaign effectiveness.

Mudit Jaju, Global Commerce Media Lead, Publicis Groupe, said: “To me, the most exciting thing happening is that retail media is no longer limited as this end-of-the-funnel conversion channel.”

Analysis of WARC Digital Commerce’s latest dComm Index data for Amazon found that Starbucks has emerged into a leadership position in the coffee and tea category following it having the

highest (9.1%) paid share of voice (SOV) in the category. WARC analysis observed that a one percentage point change in Starbucks’ paid SOV is typically followed by a c.$1.6m increase or decline in Amazon sales.

Read a complimentary sample report of WARC Global Ad Trends: Retail media’s path to consolidation here. A WARC podcast discussing the findings outlined in the report is available to tune into from today.

Global Ad Trends, is a quarterly report which draws on WARC’s dataset of advertising and media intelligence to take a holistic view on current industry developments. It is part of WARC Media, which provides rigorous and accurate benchmarks aggregated and verified from over 100 reputable sources, empowering media decision makers to plan strategies with precision. WARC Media is available by subscription.

Feedback: [email protected]

(This information is published from a press release.)