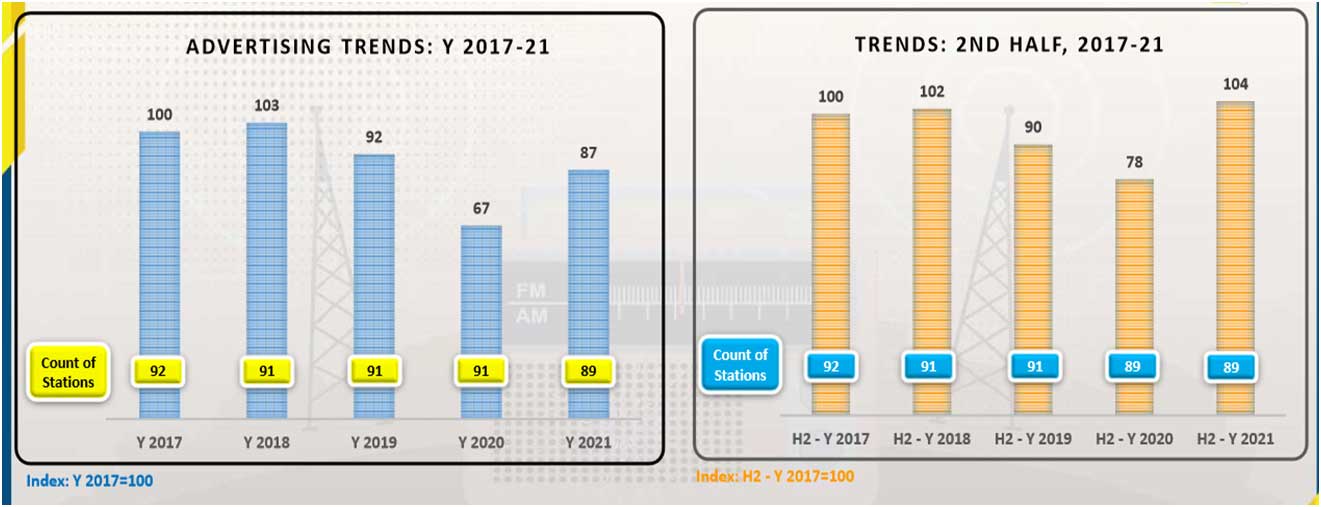

According to TAM AdEx-Mirroring Year 2021 for Radio Advertising, ad volumes witnessed 3% growth in the year 2018 whereas 2020 saw a 33% decline compared to 2017. Ad volumes grew to 29% in 2021 compared to Covid hit the year 2020.

Ad Volume growth in period (H2, 2021) crossed last 5 year’s mark i.e. Second half of the year 2021 grew by 4% compared to the period (H2, 2017).

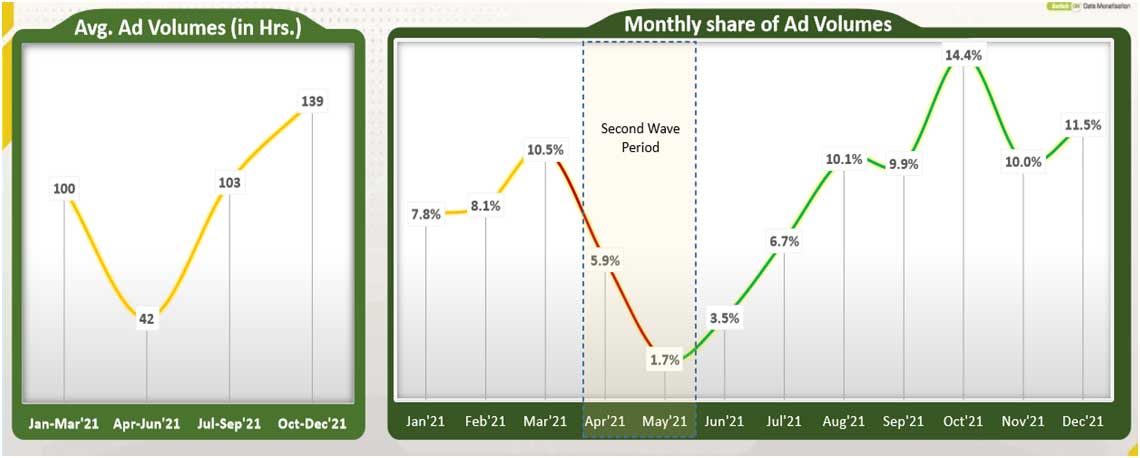

The lowest Average Ad Volumes seen in the 2nd quarter is the dip owing to the Covid second wave.

Ad Volumes on Radio show a V-shaped recovery in Q3’21 and Q4’21. Radio Ad Volumes recovered to the Pre-Second wave level during the festive period, where they witnessed double-digit share.

Among the Leading Sectors, the Services sector claimed the top position in the year 2020-21. The services sector had a 27% share of Ad Volumes on Radio followed by F&B with 13% share in 2021. The top 3 sectors together accounted for more than 50% share of Ad Volumes. With a minor rank shift, all the Top 10 sectors of 2020 remained in the Top 10 list of 2021.

Among the Leading Categories, Properties/Real Estates maintained the top spot in the chart with an 11% share of Ad Volumes.Hospital/Clinics shifted up 2 positions to secure 2nd rank. Pan Masala and Multiple Courses also maintained their ranks. 2 categories each out of the Top 10 categories belonged to Services, BFSI, and Retail sector. The housing/Construction Loans category was the new entrant in the Top 10 categories list. Hospital/Clinics, Retail Outlets-Jewellers, Retail Outlets-Clothing/Textiles/Fashion, Retail Outlets-Electronics/Durables, and Housing/Construction Loans categories saw a positive rank shift.

In the Leading Advertisers category, LIC retained its top spot in the list for 2021 compared to last year followed by Maruti Suzuki. Mother Dairy, GCMMF (Amul), LIC Housing Finance, Honda Motorcycle, Vicco, and Vishnu Packaging observed a positive rank shift compared to 2020. LIC Housing Finance, Honda Motorcycle & Scooter, Vicco and Vishnu Packaging were the new entrants in the Top 10 advertisers’ list on Radio. Top 10 Advertisers contributed to 16% share of Ad Volumes on Radio.

In the Leading Brands category for 2021, LIC Housing Finance topped among the brands followed by LIC. 3 out of 10 Top brands were related to LIC India. During the year 2021, there was a total of 10.5K+ brands present on the Radio. 4 out of the Top 10 brands were from the BFSI sector and 2 were from the F&B sector. Top 10 Brands contributed 9% share of Radio Ad Volumes.

220+ Categories registered Positive Growth in the Top Growing Categories.Properties/Real Estates among categories saw the highest increase in Ad seconds with the growth of 50% followed by Hospital/Clinics with 60% growth in 2021 compared to 2020. In terms of growth %, Corporate-Pharma/Healthcare category witnessed the highest growth % among the Top 10 i.e. 3.8 Times in 2021. Three of the Top 10 categories belonged to Services Sector and two each from the BFSI sector & Retail sector.

4.9K+ Advertisers & 6.5K+ Brands Exclusively advertised during the year 2021 compared to 2020 on Radio.

SEBI (Securities & Exchange Board of India) was the top Exclusive Advertiser as well as Brand in 2021 compared to 2020. 3 brands each among the Top 10 Exclusive Brands belonged to the Auto, F&B, and BFSI sectors.

Advertising in leading States and Cities on Radio showed Gujarat State on top with a 19% share of Ad volumes followed by Maharashtra with a 16% share. The top 5 States accounted for 61% of Total Ad Volumes and South Radio Stations accounted for 27% share on Radio. New Delhi topped among the 18 cities on Radio followed by Indore on 2nd position. The top 10 cities accounted for 68% of Total Ad Volumes on Radio.

The list of Top 10 Cities Bouncing Back in 2021 compared to 2020 showed New Delhi with the highest rise in Ad Volumes growth in 2021 i.e. rise of 54% compared to 2020 followed by Hyderabad. After New Delhi, Vadodara observed the highest increase in Ad Volumes in 2021 compared to 2020.

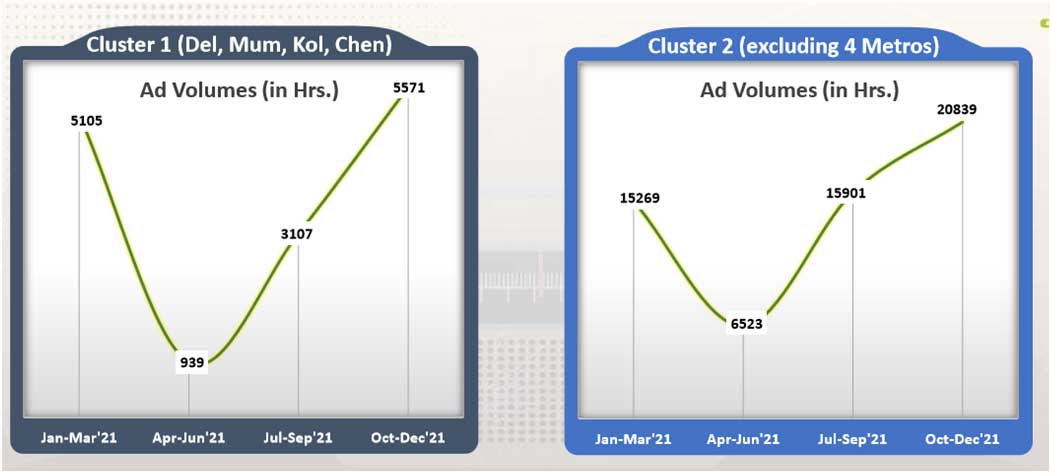

The Advertising Trends for 4 Metros (Del, Mum, Kol, Chen)-Cluster 1 Vs. Other Cities-Cluster 2.

In both the Clusters, Ad Volumes on Radio witnessed considerable upsurge during Q3’21 and Q4’21 compared to Q2’21.Q4’21 saw 3.7 Times rise for Cluster 1 cities and 3.2 Times rise for Cluster 2 cities compared to Q2’21.

The Leading Categories for Cluster 1 and Cluster 2 in 2021 showed Properties/Real Estates at the top on Radio with 10% share in Cluster 1 and 11% share in Cluster 2. 8 of the Top 10 categories were common between both Clusters. The top 10 categories added 39% share of Ad Volumes for Cluster 1 and 44% share for Cluster 2 during Y 2021.

The Leading Advertisers for Cluster 1 and Cluster 2 in 2021 showed LIC of India leading the list in both the Clusters. 8 of the Top 10 advertisers were common between both Clusters. Top 10 advertisers added 21% share of Ad Volumes for Cluster 1 and 14% share for Cluster 2 in the year 2021.

The evening was the most preferred time-band on Radio followed by Morning and Afternoon time-bands. Evening & Morning time bands together added more than 65% share of ad volumes.

Ad lengths on Radio saw a similar share of Ad Volumes in both the years, 2020 and 2021. Ad Commercials with < 20 secs was most preferred for advertising on Radio during both the years.