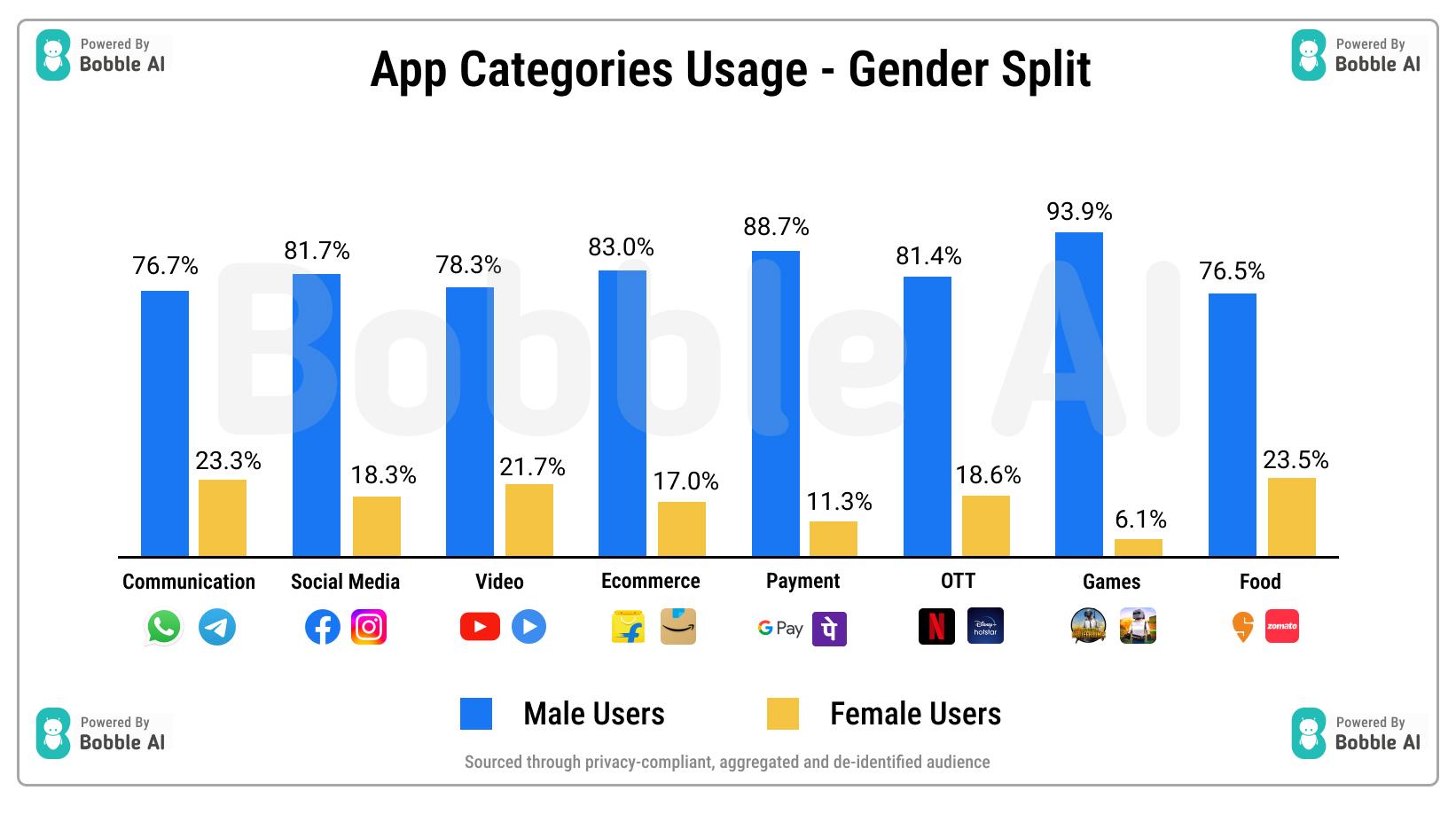

Despite a 50% rise in the Indian users’ time spent over smartphones in the last year and the participation of women in the workforce rising consistently, only 11.3% of Indian women are using smartphones to access payment applications and hardly 6.1% women are active on gaming applications, reveals Bobble AI data report.

The Mobile Market Intelligence (MMI) unit of Bobble AI conducted a study to understand the trends around cell phone usage and the subsequent interaction of the users with the market and different platforms. The research was done in a privacy-compliant manner by the mobile market intelligence division at Bobble AI, India’s top conversation media platform, using first-party data covering its vast base of more than 85 million Android smartphones. The report looks at the data from the months of 2022 and 2023 to analyze mobile usage trends and the evolving mindshare of the Indian consumers.

Not enough women make financial decisions on their own

This finding is consistent with the fact that the participation of women in the workforce has been rising consistently, but the participation of women in decision-making remains limited to deciding about meals at home as reflected in the higher proportion of women using food apps. Even though the usage of apps by women is low in general, the participation in the usage of communication apps (23.3%), video apps (21.7%) and food apps (23.5%) is comparatively higher. The concentration of women using payment apps (11.3%) and games (6.1%) was found to be the lowest in comparison to men using these applications.

Users spending 50% more time on their Smartphones in 2023

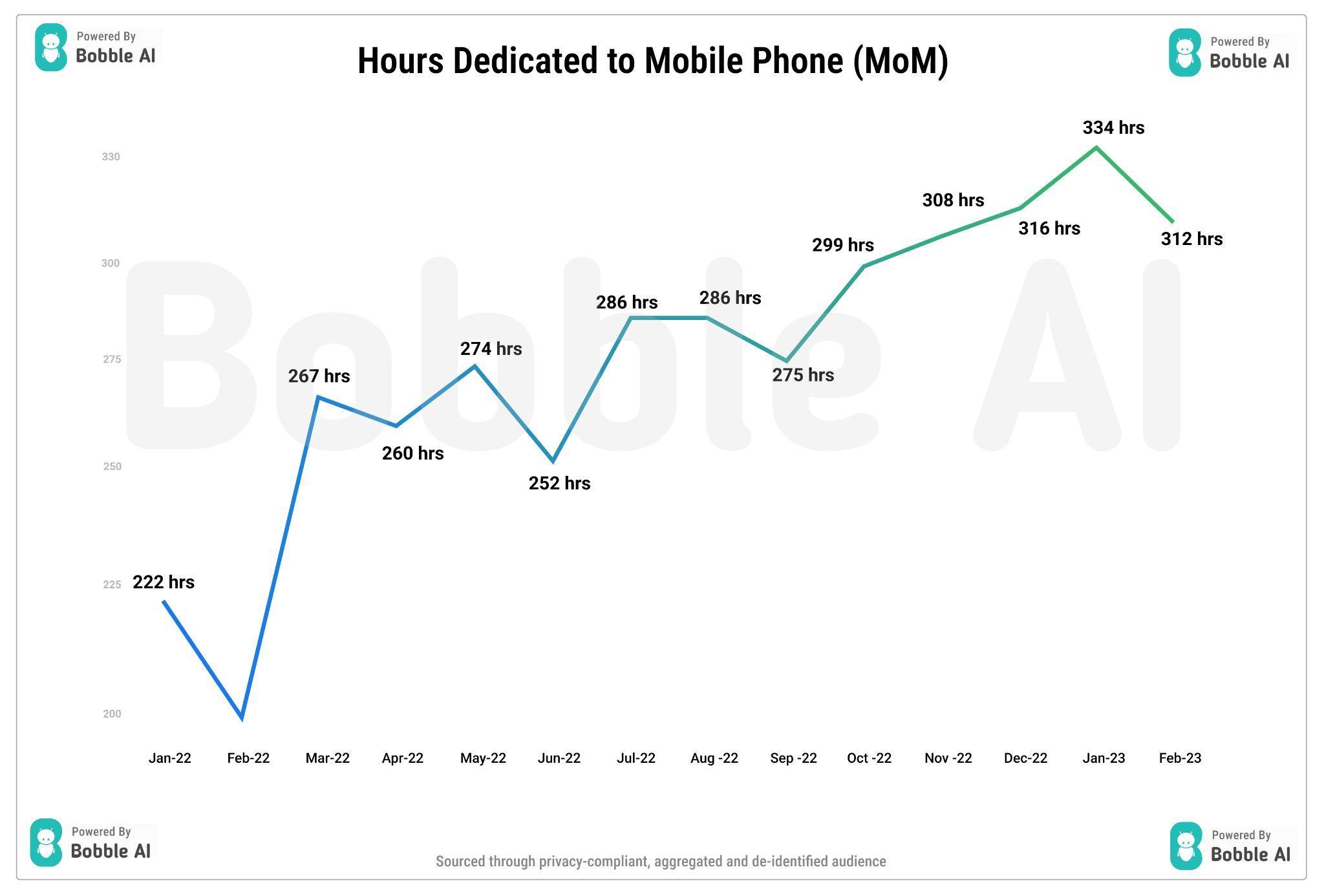

As per Bobble AI’s latest report, the aggregate time spent on smartphones has been increasing consistently from January 2022 to January 2023. The data reveals that the average phone usage has increased from 30% of the month in 2022 to 46% of the month in 2023. Subsequently, the data also found that, on average, the users spend more than half an hour on their mobile keyboard every day. The overall data also found that the users spent 50% more time on their smartphones in the early months of 2023 as compared with 2022.

Communication, Social Media & Video Applications rule

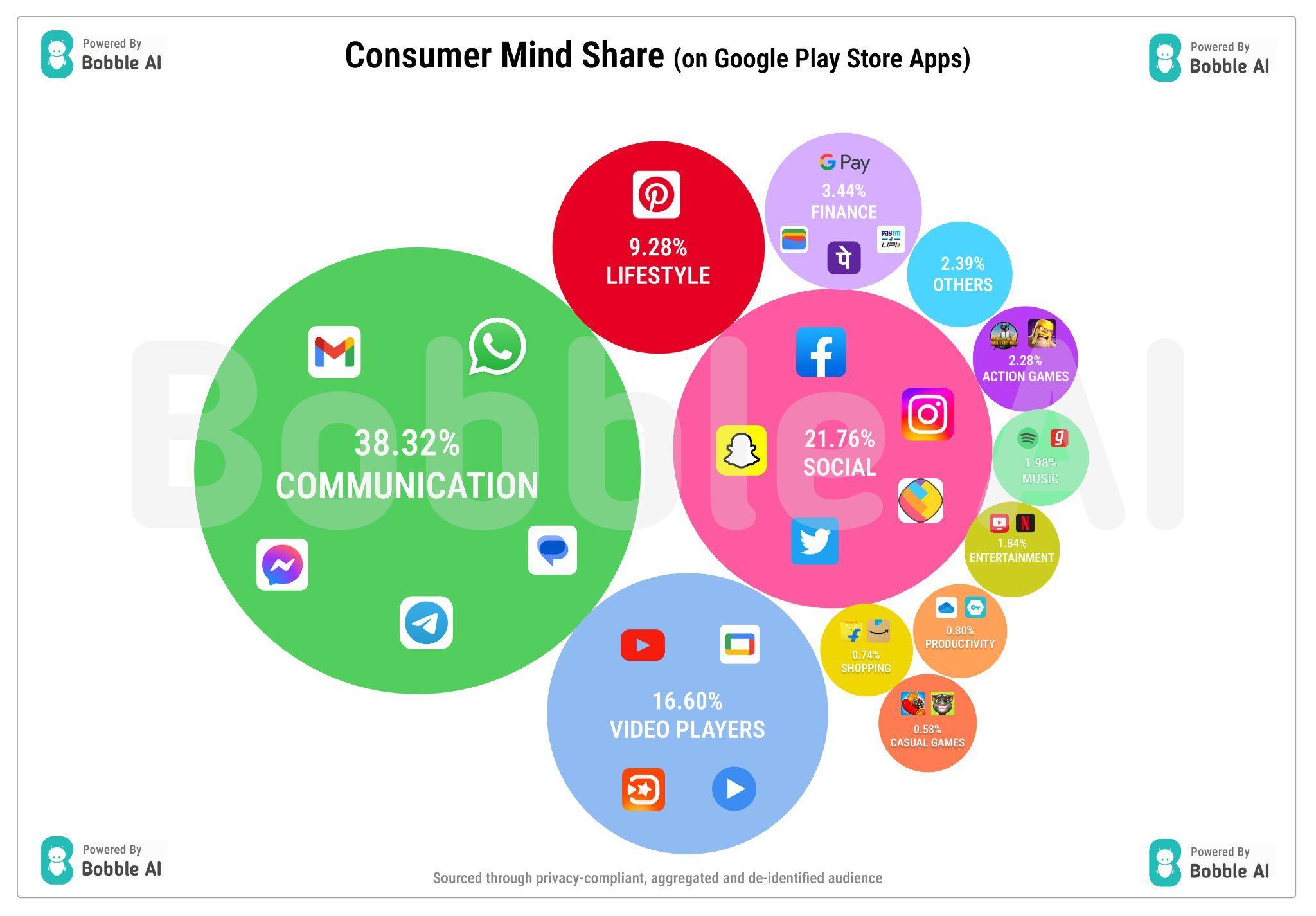

The report claims that India spends the majority of their time on communication apps, social media apps and video apps (a total of 76.68%), the rest of the apps get just a little more than 23% of the total time pie that the users spend on their smartphones. Among the other apps, lifestyle apps emerged as the most engaging with users spending more than 9% of their time on this category of apps. Apart from these categories, finance, gaming, music and entertainment apps saw an engagement of more than 1% concerning the time spent.

Teenagers decide the fate of free applications

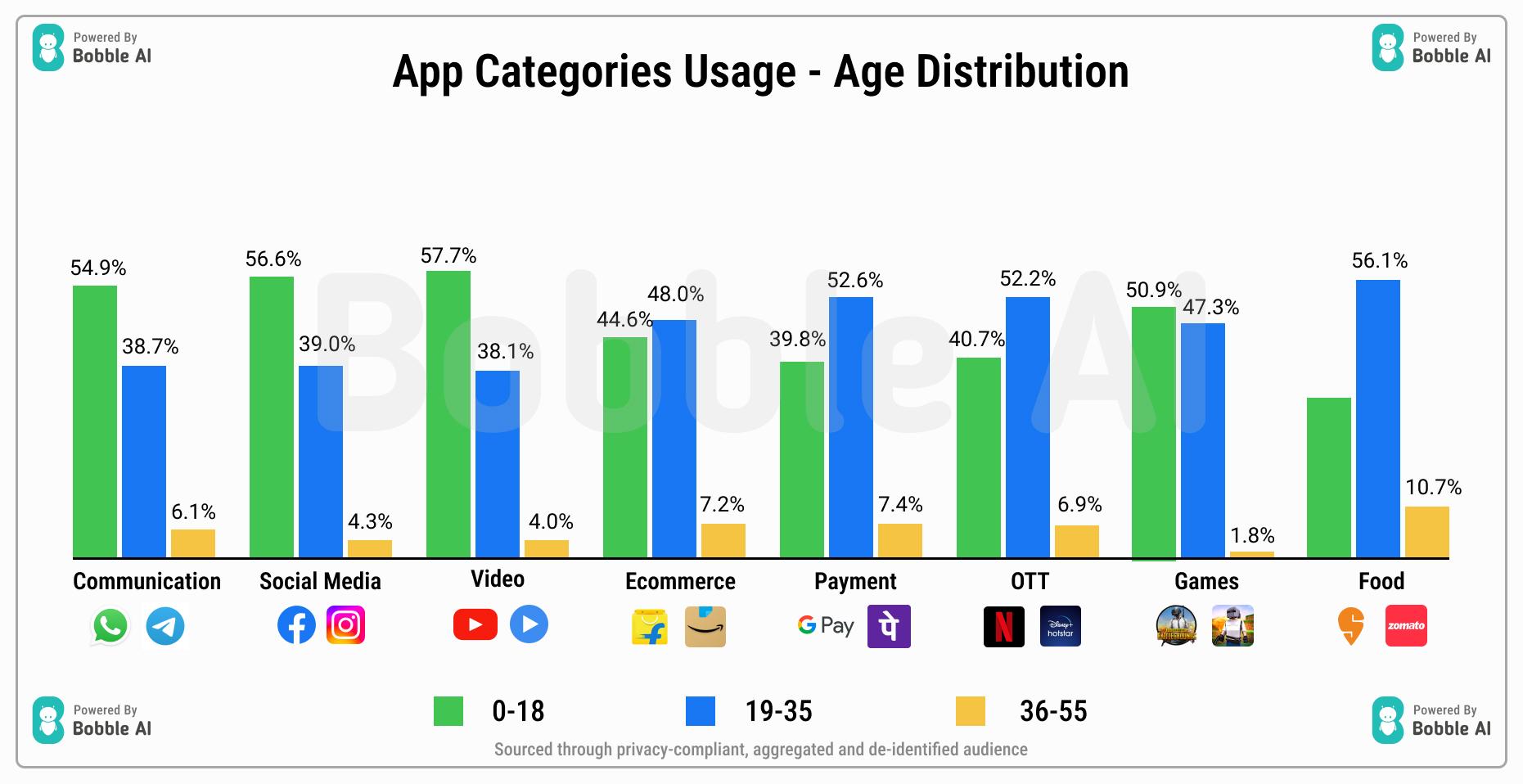

Furthermore, interestingly there is usage driven as per age categories too. The concentration of the under 18 age group is found to be maximum reflecting that most people in this age group are not earning and hence depend highly on free apps for their consumption whereas the people in the 19 – 35 age groups, the usage of subscription or payment based apps such as the Ecommerce apps (48%), payment apps (52.6%), OTTs (52.2%) and Food apps (56.1%) was found to be higher. Based on these findings the recommended way for advertisers to target adolescents and teens would be an increased focus on free apps for their marketing, however, the products targeting adults (about 30% of the population) can look to subscription-based apps to create a differentiation for their products.

Midday is the time when essential transactions happen

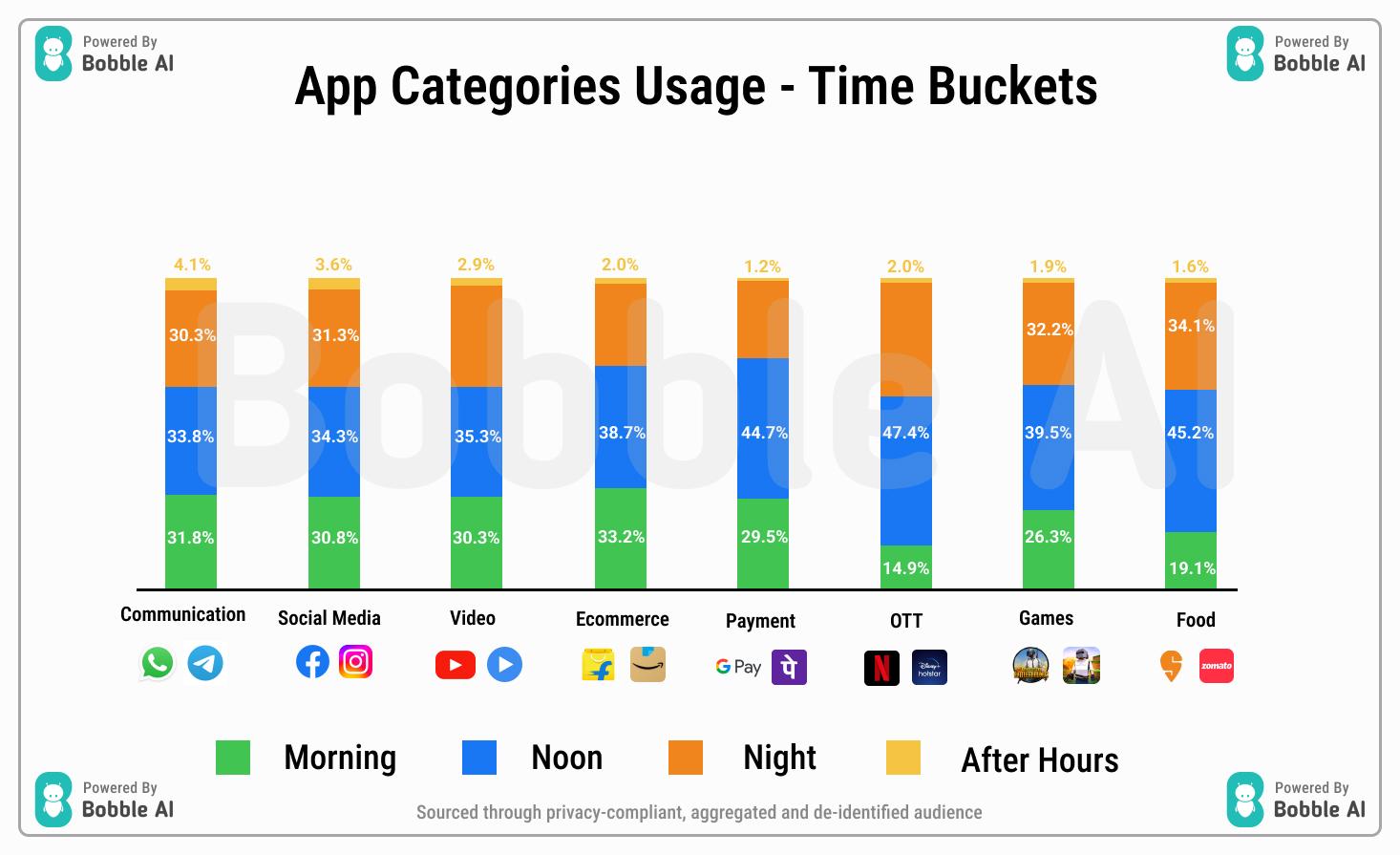

Another important metric that decodes user behavior is the time bracket of the user. The results depict that apps such as social media apps are being used throughout the day as a lot of users use Social media for activities such as checking the news, communicating with friends or just scrolling away to destress. However, in the case of specialized apps such as payment apps (44.7%), OTT (47.4%) and food ordering apps (45.2%) are being used more in the noon hours when people are active online for a specific purpose.

As shown by the data the smartphone user time has increased from 30% to 50% in the last year; moreover, on average, Indians spent 4.9 hours on their smartphone daily in the past year with the total smartphone usage time coming out to be 0.75 trillion hours. These findings can be particularly relevant to industry strategy-makers in creating targeted campaigns instead of traditional campaigns that target all the users irrespective of their preferences, such as Television ads, which cost more and have less ROI comparatively. There is a huge ready-to-consume consumer base ready in the digital space that can be strategically used by all reaching out to their clients and consumers digitally.

Feedback: [email protected]