In a rapidly evolving industry such as digital advertising, new technology-based innovations and trends continue to take prominence with the emergence of new platforms. For Example, the rise of content creation, Google’s decision to postpone the usage of third-party cookie data, and ads coming to Netflix. However, a constant that will remain is the enhanced need for media quality metrics.

As digital marketers look to optimise their digital campaigns to get the most value for their ad spends, it becomes critical for them to stay ahead of the unpredictability of digital media. Integral Ad Science’s (IAS) recently released 17th Edition of our Media Quality Report provides transparency into the performance and quality of digital media in the Asia Pacific region, alongside global comparisons. This report explores how media quality has evolved over the past six months and how marketers can use these shifts to maximise future campaign performance. The report gives detailed insights into metrics such as viewability, ad completion, brand risk, time-in-view, and ad fraud; however, I want to take a deep dive at just how important viewability is and how trends within it have changed within the past six months.

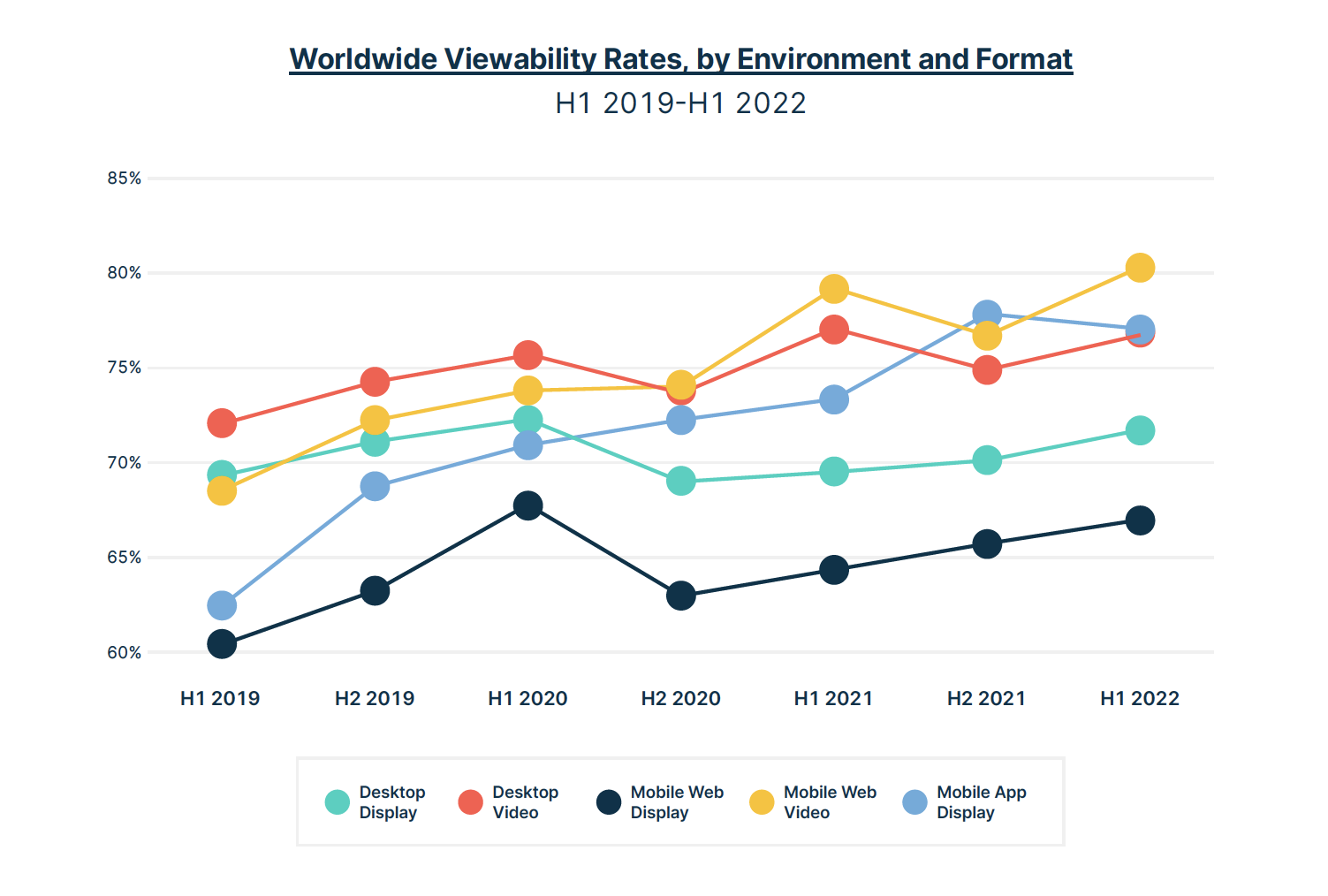

Ask any marketer what the first metric is that they use to measure their ad. The answer 9 out of 10 times will be viewability. Viewability has long been a go-to key performance indicator for advertising campaigns across digital environments. One can certainly say that the simplicity of viewability makes it easy for marketers to understand, activate, and set custom standards. After all, no advertiser wants to pay for ads that aren’t given a chance to be viewed by a human. As ad buyers continue to weed out non-viewable impressions, worldwide viewability rates have soared, rising as much as 15 points in some formats between 2019 and 2022.

In the first half of 2022, only mobile web display ads averaged less than 70% viewability worldwide. Video ads in mobile environments boasted viewability rates above 80% during this period.

Barring Japan, all APAC markets saw an uptick in viewability in display environments, with Australia registering the highest viewability level at 74.6%, an increase of 2.9 percentage points YoY. Japan reported the lowest desktop display viewability at 48.4% compared to the global average of 71.5%. The other APAC markets reported more than 60% viewability rates. While this is just one side of the story, we also need to look at ad completion and time-in-view to completely understand just how much importance we should place on viewability.

In Australia, ad completion rates for desktop video as well as mobile web video started strong in quartile 1 but noticed a gradual decline by quartile 4.

Noticeably, ad completion rates in Australia, for desktop video and mobile web video, across all four quartiles were higher than worldwide averages. This means that Australian marketers have done a good job at engaging with their consumers, resulting in the audience viewing more of the ad than the rest of the world. However, when you look at the Time-in-View (TIV) metric for desktop display and mobile web display, Australia noticed a decline in Y-o-Y numbers as well as faired lower than global averages. Stay with me for a moment here, this gets more interesting. For desktop display, except for India and New Zealand, other countries in the Asia Pacific such as Indonesia, Japan, Australia, Vietnam, and Singapore all noticed a decline in Y-o-Y TIV and reported numbers lower than the global average of 21.79 seconds in H1 2022. Interestingly, when it comes to mobile app display, only New Zealand and Vietnam faired lower than the TIV global average of 17.75 seconds; all other Asia Pacific countries outperformed the worldwide average.

Australia, Indonesia, Singapore, and Vietnam surpassed 65% viewability in mobile app display.

Viewability on mobile app environments has also benefited from increased adoption of the IAB Tech Lab’s Open Measurement SDK and third-party access to measurement data. Regional brands understand that viewability is a prerequisite to attention, and viewability rates should be high before tackling attention.

Rethinking Viewability Optimization

From this mixed bag of findings, we can tell that viewability is a metric that presents its own set of challenges. Recent findings by the IAS’s Insights As A Service (IAAS) team suggest that there is a point of diminishing return for viewability: while targeting higher viewability with pre-bid segments may lead to higher quality impressions, marketers can risk compromising scale.

The experiment showed that reach was highest for pre-bid segments targeting viewability rates between 40%-50%, with clear but limited reductions in reach up to a viewability of ≥60%. When pre-bid segment optimization was set to 70% viewability and higher, a 41% drop in reach followed.

Additionally, supply that qualified for higher viewability pre-bid segments led to better outcomes, but only up to a certain point. Impressions targeting the ≥70% viewability segment had no impact on conversion rates compared to ≥60% rates, but increased cost-per-conversion (CPC) by 10% and lowered reach.

The IAAS team concluded that targeting against the ≥60% viewability pre-bid segment appears to be the sweet spot to maximize conversions, maintain a competitive CPC, and minimize the impact on scale.

Views expressed are personal.