Mumbai: Axis My India, a leading consumer data intelligence company, released its latest findings of the India Consumer Sentiment Index (CSI), a monthly analysis of consumer perception on a wide range of issues. Reflecting the view of the majority, the survey for the month of October reveals that media consumption remains the same for 48% of the families while the same has increased for a 25%. In addition, a combined 82% said that they had seen more ads on TV and Digital platforms over others.

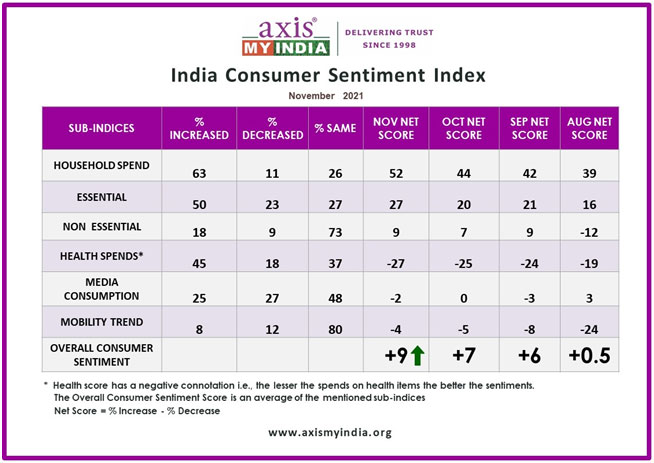

The November net CSI score, calculated by percentage increase minus percentage decrease in sentiment, was recorded at +9, up from +7 last month and rising at a constant pace over the last three months, indicative of a positive shift in consumer consumption metrics.

The sentiment analysis delves into 5 relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits & mobility trends.

This month, Axis My India’s Sentiment Index also delved deeper to understand consumers view on varied issues of national interest. These include privatisation of loss-making public sector companies like that of Air India, views on economic recovery by 2022, alternatives to rising fuel prices, investment preferences, sentiments around Diwali and on brand advertisement placements.

The surveys were carried out via Computer-Aided Telephonic Interviews with a sample size of 10430 people. 62% belonged from Rural India while 38% belonged from urban counterparts.

Commenting on the October report, Pradeep Gupta, CMD, Axis My India, said, “With the festivities at its peak, one can easily witness consumer’s excitement in terms of loosening their purse strings for varied expenses and experiences. While Diwali has triggered spending on products of personal indulgence (like 2-wheeler/4-wheelers or jewellery) and household items, the upcoming festivities and enthusiastic consumer sentiment will further set the momentum for the last half of this year. In addition, one can also witness a transition in terms of preferences amongst consumers’ like opting for EVs or cheering for privatisation of loss making companies. The growth of digital as a medium of advertising overtaking Print & just after TV reflects the change in media consumption habits which was triggered by the pandemic. Lastly our survey shows that a vast majority of India is still not investing in this age of cryptocurrencies, it would be interesting to see how financial players beyond traditional banks can capture and convert their interests for investments using varied instruments.”

Key findings:

- Overall household spending has increased for63% of families which reflects an7% increase from the last month. This increase is highest in Northern India.

- The increase in spends on essentials like personal care & household items stands at 50% reflecting a surge by 5%. The net score which was +20 last month has increased to +27 this month. The growth in Rural India is slightly higher as compared to Urban markets.

- Spends on non-essential & discretionary products like AC, Car, Refrigerator has increased for 18% of families. For 73% spends on non-essential purchases remain the same which reflects an uptick of 3% from last month. The non-essentials November net score therefore lies at +9. The trend on spends on discretionary products reflect a fine balance between caution and indulgence.

- With more exposure to outside activities, importance of health bounced back quickly. Consumption on health-related items increased for 47% of families as compared to 44% last month. The health score which has a negative connotation i.e. the lesser the spends on health items the better the sentiments, hasa net score value of -27.

- Consumption of media remains the same for a majority of 48% families and increased for 25% of the family, reflecting an overall Net score of -2 as compared to base value of 0 for the previous month.

- Mobility net score reflects a constant improvement over the last four months. 88% families said that they are going out the same or more on getaways/staycations /mall/restaurants, with travel bans being lifted and double vaccination providing easier movement opportunities. The overall mobility score is at -4 which is an improvement over last month which was at -5. This reflects slow but consistent progress in people’s sentiments for engaging in out of home activities

On topics of current national interest:

- While the long-awaited sale of Air India to the Tata group reflected a hopeful future for the airline. Axis My India further gauged consumer’s sentiment on whether or not the government should privatise other loss-making public sector companies. 46% is in agreement to privatisation of such companies while 36% disagreed with this view.

- When asked if economy/livelihood and business is expected to bounce back by January 2022, 41% believes that the same is possible and Southern India being more optimistic with 54% agreeing to this.

- With rising prices fuel being a concern, 48% are optimistic of shifting to electric vehicles wherein 33% and 15% said that they will consider buying a 2-wheeler and 4-wheeler respectively in this segment. The younger age group of 18-35 have a more likelihood, with 53% in agreement to an EV shift.

- In terms of brand advertisement placements, 44% and 38% of the consumers said that they have majorly seen ads on Television and on Digital platforms respectively. While only 11% and 7% of the audience believe that they have seen ads on Print or Outdoor. This reflects the changing media consumption habit and the surge both in Digital consumption & advertising. This digital growth is led by 26-35 yr audience.

- Sharing their views on financial planning, a majority of 23% still prefers to park their money in savings account, while a combined12% prefers to invest in Fixed Deposits, Shares/stock market and mutual funds. Gold is still seen as a reliable investment option for 4% of the consumers. 40% of the audience still don’t invest and interestingly 2% still save their money in post offices.

- Gauging views around the Diwali festivities, Axis My India, further discovered that 36% of the consumers are planning to go beyond small-ticket purchases this festive season. While 24% are looking to spend on household or personal items like White Goods (AC, TV, Washing Machine, Refrigeratoretc.), furniture, electronics and jewellery; 9% is looking to buy a 4-Wheeler or a 2-Wheeler. Further from a purely sentimental outlook, 59% of the consumers reflect the view of a more hopeful and cheerful Diwali this year.