E-commerce in India has witnessed an uptick of 77% between 2020 and 2021 and tier 2,3 cities are transacting more than ever as per a report by India’s largest conversation media platform Bobble AI. Bobble AI report is based on over 50 million smartphone users’ (in 640+ Indian cities) data processed in a privacy-compliant manner. It also revealed that while tier 1 cities dominate the fashion festival figures, transactions in tier 2 cities like Jaipur, Guwahati, Lucknow, Kochi, Mysore, and Bhubaneswar are at an all-time high – up 82% over the previous year.

Apart from that, the majority of consumers are between the ages of 26 and 35 accounting for 37%, and between the ages of 18 and 25, accounting for 26% with 72% males and 28% females. According to the data intelligence company’s survey on the state of eCommerce in India, which was conducted across Tier 1, 2 and 3, beauty e-commerce apps usage grew by 64%, whereas fashion e-commerce grew by 368% over the past year. The festive period has only led the two e-commerce domains to skyrocket, with at least two transactions completed by shopaholics during the fashion festivals.

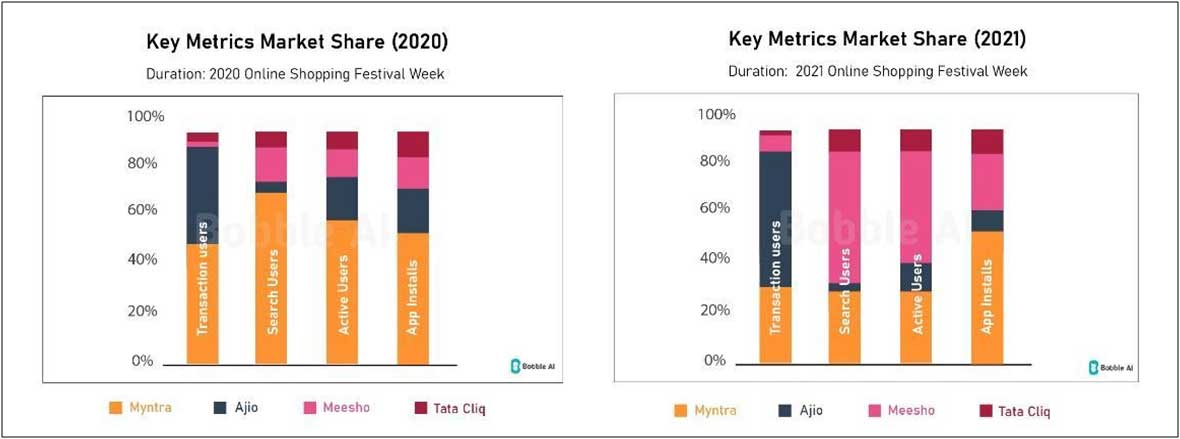

In an interesting insight highlighted by the study, India’s fashion e-commerce industry has transformed from ‘Monopoly’ to ‘Ludo.’ Fashion giant Myntra faced tough competition from its competitive counterparts, Meesho, Ajio, and TataCliq. While almost 46% of all transactions belonged to Myntra during the 2020 festive period, Ajio bagged around 69% of all transactions in 2021. The share of Myntra’s active users, also using Meesho, Ajio, and TataCliq has also increased significantly, indicating how users are exploring multiple options this year.

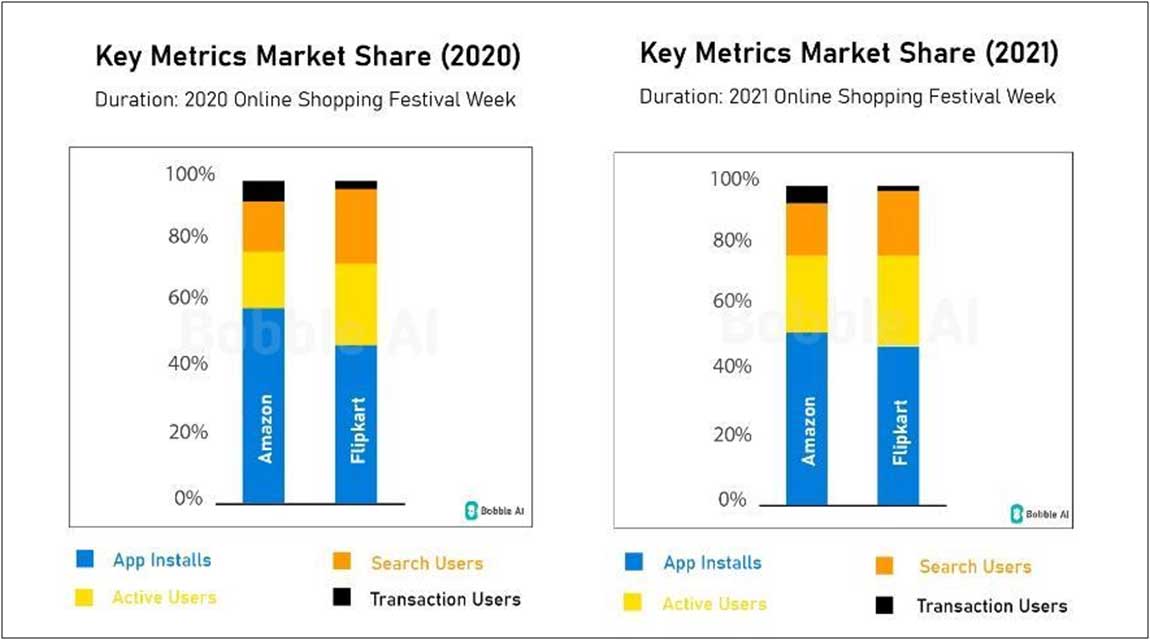

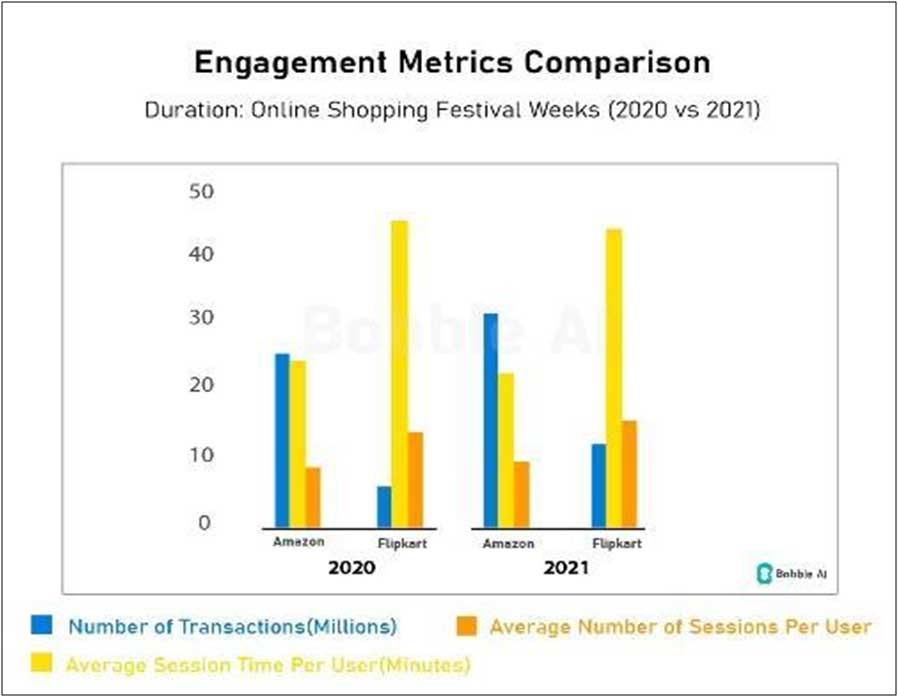

The battle of the e-commerce legends, Amazon, and Flipkart is worth noting, with Flipkart’s active user base rising 83% in the 2021 online shopping festival compared to Amazon’s 72%. Despite the fact that Flipkart is dominating in terms of engagement metrics like search frequency and active sessions, Amazon is winning in terms of transactions, significantly less average session times.

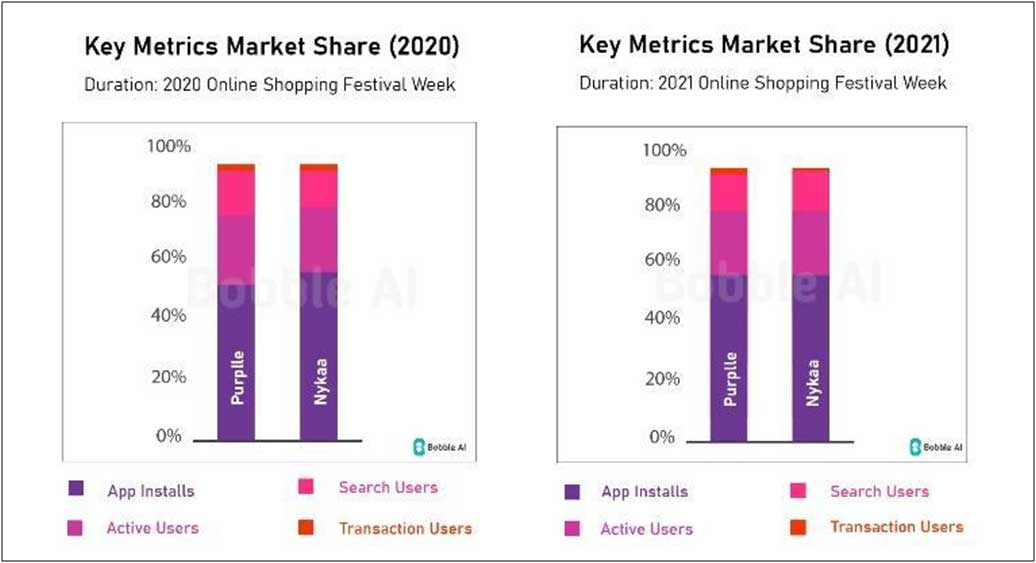

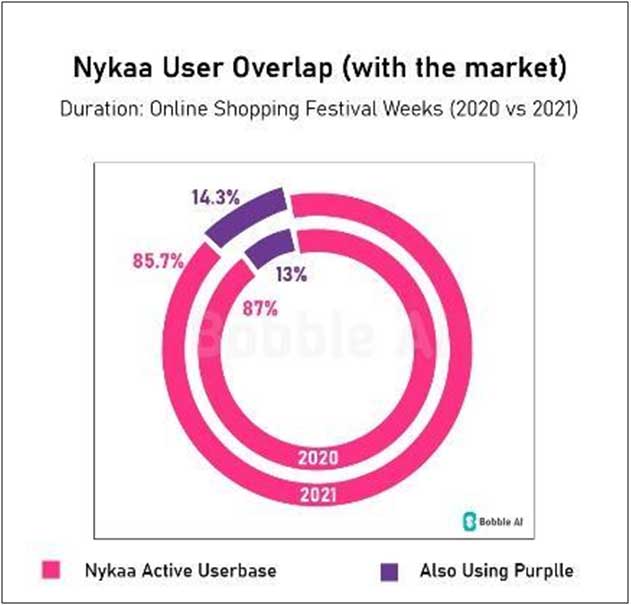

Apart from fashion e-commerce, interesting insights have also emerged from the beauty e-commerce segment. Leading players Nykaa and Purplle locked horns this festive season – and Purplle took a piece from Nykaa’s pie. In light of Nykaa’s IPO, let’s look at their market share against Purplle, Nykaa’s pure-play fashion e-commerce competitor. Purplle had a 70% growth of inactive users in the 2021 shopping festival, compared to a 50% increase for Nykaa. With a 15% common user base in 2020, Purplle is now standing at 17% in 2021.

The festive season trends point towards healthy and fast-evolving competition in the e-commerce market, which bodes well for customers who are looking for high-quality products at affordable prices. With the festive season coming to a close, it is exciting to anticipate how the competition will pan out in 2022. With India’s e-commerce market set to reach $120 billion by 2025, the future seems promising. Hypergrowth is definitely on the horizon for the segment, and according to Bobble AI’s findings, brands are poised to capture growth opportunities.