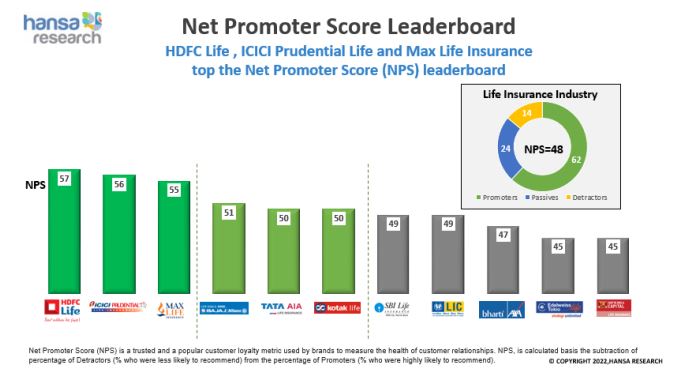

Insurance CuES India Report, 2022 that captures exciting insights about the perception and purchase of life insurance among Indian consumers is an annual syndicated study of Hansa Research. This study ranks insurers by Net Promoter Score (NPS) and has revealed the rankings for Life Insurance Brands for 2022. The study conducted in March 2022 covered around 4000 respondents across India.

Commenting on the significance of the Insurance CuES India Report, Praveen Nijhara, CEO – Hansa Research said, “The Insurance CuES India Report is a benchmark study for insurance sector to understand the experiences and expectations of Indian customers. The study highlights the need and importance for these brands to invest in building trust among customers to convert them into consumers. Compared to previous years, last year we saw some of the smaller players had not been able to match customer expectations on experiences due to the sudden onset of the pandemic. However, this year these brands have closed out some key gaps in experiences like purchase, ease of dealing, advisor interaction that has led to a strong positive momentum.”

Top 10 insurance brands for 2022

Key Findings

- NPS moved up for the life insurance industry, from 38% to 48% over the last year. HDFC Life, ICICI Prudential Insurance, and Max Life Insurance emerge as leaders on the NPS Chart with 57%, 56%, and 55% scores, respectively

- Comparative to last year, LIC and SBI Life show some improvement in their performance on customer experience but are overtaken by Bajaj Allianz Life, TATA AIA, and Kotak Life in relative rankings, as these brands show a stronger upward momentum

- Bajaj Allianz Life is one of the top gainers on the NPS leader board

- HDFC Life has strong and positive brand perceptions. It is also perceived to be deliver on Post Purchase engagement via updates, communication, and engagement via agent/advisor

- ICICI Prudential has won the lead in Digital Customer Experience, especially since the pandemic and capitalizes by ensuring product suitability and a good range of plans.

- Max Life Insurance and HDFC Life are both seen as easy to deal with

Commenting on the findings of the Insurance CuES India Report, Piyali Chatterjee, Senior Vice President, CX – Hansa Research said, “One of the most significant findings is a noticeable positive shift in the industry which has been brought by several factors including increased awareness and relevance of the product spurred by the pandemic. HDFC Life, ICICI Prudential and Max Life Insurance are in the top three scorers in terms of brand NPS as they have been more successful in providing faster and increased communication and post-sales customer support by adopting digital technology. This shows that companies must continue to focus on forging a connection with the customer and engage in frequent intervals for long-term loyalty.”

Many exciting trends emerged from the Insurance CuES India Report, 2022. These insights indicate how customer experience and post-purchase engagement are driving factors when scouting for insurance:

- The study highlights that Digitalization is changing consumer’s patterns of brand selection, buying, consumption even in the life insurance category. The study found that 1 in 2 customers relied on digital sources of information before purchasing a life insurance policy in the last one year. Modern customers are increasingly relying on direct digital channels such as the company’s website, emails, and social media pages for information and customer support.

- Product continues to remain of key importance to the customer. The industry sees 1.3X improvement in satisfaction among customers who bought a LI product recently than those who bought 5 years ago, especially on Pricing, Transparency, etc. What is heartening is that customer experience has improved significantly for even ULIP products over the past year.

- Customers are proactively seeking out companies instead of remaining Passive, especially the Millennials. Overall, 8 in 10 customers sought out interactions with the company in the past 1 year, seeking either information, service request, or complaint resolution. Hence, easy access to customer support should remain a priority.

- Another key finding of the study was that the Purchase of LI for Protection continues to remain the key reason for purchase as seen previously as well, with 4 in 10 customers having it bought for financial protection. However, Growth of Wealth is also another key reason, with approx. 20% choosing LI primarily as a tool for Financial Wealth creation.

- Inspite of the digital experiences on offer, Physical interaction continues to remain important for now, with 3 in 4 customers wanting the Agent/ Bank RM to engage atleast once in 6 months to provide reminders, update about new policies.