TV ratings for the Indian Premier League (IPL) have seen a significant fall in week 5 of its 16th edition. According to BARC data, the ratings hit a low of 4.16 TVR on linear TV under BARC TG: M15+ AB Urban, which is considered as advertisers oriented TG for Sports entertainment genre. marking the lowest point in this tournament. This year’s IPL ratings are the second-lowest in the last five years, with 13 pc lower viewership than the average of the past five seasons.

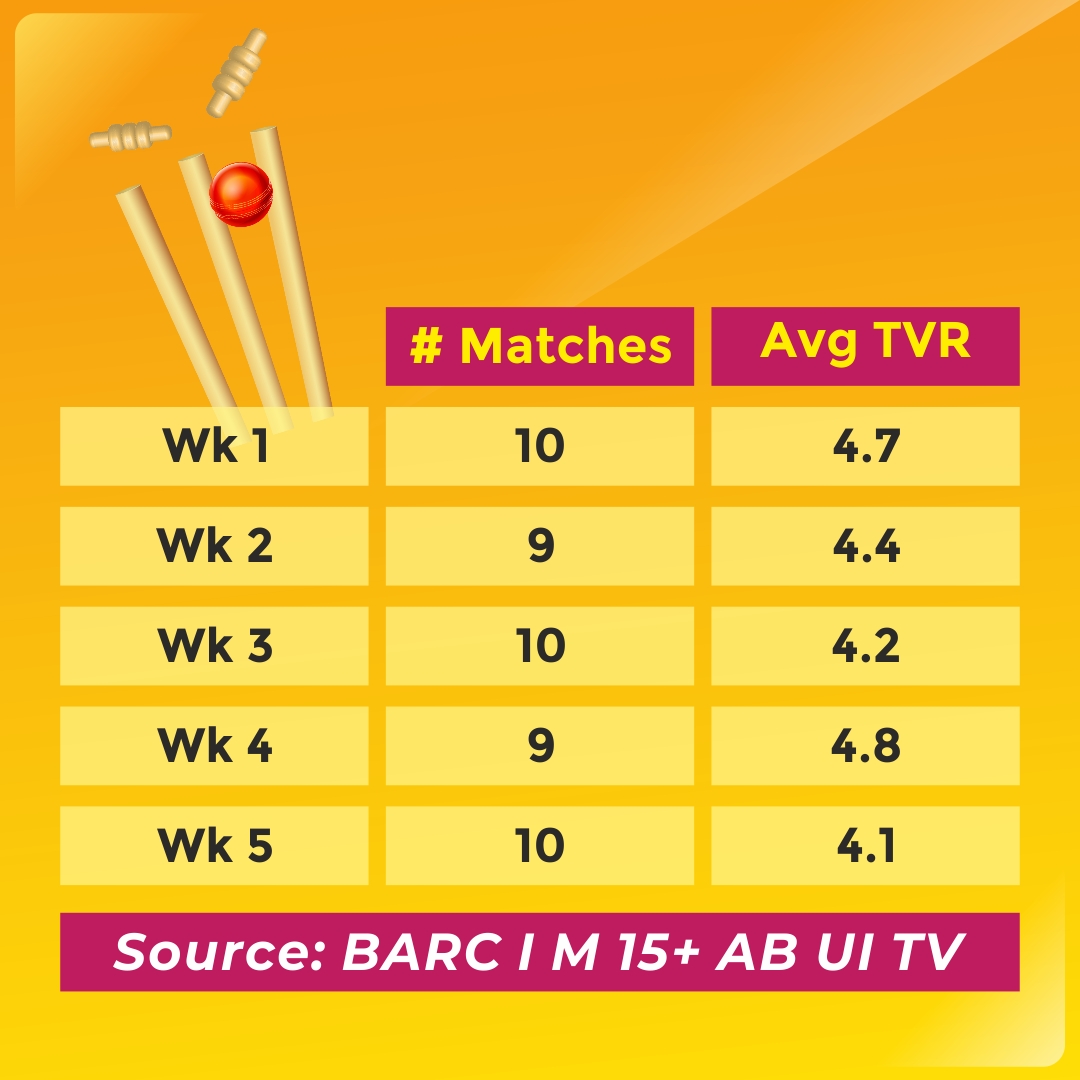

The IPL on TV ratings opened with 4.7 TVR in the first week and dipped to 4.4 in second week and reached 4.2 in the third week before bouncing back to 4.8 TVR in week four. However, by dipping to 4.1 TVR in week five, the IPL viewership ratings on Television has touched its lowest orbit ever in this season.

The declining viewership is also reflected in the frequency of IPL match-watching on TV. The number of matches watched on IPL has been steadily declining since IPL 2020 and is at its lowest point this year. Watch time is also down from an average of 257 billion minutes over the past five years to 226 billion minutes this year. Even the contribution of the core sports target group to the overall reach has declined from 16.4 pc last year to 14.4 pc this year, making the current season’s reach contribution the lowest since 2018.

Low figures are also being observed in IPL’s television ad spots. Week on week, TV advertising spots per match are declining while connected TV advertising spots are increasing. This shift in advertising trends is likely due to the declining viewership on traditional TV and the rise of connected TV platforms.

The declining trend in viewership on traditional TV has also reflected in the viewership of IPL on HD TV. The viewership of IPL HD is at a mere 28.7 million viewers compared to over 55 million on connected TVs. The HD reach of above 70 million claimed by Star is a figure including OOH HD TV’s as well.

A buying expert in sports genre said, “While Advertisers pay higher CPRP for HD households to access premium customers in their houses to get attention for their ads. Most of the OOH TV HD screens located in public placed do not have audio, and the profile of people on OOH is not necessarily premium. Advertisers pay for HD pay TV households, but the reach for pay TV is only 8.9 million households.”

“Finally, the decline in the number of advertisers after week 5 is also a worrying trend. The number of advertisers has fallen by 42 pc. The decline in viewership on traditional TV, the rise of connected TV platforms, and the decline in the number of advertisers are all indications of a shifting media landscape. The IPL organizers and advertisers will need to adapt to these changes in order to maintain their market position in the years to come” he added.