Several categories are fuelling the growth of print media, specifically newspapers, post the pandemic. Notable among them is real estate. Leading publications affirm that they have seen 2x growth in real estate advertising.

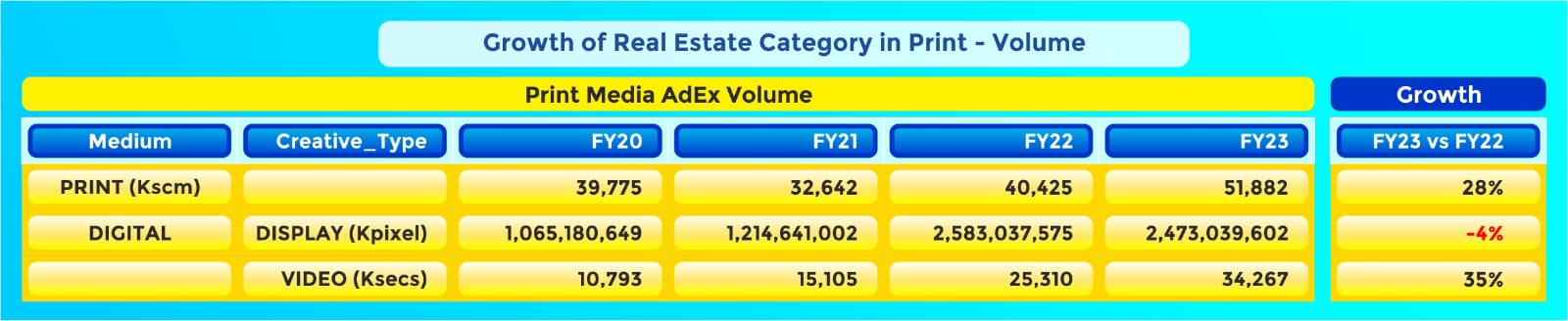

TAM’s AdEx report reveals that volume of the real estate category in print grew by 28 pc in FY23 over FY22. The data reveals that English ads accounted for 37 per cent of real estate ad volume and the top five languages together accounted for 92 per cent share of the category ad volume.

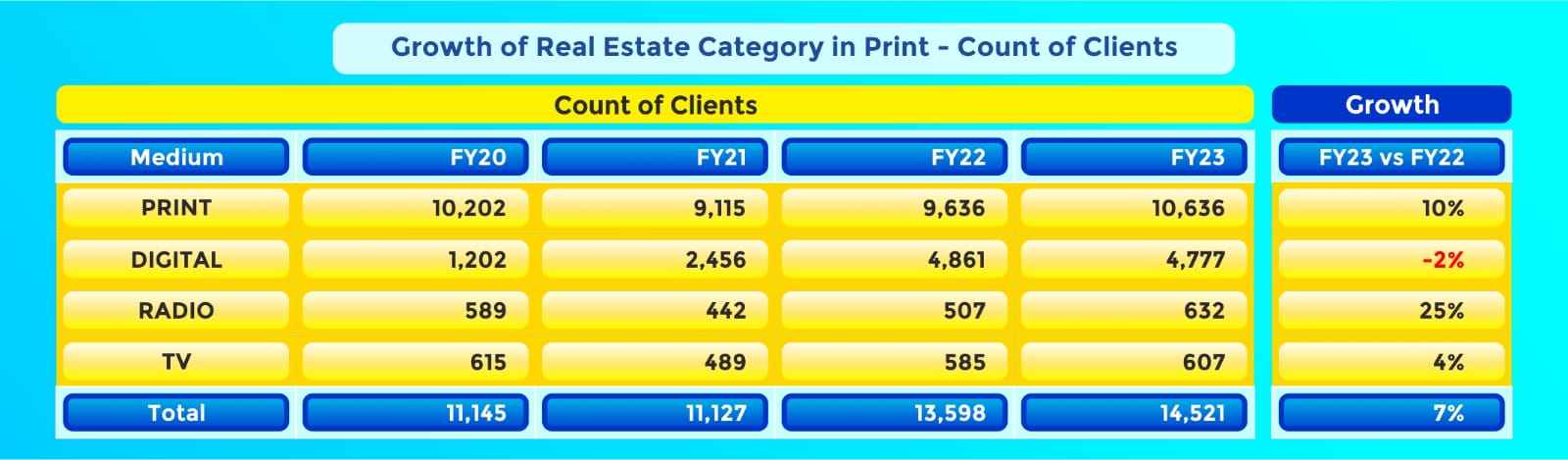

Did the increase in print media happen at the cost of budget reduction towards other media like TV and digital? AdEx data reveals that digital display ad volumes of real estate declined by 4 pc and that around 87 pc of 10,636 print advertisers did not advertise on the digital medium in FY23. The number of print insertions was 2.2x that of digital display. AdEx also shows that over 60 advertisers shifted their advertising completely from digital (in FY22) to print in FY23. That said, there were 3,000 advertisers who were on digital with Kapltaru leading the list in FY 2023.

While we see a host of real estate ads in print, some in the industry say they see a reduced spend on print. Some agencies also believe that the shift to digital is inevitable. However, there are some attributes of print that make it critical for categories like real estate, remind practitioners.

MediaNews4u approached print media publications, agency professionals and marketers to understand the ground reality.

‘Advertisers see that only a print advertisement gives them credibility and response’

Reacting to the deadly Covid pandemic, when several factors contributed to a significant slowdown in all sectors, real estate also took a severe beating. However, the situation changed slowly through factors like the growth of digital media, which fueled a growing interest among consumers to look at real estate as an investment. The print media, including Sakshi, certainly took a toll. Digital revolution certainly helped in taking a toll on the print media. As the year went by, the economic recovery and boom in employment and business opportunities enabled the real estate sector to make a significant recovery. A stable government, pragmatic policies and willingness of the government to look into the problems faced by the real estate sector as well as a dramatic rise in the number of business entities coming to the southern states and setting up base have also contributed to the growth of real estate in the region.

According to a report by real estate consultant Anarock, Hyderabad has experienced a remarkable growth of 50 pc in the total value of housing sold during the fiscal year 2023 (April 1, 2022 to March 31, 2023) compared to the previous year.

Between 2011 and 2021, residential properties in Hyderabad have seen annual price growth of roughly 8 pc, while commercial properties witness a growth rate of 15 pc, leading to substantial returns on investment for homeowners and investors alike. With improved connectivity, expanding job opportunities, supportive policies, and a focus on sustainable development, emerging localities are poised for a prosperous future in Hyderabad’s real estate market.

Sakshi Telugu Daily was forced to take several radical steps to manage the crisis. Prior to Covid, Sakshi used to extensively promote the real estate developers in reaching out to their customers through special supplements, features and property shows. During the lockdown, Sakshi’s digital avatar bridged the gap and disseminated information online to its readers, maintaining its hold on the customer base.

The real estate sector in Telangana and Andhra Pradesh began to tap opportunities that arose from the growth of IT and industries from Hyderabad to Tier 2 and Tier cities where new IT complexes and industrial units sprang up, generating employment and business opportunities on a wide scale. The housing sector has seen a tremendous boom due to the above factors.

Today, we can say that print media has risen like a Phoenix from the Covid ashes but there is still some way to go before they climb to pre Covid levels. We are pleased to see advertisers come back to print as they see only a print advertisement gives them the credibility and response from their customers.

As far as Sakshi is concerned, we have always delivered to our advertisers on the reach, impact and quality of readership, due to which there have been many success stories of brand launches.

On real estate on digital avatars

Sakshi’s digital footprint certainly gained significantly post Covid. The smartphone revolution has given a great impetus to the growth of its digital avatars. The real estate adopted the digital mode with enthusiasm, but soon realised that online ads and information did not do justice to their ventures given the transitory nature of the advertisement on mobiles.They harked back to the tried and tested medium of print where a potential customer could literally grasp the information at his pace and even store it for future reference. Today we can say that digital is playing a role as a tertiary medium while the primary mode is still advertising in print. Customers who look at properties to buy still prefer to go through the project literature for information.

In sum, I would like to say that print advertising is preferred by advertisers for credibility, information absorption and reference while the digital media is at best a reminder medium, supplementing the primary efforts of the real estate developers in booking sales and boosting profits. We will certainly see a bright future for Print Advertising as it remains the best medium for communicating their message with clarity, colour and credibility.

- KRP Reddy, Director – Advertising & Marketing, Sakshi

_______________________________________________________________________

‘Print as a medium delivers trust’

Real estate has always been a local business as most builders operate in their own cities, with a few exceptions. Hence, print has been the dominant medium for its local strength. It is only in the recent past that some builders have begun expanding across cities or promoting their properties to buyers from other cities for investments, second homes or retirement homes.

We have got feedback from developers that advertising only on digital platforms has often resulted in the generation of non-relevant leads. However, the combination of digital and print advertising has emerged as a great combination in generating quality leads and a balance in terms of impact and sustained presence.

Credibility is a key factor when it comes to real estate projects and print as a medium delivers trust. This is another factor that makes print imperative for the category and has shown results across the years.

We have seen developers effectively use print to build their brand equity; an improved brand image has enabled them to launch premium projects and print has helped create a larger than life impact for their projects and sell their inventory fast.

Real estate brands have also used some very impactful innovations with The Times of India going beyond just full page ads. We have had many clients move to GNP jackets, 4 page vantage ads, French windows, 8-page super panorama, special high quality paper like velvet paper etc. This clearly demonstrates the impact and importance of print in the real estate category as the results are there for all to see. In some cases, single campaigns have resulted in a sale of almost half of the entire inventory.

Some developers have also started looking at expanding their reach through effective packages of combining our language papers like Maharashtra Times, Navbharat Times along with The Times of India.

- Malcolm Raphael – Senior VP and Head – Creative Strategy, Innovations, Branded Content and Trade Marketing, BCCL

________________________________________________________________________

Newspaper delivers impact, high visibility and recall for real estate projects

The real estate advertising in Print saw a substantial jump in FY 23 over FY 22 as the sector came back strongly after the Covid lull. A lot of the project launches that had got delayed due to Covid were announced in FY 23. To announce these launches many of the top Real estate promoters showed a preference to use large format inventories like Jackets, Full pages, and innovation like edit raps, Gatefolds etc in the Newspaper to deliver impact, high visibility and recall for their projects. The occasion of reading the newspaper with undisturbed attention and to seek information by the readers serves well for the real estate sector as they try to showcase the pictures of their project layouts and provide details about their amenities.

- Deepak Saluja, CEO – Vijay Karnataka

________________________________________________________________________

‘We’ve experienced relatively stable conditions’

The ground reality in the Kerala market is that real estate is yet to bounce back after the pandemic; hence the muted advertiser response:

Comparing the performance of our real estate sector between FY22 and FY23, it’s clear that we’ve experienced relatively stable conditions. There hasn’t been any significant upturn or downturn in this period.

Similarly, our digital platform has shown steady progress without significant growth spikes. However, it’s essential to highlight initiatives such as Property Expos.

These efforts have extended domestically in Kerala and internationally, where we’ve collaborated with our print media counterparts. A noteworthy achievement during this time has been attracting more than 50 clients and welcoming over 5,000 walk-in visitors in Muscat. It was our 5th edition.

- Devika Shreyams Kumar, Vice President – Operations, Mathrubhumi Group

________________________________________________________________________

‘Real estate among key categories spending on print’

IRS (Indian Readership Survey) has still not appeared post-Covid but overall readership, which had declined during the early months of Covid, seems to be almost back to its pre-pandemic level. And with that advertisers have also come back with volumes almost back to earlier levels. However the growth trajectory is low and will continue to be slow. And may not have as yet reached pre pandemic levels in terms of revenue realisation. This could be the effect of pressure on rates in an effort to retain the advertisers and also inability to offer their digital assets as a viable option as against other digital platforms.

In India as against the rest of the world, advertisers still flock to print for quick reach and impact. While some of the mainstay categories like auto, FMCG, education, real estate have reduced spends on print, they have not moved away and remain the key categories spending on print. The choice of space however seems to have shifted to more of front pages, jackets indicating the desire in using print for more impact by advertisers. And for regional languages as well.

As digitisation is rapidly engulfing the way media is consumed, print has done a great job in launching digital versions but are not succeeding in monetising it. And in that aspect print is losing out on digital. Even if we consider Comscore’s reported number of impressions generated on the digital versions of print, the revenue realisation is abysmal. The struggle is to monetise the digital assets along with the physical assets to ensure that they retain the print spends which otherwise will shift to other digital options.

- Vinay Hegde, Chief Buying Officer, Madison Media

________________________________________________________________________

‘Real estate advertising has grown on all mediums post-pandemic’

Real estate advertising has grown on all mediums post-pandemic. This is no magic rather an obvious one because everything from earning to purchase was on tenterhooks. As a result, when things started streamlining, they too started putting in more money on advertising as that was the only way to reach the end users faster to bridge the time gap.

Amongst all other mediums, digital has undoubtedly seen the highest growth in a multiplication of 5x to 6x and print by 2.5x.

Almost 400 real estate clients are active and on an advertising spree across mediums.

Interestingly, depending upon the market and size of the real estate house, the top advertiser in those categories varies across the medium. No single brand tops the chart across the medium.

- Kumar Awanish, Chief Growth Officer, Cheil Worldwide

________________________________________________________________________

‘Print growth due to reliability, effectiveness in localised targeting’

There has been a noticeable increase in advertising spend towards print media in India during the post-pandemic era. The real estate sector, in particular, has seen a resurgence in interest, leading to greater investments in print advertising. As businesses adapted to the evolving landscape brought on by the pandemic, they recognised the enduring value of print media in India, especially in reaching local and regional audiences. This shift in strategy reflects the growing confidence in the print medium’s ability to effectively engage with Indian consumers.

There are noteworthy examples of successful real estate category advertising campaigns in print media in India during the post-pandemic era as well.

There has indeed been a significant increase in advertising spend on print media in the Indian market during the post-pandemic era. The increase in advertising spend on print media in the Indian market post-pandemic can be attributed to its reliability, effectiveness in localised targeting, the tangible and memorable nature of print ads, regulatory compliance, and the need for adaptable marketing strategies. These factors collectively contribute to the resurgence of print advertising in the real estate sector in India.

On impact on other media

Overall, while there was an increase in print media spend in the Indian market post-pandemic, it wasn’t necessarily at the direct expense of TV and digital advertising. Instead, advertisers in India aimed to strike a balance between various media channels, leveraging each one’s strengths to achieve their marketing objectives efficiently. This approach allowed them to navigate the evolving media landscape while optimizing their advertising investments.

- Amit Thakkar, Partner & Chief Sales, Excellent Publicity

________________________________________________________________________

‘Print maintains strong consumer connect, digital delivers superior RoI’

In the post-pandemic era, we strategically reallocated our advertising budget to primarily enhance our visibility through digital media. We firmly believe that print media still maintains a strong connection with consumers and will remain an essential component of our marketing expenditures. We employ print media for announcing new project launches and executing 360-degree marketing campaigns. However, for sustainability campaigns, we have shifted to digital mediums due to their ability to deliver a superior return on investment. This strategic pivot is primarily driven by the evident surge in digital platform consumption among our target audience. As people increasingly turned to digital channels for information, entertainment, and shopping during and after the pandemic, we recognised the need to align our advertising efforts with these changing consumption patterns.

Digital platforms offer distinct advantages, including better ROI and highly precise targeting capabilities. The ability to measure the impact of campaigns in real-time and tailor them to specific demographics and behaviours makes digital advertising a more cost-effective and flexible choice for our marketing objectives.

While we acknowledge the enduring value of print media in certain scenarios, our current focus on digital platforms reflects our commitment to staying attuned to consumer preferences and market dynamics, ensuring that our advertising resources are optimised for maximum impact in the evolving post-pandemic landscape.

Reduction in spending on print

Our observation has been that there has been a notable reduction in spending on print media as a whole due to a consumer shift toward digital platforms for news and information consumption. This shift is driven by the perceived higher return on investment that digital platforms offer.

Brands have found digital advertising to be more cost-effective, efficient, and adaptable in reaching their target audiences, which has naturally led to a reallocation of marketing budgets in favor of digital media. As a result, there hasn’t been a direct correlation between increased print media spending and reduced budgets for TV and other digital channels. Our budget allocation decisions are influenced by evolving consumer behavior and our commitment to optimising resources to achieve the best results in the dynamic media landscape.

- Rajanish Dixit, Vice President- Marketing, Urbanrise

Feedback: [email protected]