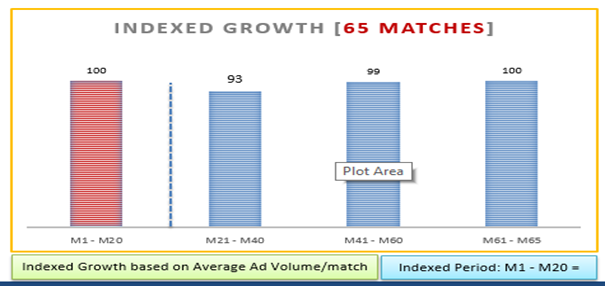

According to TAM Sports Report, indexed growth based on average ad volume of last 5 matches was equivalent to the average ad volume of first 20 matches of IPL 15.

Lowest ad volumes was registered during Match 21-40, 7% less than the initial 20 matches.

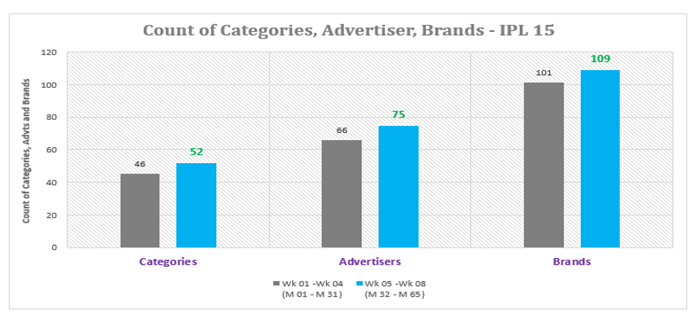

Average count of Categories, Advertisers and Brands soared in last 4 weeks of IPL 15 compared to first 4 weeks.

Average count of Categories, Advertisers and Brands were up by 14%, 13% and 8% respectively in the latest 4 weeks of IPL 15 compared to initial 4 weeks.

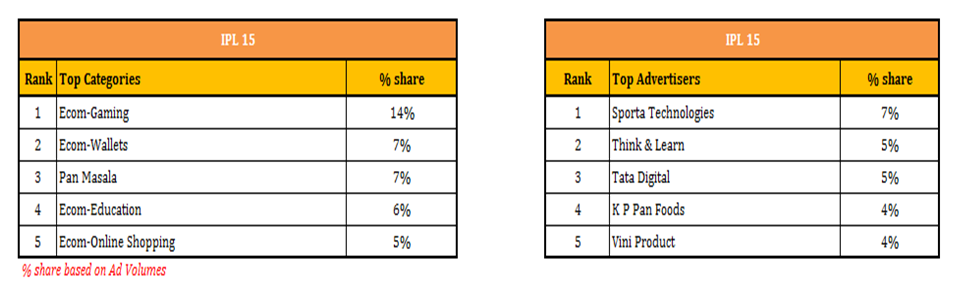

In the Top 5 categories list, 4 categories were from ‘E-commerce’ sector with 32% share of Ad Volumes during65 matches of IPL 15.The Top 5 categories together accounted to 38% share of Ad Volumes.

Top 5 Advertisers contributed to 24% share of Ad Volumes during 65 matches of IPL 15.

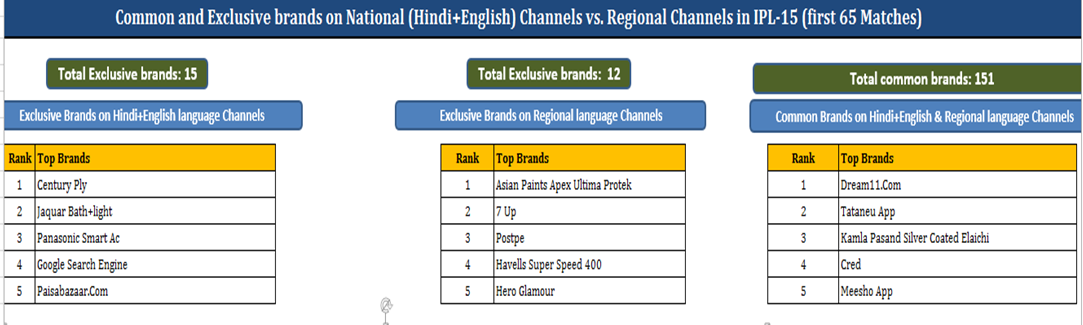

Among the Exclusive Brands on Hindi + English language Sports channels, Century Ply claimed the top spot whereas Asian Paints Apex Ultima Protek led the Exclusive Brands on Regional Sports channels.

Total 151 brands advertised on both Regional and Hindi+ English sports channels during 65 matches of IPL 15. Dream11.com was on top among the common brands.